January 1, 2022

Dear Fellow Shareholders,

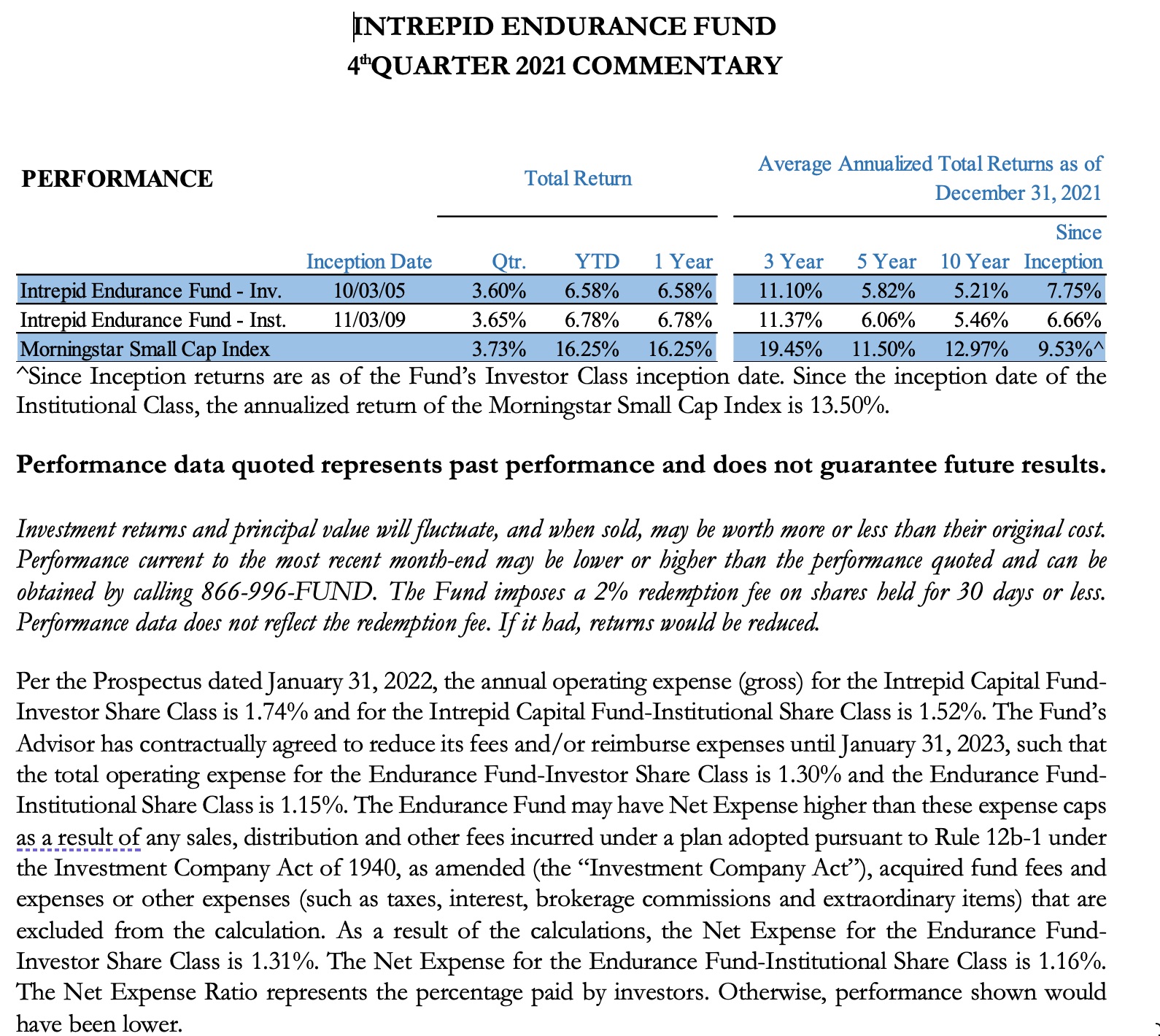

Small cap stocks finished off the last quarter of the calendar year with a more volatile path than one would assume just by looking at the result. Small cap indices rose over 10% by early November, fell to negative returns by early December, but rebounded to low single-digit percentage returns by the end of the quarter. Specifically, the Russell 2000 returned 2.12% in the fourth calendar quarter of 2021 (the Fund’s first fiscal quarter of 2022). The Intrepid Endurance Fund Investor Share Class (“Fund”) returned 3.60%, slightly underperforming the 3.73% return of its benchmark Morningstar Small Cap Index.

Activity in the Fund was higher than usual, as the volatility this quarter gave us more opportunities to gradually position the portfolio better for potential inflationary economic outcomes and/or higher interest rates. To reiterate our goal from last quarter, we try not to base our investment decisions on macroeconomic predictions, but we do want to make sure that the Fund is appropriately positioned should the market’s fear of “higher for longer” inflation and higher interest rates come true.

