April 5, 2017

Dear Fellow Shareholders,

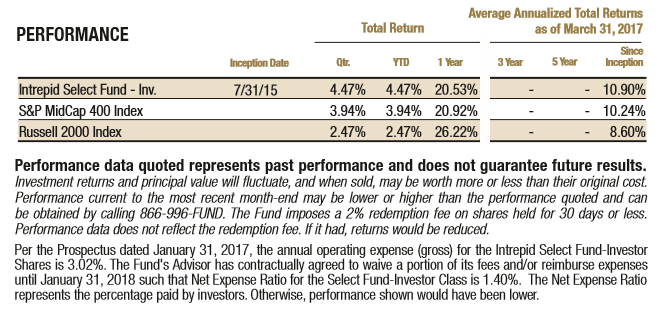

The Intrepid Select Fund (the “Fund”) increased 4.47% for the first quarter ending March 31, 2017, while the Russell 2000 increased 2.47%. The larger capitalization securities in the Fund generally performed better over this period, which was consistent with the overall market. The S&P MidCap 400 rose 3.94% during Q1. Cash accounted for 12.0% of the Fund’s assets as of March 31st.

The largest contributors to the Fund in the first quarter were Dominion Diamond (ticker: DDC), Western Digital (ticker: WDC), and Oaktree Capital (ticker: OAK). On March 16th, Dominion announced strong guidance for its 2018 fiscal year, which ends on January 31, 2018. This led to a 12% spike in the stock, which had been selling off over concerns that India’s demonetization could have longer-lasting impacts on rough diamond prices than previously thought. That weekend, The Washington Companies disclosed that it made a U.S. $13.50 per share takeover offer to Dominion’s board in February, which was a 54% premium to where the stock traded before the company issued guidance. We were not completely surprised by the offer, since Dominion’s balance sheet has a large amount of cash and because the stock had been trading near multiyear lows. Washington consists of a group of privately held businesses in the U.S. and Canada, including one of the largest copper and molybdenum mines in North America. Billionaire Dennis Washington owns the firm, and the bid for Dominion was rumored to be pushed by David Batchelder, the activist who co-founded Relational Investors and who sits on Washington’s board. Dominion and Washington have not been able to agree on terms that would allow Washington to complete it due diligence. Both parties have publicized their dispute.

On March 27th, Dominion said it would explore strategic alternatives that could include a sale of the company. The firm engaged in a similar process beginning in 2015, but the effort seemed to fizzle after Dominion entered into a settlement with an activist group. We believe the odds are higher of a deal being completed this time due to Washington’s expressed interest and because the composition of the board has changed. The rough diamond market is also in better shape today. Dominion’s shares are now fully valued using our base case assumptions, so we partially reduced the position. However, the stock continues to trade below Washington’s conditional offer. We think Dominion could be more valuable in the arms of a strategic suitor, so we have maintained exposure to the name.

Western Digital has been a standout performer for the Fund over the past year. The company’s results, announced in January, were once again better than anticipated, with strength in each end-market. Data center growth is being driven by cloud-related storage demand, while mobile phones are experiencing increasing storage capacity. Our thesis is that Western Digital can continue to improve results through cost cutting at its acquired Hitachi Global and SanDisk subsidiaries, combined with an industry recovery for Solid State Drives and Hard Disk Drives.

Oaktree Capital now has over $100 billion of assets under management. On the latest earnings call, Chairman Howard Marks commented, “We still face some of the lowest prospective returns in history as well as asset prices that I generally describe as being, on the high side of fair or the beginning of rich.” We agree with the first half of that comment but are much more negative than Mr. Marks about asset prices. In our opinion, we are way beyond “the beginning of rich.” We think the market is Uncle Scrooge Rich, except it isn’t backed by a giant swimming pool full of gold coins like that owned by the Disney character. Nevertheless, we think our pessimistic view of asset prices should eventually be favorable for Oaktree, since they are renowned distressed debt investors.

