July 1, 2021

“Inflation is just like alcoholism. In both cases, when you start drinking or when you start printing too much money, the good effects come first. The bad effects only come later.”

— Milton Friedman

Dear Fellow Shareholders,

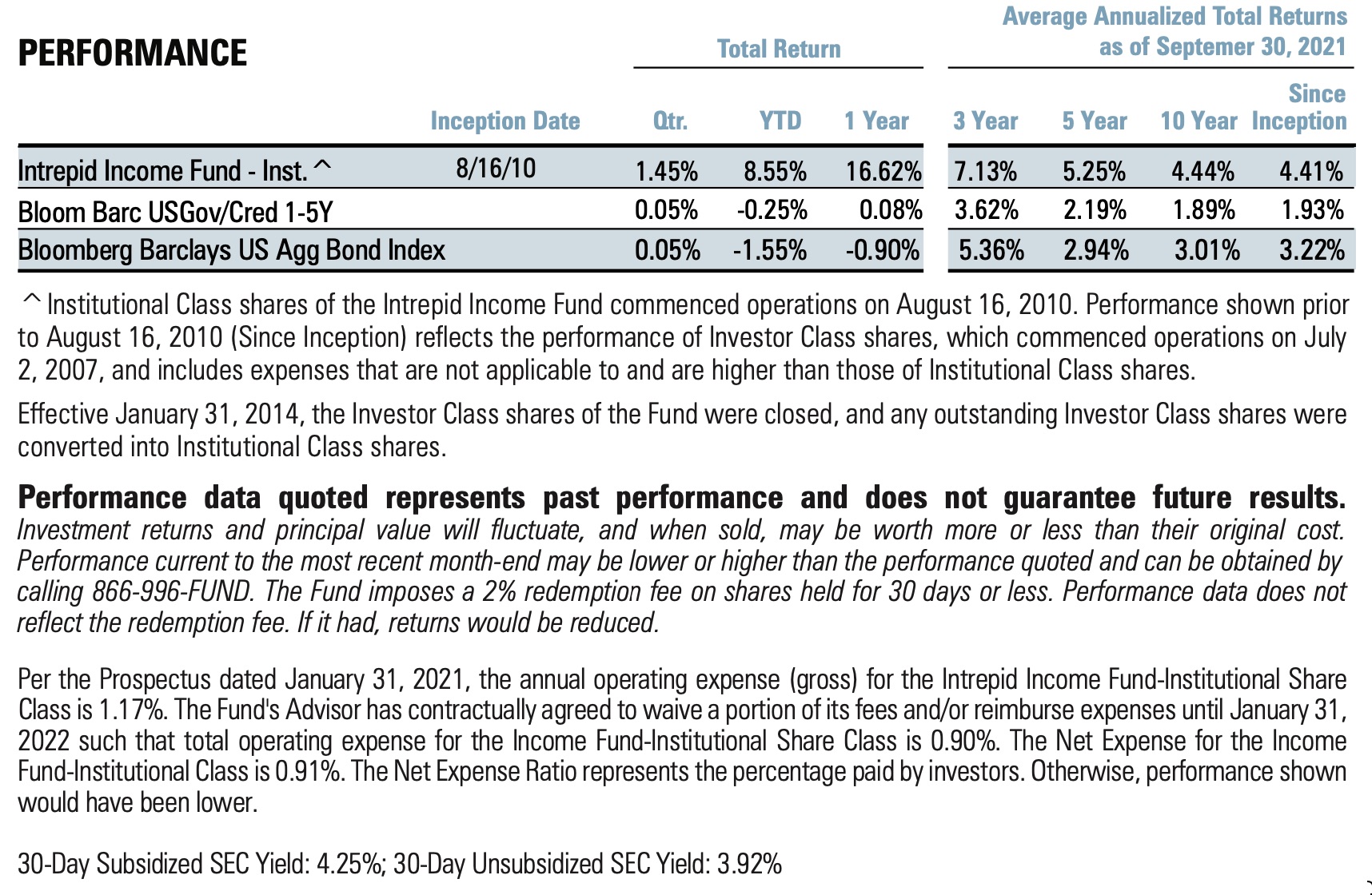

We are pleased to report that The Intrepid Income Fund (the “Fund”) gained 1.45% for the quarter ended September 30, 2021. General fixed income performance for the third quarter was mixed. Rates round tripped, with the 10-Year Treasury ending September yielding 1.52%, 7 basis points above the end of last quarter. That translated into flat performance for the duration-heavy Bloomberg Barclays US Aggregate Index (the “Barclays Aggregate Index”), which rose 0.05% for the quarter ended September 30, 2021. Similarly, the ICE BofAML US Corporate Index (the “Corporate Index”) returned -0.06% over the same period. Riskier debt continued its recovery on the back of improved earnings, with the ICE BofAML High Yield Index (the “HY Index”) gaining 0.94% in the quarter. The shorter-duration Bloomberg Barclays US Govt/Credit 1-5 Year Total Return USD Index (the “1-5 Year TR Index”) returned 0.05% over the same period.

The Fund’s success during the third calendar quarter was primarily attributable to idiosyncratic security performance, but we also benefited from a positive overall environment for risk assets. Our top contributors for the three months ended 9/30/2021 included:

- GRTWST 0% due 9/01/2025 – Great Western is the gift that has kept on giving du

ring calendar Q3 for The Intrepid Income Fund. Since troughing in the low 90s in early Summer, these notes now trade above par on the back of significantly higher oil and natural gas prices. The company’s CEO, Rich Frommer, announced his retirement at the end of September and John McCready has stepped in as the new leader of this DJ Basin private operator. We continue to believe that Great Western remains an attractive buyout candidate. If the company is purchased before March 2022, these notes have a special call price of 110 cents on the dollar.

ring calendar Q3 for The Intrepid Income Fund. Since troughing in the low 90s in early Summer, these notes now trade above par on the back of significantly higher oil and natural gas prices. The company’s CEO, Rich Frommer, announced his retirement at the end of September and John McCready has stepped in as the new leader of this DJ Basin private operator. We continue to believe that Great Western remains an attractive buyout candidate. If the company is purchased before March 2022, these notes have a special call price of 110 cents on the dollar. - ACREAGE 15% due 10/30/202 – Acreage reported improved 2nd quarter earnings as the company has continued to scale its attractive footprint in limited license