April 1, 2017

Dear Fellow Shareholders,

The Trump euphoria continued almost unabated into the first quarter of 2017 despite mediocre macroeconomic results, higher inflation, and another 25 basis point rate hike. Small caps felt some pressure in March due to declining oil prices and pressure on the retail sector, but they subsequently recovered when crude regained $50 per barrel. Large caps essentially shrugged off any negative news and rocketed 6.07% higher in the first quarter with historically low volatility. In fact, the S&P 500 traded lower on just three of the nineteen trading days in February. Here’s another fun fact: the Dow Jones Industrial Average closed at record highs for twelve straight days in February. This has only occurred two other times in history.

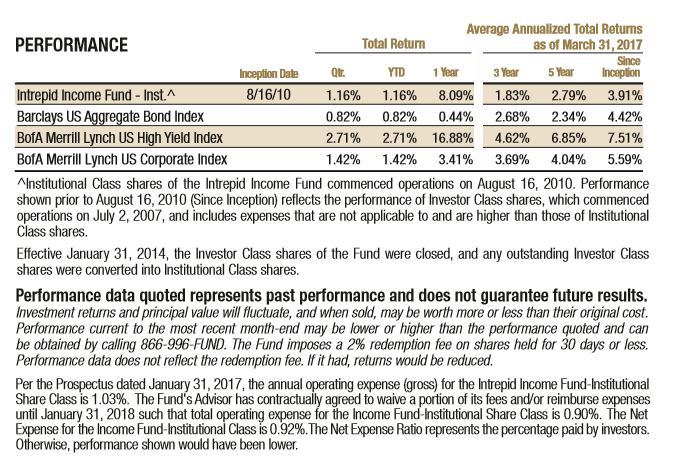

U.S. fixed income assets also recorded positive returns in the first quarter. Longer duration risk-free bond yields spiked in March to the highest levels seen in years. This caused moderate losses, but bonds recovered significantly over the last three weeks. By the end of the quarter, longer-dated Treasury bond yields were slightly lower, adding positive pricing contribution to the income production. The appetite for risk resulted in credit spread tightening. The worse the credit rating, the greater the magnitude of the tightening, meaning riskier bonds outperformed safer bonds. The Bloomberg Barclays US Aggregate Index gained 0.82% in the quarter ended March 31, 2017. Investment-grade corporates, as measured by the BAML US Corporate Index, returned 1.42% in the quarter. As experienced in equities, the decline in oil prices had a negative impact on riskier bonds, but only temporarily. The high-yield market, as measured by the BAML High Yield Index, rose 2.71% in the quarter.

The Intrepid Income Fund (the “Fund”) gained 1.16% in the quarter. The Fund participated in little if any of the volatility experienced by the indexes presented above. This is explained by the Fund’s very low energy exposure, ownership of less-volatile short-term investment grade corporates (~36% of the Fund’s assets) and U.S. Treasury bills (~15% of AUM). Furthermore, the Fund typically exhibits a low correlation to the high-yield index simply because many of our holdings are not included in the Index. At the end of the quarter, approximately 16% of the Fund’s assets were invested in bonds that are represented in the high-yield index. Lastly, the Fund has a much shorter duration than the indexes presented above, so the impact of changes in interest rates was minimal. At the end of the quarter, the effective duration of the Fund was 1.2 years.

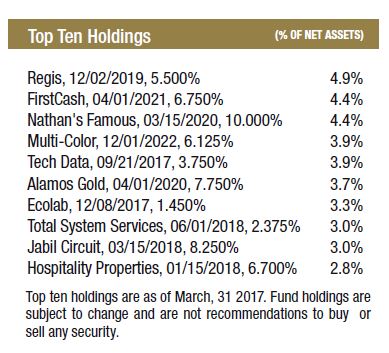

Last year we owned the bonds of three different publicly-traded pawn shop operators – EZCORP (ticker: EZPW), Cash America (ticker: CSH), and First Cash Financial (ticker: FCFS). First Cash acquired Cash America last September and retired the Cash America bonds at a significant premium as required by the make-whole covenant. The Cash America notes were one of the Fund’s top contributors last year. After the notes were retired, we were contacted by a broker asking us to sell our rights to participate in a legal settlement. The lawsuit was related to the retirement of $103.5 million of the notes after Cash America spun off an online lending business in 2014. Despite the notes being non-callable at the time, CSH did not pay a make-whole premium on the retirement. A hedge fund has been suing since then.

The broker offered us 1-2 cents on the dollar for our participation rights. We analyzed the relevant documents and spoke to one of the lawyers on the case and determined that the case might possibly be resolved within a few months. Summary judgement had already been completed on September 19, 2016, and was in favor of the bondholders. The only disagreement was the amount of compensation that would be awarded to bondholders. We chose to hold onto the rights. After several short delays, the parties came to an agreement. On January 13, 2017, the Fund received 8.6 cents on the dollar in compensation. This gain was the top contributor in the three-month period ended March 31, 2017.

Dominion Diamond common stock (ticker: DDC) is one of the Fund’s newest positions and happened to be the second largest contributor in the first quarter. Dominion is the world’s third largest diamond producer. The company owns interests in two mines located in Canada, which is one of the most stable political jurisdictions in the world.