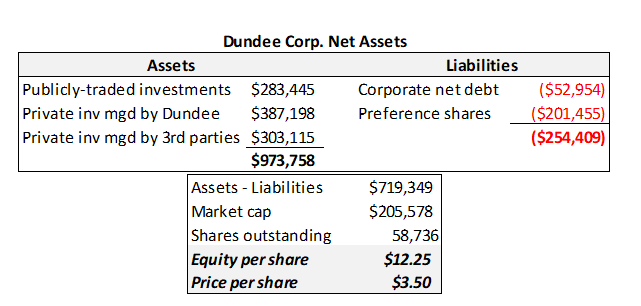

The top detractors from Q1 performance were Dundee Corp. (ticker: DC/A CN), Syntel (ticker: SYNT), and Primero Mining’s 5.75% Convertible Notes (CUSIP: 74164WAB2). Dundee’s performance has been abysmal, and that comment doesn’t just apply to the stock. The company is involved in many different ventures, but almost nothing has worked out. We attribute at least half of the unfavorable outcomes to poor decisions by management and the rest to bad luck. Hindsight is 20/20, and our involvement in Dundee came from trying too hard to find value in an over-picked market. Our fair value for the stock is based on asset value, in contrast to our typical discounted free cash flow valuation. We felt comfortable with this approach because the assets were originally anchored by publicly-traded equities that seemed reasonably valued to us on inspection. Dundee’s cash flow has been negative as the team attempted to nurture a basket of various nascent businesses into self-sustaining enterprises. It hasn’t worked. We had chances to revisit the investment as the situation changed and decent investments were exchanged for speculative ones. The mistake is on me, your Portfolio Manager.

So where do we go from here? Dundee is a $3.50 stock with $12.25 of book value. That book value continues to decline as the company’s portfolio is not generating cash flow but Dundee is incurring corporate overhead and financing costs. Right now the market is implying that every single private company Dundee manages is worth nothing, plus that the business burns cash at the current rate for another three years. We have urged management to sell Dundee’s public investments to pay off bank debt and preferred stock, which would reduce cash burn by half. If the company then catches a break on one of its major private investments, it could mark a turning point for the company’s fortunes. We’re not holding our breath but aren’t yet inclined to sell Dundee at today’s prices.

Our investment in Syntel started off well, increasing over 15% in just a few months…then the company announced guidance in February. The stock gave it all back and then some, so now we’re about 15% in the red. While fourth quarter results were in line with projections, the company’s outlook for 2017 was well below consensus estimates. Management painted a subdued spending picture for the industries Syntel serves. The stock’s underperformance is primarily tied to Syntel’s revenue declines versus growth for the rest of the IT services industry. The company coasted for years on sales growth from its largest customers—American Express, State Street, and FedEx. Those customers are now reducing spending, and Syntel’s smaller clients are not picking up the slack. This has prompted management to increase the heretofore lean marketing budget.

Some investors are also concerned about Syntel’s chops in the digital arena, but the company’s well-regarded SyntBots automation platform demonstrates that Syntel can develop cutting edge IP. Lastly, legal immigration policy remains an overhang, as there are several bills in Congress that seek to change the H-1B visa program, and the Trump administration has already made a couple of marginal changes that could negatively impact outsourcers. We take some comfort that both Chuck Schumer (D-NY) and Paul Ryan (R-WI) have previously expressed support for the H-1B program, suggesting that it may be difficult to push a bill through Congress that severely curtails visa issuances. Even if we are wrong, Syntel has several ways to deal with fewer visas, including sending more work offshore, increasing local hiring of Americans, expanding automation to reduce labor, and also passing along cost increases to customers. Syntel trades for about 9x expected free cash flow. It is now the second largest position in the Fund and one of the biggest discounts to our estimated fair value.

Primero Mining experienced an eventful quarter, which included a mine strike, reserve reduction, CEO resignation, and going concern language. Did we mention we like this security? The bonds certainly carry risk, but they yield 25%. We believe the strike at the San Dimas Mine in Mexico will end shortly, since the miners have few other options for employment. Additionally, Silver Wheaton has indicated that it is willing to modify its silver stream with Primero if it is fairly compensated. Silver Wheaton also recently guaranteed Primero’s credit facility, enabling a 6 month extension that gives Primero time to explore strategic alternatives. In other words, Silver Wheaton is as attached as ever to Primero. We view this relationship as the main lever to improve the company’s health.

With that said, Primero, Silver Wheaton, and the Tax Administration Service (SAT) are embroiled in a Mexican standoff at the moment (pun intended). Primero can survive if either the SAT relinquishes its pursuit of Primero for higher taxes on its silver production or if Silver Wheaton reduces the burden of its silver stream on San Dimas. However, if either the SAT or Silver Wheaton acts, the other party may not have to yield anything. We think Silver Wheaton will cave first, since its Herculean efforts to avoid paying taxes in Mexico and almost everywhere else make it unlikely that it would want to see this situation through a restructuring. Silver Wheaton as a mine owner in Mexico would be a much juicier target than Primero.

The Select Fund’s Co-Lead Portfolio Manager, Greg Estes, notified us last month that he would be leaving Intrepid Capital for another opportunity in the Jacksonville area. Greg has been a valued employee of Intrepid since 2000. His focus was on sourcing mid and large capitalization equity ideas. Two Intrepid analysts have absorbed primary coverage of the mid cap names held in the Select Fund that Greg previously followed. We are also in the process of hiring a new analyst for our investment team.

Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Chief Investment Officer

Intrepid Select Fund Portfolio Manager