July 9, 2018

July 9, 2018

Dear Fellow Shareholders,

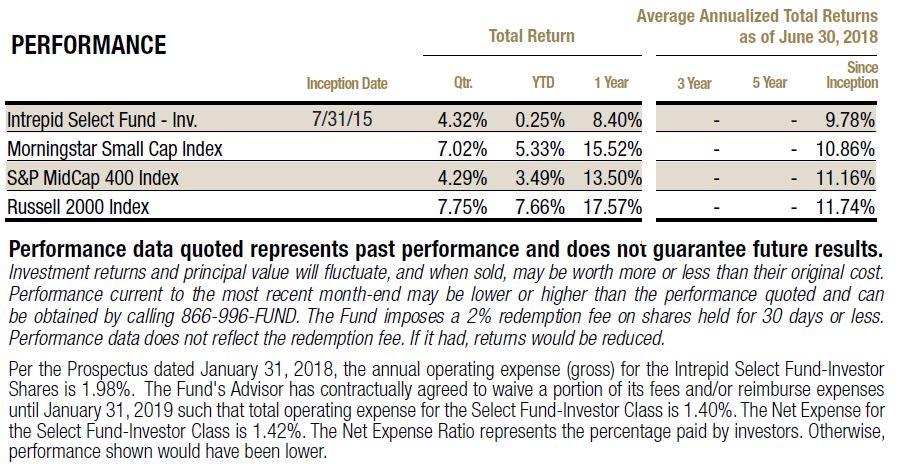

Small cap stocks rallied during the second quarter along with technology shares. The Russell 2000 and Morningstar Small Cap Index were up 7.75 and 7.02%, respectively, over the three-month period ending June 30, 2018. The S&P MidCap 400 rose 4.29%. The Intrepid Select Fund (the “Fund”) increased 4.32% over the same period. The Fund ended the quarter with 9.9% of assets held in cash, but cash averaged a mid-teens percentage over the three-month period.

The Fund’s top three contributors in the second quarter were Baldwin & Lyons (ticker: BWINB), Greenhill & Co. (GHL), and Discovery Communications (DISCK). Baldwin earned an underwriting profit in the first quarter, following a very tough 2017 that included significant adverse reserve developments. Baldwin’s shares appreciated after the resignation of its Executive Chairman, who is also a controlling shareholder and manages a hedge fund focused on insurance stocks with a successful track record. Other shareholders may believe his departure reduces tension between management and the board. Baldwin continues to trade at a discount to tangible book value, and we feel it is a reasonable place for our capital while we seek compelling opportunities.

Greenhill’s shares continued to rally after the firm posted record first quarter advisory revenues and a strong operating margin. The firm is still demonstrating much more strength overseas than for domestic M&A deals. We believe the stock fully reflects a stabilization of Greenhill’s market share that is not assured. We were pleased to sell our remaining position at a material gain to our cost basis in the $15 range.

Discovery Communications’ stock performed strongly amidst consolidation activity in the media sector. Takeover activity may continue following the U.S. District Court’s approval of AT&T’s acquisition of Time Warner and a bidding war for assets of 21st Century Fox. When it reported first quarter results, Discovery’s management significantly raised expected synergies from its Scripps Networks acquisition. Despite ongoing attrition of cable subscribers, Discovery owns several leading networks and is producing low-single digit EBITDA growth. The firm is also actively investing in sports content such as the Olympics and PGA Tour for its European streaming product, while pledging not to pay aggressive prices for sports rights like soccer.

We think Discovery is better positioned to deal with competition from Netflix and other OTT players because its content is low cost and unscripted versus the high-budget scripted fare produced elsewhere. Engaging in an arms race against Netflix and Amazon would be futile. While it is likely that digital entrants will devote growing budgets to unscripted content, Discovery owns a very deep library and still trades for a modest multiple of free cash flow. With industry pressures and a leveraged balance sheet, Discovery must operate judiciously and remain open to combinations with other players. Several insiders have purchased shares at higher prices than our entry point, including Discovery’s new CFO, board members, and even cable magnate John Malone.

We think Discovery is better positioned to deal with competition from Netflix and other OTT players because its content is low cost and unscripted versus the high-budget scripted fare produced elsewhere. Engaging in an arms race against Netflix and Amazon would be futile. While it is likely that digital entrants will devote growing budgets to unscripted content, Discovery owns a very deep library and still trades for a modest multiple of free cash flow. With industry pressures and a leveraged balance sheet, Discovery must operate judiciously and remain open to combinations with other players. Several insiders have purchased shares at higher prices than our entry point, including Discovery’s new CFO, board members, and even cable magnate John Malone.