While the diamond industry is not recession-resistant, the long-term supply and demand fundamentals appear to be supportive of prices. Diamond mines can take over a decade to construct from start to finish, which tends to stabilize the supply side of the equation. Furthermore, because just four producers account for roughly 75% of global production value, the industry has historically been quite rational in pulling back supply in the face of weak end-market demand.

Last month we attended a mining conference where we met with Dominion’s management team and that of a competing diamond producer. We left more confident in the long-term industry fundamentals, as well as Dominion’s capital allocation plans. Dominion’s equity appeared quite a bit cheaper than comparable diamond producers. The firm has a very strong balance sheet that includes a large cash balance and sizeable inventory of diamonds. We purchased the stock in early March. Two weeks later, Dominion received an unsolicited buyout offer from billionaire David Washington at a 36% premium to the prior closing price.

Rent-A-Center 4.75% notes due 5/01/2021 (ticker: RCII) were our worst performing security in the quarter but had an immaterial impact on the Fund’s performance. We cut our position last year and exited the remainder in the first quarter. The business began to show cracks in the November earnings report when operations were hurt by bugs in a new software system that impacted stores’ ability to sell and collect payment. We assumed the software issues were fixable, but the sales trends were clearly deteriorating, even excluding management’s estimate of the software impact. We have various ideas as to why the top line might be experiencing secular pressure, but what was most enlightening to us was the level of operating leverage the business exhibited with a higher than nominal change in sales. The company has been cutting store-level costs for years to battle a slowing declining business, which masked the operating leverage.

Fast forward to January. Rent-A-Center pre-announced fourth quarter earnings. A pre-announcement is almost never good. It means the business has deteriorated significantly (or not improved as hoped) in relatively short order. Importantly, there was no issue with the software system, yet sales deteriorated even further. The firm announced same store sales in the core rent-to-own business were down about 14%. The company also announced management turnover. Our view is that Rent-A-Center is not suffering from company-specific or transient issues. We exited the position when we learned the point-of-sale system was not responsible for the operational missteps. Our timing could have been better, as a well-known activist hedge fund stepped in less than two weeks later and so far has provided significant support for the bonds and the stock.

As short-term rates have risen over the past few quarters, we have had some success in identifying investment-grade bonds maturing in 1-2 years that in some cases offer yields close to 2%. We believe such bonds are an attractive use of cash in the current environment of extremely low yields offered by lower-rated issues. We sourced several new short-term investment-grade ideas in the first quarter, including the bonds of familiar businesses such as Hasbro and Wyndham Worldwide. We also added to existing investment-grade and high-yield positions. The Fund initiated positions in two new high-yield securities in the quarter; Actuant Corp 5.625% due 6/15/2022 and Cable One 5.75% due 6/15/2022. As for the Fund’s sales, the exit of the Rent-A-Center position was discussed previously. Lion’s Gate finally completed its acquisition of Starz in December, and our Starz bonds were retired. Lastly, two short-term investment-grade issues matured.

Actuant (ticker: ATU) is a leading provider of niche tools and solutions to diverse end markets. The firm’s Enerpac business has dominated its market for years and has branded itself as the most trusted supplier of heavy lifting products, and Actuant also has commanding positions in other product lines. While its end markets can be highly cyclical, the company prints cash in good times and in bad. This is a blessing during recessionary periods, as ATU generates plenty of cash to service and reduce debt. However, limited reinvestment opportunities have resulted in a number of questionable acquisitions over the last several years, mostly funded with debt.

All of Actuant’s businesses have struggled over the last two years due to weak end markets, which has pushed leverage above the high end of management’s targeted range, but the market for high-margin industrial tools appears to have stabilized. Actuant has a long history of generating significant free cash flow. While gross leverage appears elevated for an industrial firm, its debt/free cash flow is quite low at 3.9x. Actuant also holds $180 million in cash, or 31% of the outstanding debt. Furthermore, we believe management has the ability and willingness to pull multiple levers, if needed, including potentially divesting segments. Our view is that the Enerpac business alone is worth more than the par value of all of the debt.

Cable One (ticker: CABO) is one of the largest cable operators in the United States. The company targets smaller metro areas with less competition. CABO has been transitioning its business toward data as video subscribers have turned to over-the-top offerings, such as Netflix, Amazon, and Hulu. While the firm did use debt to fund a recent acquisition, we believe the obligations are manageable. Cable One has one of the better balance sheets in the industry. We believe the notes maturing in 2022 offer a fair return for the risks.

There have been some rumblings in the high-yield market recently, specifically in energy and distressed retailers. Several of the largest brick-and-mortar retailers are closing stores at a rapid pace, and the number of retailer bankruptcies is on pace to exceed 2008. So far this year, well-known retailers Gander Mountain, HHGregg, Wet Seal, and Limited Stores have declared bankruptcy, in addition to five other large businesses. RadioShack filed Chapter 22, meaning the firm has entered Chapter 11 for the second time in recent history. Several others are on the brink. Some distressed retailers may be able exit bankruptcy and continue to operate with newly restructured balance sheets. The weaker concepts may be shuttered for good. Wet Seal and Limited have already closed all of their stores. HHGregg is likely to follow suit. The Income Fund has limited exposure to the discretionary retail sector, a position we have maintained for some time considering the current state of the economic cycle, but we welcome any market dislocations that might lead to attractive investment opportunities.

As always, we are diligently searching for undervalued securities on your behalf. Thank you for your investment.

Sincerely,

Jason Lazarus, CFA

Intrepid Income Fund Portfolio Manager