January 1, 2021

Dear Fellow Shareholders,

Wow, what a wild quarter and year. For the quarter, small cap stocks went on an absolute tear, with the Russell 2000 index returning 31.4%. Optimism about a strong economic recovery in 2021, expectations of further economic stimulus, and the release of very positive vaccine news drove small caps to a historically strong quarter.

For the full calendar year, small cap stocks returned a very attractive 19.9% as measured by the Russell 2000. But as hinted above, it was quite a path to get there. We won’t re-hash the twists and turns, as we are sure all reading this remember the tremendous market swings throughout the year quite well.

We believe there were countless investing takeaways from the volatility this year, but none larger than confirming that making economic or market predictions about the future is not a useful exercise. Anyone who says they predicted and positioned their portfolio accordingly for what happened this year is probably lying to you.

Relatedly, we spent our time in 2020 1) taking advantage of buying opportunities during the panic early in the year and 2) finding new, high-quality small cap companies to add to our possible buy list. Our belief is that there is no better use of our time in any market environment, but that that focus paid off especially well in calendar 2020.

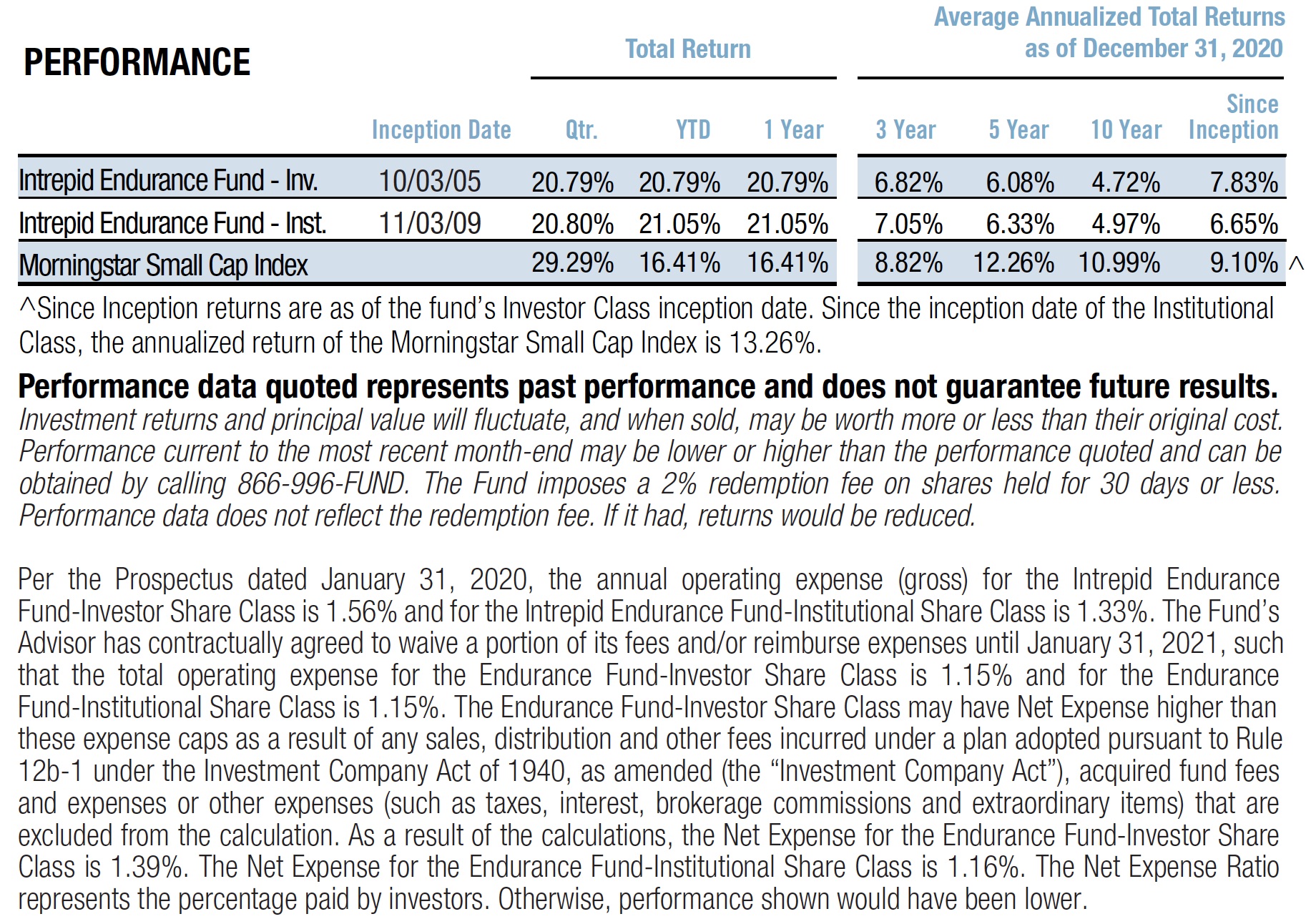

Specifically, despite underperforming our benchmark (the Morningstar Small Cap Index) in calendar Q4, the Intrepid Endurance Fund (“the Fund”) outperformed it handsomely for the full calendar year.

