30-Day Subsidized SEC Yield: 7.06%; 30-Day Unsubsidized SEC Yield: 6.78%

October 1, 2020

Dear Fellow Shareholders,

Blaise Pascal was a Renaissance man. During his short life, the Frenchman made vast contributions to mathematics, physics, philosophy, and even finance. In fact, Pascal was the first person to explore the now ubiquitous concept of expected value. He reasoned that, when faced with a choice, one should identify all possible outcomes, determine the values and probabilities of the outcomes, multiply the two, then sum up those products to make an optimal decision.

At Intrepid, we use the concept of expected value all the time. For example, if we are evaluating an investment that has a 50% chance of returning 10% and a 50% chance of returning -10%, the probability weighted expected return would be 0%, and we would pass on that idea. Things are never this clear cut in real life, but the framework is useful for evaluating investment decisions.

When we determine whether to lend a company money, we often define a best and worst-case scenario and assign probabilities to each. After calculating an expected value, we can view capital deployment through a risk-adjusted lens. Although this framework is entirely reliant on our assumptions, it allows us to ascertain risk and reward in a practical and easy-to-understand way.

Pascal’s concept of expected value is also the basis for perhaps his most famous argument – Pascal’s Wager. This wager is Pascal’s solution to the age-old question of whether one should believe in God or not. Pascal argues that the reward for belief in God is infinite (eternal life, heaven, etc.) while the cost for believing in God is relatively low (going to church, praying, etc.) and the worst-case outcome is unknowable. Therefore, Pascal argued, it is prudent to keep praying!

It seems like many investors have adapted Pascal’s Wager to the financial markets. We have heard countless arguments about the omnipotence of the Federal Reserve and the endless arsenal of tools Jerome Powell possesses to buoy risk assets. Given recent history, one might assume that buying any dip offers tantalizing upside and muted downside. After all, spreads on high yield bonds peaked the day the Fed announced it would implicitly backstop junk bonds, and the Nasdaq is up over 50% since April.

In the world of high yield debt, where many credits yield less than 3% today, debt investors in search of meaningful yield must now venture farther out on the risk spectrum. Generally, riskier credits carry more debt which makes the issuers of that debt more sensitive to economic shocks. Some investors seem convinced that the Fed can continue to insulate these riskier borrowers indefinitely with a deluge of liquidity and low rates.

But the Fed is not omnipotent. The liquidity band-aid that has been slapped on the economic wound from the pandemic is cosmetic at best. When the dust settles, we will be left with a deep scar in the form of onerous corporate, personal, and national leverage. The assumption that support from the Fed somehow justifies absurd equity valuations or makes all indexed high yield issuers creditworthy is flawed. The Fed cannot turn bad credits into good credits just by pushing prices up.

We are not suggesting that it is prudent to sit this market out. After all, the Income Fund is fully invested. We are pointing out that everything seems to be working right now. As an investor once put it, “making money in a rising market is no more remarkable than getting wet while walking in the rain.”

Just like a rainstorm, we do not believe that rising markets last forever. Sooner or later, which companies we lend to will matter. Accordingly, we continue to deploy capital through a disciplined approach based on expected value and do not make decisions predicated on a handout from the Fed.

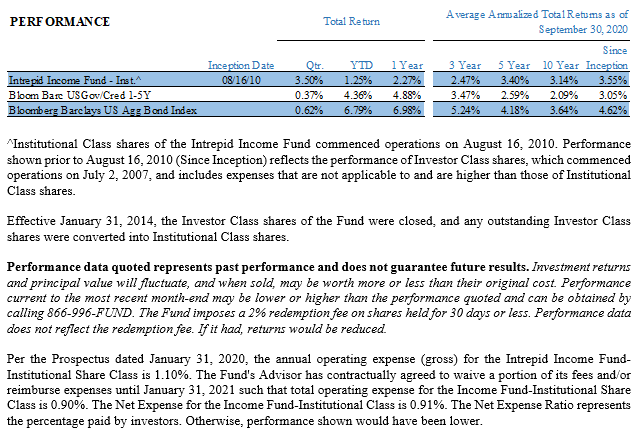

Credit markets enjoyed a strong calendar third quarter. The Bloomberg Barclays U.S. Gov/Credit 1-5Y TR Index returned 0.37%. Investment grade corporate bonds returned 1.69% for the quarter, as measured by the ICE BAML US Corporate Index. The lower quality ICE BAML US High Yield Index saw an increase of 4.71%.

The Income Fund returned 3.50% in the third calendar quarter. At the end of the quarter, the Fund had a yield-to-worst of 8.40% and an effective duration of 1.94 years.

For the fiscal year which ended 9/30/2020, the Fund returned 2.27%. During the same period, the Bloomberg Barclays U.S. Gov/Credit 1-5Y TR Index returned 4.88%, the ICE BAML US Corporate Index returned 8.06%, and the ICE BAML US High Yield Index saw an increase of 3.80%.

