April 1, 2022

Dear Fellow Shareholders,

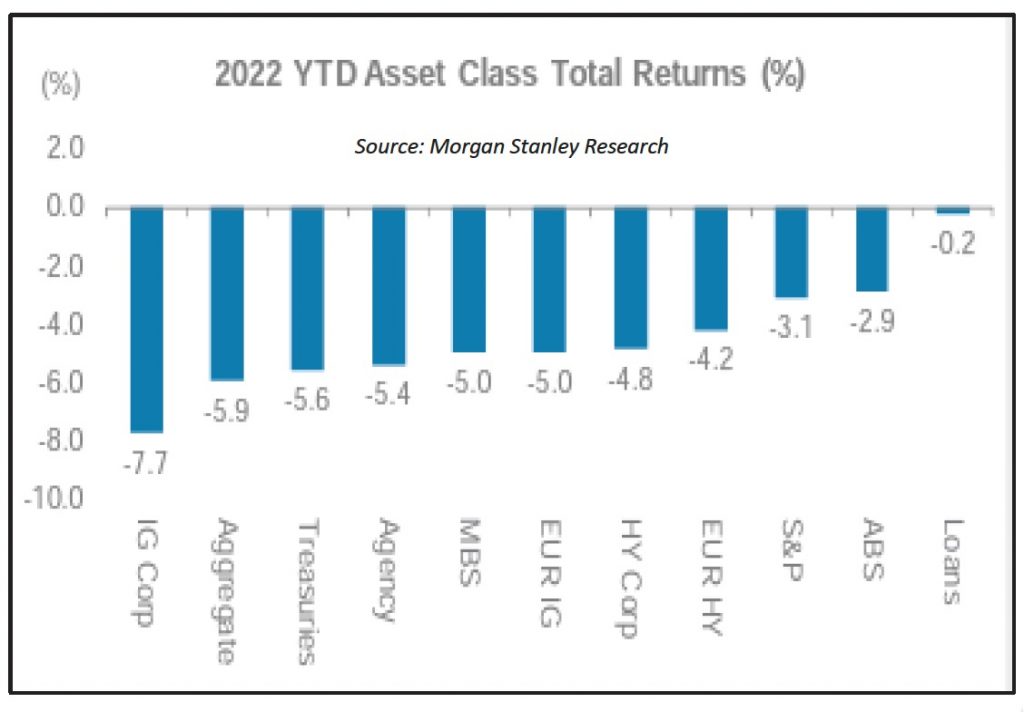

There was nowhere to hide for investors in the first quarter of 2022. We witnessed a pernicious combination of accelerating inflation and rising rates that dented every major asset class. Income-oriented investors were especially affected by the rise in the cost of borrowing, which skewered long-duration bonds. Treasuries and investment-grade bonds sold off significantly more than junk bonds, and even equity indices, as investors repositioned for the end of an overly accommodative Federal Reserve.

