October 4, 2017

Dear Fellow Shareholders,

I feel like the ancient mariner: “Water, water, everywhere, nor any drop to drink.”[1] For us, as your fellow shareholders and fund managers, a market that keeps going up, up and away can be frustrating. It’s easy to become myopic in an industry where everyone appears to be making easy money. The annualized S&P 500 returns for the trailing 1-, 3- and 5-years are all very compelling at the moment, but they are a relative anomaly historically and are only one side of the market cycle equation. Would you be as comfortable with a five-year string of double-digit returns if you knew they would be followed by a 30% – 50% reduction of your capital?

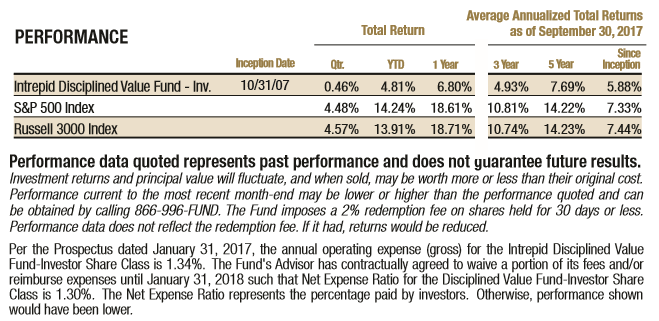

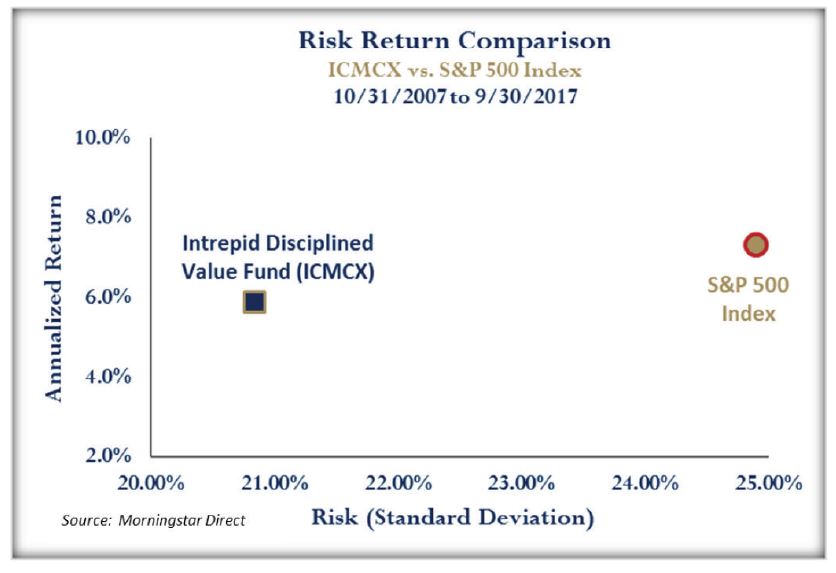

Well, here we are again! Our refusal to overpay for high-quality, cash-generating businesses has left us with more than ample cash balances in the Intrepid Disciplined Value Fund (the “Fund”). As of September 30, 2017, the Fund’s fiscal year-end, the Fund consisted of 64% in stock and 36% in cash and T-bills. For the trailing one-year period, the Fund increased 6.80%. The return for the quarter was a barely visible 46 basis points. Since inception, the Fund has an annualized return of 5.88% through September 30, 2017. For the same time frame, the S&P 500 Index has averaged 7.33%. While the Fund doesn’t show quite the increase as that of the S&P 500, it has taken considerably less risk (see chart below).

The Fund’s five largest contributors during the quarter were Teradata (ticker: TDC), Verizon Communications (ticker: VZ), Apple (ticker: AAPL), Oaktree Group (ticker: OAK), and Dollar General (ticker: DG). The Fund’s five largest detractors for the quarter were Leucadia National (ticker: LUK), Alamos Gold (ticker: AGI), Northern Trust (ticker: NT), Contango Oil/Gas (ticker: MCF), Coach (COH).

We continue to broaden our search geographically to find attractive investments for the Fund which will celebrate its 10th birthday on October 31, 2017. Thank you for investing with us. If there is anything we can do to serve you better, please ask.

Best regards,

Mark Travis

President

Intrepid Disciplined Value Fund Portfolio Manager

[1] Coleridge, Samuel Taylor. “The Rime of the Ancient Mariner.” Poetry Foundation. June 2015. Web. 4 October 2017.