The Fund’s top three detractors were Western Digital (WDC), the iShares Gold Trust (ticker: IAU), and Net 1 UEPS Technologies (ticker: UEPS). Western Digital’s shares remain under pressure from investor fears over NAND flash memory pricing, despite the company’s position as the leading hard disk drive (HDD) producer in the world and the second largest manufacturer of solid state drives (SSD). HDD sales are supported by the expansion of cloud computing, which is offsetting decreases from traditional computers. Judging by the low P/E of 6x on the stock, the market appears to be expecting NAND price declines to outpace cost reductions. Western Digital’s management predicts the market will firm up later this year.

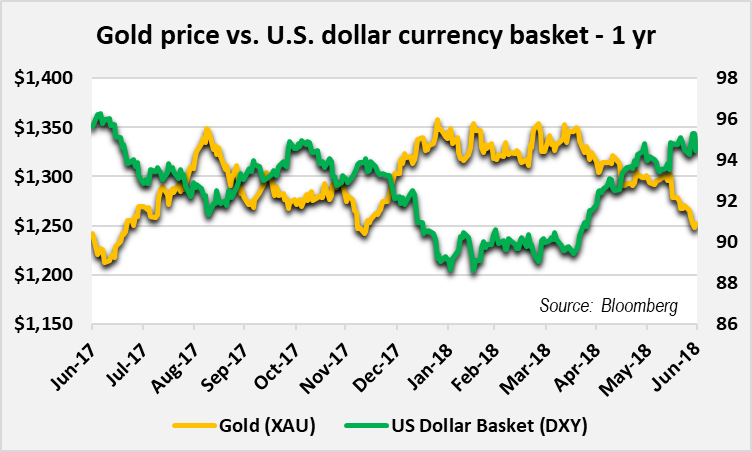

Gold prices sank in the second quarter due to rising interest rates and the strength of the U.S. dollar. Gold exploration spending is down, and production is becoming more challenging as the easy reserves have been mined. We expect loose monetary policy and a favorable supply and demand backdrop to help drive up gold prices in the long run; however, in the nearer term we also believe our gold position could flourish when other assets are in disarray.

Gold prices sank in the second quarter due to rising interest rates and the strength of the U.S. dollar. Gold exploration spending is down, and production is becoming more challenging as the easy reserves have been mined. We expect loose monetary policy and a favorable supply and demand backdrop to help drive up gold prices in the long run; however, in the nearer term we also believe our gold position could flourish when other assets are in disarray.

Net 1 UEPS Technologies’ (UEPS) stock rose sharply after first quarter earnings when the company reported the addition of several hundred thousand new customers for its EasyPay Everywhere banking offering, which will help offset the loss of the welfare distribution contract from the South African Social Security Agency. However, the shares gave back all those gains as the media continued to paint the company as a villain as it transitions the welfare contract to the South African Post Office (SAPO).

Predictably, it was reported today that hundreds of welfare recipients couldn’t receive their grants due to a strike by Post Office workers for higher wages. UEPS never failed to deliver grants on time when it administered the entire contract. Whatever the case, our investment in UEPS is buttressed by the company’s balance sheet and ownership of the third largest South Korean payments company, which have a current combined value that exceeds UEPS’ stock price. The firm’s continued provision of financial services to the underbanked population in South Africa would just be a bonus for us.

We acquired several new positions during the quarter, including Crawford & Company (ticker: CRD/A), AmerisourceBergen (ticker: ABC), Omnicom (ticker: OMC), FibraHotel (official name: Concentradora Fibra Hotelera Mexicana S.A. de C.V.; ticker: FIHO12 MM), Donnelley Financial Solutions (ticker: DFIN), Molson Coors (ticker: TAP), and Big Lots (ticker: BIG).

