July 5, 2017

Dear Fellow Shareholders,

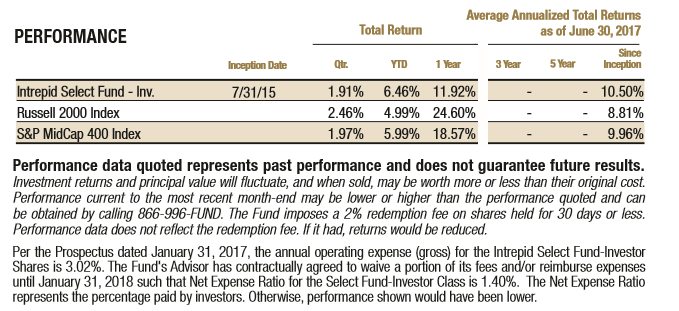

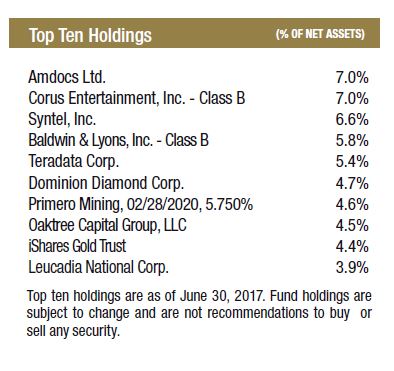

The Intrepid Select Fund (the “Fund”) increased 1.91% for the first quarter ending June 30, 2017, while the Russell 2000 increased 2.46%. The S&P MidCap 400 rose 1.97% during Q2. Cash accounted for 10.2% of the Fund’s assets as of June 30th.

The largest contributors to the Fund’s performance in the second quarter were Corus Entertainment (ticker: CJR/B CN), Coach (ticker: COH), and Tetra Tech (ticker: TTEK).

Corus Entertainment’s shares rose modestly at the end of June when the company reported its fiscal third quarter earnings. Corus delivered 14% EBITDA growth over the prior year’s quarter, after adjusting for the impact of the Shaw Media acquisition. Television ad revenues were flat on a pro forma basis, which was a marked improvement from the 4% decline in fiscal Q2 and double-digit drops prior to that. Corus is finally outperforming its competitors on the advertising front. However, the overall ad climate in Canada remains challenging, with an ongoing share shift to digital players. We believed Corus’s advertising results would be even better this quarter, since the company had higher price and volume commitments with all of the major ad agencies compared to last year. The structural pressures on television advertising in Canada are greater than we forecasted, but we believe that TV will remain a key advertising market and will be enhanced by more targeted ad delivery. Corus has the leading English-language TV market share in Canada. The stock is trading for less than 10x expected free cash flow. Corus continues to be an important holding for the fund, but we trimmed our stake.

A return to positive same-store sales growth in North America favorably impacted the shares of Coach. The drawn-out restructuring is finally bearing fruit, and management has focused on bolstering the Coach brand by reducing promotions and consolidating the distribution footprint. The company has succeeded in lifting the average price point of handbags, after many in the investment community had been concerned Coach was going too far downmarket. While our investment in Coach was predicated on an operational turnaround, we are not forecasting a return to the company’s former glory in our valuation. The market also warmly received the acquisition price Coach proposed for Kate Spade, a competitor. Management plans to adopt the same playbook it used for Coach to breathe new life into the Kate Spade brand, which is currently overexposed to promotional activity.

Tetra Tech posted solid growth from ongoing operations, excluding the drag from the intractable Remediation and Construction Management division that the company has nearly exited. The company’s cash flow rebounded significantly from a depressed Q1. Management cited broad-based growth in U.S. state and local government project-related infrastructure, such as water collection in California and desalination in Texas. The U.S. federal business also increased due to more work for the Department of Defense, State Department, and USAID. Tetra Tech was the #2 USAID contractor in 2016. Management is bullish on the increase in the defense budget. However, the Trump administration has proposed draconian budget cuts to the State Department and USAID. We doubt the ultimate budgets for these departments will experience steep haircuts; nevertheless, we remain cognizant of the political pressure.

The top detractors from the Fund’s performance in the quarter were Dundee Corp. (ticker: DC/A CN), Cubic Corp. (ticker: CUB), and Teradata (ticker: TDC).