The third quarter was an active one for the Fund. We lent money to eight new companies, including:

- KeHE Distributors, LLC – KeHE is a food distribution company in the specialty, natural, and organic categories. We like the experienced management team and the fast-growing end-markets to which KeHE has exposure. When the company issued its 8.625% notes due 10/15/2026 late last year, we passed on the deal in the primary market because of the high leverage. During the pandemic, however, sales have surged, and the company has improved its balance sheet. Today, KeHE’s notes yield over 6% to the 2022 call which we believe is good value given the company’s low leverage, high free cash flow generation, and ample liquidity.

- Meredith Corporation – Meredith is a diversified media company that owns several large magazine brands and network-affiliated television stations. A few years ago, Meredith took on some debt to purchase Time for $3.2 billion. Although this turned out to be an ill-timed acquisition, the company still generates good free cash flow (double-digit percentage of total debt) and has been using this cash towards debt reduction. Although COVID-19 has caused leverage to increase, we believe Meredith is in a good liquidity position and can get to its long-term net total leverage target of 2.0x over the next couple of years. We own the 6.875% notes due 02/01/2026 that currently yield just under 10% to maturity.

- Speedway Motorsports, LLC – Speedway is a leading promoter, marketer, and sponsor of motorsports. We have owned the company’s equity and debt in the past and decided to dive back into the debt after it sold off. The company generates consistent free cash flow and has had a nice bounce back in revenue with NASCAR events starting to resume. When we purchased the 4.875% notes due 11/01/2027 during the quarter, the bonds were yielding ~6.50% to maturity. Although they have traded up since then, we continue to hold this position.

- Turning Point Brands, Inc. – We purchased Turning Point’s 2.5% broken convertible bonds due 7/15/2024 at roughly an 8% yield to maturity at the beginning of the quarter. The company sells tobacco products through three verticals: Smokeless, Smoking, and NewGen. The Smokeless and Smoking segments are stable and recession resistant with >50% gross margins and ~40% operating margins. Both segments are still growing the topline through market share gains and price increases. NewGen has exposure to vaping and is a high risk/reward call option. We believe the company carries investment grade credit risk even though the notes are unrated. If NewGen works out, we believe the stock could also appreciate considerably and cause the converts to end up in the money.

- Vista Outdoors, Inc. – Vista is an outdoor sports and recreation company. This is another position we have owned on both the debt and the equity side before. The company has steadily been deleveraging its balance sheet through asset sales and enjoyed a surge in ammunition sales earlier this year that translated to a free cash flow yield of over 25% of its debt load. We continue to like Vista’s 5.875% notes due 10/01/2023 which are currently yielding ~4.5% to next year’s call.

- Oppenheimer Holdings Inc. – Oppenheimer is a middle market investment bank and wealth manager that serves companies and high net worth customers. The company makes its money through advisory services, fees on assets under management, trading, and retail commissions. We even do a decent amount of our bond trading through Oppenheimer! We bought the company’s 5.5% notes due 10/01/2025 in the primary market given the low leverage and improving profitability profile.

- Tervita Corp. – Tervita is a Canadian energy services company. Although the company was thwacked along with other energy names during the worst of the pandemic, Tervita has a good balance sheet and an undrawn revolver that gives it tons of liquidity. Drilling has started to resume in the Western Canadian Sedimentary Basin, which is good for Tervita. We recently purchased the company’s 7.625% notes due 12/01/2021, as we believe a refinancing is imminent.

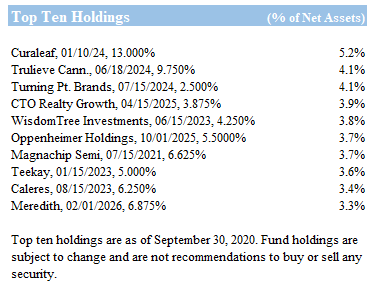

The Fund’s top contributors for the three-month period ending September 30, 2020 were Matador Resources Co. 5.875% notes due 9/15/2026, Consolidated Tomoka Land Co 3.875% notes due 04/15/2025, and Caleres Inc. 6.25% notes due 8/15/2023. The Fund only had one material detractor for the quarter, EZ-Corp Inc. 2.875% notes due 7/01/2024. After a large run-up from our initial purchase price, these convertible notes gave up some gains but remain one of our favorite positions.

The Fund’s top contributors for the fiscal year ending September 30, 2020 were Cincinnati Bell 8.0% notes due 10/15/2025, Curaleaf Inc. term loan due 01/14/2024, and Trulieve Corp. 9.75% notes due 6/18/2024. The Fund’s top detractors for the fiscal year were EQM Midstream Partners 4.75% notes due 7/15/2023, Bombardier Inc. 6.0% notes due 10/15/2022, and Great Western, LLC 9.0% notes due 9/30/2021.

The Income Fund had seven positions that were called or matured in the third calendar quarter. We also rebalanced several positions. The proceeds from the bonds that matured or were called were redeployed into some of the new securities we listed above as well as existing positions.

We are pleased with the amount of opportunities we have uncovered during this unusual time. Our preference is to continue deploying capital into short duration securities with a clear path to repayment. As tempting as it may be to put one’s faith in the almighty Federal Reserve, we remain steadfast in our conviction that good credit work and discipline will ultimately prove the more prudent path.

Thank you for your investment.

Sincerely,

Mark F. Travis, President

Intrepid Income Fund Co-Portfolio Manager

Hunter Hayes

Intrepid Income Fund Co-Portfolio Manager