Crawford is one of the world’s largest independent providers of claims management services to insurance companies and self-insured entities. The company’s stock has underperformed for years due to weak top line growth, substandard margins, an underfunded pension, a muddied financial picture, and a dual class share structure. An aggressive restructuring program has significantly improved underlying profitability and the pension’s status is much-improved. However, a declining contribution from administering the BP oil spill class action has overshadowed margin gains in Crawford’s core outsourced claims management and third-party administration franchises. The recent sale of the underperforming class action business helps simplify the story. We acquired Crawford’s shares at 5x EV/EBITDA. Competitors have been acquired recently at over twice that multiple. Crawford is selling for just over 10x estimated leveraged free cash flow.

AmerisourceBergen is a pharmaceutical distributor that connects drug manufacturers with pharmacies, hospitals, and other health care providers. It is one of the “Big Three” wholesalers along with McKesson and Cardinal Health. We believe Amerisource is an efficient operator with a solid balance sheet and is a good way to participate in the robust growth of the healthcare industry. While Amazon has recently entered the space through its acquisition of the online pharmacy PillPack, we think Amazon’s main targets will be pharmacies like CVS, Walgreens, and Rite Aid, as opposed to lower-margin distributors. Nonetheless, Amazon is not afraid of low margins and has logistical expertise, although it generally relies on outside carriers like USPS, FedEx, and UPS for the bulk of its deliveries. Walgreens Boots Alliance is a 26% owner of Amerisource, and we would not be surprised by a future takeover attempt as Walgreens vertically integrates to strengthen its competitive profile. We acquired ABC at a 12.5x multiple to normalized unleveraged free cash flow.

We purchased the advertising agency Omnicom for largely the same reasons as our earlier acquisition of WPP. While Omnicom’s shares have not fallen as much over the past year, it is also not experiencing management and boardroom drama like WPP. Omnicom’s shares are valued at a similar multiple to WPP. We believe it is a strong operator and has recently enjoyed slightly better revenue growth than WPP. We view our purchase as a way to spread our bets in a space where major accounts can shift between competitors.

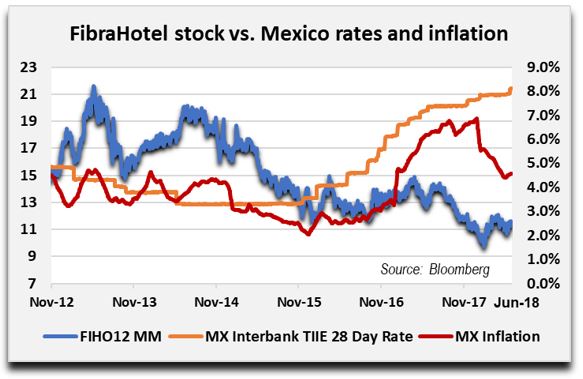

FibraHotel is the first and largest hotel FIBRA in Mexico. FIBRAs are the Mexican versions of REITs and must pay out 95% of their income. FibraHotel owns 87 properties spread around Mexico and has enjoyed consistent growth in Revenue per available room (RevPAR) and Adjusted Funds from Operations (AFFO) per share.[1] The hotels mainly serve business customers, but the firm recently acquired a resort in Cancun. The company has a net leverage ratio of approximately 1.5x estimated EBITDA, which is far below U.S. hotel REITs, which carry lower leverage than other REITs due to more volatile occupancy. We acquired the shares at a double-digit dividend yield, which was more than twice the yield offered by most U.S. comps.

FibraHotel is the first and largest hotel FIBRA in Mexico. FIBRAs are the Mexican versions of REITs and must pay out 95% of their income. FibraHotel owns 87 properties spread around Mexico and has enjoyed consistent growth in Revenue per available room (RevPAR) and Adjusted Funds from Operations (AFFO) per share.[1] The hotels mainly serve business customers, but the firm recently acquired a resort in Cancun. The company has a net leverage ratio of approximately 1.5x estimated EBITDA, which is far below U.S. hotel REITs, which carry lower leverage than other REITs due to more volatile occupancy. We acquired the shares at a double-digit dividend yield, which was more than twice the yield offered by most U.S. comps.

FibraHotel’s shares have been pressured since 2015 by increases in local interest rates. The tightening cycle may be almost finished, since inflation has turned lower. The shares trade at a significant discount to the capital FibraHotel has invested in its relatively young portfolio. The biggest risk is economic turmoil in Mexico that pushes down occupancy levels, possibly induced by changes in trade agreements or an acceleration of drug violence. The company offers English-language filings, presentations, and conference calls. We sold forward enough Mexican pesos to offset the currency risk of the equity position.