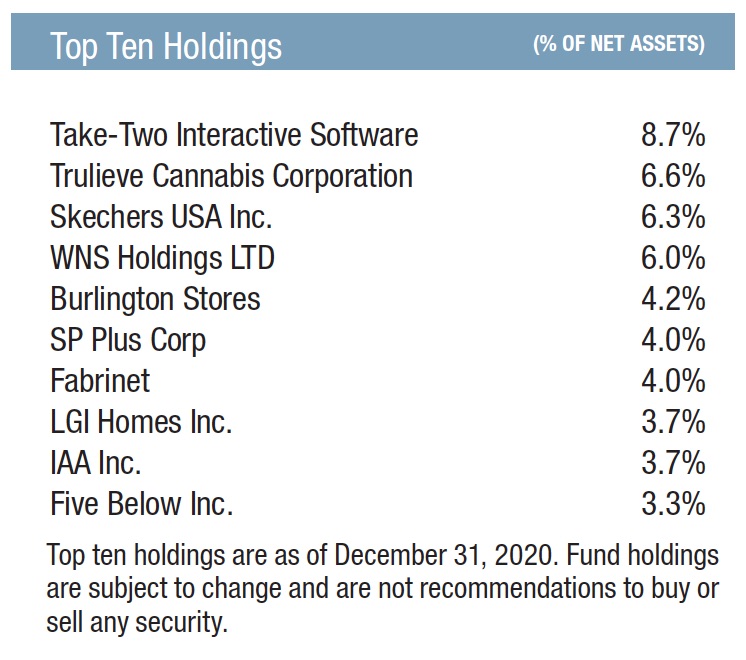

In calendar Q4 (the Fund’s first fiscal quarter of 2021), the Fund returned 20.8% versus the benchmark’s 29.3%. The largest contributors were Trulieve Cannabis (TRUL CN), Take-Two Interactive (TTWO) and SP Plus (SP). The only material detractor was LGI Homes (LGIH). Trulieve and Take-two both benefitted from strong quarterly results. SP Plus stock was a strong beneficiary of the vaccine news, as its business is exposed to travel and other sectors of the economy that were impacted by shutdowns and the work from home trend. LGIH stock declined slightly during the quarter, most likely due to a slight increase in interest rates, but there was not any deterioration in its business fundamentals, in our opinion.

For the full calendar year, the Fund’s return was 21.1% vs. the benchmark’s 16.4%. The largest contributors were Take-Two Interactive, Trulieve Cannabis and Burlington Stores (BURL). The largest detractors were SP Plus, Hanesbrands (HBI) and Garrett Motion (GTX). The Fund no longer owns Hanesbrands and Garrett Motion, and we believe SP’s business will gradually recover as the virus fades away and there is a broader reopening of the economy.

We attribute both the quarterly underperformance and the full year outperformance to the same drivers. True to the Fund’s namesake, we maintained our focus this year on companies that could “endure” most conceivable economic environments. This drove the overall outperformance during the coronavirus panic early in the year, as we tended to be under-exposed to companies that were highly leveraged or that had weaker business models. However, when optimism about a strong economic recovery, stimulus, and a covid-19 vaccine emerged, it was many of these same stocks that became “recovery plays” (stocks which were most at risk of prolonged economic downturn from the virus) and ended up driving the incredible performance of small cap stocks late in the year. By comparison, the higher quality and more stable businesses that we prefer to own tended to underperform small cap indices in Q4.

So how to position the portfolio looking forward?

We believe the underlying concept that your capital should be invested in companies with the capacity to “endure” is crucially important. It is not a strategy we adopted in response to the emergence of the coronavirus. It is a North Star philosophy that we believe helps create value by reinforcing to you that the Fund is invested in companies that can preserve and grow your capital over time with a high degree of confidence. It also helps us, as Portfolio Managers of the Fund, to act with confidence when uncertainty is high and opportunities arise (such as in much of 2020) since our familiarity is mostly concentrated on businesses whose fundamentals can withstand nearly any operating environment.

This has important implications for how the Fund is positioned going forward. To start, we must avoid companies and industries within the small cap universe that are structurally challenged and are unlikely to grow intrinsic value much over time. Two industries that come to mind are small cap energy and financials. While certain macro conditions can emerge that are very favorable for these sectors, we know that the small cap energy production industry has never made a collective profit since the shale revolution began. Similarly, we believe that small banks are competitively disadvantaged due to lack of scale, high regulatory costs, and growing fintech competition. So while we may find an occasional exception, the Fund will almost always be structurally underweight in these industries.