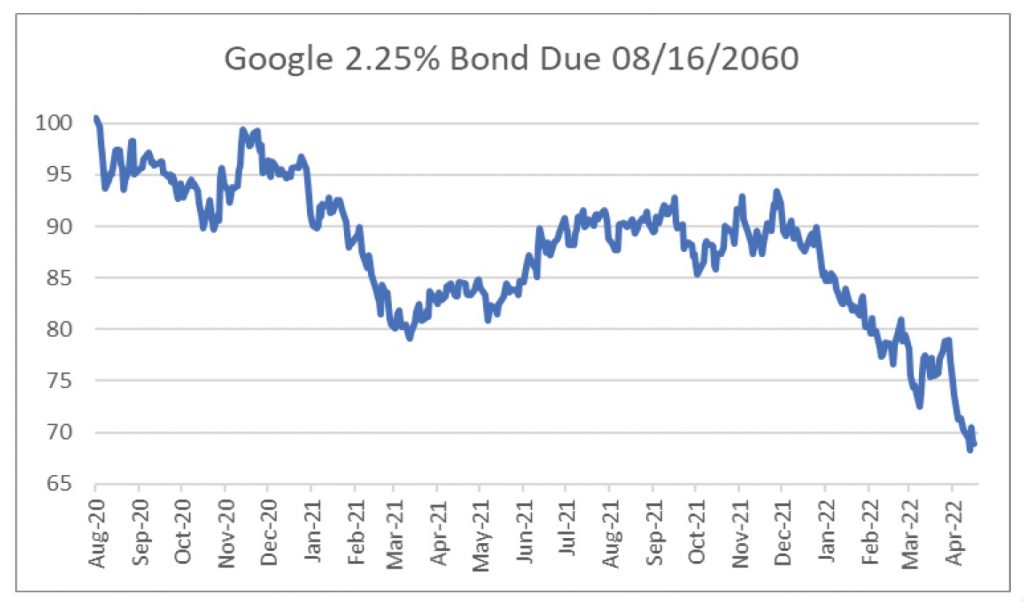

It turns out that low-single-digit coupons on long-dated fixed income securities are not especially attractive in a normalized environment. Take Google’s 2.25% Senior Unsecured Bond due in 2060. These bonds were issued in August 2020 when the 30-year Treasury was yielding a measly 1.25%. The chart to the left highlights how brutal duration risk can be. These bonds have sold off over 30% since issuance as rates have moved higher.

Our last several commentaries have outlined the peril of long-duration assets and what might happen if/when inflation spurs the Federal Reserve to act. Fed fund futures are now predicting an effective rate of 2.735% by the end of the year compared to an effective rate of just 0.33% today. It is hard for us to imagine anything but pain for fixed income indices if rates move that much that quickly.

We wish we could predict with certainty what will happen next. Perhaps inflation has already peaked and now is a great time to buy long-duration assets. Or perhaps inflation continues to accelerate, and we are headed for a recession as stimulus from the pandemic wears off and businesses fail to pass along higher input costs. We believe that the Intrepid Income Fund (the “Fund”) is well-positioned for either scenario.

