October 2, 2017

Dear Fellow Shareholders,

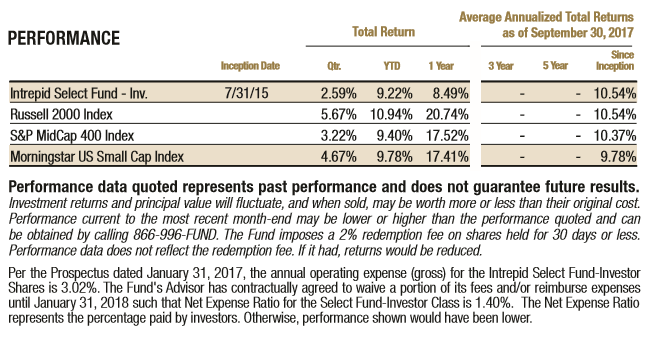

The Intrepid Select Fund increased 2.59% for the third quarter ending September 30, 2017, while the Russell 2000 increased 5.67%. The S&P MidCap 400 rose 3.22% during Q3. The Morningstar Small Cap Total Return Index jumped by 4.67% during the quarter. We are now disclosing additional benchmarks because Russell representatives want to charge us to use their benchmark. We may transition to a different small cap benchmark over the coming year. The Fund increased 8.49% for its fiscal year ending September 30th compared to a 20.74% gain in the Russell 2000, a 17.41% increase in the Morningstar Small Cap Index, and a 17.52% gain for the S&P Mid Cap 400 Index. We believe most of our shareholders pay closer attention to calendar year performance, but we are obligated to disclose fiscal year results. During calendar 2016, the Fund’s return (+23.4%) was front-end loaded before the election, whereas most small cap benchmarks earned the majority of their returns after the election. The Fund has a high active share and has frequently performed differently than its benchmarks since its inception. Cash accounted for 10.5% of the Fund’s assets as of September 30th.

The Fund acquired one new holding during the third quarter. Greenhill & Co. (ticker: GHL) is an independent investment bank that provides advice on mergers and acquisitions, raising capital, and restructurings. The stock recently fell to all-time lows due to the company’s failure to participate in the latest Mergers & Acquisitions (M&A) boom. Greenhill’s 2017 operating results are forecasted to be the worst ever recorded for the firm. Absent a sharp pullback in overall M&A activity, we believe 2017 will mark a trough in the company’s performance and Greenhill’s stock will rebound when 2018 results return to more normalized levels. We believed the shares were trading for approximately 10x adjusted free cash flow, assuming a cash impact from stock compensation, when we began establishing our stake. On September 25th, Greenhill announced a leveraged recapitalization (taking on debt to buy back its own shares) that sent the shares up by 16% before we could finish building our position. The stock is still trading below our estimated fair value, but we are not thrilled with the company’s new leveraged balance sheet. With that said, investment banking is a cash-generative business, and we think Greenhill could pay off its debt in less than five years. We currently plan to hold the name to wait for an expected recovery in Greenhill’s revenue.

The largest contributors to the Fund’s performance in the third quarter were Syntel (ticker: SYNT), Teradata (ticker: TDC), and Dominion Diamond (ticker: DDC).

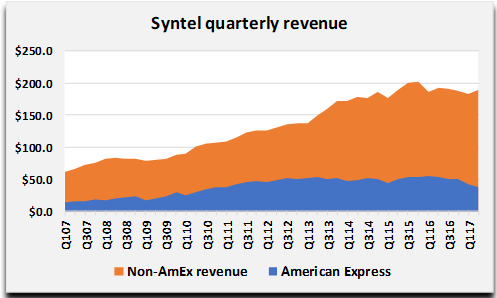

We believe the prescription to fix Syntel is simple: the company needs to grow revenue. Syntel has been disproportionately affected by a reduction in IT spending by American Express, its largest customer. However, the business has also been starved of new relationships due to an overly lean business development budget. Syntel is addressing these issues through increased marketing spending and a greater involvement from executives in closing deals. The company showed modest progress on this front in the second quarter, as revenue excluding American Express increased 3% sequentially. It’s too early to call a recovery. Nonetheless, immigration-related rhetoric has noticeably decreased, possibly indicating less of a headwind to Indian IT outsourcers from regulatory changes. Furthermore, the Indian rupee has weakened against the dollar over the past month, which relieves some pressure on the cost side for outsourcers. The stock is selling for approximately 11.5x expected free cash flow.