In addition, our focus on companies that can endure guides us to favor companies with competitive advantages, are market leaders within their niche industries and are creating value for both their customers and shareholders. Not surprisingly, these companies tend to be less economically sensitive and often have little to no debt or financial risk. They usually have very strong, proven, incentivized, and accomplished management teams. And they often have modest growth tailwinds to their business. We view our job as finding companies with these qualities and buying them for the Fund when they are priced at a value that implies attractive future returns.

This has led to two important and related changes. The Fund’s positions have now skewed to higher quality companies on average versus the type of companies it owned several years ago. And because of our higher confidence in these companies and their future value creation, the Fund will maintain a much smaller cash position than the extreme levels it has had in the past. We believe the Fund’s new positions in this most recent quarter exemplify well the type of companies it will hold going forward.

New Purchases

- InterActive Corp (IAC) – IAC is a holding company with an exceptional capital allocation record that has been a highly successful value compounder for its owners. It has a niche focus on digital network and marketplace businesses, and the majority of its value today rests in its stakes in Angi HomeServices (described below), global video platform Vimeo, gaming company MGM, and a substantial net cash balance sheet position. We believe the stock trades at a discount to a conservative estimate of the sum of its parts. Given the company’s historical capital allocation success and willingness to divest assets once the appropriate value can be realized, we think this discount is unjustified.

- Angi Homeservices (ANGI) – This business is majority owned by IAC, but we took a separate position in its stock in order to gain pure-play exposure to its business. Angi operates a platform which connects a network of service professionals with homeowners looking for a contractor. The company has generally underwhelmed expectations over the past several years as contractors have had plenty of steady demand and have not needed to source leads through the Angi platform. However, we believe this will change as the platform matures. Like so many other services that have removed friction through digitizing a cumbersome transaction (e.g., Uber for hailing transportation, Booking.com for reserving travel, etc.), we think the Angi platform will ultimately be a better way to schedule home services. We think this will become especially apparent as the company rolls out a fixed price offering and as more younger consumers purchase homes. We expect this demand-side platform growth to force growth for the contractors on the platform (i.e., supply-side), thus creating a lot of value for the Angi platform. While the stock does not appear cheap on historical financials, we believe it is quite attractive relative to cash flows that we think it can generate prospectively.

- CBOE Global Markets (CBOE) – A financial markets exchange business, the company has a dominant position in the trading of options, futures and other derivatives. The economics for exchange businesses like CBOE are highly attractive (returns on invested capital are enormous), and we believe the scale and complexity of the established competitors leads to a defensible earnings stream for CBOE. We purchased CBOE at a mid-teens earnings multiple, which we believe undervalues its business in a normalized environment. Furthermore, we think there is a reasonable chance that the current regime of ultra-low rates and central bank support may lead to structural growth in certain derivative trading strategies that will benefit CBOE’s exchanges. We think of this possibility as an upside optionality that is not priced into the stock.

- Dropbox Inc (DBX)- is an enterprise software company that focuses on workflow productivity for small enterprises. We believe Dropbox has fallen through the cracks – it is growing but too slow for growth investors. And the technology focus and mid-teens free cash flow multiple are not attractive to deep value investors. We are attracted to DBX’s current valuation (15x free cash flow) and its growth (low double digits). However, we are especially excited about the catalyst of its new organizational plan to reduce expenses, expand margins, and return its rapidly growing free cash flow generation back to shareholders. The management team is also highly incentivized through share award targets to increase the stock price after being designated a “broken IPO” from 2018.

The Fund ended calendar 2020 with a cash level of approximately 8%. While this will fluctuate somewhat from here depending on our opportunity set, we believe a cash balance in this range maintains our ability to be aggressive when opportunities arise. In addition, retaining the ability to hold some cash reduces our risk of over-paying for our high-quality opportunity set. We believe investing in enduring companies is important, but we do you no favors by overpaying for them.

We believe the philosophy outlined above is an attractive way to protect and grow your capital. It runs the risk of underperformance during periods in which trends or industries the Fund is under-exposed to (such as “recovery plays,” small cap energy, and financials) are in vogue, but we believe focusing on companies that can endure is a much more prudent long-term strategy than trying to time whatever economic or market trends we think might prevail in the short-term. Remembering how 2020 played out compared to everyone’s expectations only reinforces that belief for us. We prefer to position the Fund in a way that gives us the most confidence in its long-term success.

So long story short, the Fund has less cash and is more invested than at any time in the last 12 years. But that investment is in great companies and at attractive prices that over time should protect and grow your capital. For that reason, we will keep some level of opportunistic positioning going forward, but we will manage the Fund with much less cash than it has had historically.

We hope you had a safe 2020 and an enjoyable holiday season.

Thank you for your investment.

Matt Parker, CFA, CPA

Intrepid Endurance Fund Co-Portfolio Manager

Joe Van Cavage, CFA

Intrepid Endurance Fund Co-Portfolio Manager

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.