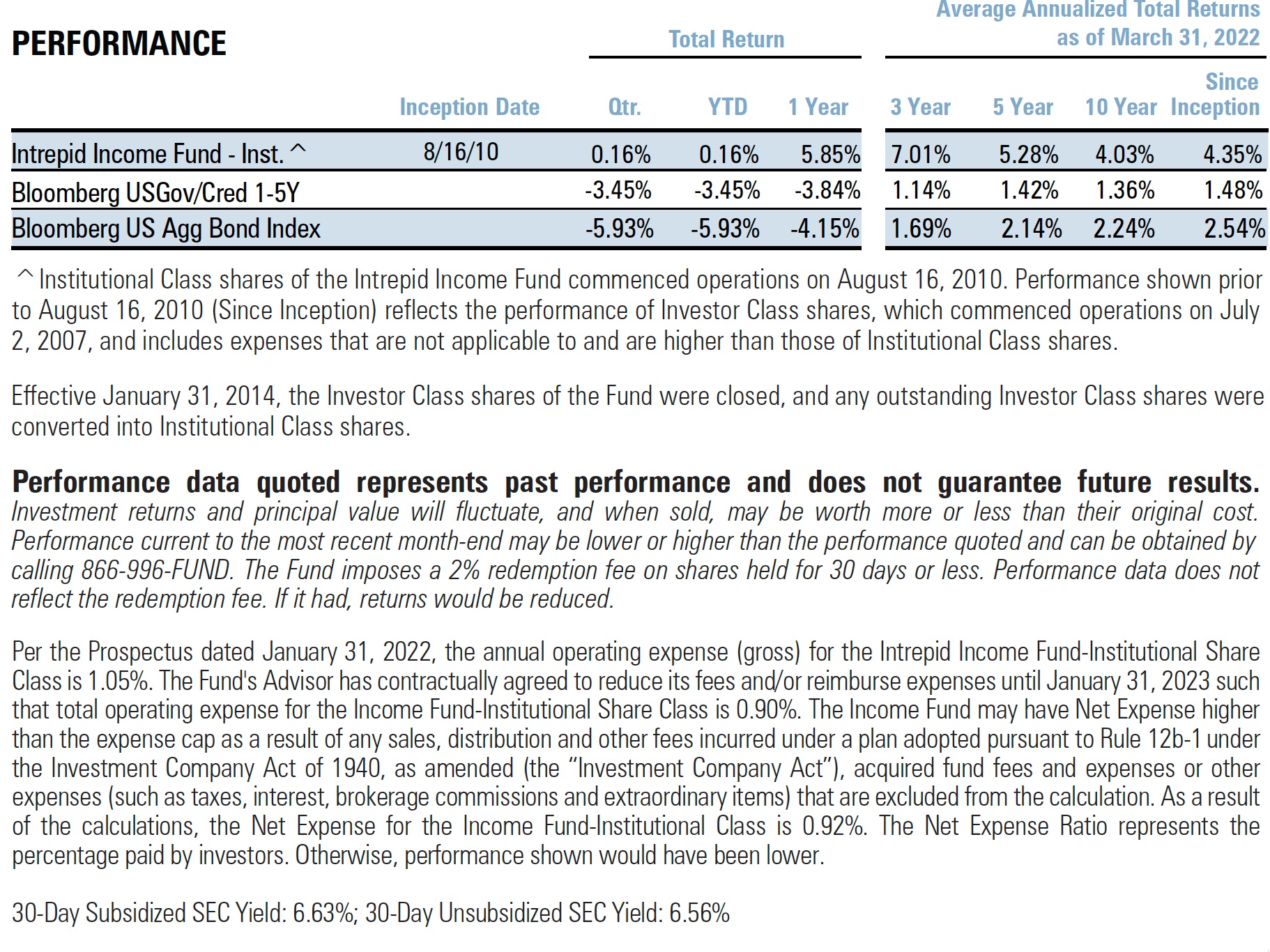

The primary goal of the Fund is to make money in any environment. To that end, we are pleased to have gained 0.16% for the quarter ended March 31, 2022. We accomplished this result through a mixture of careful underwriting and a focus on short-duration credits that are not as susceptible to the duration risk we discussed in the introduction. We detail specific contributors and detractors for the Fund later in the commentary.

The beauty of our strategy is that we are constantly able to redeploy capital from maturing securities into the market.

For instance, we expect nearly 1/3 of the Fund’s current positions to be called or to mature before the end of 2022. In a rising rate environment, this liquidity allows us to take advantage of more attractive prices on bonds as yields increase and prices fall. Hence, we expect to continue enhancing the Fund’s yield profile to keep up with inflationary pressures.

