October 1, 2021

“I sit on a man’s back, choking him and making him carry me, and yet assure others that I am very sorry for him and wish to ease his lot by all possible means.”

— Leo Tolstoy

Dear Fellow Shareholders,

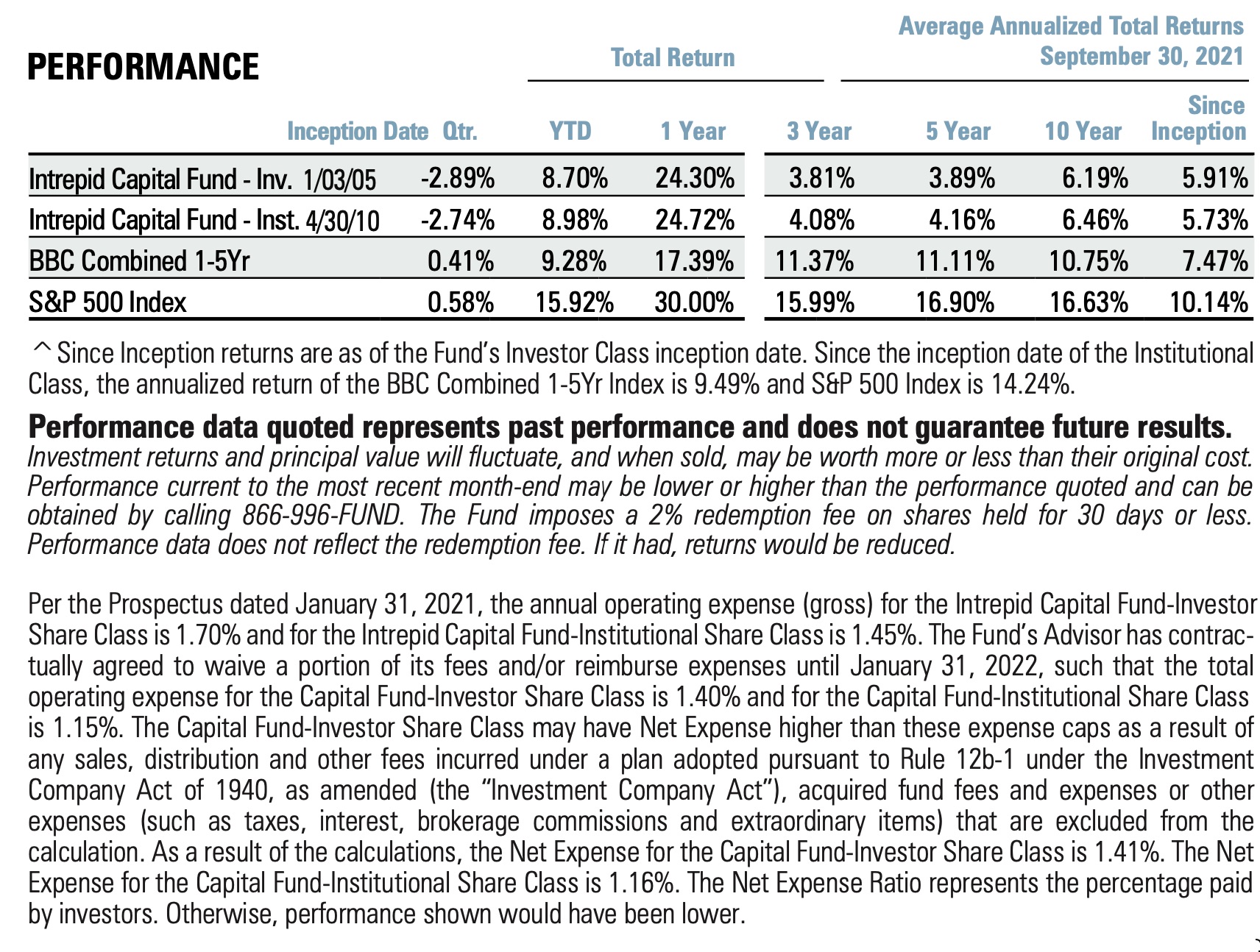

The Intrepid Capital Fund completed its fiscal year on September 30th, 2021 with a total return of 24.30% for that period. For the six months since our last shareholder letter of 3/31/21, the Intrepid Capital Fund had a total return of 3.22%. Much of the Fund’s performance was “front-loaded” into the fourth calendar quarter of 2020 and first calendar quarter of 2021. The third calendar quarter of 2021 (the Fund’s fourth fiscal quarter) proved to be more difficult for the Fund with a return of -2.89%.