Donnelley Financial Solutions, or DFIN, was spun off from R.R. Donnelley in October 2016. DFIN supports the global capital markets compliance and transaction needs for corporations and their advisors and the investment management compliance requirements of mutual funds. DFIN helps companies comply with ongoing regulatory filings and deliver printed communications to investors, and it also provides language translation services. This creates a strong recurring revenue base (60%) to support the more volatile transactional revenue DFIN receives as a leading provider of data room solutions for corporate IPOs and M&A.

DFIN still derives 40% of revenue from lower-margin legacy printing services, which are in structural decline, but this is being offset by fast-growing software and services. The shares had significantly underperformed since the spinoff due to volatility on the transactional side. We picked up a small position near the lows at a double-digit free cash flow yield but stopped buying when the stock rebounded due to sabre rattling from two small activist investors.

MolsonCoors is one of the world’s largest brewers and owns brands including Blue Moon, Coors Light, Miller Genuine Draft, and Miller Lite. Major brewers have been negatively impacted by growing consumption of craft beers and other alcoholic beverages. More recently, MolsonCoors’ shares have been hurt by the prospect of tariffs on aluminum imports, which will increase packaging costs. Coors Light and Miller Lite are the second and third best-selling beers in America, and Coors Light is also the “Right Beer Now” for your Portfolio Manager.

The Fund acquired a small position in Big Lots near the end of the quarter. Big Lots was a previous successful holding for our firm. The company’s earnings are in the process of roundtripping since we sold in 2014. Same store sales have been stubbornly weak since the middle of 2016 but worsened last quarter as Big Lots posted a -3% comp. Management blamed the weakness on cool weather that impacted sales of seasonal merchandise, and they project same store sales to grow over the rest of the year.

The jury is still out on how well Big Lots will navigate increasing online and offline competition, ranging from websites like Overstock.com to large format close out retailers like Ollie’s Bargain Outlet to dollar stores that specialize in consumables. Big Lots possesses an excellent balance sheet and we bought the stock below 7x trailing EBIT and 12x free cash flow. Free cash flow is currently suppressed because the company is remodeling locations to a more polished “Store of the Future” concept, which is arguably sorely needed based on our visits to local stores.

We exited three positions in the second quarter: Retail Food Group (ticker: RFG AU), Greenhill (ticker: GHL), and Primero Mining’s 5.75% convertible notes. The Primero bond was retired at par in May upon the completion of the takeover of the company by First Majestic Silver.

We sold Retail Food Group, the restaurant franchisor, during the quarter. Men at Work put it best, “Do you come from a land down under?…You better run, you better take cover.” In last quarter’s letter, we informed you that we were performing additional diligence on the name. We shipped two of our brightest blokes to Australia for a walkabout to uncover the real story on Retail Food Group (RFG).

They witnessed a kangaroo get plowed by a speeding Jeep in the bush, but that wasn’t their most frightening encounter. Maybe it was the fact that they couldn’t find a single franchisee who was happy with the parent company. Or perhaps it was the call a few days into the trip from RFG’s CEO, who warned us to not “intimidate” franchisees by politely asking them about their satisfaction. No, the final straw had to be a meeting with top management that was conducted in a dimly lit old nursery, where the only chairs were preschool-sized. Crikey! That up-close encounter made it clear that the people leading the firm were either incredibly dishonest or a few sausages short of a barbie. We bailed immediately.

It’s not hard to determine where we went wrong on this investment. We bought the shares when they nosedived during an aggressive smear campaign by the media. We were able to internally disprove some of those accusations. We thought this meant the other claims were less likely to be credible or were blown out of proportion, and we felt we had a margin of safety in the relatively stable franchise royalty stream and unrelated wholesale business. Unbeknownst to us, the franchisee base was disintegrating. We didn’t reach this conclusion until we traveled from store to store in Australia. While our exit was painful and marred performance earlier this year, we have avoided additional steep losses by selling when we did.

Sincerely,

Jayme Wiggins, CFA

Chief Investment Officer

Intrepid Select Fund Portfolio Manager

[1] RevPAR, or revenue per available room, is a performance metric in the hotel industry that is calculated by dividing a hotel’s total guestroom revenue by the room count and the number of days in the period being measured. The AFFO, or adjusted funds from operations, of a REIT is generally equal to funds from operations (FFO) with adjustments made for recurring maintenance capital expenditures. (Source: Wikipedia)