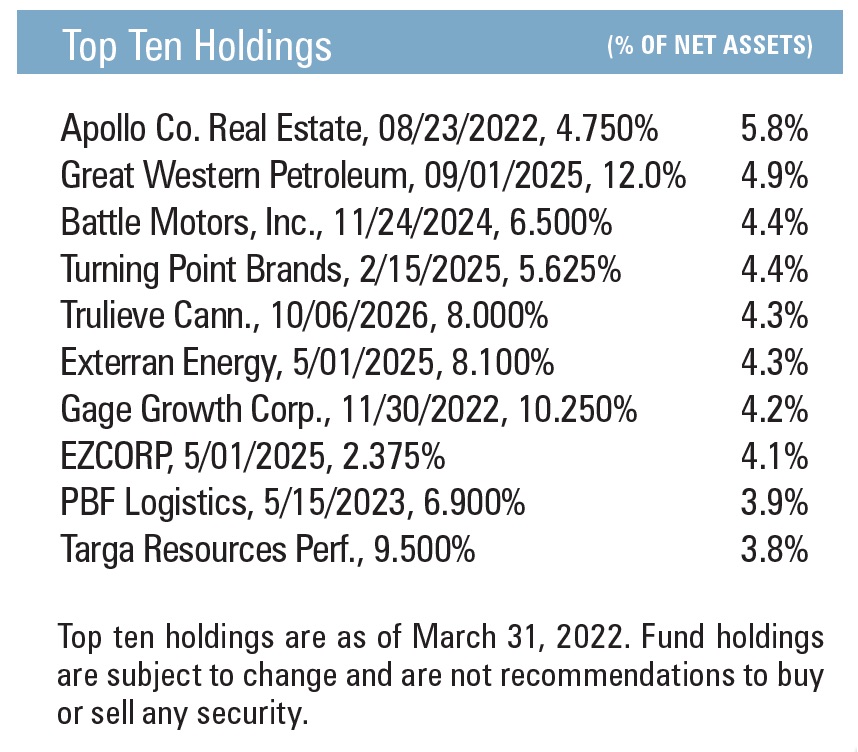

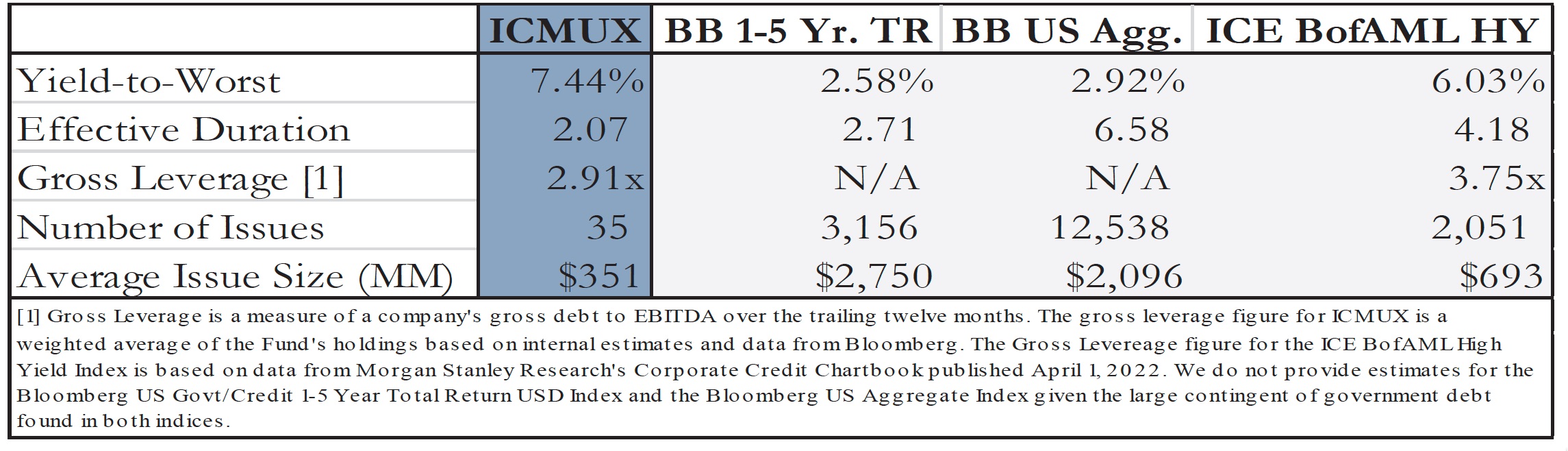

At the end of the first quarter, the yield-to-worst on the Fund was 7.44%, nearly 200 basis points higher than at the end of the prior quarter. Combined with our emphasis on smaller issue sizes, our strict underwriting criteria, and our short duration bias, we believe we are tailor-made for this environment.

The chart below shows how our Fund’s metrics compare to various fixed income benchmarks.