The market has now caught a whiff of several things in my opinion that caused the third quarter to be more challenging:

- Inflation. Despite repeated attempts by Jerome Powell (Head of the Federal Reserve) to let us know inflation was – in his words – “transitory,” a quick look at the results of commodities during the quarter show double digit increases in everything from natural gas (+61%) to coffee (+22%). In addition, with governmental incentives to not

work, almost every business is facing a labor shortage. Surely you have noticed the help wanted signs at local and national businesses offering $15.00 hourly rates for new hires.

work, almost every business is facing a labor shortage. Surely you have noticed the help wanted signs at local and national businesses offering $15.00 hourly rates for new hires. - Interest rates. Rates are starting to rise to reflect the above inflationary pressures, along with the anticipation of a tightening cycle implemented by the Federal Reserve. Please keep in mind in a discounted cash flow analysis the farther out in the future a projected return (longer duration), the more drastic the price depreciation as rates move Businesses not profitable or with cash flows farther into the future were hit harder this quarter.

- Politics. Last, but not least, our friends in Washington are wrangling with a debt ceiling limit, an infrastructure bill which has cleared the Senate, and a monster $3.5 trillion stimulus To “sidestep” the 60 votes required to avoid a filibuster to pass the stimulus bill through “reconciliation,” 50 Democrats must vote “Yea” knowing all 50 Republicans are voting “No.” This stimulus bill, if passed, has a plethora of both corporate and personal tax increases. As simply as I can put it: higher taxes equal lower earnings. Based on possible lower earnings (the market is now discounting that possibility at the least) I am hoping some more conservative members of the Democratic Party can remove the economically destructive parts (higher taxes, higher spending) of the current $3.5 trillion stimulus bill. Time will tell.

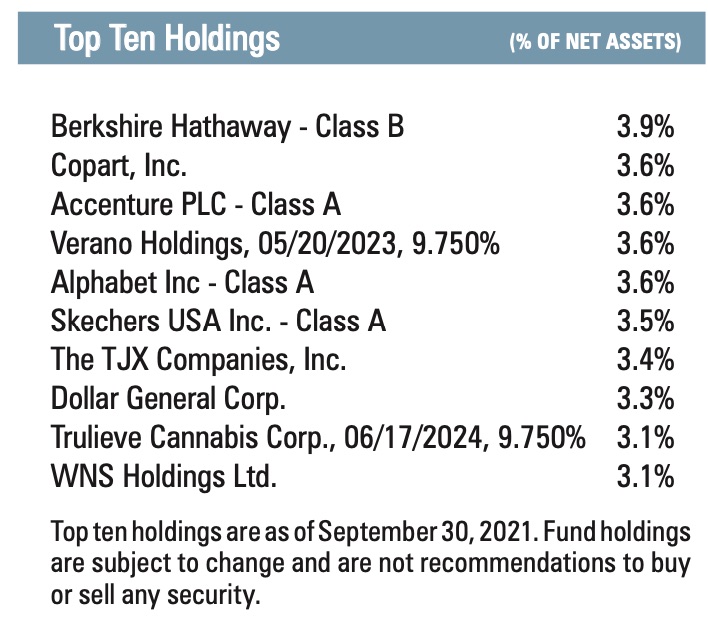

For the third quarter of 2021, the following were the top five contributors to the Intrepid Capital Fund:

- Alphabet (GOOGL)

- Jefferies Financial (JEF)

- Accenture PLC (ACN)

- Copart (CPRT)

- Great Western Petroleum 12% 9/1/2025 The biggest detractors for the same period were:

- Trulieve (TCNNF)

- Skechers (SKX)

- Twitter (TWTR)

- Vimeo (VMEO)

- Take Two Interactive (TTWO)

Thank you for your continued support. If there is anything we can do to serve you better, please don’t hesitate to call.

Best Regards,

Mark F. Travis, President

Intrepid Capital Fund Portfolio Manager

Mutual fund investing involves risk.

All investments involve risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.