We purchased five new positions during calendar Q4 and sold three. The purchases were:

- Civitas Resources (CIVI) – Civitas Resources is the new name of a company we have owned in the past– Bonanza Creek Energy. A lot has changed, the company has done several mergers over the last year and has consolidated itself into one of the largest, scaled energy producers in Colorado. But their low leverage, high free cash flow model has only gotten better as they have grown.

- Hilltop Holdings (HTH) – Another former holding, Hilltop is a diversified regional bank based in Dallas. We believe it is one of the best positioned and well-managed small cap banks that we have researched and trades at what we consider an attractive multiple on a relative or absolute basis.

- Conduent Inc. (CNDT) – A large player in the business process outsourcing industry (BPO) where we believe the market has not recognized new management’s progress in its turnaround after prior years of mismanagement.

- Verano Holdings (VRNOF) – A major US cannabis company with operations in a number of limited license states. We reduced positions in our other cannabis names upon adding Verano in an effort to diversify total cannabis exposure (we now own three cannabis businesses).

- Naked Wines (WINE LN) – A direct-to-consumer wine retailer with an interesting “subscription-like” business model that we think is being unfairly punished in the market’s rotation away from “covid winners ”

Our three sales this quarter were Vimeo (VMEO), Five Below (FIVE), and Etsy (ETSY). Vimeo was a holding we received as a spin-off from another position and subsequently divested. Five Below and Etsy are both consumer companies whose stocks exceeded our estimates of intrinsic value during the quarter following quite successful holding periods.

The largest positive contributors for the quarter were Take-Two Interactive Software (TTWO), Etsy (ETSY), and Franklin Covey (FC). Take-two reported one of the strongest quarters of the large video game publishers and the stock rebounded from a sluggish end to calendar Q3. Similarly, Etsy’s stock rocketed higher following stellar results and we sold the stock shortly after. Finally, Franklin Covey finished the year with continued improved results that have more than fully recovered from the pandemic.

The largest negative contributors were Green Thumb Industries (GTBIF), Turning Point Brands (TPB), and Dropbox Inc. (DBX). Despite a great Q3 result, Green Thumb stock fell sharply during the quarter as negative investor sentiment around political developments for cannabis continued to outweigh economic fundamentals. Tobacco products company Turning Point Brands stock fell after revising guidance for Q4 results lower. Finally, Dropbox fell in the quarter despite solid results as we believe it got caught up in drawdown in speculative technology stocks despite sporting strong cash flow and a reasonable valuation.

For the calendar year, the Fund reported a disappointing 6.58% return versus the benchmark Morningstar Small Cap Index’s 16.25% return. The Russell 2000 index returned 14.78% for the calendar year.

The top contributors for the calendar year were Franklin Covey (FC), LGI Homes (LGIH), and Fabrinet (FN). The top detractors for the calendar year were each cannabis businesses – Green Thumb Industries (GTBIF), Cresco Labs (CRLBF), and Trulieve (TRUL CN).

The Fund’s underperformance for the calendar year was due to the large weight throughout the year in the cannabis industry as well as its underweight position in several industries that outperformed.

The US cannabis industry is one we have discussed at length before in the Fund’s prior letters. To avoid sounding too much like a broken record, we will keep it short: we are very disappointed in the poor returns these stocks reported this year, but their operating results were outstanding. We continue to hold these positions, although to remain prudent we have reduced our overall weighting over the last six months, spread out our bet a bit more to reduce concentration while keeping quality high, and utilized the drawdown to harvest tax losses towards the end of the year.

The remaining underperformance for the year was attributable to an underweight position in “recovery play” stocks such as energy and financials. These types of stocks were especially in favor during Q1 of the calendar year, and we found ourselves somewhat “offsides.” In general, these sectors have not been our favorite areas in which to allocate capital over the last few years, as many of these companies are unprofitable or lack any meaningful competitive advantages. However, as conditions have changed (namely higher interest rates and commodities prices), we have increased exposure to these sectors and have a more balanced positioning heading into calendar 2022 than in 2021.

Looking at the whole portfolio, it is clear our underperformance was due to positioning rather than underlying company results. With very few exceptions, the companies the Fund held this year performed well in excess of our expectations. We will continue to focus our effort on discovering and investing your capital in companies that have significant competitive advantages, are well-managed, have conservative balance sheets, and trade at reasonable valuations. We will also work hard to continue to maintain a well-balanced portfolio among industries and “factors,” as the stock market shows no signs of abating from the trend of violent factor rotations that we have written about in the past. Over longer time horizons (e.g. 2-3 years), however, we are confident that fundamentals will outweigh the market’s mood swings, and that our process will deliver attractive risk-adjusted returns.

Thank you for your trust and investment. With the Fund full of well-run and well-managed companies reporting results consistently above our expectations, we look forward to 2022. While many in the financial press are currently making predictions of higher inflation, slower growth, or other worrying developments, we remain focused on finding the best risk/reward opportunities we can in the small cap market. Should the volatility we saw this quarter continue, we will work hard to use that to your advantage.

Thank you for your investment.

Matt Parker, CFA, CPA

Intrepid Endurance Fund Co-Portfolio Manager

Joe Van Cavage, CFA

Intrepid Endurance Fund Co-Portfolio Manager