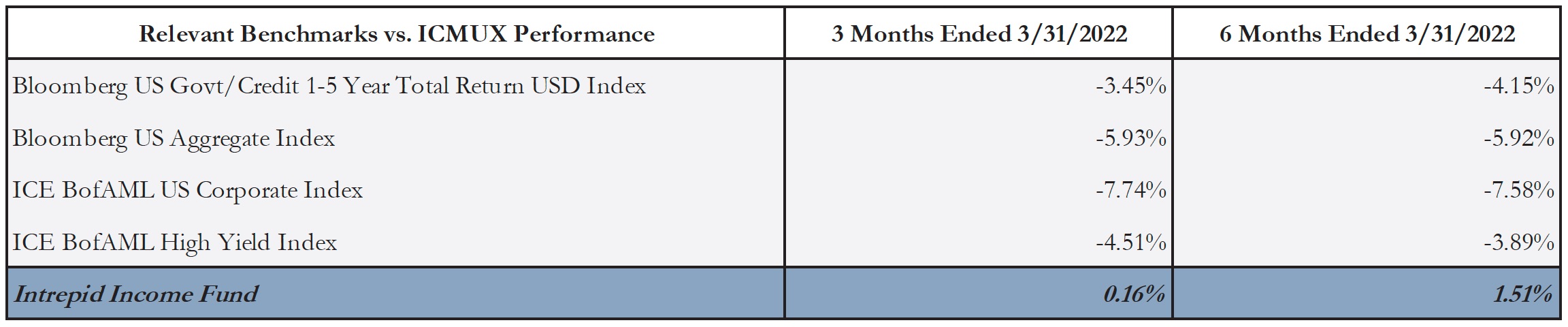

Outside of the Fund, fixed income performance in the first quarter was down across the board. The duration-heavy Bloomberg US Aggregate Bond Index (the “Bloomberg Aggregate Index”) dropped -5.93% for the quarter ended March 31, 2022 and the ICE BofAML US Corporate Index (the “Corporate Index”) returned -7.74% over the same period. Riskier debt also suffered, with the ICE BofAML High Yield Index (the “HY Index”) losing -4.51% in the quarter. Even the shorter-duration Bloomberg US Govt/Credit 1-5 Year Total Return USD Index (the “1-5 Year TR Index”) lost -3.45% over the same period.

We also report semiannual results given the Fund’s 9/30 fiscal year end. For the first six months of the Fund’s fiscal year, the Fund gained 1.51%. This compares to a loss of -5.92% for the Bloomberg Aggregate Bond Index and a loss of -7.58% for the Corporate Index. The 1-5 Year TR Index lost -4.15% and the HY Index lost -3.89% over the same period.

Our performance vs. benchmarks is summarized in the table below.

The Fund’s success during the first calendar quarter was primarily attributable to idiosyncratic security performance, but we also benefited from our lack of exposure to longer duration credits. Our top contributors for the three months ended 3/31/2022 included:

-

- ZEV 7.5% due 5/15/2024 – Lightning eMotors Inc. is an electric vehicle company with a very peculiar busted convertible bond. The company emerged from a special purpose acquisition company (SPAC) in May 2021, which is when the convert was issued, and the stock quickly deteriorated as SPACs broadly fell out of favor.

Although ZEV is not the sort of company we typically lend to, we recognized that the Colorado-based manufacturer was flush with cash, had an impressive backlog with blue-chip counterparties, and had massive equity backers like BP Technology Ventures (the venture capital arm of BP), which made it unlikely to default on its debt. We began purchasing the converts at 70 cents on the dollar, which equated to a very juicy yield of over 20%.

Shortly after we started buying a position, the company announced a large deal with Forest River, a Berkshire Hathaway company, that sent the stock soaring. The converts quickly traded up. Luckily for us, ZEV’s stock has been volatile enough over the past few months that we have opportunistically built a larger position in the converts with a cost basis below 80 cents on the dollar.

The company continues to carry nearly $200 million of cash on its balance sheet against the ~$88 million outstanding on this convertible note. We like the fact that the indenture for this note has some protections that are not normally found in a convert, like a negative pledge that restricts the company from borrowing any more debt, and a make-whole feature that allows us to convert the note early with a hefty cash premium from the company. Given how soon these notes mature, we are confident that the company will find a way to refinance them.

We will consider adding to our small position in this quirky convert if the company continues its positive fundamental trajectory.

GRTWST 12% due 9/01/2025 – We have written at length in previous commentaries about our affinity for the debt of Great Western. No issuer has contributed more to the Fund’s performance over the past few years. Unfortunately, it seems our favorite driller’s legacy of creating value for the Fund will end towards the close of this Summer.

PDC Energy announced it is purchasing GRTWST for $1.3 billion and expects to close on the deal by the end of the 2nd quarter. It is likely that PDC will refinance GRTWST’s bonds upon closing, which means we could get as high as 113 cents on the dollar for a bond that was issued at 97.5 cents on the dollar a little over a year ago and clipped 12% coupons in between. We see very little risk of the deal not getting done

We have enjoyed nearly a 35% weighted-IRR across two separate issues since first purchasing GRTWST bonds. We will be sad to see these go.

- PBFX 6.875% due 5/15/2023 – PBFX continues to march closer to a refinancing, which we believe will happen before the end of the Summer. The logistics company is a free cash flow machine and has done a nice job paying down its revolver in front of these notes coming due. Nothing special caused these notes to trade up during the quarter, but we believe the market is starting to reward free cash flow generators against the backdrop of a rising rate environment.

Both ZEV and GRTWST were also top contributors for the six months ended 3/31/2021, along with:

- TK 5% due 1/15/2023 – Similar to GRTWST, Teekay Corporation has created a lot of value for the Fund over the past couple of years. In January, the company announced a tender offer for these convertible notes that was too good to pass up. We received 102 cents on the dollar for a security we started accumulating for 80 cents on the dollar a couple of years ago.