Source: Company filings

Teradata’s stock continued to exhibit its normal earnings-related volatility. This time, the shares reacted favorably to the numbers, even though revenues and margins fell again. We think the company is making progress on its transition to a subscription-based model. Recurring revenue grew by 7% in constant currency during the quarter and now represents half of total revenue. Management projected that overall revenue will grow in 2018, marking a key inflection point. While the company’s results are far from clean, we maintain our positive view of Teradata’s trajectory.

On July 17th, Dominion announced it would be acquired by The Washington Companies for U.S. $14.25 per share. The board had been conducting a strategic review since Washington first expressed interest earlier in the year. The takeover price represented a substantial premium to our $9.03 average cost basis in the shares, although we had partially reduced the position in March and April when the price was lower and a takeover was less certain.

The largest detractors to the Fund’s performance in the third quarter were Coach (ticker: COH), Baldwin & Lyons (ticker: BWINB), and Leucadia (ticker: LUK).

Coach’s stock dropped sharply after the company’s fiscal Q4 earnings release, in which management provided softer-than-expected guidance. We think investors were expecting too much. The fourth quarter results were decent compared to the prior year, with rising operating margins and stronger free cash flow. Looking ahead, the company forecasted low-single digit organic growth for fiscal 2018, which reflects reduced square footage. The company will attempt to turn around the recently acquired Kate Spade using the same approach it used to revive Coach’s own performance. This includes a pullback in certain distribution channels like online flash sales.

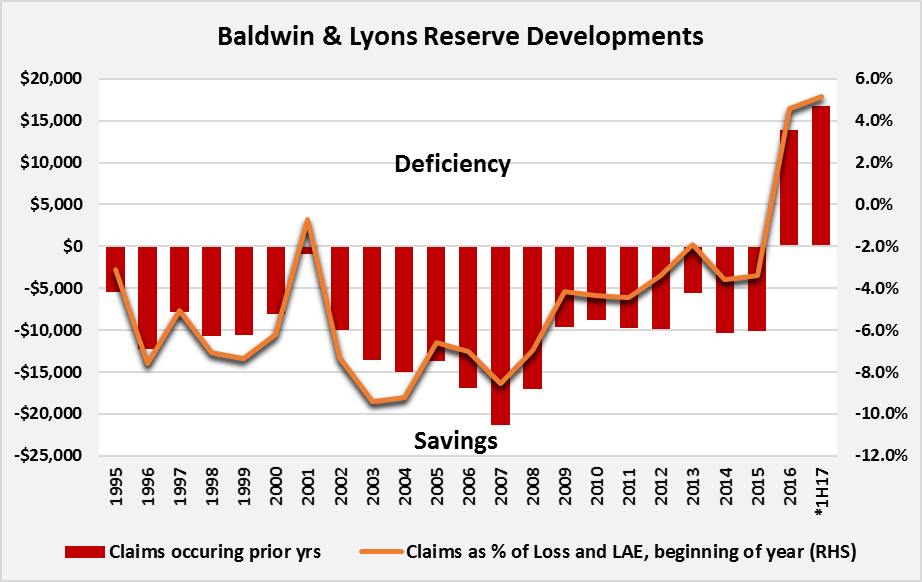

Baldwin & Lyons, the property and casualty insurer, is trading at a multiyear low Price to Book multiple near 0.8x. This is less than half the median multiple of other small cap P&C insurance firms. Baldwin specializes in commercial trucking policies, like FedEx contractors. According to Fitch, the commercial auto industry is experiencing its worst underwriting performance since 2001 as a result of accidents caused by texting and unexpectedly high jury awards. These factors have recently led to unfavorable reserve developments at Baldwin, which previously had an unblemished history of conservative reserving. In response, the company and other insurers are increasing premiums and promoting technology to monitor and control smartphone usage in an attempt to reduce accident rates. Competitors like AIG and Zurich have pulled back from certain markets. We believe Baldwin will restore its profitability, which will lead to a recovery in the stock price. Insiders have been buying shares. So have we.

Source: Company filings

*1H17 =1st half of 2017

Leucadia’s shares declined by a few percent during the quarter, which was enough to qualify it as the third largest detractor to the Fund’s performance. We believe the firm’s second quarter results were reasonable. Jefferies, which makes up the largest share of Leucadia’s results, showed decent performance in trading, with strong results in equities offset partially by lower fixed income revenue. Investment banking revenues at Jefferies were up significantly from the prior year. Jefferies also benefited from the buyout of one of its holdings, the high frequency trading firm KCG Holdings. National Beef’s results improved from higher selling prices and more cattle processed.

Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Chief Investment Officer

Intrepid Select Fund Portfolio Manager