states like Illinois, Ohio,and New Jersey. Despite the improved earnings, the company breached one of the covenants specified in the loan’s credit agreement and agreed to pay lenders a consent fee in exchange for waiving that covenant for a time. We continue to believe that this loan is currently strong given that it is backstopped by valuable licenses and the implicit support of Canopy Growth. We also believe the loan is likely to be taken out at a call price of 107.5 cents on the dollar as the company continues to improve its operating results.

- EZPW 375% due 5/01/2025 – EZCORP has been a perennial Intrepid holding across its entire capital structure. These convertible notes were purchased in the low 80s last year when they were deeply “busted.” We feel that the appreciation in the notes this quarter was the market continuing to recognize EZPW’s resilient cash flow profile and strong balance sheet, which now carries net cash, as well as how EZPW’s core business is insulated from inflation. As EZPW’s stock has continued to run up, we have swapped out of the company’s 2024 notes, which are now close to being “in the money,” and into these 2025 notes which currently yield 5% to maturity.

Our only material detractor for the three-month period ended 9/30/2021 was:

- UPH 25% due 6/15/2026 – UpHealth is a global digital healthcare company that recently went public via SPAC and issued these convertible notes as part of its qualifying transaction. Although we viewed these notes as being well covered by the underlying assets, we were puzzled by several decisions that UPH’s management team made since going public, including an extremely dilutive equity offering that we believe drove the price of these converts lower. We have since completely sold out of our UPH position, which was relatively small, but will keep an eye on this nascent company as it develops.

The Income Fund had two corporate bond positions that were called or matured in the third calendar quarter. We also reduced one position after it hit our internal yield bogey, selling out of our Terrascend 12.875% Notes due 12/18/2024 entirely.

The proceeds from the bonds that were called, sold, or matured were redeployed into a mixture of existing positions and new positions, including:

- ZEV 5% due 5/15/2024 – Lightning eMotors is a leader in the electrification of Class 3-7 vehicles. We started nibbling at the company’s convertible debt after doing our initial due diligence and then took a full position after the company announced a transformative order with Forest River, a Berkshire Hathaway portfolio company, for ~$850 million of revenue over the next few years. We believe ZEV will continue to scale as it fills its robust backlog and that there are immense tailwinds for electric vehicle manufacturers.