Our top detractors for the three-month period ended 3/31/2021 all had one thing in common: a longer-dated maturity. Although the vast majority of the Fund’s holdings are concentrated in short duration credits, we occasionally lend to exceptional companies for longer periods of time. These positions included:

- CNSL 5% due 10/01/2028 – Consolidated Communications Holdings, is in the middle of an expensive buildout of its fiber network. We believe in the long-term strategy of the company, and we like the fact it is backed by a strong private equity partner in Spotlight, but the duration risk for these notes was too great for us to hold onto them. We sold out of this position completely during the quarter after suffering a modest loss.

- LGIH 4% due 7/15/2029 – We have written in previous commentaries about why we like LGI Homes, We believe this company is helping to address the shortage of affordable housing that our country faces. However, the double whammy of a long-dated bond and a business that is susceptible to rising mortgage rates make this position too risky for the Fund. We sold out of LGIH completely during the quarter at a loss but will look to add back to this position if the yield becomes attractive enough.

- RAX 375% due 12/01/2028 –Rackspace Technology, Inc. is generating decent free cash flow that it is using to improve its balance sheet and it only has modest capital expenditure needs. Unfortunately, the bonds for this informational technology services company were long-dated enough to get whacked by the sell-off in duration. We quickly trimmed this position in half during the quarter after suffering a modest loss and have watched the bonds continue to move lower. We will consider adding back to this position as the yield on the notes moves closer to double-digit territory given that we love the underlying business.

Both CNSL and RAX were also top detractors for the six months ended 3/31/2021, along with:

- TPB 5.625% due 2/15/2026 – We have discussed Turning Point Brands, Inc. extensively in previous These senior secured bonds are well covered by the underlying tobacco business (Stoker’s), which we believe should continue to generate gobs of cash flow in any economic environment. Over the last year, TPB has experienced changes in the c-suite which has led to the stock selling off. The new CEO, Efremov Yavor, responded by purchasing some shares in the open market. We believe the bonds have suffered from being slightly longer dated, but we remain confident in the company’s long-term trajectory and have been adding to our position in the mid-90s.

The Income Fund had four corporate bond positions that were called or matured in the first calendar quarter. We were very active in reducing or selling out of positions as they hit our internal yield bogey, or presented too much duration risk, completely exiting ten of our holdings. The proceeds from the bonds that were called, sold, or matured were redeployed into a mixture of existing positions and new positions, including:

- ESICN 9.25% due 4/15/2024 (Owned Previously) – We have written at length about Ensign Energy Services, Inc. in previous commentaries. We first purchased these bonds when they were issued in the primary market in early 2019. Not long afterwards, oil prices began to deteriorate, and we quickly trimmed our exposure to oil field services, exiting ESICN completely.The company took advantage of the turmoil in the energy market by buying back nearly $300 million worth of bonds at a deeply discounted price. Today, the company has $400 million of bonds outstanding under this issue which sits beneath ~$700 million of revolver debt. Despite this large debt load, the company should generate ~$130 million of free cash flow this year, almost all of which will go towards debt paydown, and should exit the year with less than 3x gross leverage. We expect the landscape for drilling to continue improving as oil companies become more active and we think that Ensign should have an opportunity to refinance these bonds as soon as this Summer when the call price drops down to 102.313.

- EXTNRG 8.125% due 5/01/2025 – Exterran Corporation is being acquired by Enerflex Limited in an all-share transaction, and these EXTNRG bonds will be taken out once the deal is closed. EFX has committed bridge financing from RBC that will backstop an anticipated issuance of new debt securities prior to the close. The combined company will be ~2.5x net levered and should have a BB+ rating, which means it will have a significantly lower coupon than the existing EXTNRG debt.We were able to scoop up these EXTNRG 8.125% bonds at 100.75, which equates to a ~10% yield to the 102.03 call price if the deal closes by October 1st. The company has communicated that closing should be in the 2nd or 3rd quarter, so we believe October 1st is a conservative estimate.Although we are highly confident the deal will close, we are also comfortable owning EXTNRG bonds were the deal to fall apart. Exterran’s free cash flow profile and leverage is very similar to Ensign’s, and we will look to add to this position if the bonds sell off for any reason.