In our Dundee mea culpa in last quarter’s letter, we wrote: “We have urged management to sell Dundee’s public investments to pay off bank debt and preferred stock, which would reduce cash burn by half. If the company then catches a break on one of its major private investments, it could mark a turning point for the company’s fortunes.” On May 10th, Dundee announced that Delonex Energy will acquire United Hydrocarbon (UHIC), Dundee’s Chad energy venture/money pit. Delonex offered $35 million at close, another $50 million when first oil is achieved, and ongoing royalties ranging from 5%-10% of production unless Brent prices fall below $45 per barrel. Dundee has been spending $12 million per year to maintain UHIC while seeking an investor, and this cash drain will disappear upon a sale. It’s not a done deal, as Dundee is currently in negotiations with the Government of Chad to renew its Production Sharing Contract. On May 19th, Dundee sold its entire remaining stake in DREAM Unlimited for CAD $106 million. The proceeds will likely be used to pay down bank debt. The sales of UHIC and the DREAM shares were exactly the type of positive catalysts we were seeking. The market has clearly shrugged, since Dundee’s shares are back down to all-time lows. Canadian small caps have traded weak this year, which could be a factor, but we think investors will need confirmation that the Delonex transaction closes before they bid up Dundee’s shares.

We like the transportation systems business inside of Cubic. The company is the world leader in fare collection systems for mass transit. However, Cubic’s management lacks credibility. They cut guidance again after a deferral in the expected timing of contract awards for the firm’s defense business. Cubic is one of the smaller weights in the Fund.

Teradata has endured a rough stretch over the past several years, with contracting revenue and profits. The firm is currently transitioning to a subscription-based revenue model, which is creating more turbulence for reported earnings but hopefully moving the company closer to stabilization. Teradata embraced the cloud more slowly than many other IT companies, but it is making progress in converting customers to a recurring revenue model. The stock is clearly out of favor, and we envision a return to growth as management executes the business shift.

We purchased two new securities for the Select Fund in the second quarter: Hallmark Financial Services (ticker: HALL) and Scripps Networks Interactive (ticker: SNI).

Hallmark Financial Services is a specialty property and casualty insurance company that focuses on transportation-related niche commercial markets with a concentration of business in Texas. Hallmark will underwrite accounts ignored by larger carriers due to the insured’s loss history, years in business, minimum premium size, or type of business. The firm derives a significant portion of premiums from trucking companies, which Hallmark has in common with Baldwin & Lyons (ticker: BWINB), another Select Fund holding. Hallmark has a solid long-term track record of compounding book value, but underwriting losses and unfavorable reserve adjustments have saddled returns over the past few years. Management has worked to address problem areas by raising rates and exiting markets like personal automobile insurance where Hallmark has failed to make money. The company is well-capitalized, and Hallmark’s bond portfolio carries a weighted-average credit rating of BBB+ with a three-year duration.[1] This should help protect the balance sheet under a scenario of rising interest rates. We bought the stock at 0.9x tangible book value.

Late in the quarter we established a small position in Scripps Networks Interactive, the U.S. owner and operator of HGTV, Food Network, and the Travel Channel. We simultaneously reduced our weighting in Corus Entertainment by an amount equal in size to our new position in Scripps. We have followed Scripps for many years and know its assets well, not only because of the company’s relationship with Corus (the Canadian operator of Scripps’ brands), but also because the company’s networks are frequently on display in the living rooms of our homes! Scripps owns powerhouse brands and its networks’ core viewers have extremely attractive demographics. As a result, Scripps’ advertising slots are considered premium inventory compared to most other U.S. media companies. Advertising accounted for 71% of Scripps’ revenue in 2016. On the other hand, Scripps punches below its weight in regards to the affiliate fee revenue Scripps earns from cable and satellite providers. HGTV receives monthly affiliate revenue per subscriber per month that is less than half the level of other cable networks like USA and Discovery, in spite of the superior ratings of HGTV. Correcting this imbalance over time could significantly enhance the company’s profitability and should, at a minimum, help insulate Scripps from cord-cutting pressure, the negative drag from advertising in the event of a recession, or continued advertising share shifts to digital venues.

Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Chief Investment Officer

Intrepid Select Fund Portfolio Manager

[1] Company investor presentation