- AHERN 7.375% due 5/15/2023 – Ahern Rentals, Inc. is the largest independently-owned equipment rental company in the United States. Although saddled with a high debt load, we believe the company is well positioned for a potential boom in infrastructure spending and can help mitigate inflationary pressures through its pricing We believe these 2023 notes will be refinanced over the next 6-12 months.

- ATENTO 8% due 2/10/2026 – Atento SA provides business process outsourcing services in primarily Latin America and The company has generated healthy amounts of free cash flow and has a solid balance sheet that has deleveraged every quarter.

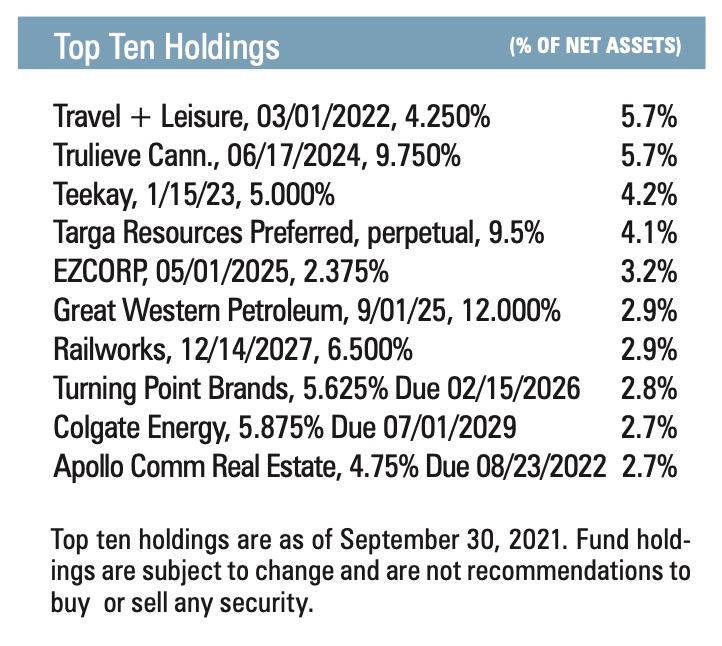

- ARI 75% due 8/23/2022 – Apollo Commercial Real Estate Finance, Inc. is a commercial real estate finance company based in New York. The majority of the company’s investment portfolio is made up of commercial mortgage loans. These busted converts offered nearly 4% yield to maturity, making this a robust short- duration credit in our view. We believe the company has myriad options for refinancing the notes next year.

- WILDCN 875% due 9/30/2024 – WildBrain Limited is a Canadian media company with an attractive mix of assets. The company owns the world’s largest independent library of children’s content and recently launched a streaming platform. We picked up the converts at nearly a 6% yield and think this paper is well positioned within the capital stack, despite the relatively high leverage. With minimal capital expenditures going forward, we expect the company to potentially deleverage a turn in 2022, with an aim to gain operating leverage as it monetizes its intellectual property.

- TRULCN 8% due 10/06/2024 – We have discussed Trulieve at length in previous commentaries. In September, the company raised $350 million of non-dilutive debt with an 8% coupon to refinance the outstanding Harvest debt that was adopted from the recently closed We continue to view Trulieve as one of the best positioned cannabis operators and we believe the company’s balance sheet is strong.

- TNL 25% due 3/01/2022 – We have owned Travel + Leisure Company’s bonds before, but under its old name of Wyndham Destinations. These notes currently offer decent yield relative to the risk profile of the company and we plan to hold them until maturity early next year.

- GLNG 75% due 2/15/2022 – Golar LNG operates LNG infrastructure assets. We picked these broken converts up at nearly a 4% yield and believe the company will likely have no problem paying this down early next year with the proceeds from its sale of Hygo Energy Transition & Golar LNG Partners.

We continue to persevere through these frothy times by scouting for strong ledges in the capital structure and by lending to companies that remain disciplined despite the temptations of cheap leverage. We would be lying if we claimed to know what will happen if and when the Federal Reserve raises interest rates and whether inflation will truly be transitory or not. However, we are confident that the companies we are lending to have the ability to potentially mitigate the insidious impacts of an inflationary environment and that our short duration bias should allow us to remain nimble.

At the end of the third quarter, the portfolio had a yield-to-worst of 5.9% and an effective duration of 2.3 years.

Thank you for your investment.

Sincerely,

Mark F. Travis, President

Intrepid Income Fund Co-Portfolio Manager

Hunter Hayes

Intrepid Income Fund Co-Portfolio Manager