- VRNO 5% due 8/28/2023 (New Tranche of Existing Loan Facility) – Verano is in our view one of the best positioned cannabis companies in the country, with exposure to limited license states like Florida, Illinois, and New Jersey. This loan was an add-on to an existing facility that was syndicated by Chicago Atlantic Group, a REIT that underwrites secured debt in the cannabis space. We believe the company will look to do a global refinancing on the entire loan facility later this year and we feel well covered by the underlying collateral on this 1st lien paper.

- DISH 5.875% due 11/15/2024 – DISH DBS is one of the largest pay-TV providers with 8.2 million satellite customers and 2.5 million Sling TV subscribers. The company is a cash flow machine that has managed quite well through continued subscriber losses. Although net leverage is a little high at 3.7x, we believe the company is well positioned for 5G and should continue generating free cash flow to pay down debt. We picked up these notes at a ~7% yield-to-worst which we believe is very attractive for a 2.5-year maturity.

Looking back over the past several quarters, we could not be more pleased with the way our strategy has worked in a volatile, rising-rate environment. We are especially proud of the fact that we were up more than our benchmarks during last year’s bull market run and subsequently have made money so far this year during a sharp sell-off in nearly every asset class.

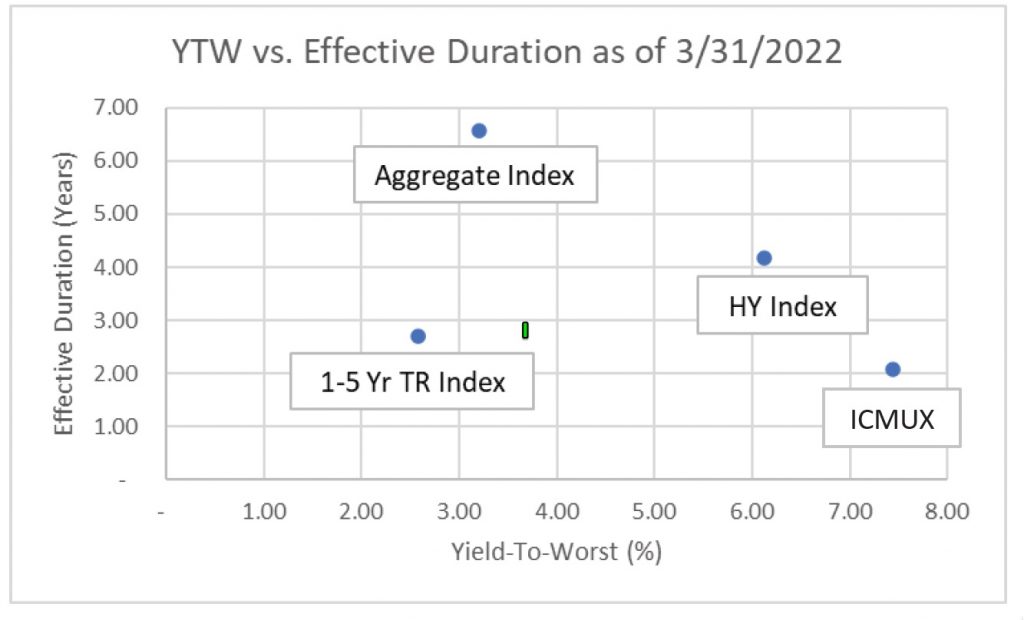

As the graph below shows, our short duration bias and high yield profile makes us a unique choice verses our benchmarks. As rates continue to move higher, we think it is likely that we will continue to enhance our yield profile while keeping a relatively low effective duration.

However, as inflation continues to wreak havoc, and rising rates dislodge stubbornly low yields on certain longer-dated fixed income securities, we will continue to stay open-minded. The portfolio will always have a bias towards short-dated credits, but, at a certain point, we believe that there will be a golden opportunity to lend further out at attractive returns. Until then, we will continue to sink the three-foot putts.

Thank you for your investment.

Sincerely,

Mark F. Travis, President

Intrepid Income Fund Co-Portfolio Manager

Hunter Hayes

Intrepid Income Fund Co-Portfolio Manager

Past performance is not a guarantee of future results.