April 1, 2022

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced by a more rapid increase in the quantity of money than in output.”

— Milton Friedman

Dear Fellow Shareholders

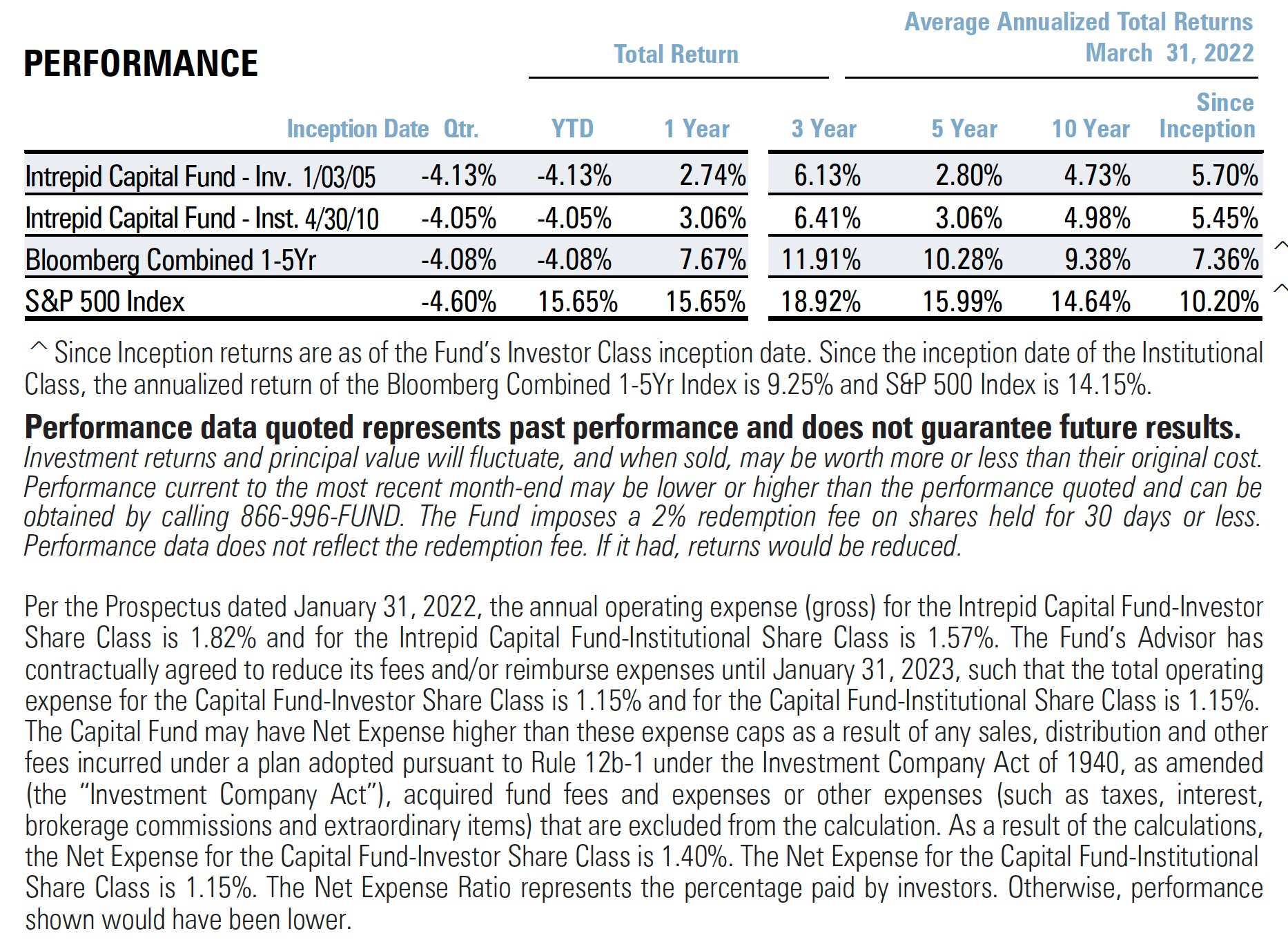

For the six months since our last shareholder letter of 10/1/21, the Intrepid Capital Fund had a return of -0.47%, which shouldn’t cause you too much eye strain as the return for this period is barely discernible – but nonetheless slightly negative for the period.

To show you the contradictions we are confronting as we navigate the capital markets, the Bloomberg Government/Credit Bond Index fell -6.16% and the S&P 500 stock index rose 5.92% over the same six month period. As a 38-year participant in the capital markets, I find these short-term (6 months) outcomes to be incongruous.

I say this as I feel certain that you have heard the phrase “don’t fight the Fed” in financial commentary. Well, the “Fed” made its first move since the fourth quarter of 2018 in an attempt to remove liquidity from the financial system, now that it is abundantly clear they have had rates too low for too long.

As the Intrepid Capital Fund invests across a broad array of both stocks and bonds, it should not be too surprising that the performance of the Fund is between that of both stock and bond indexes. With the current run rate of inflation north of 7% along with the Federal Reserve Board of Governors broadcasting a 50 basis points increase at their May meeting, the math is not looking good for what I generally call “long duration” investors, whether they are in the stock or bond market.

Duration is simply the weighted average of expected cash flows from an investment by year. This is most commonly applied to the bond market as a way to assess interest rate risk. The general assumption is a 1% rise in interest rates multiplied by a security’s duration equals the amount of expected capital loss.

This math generally held true for the first quarter of 2022 as the Bloomberg Government/Credit Bond Index lost -6.35% as rates moved up 1%, and that loss roughly matched the duration of the index (~6 years).

I don’t want to go to far down the rabbit hole of bond math here, but the takeaway is the headwind of higher interest rates has negatively impacted the bond market and is having similar effects on the more speculative parts of the equity markets. Those companies that are not cash-generative and unprofitable, with only hopes of positive cash flow far out into the future, have seen considerable markdowns in their share prices over the past six months. A couple of examples:

- In August 2021, Zoom (ZM) traded for $400/share and today trades for $125/share

- In September 2021, Docusign (DOCU) traded north of $300/share and today trades for $110/share.

The good news here is although we haven’t shown any forward progress in the last six months, I feel pretty good as we enter this new paradigm of investing with multiple rate increases in the forecast and the volatility we have already experienced so far in 2022. The reason for my confidence is centered around our preference for shorter duration investments – both bond and stock alike.

In addition, I feel certain the investment team here will be able to source attractive long-term investments if prices drop from here.

Thank you for your continued support. If there is anything we can do to serve you better, please do not hesitate to give us a call.

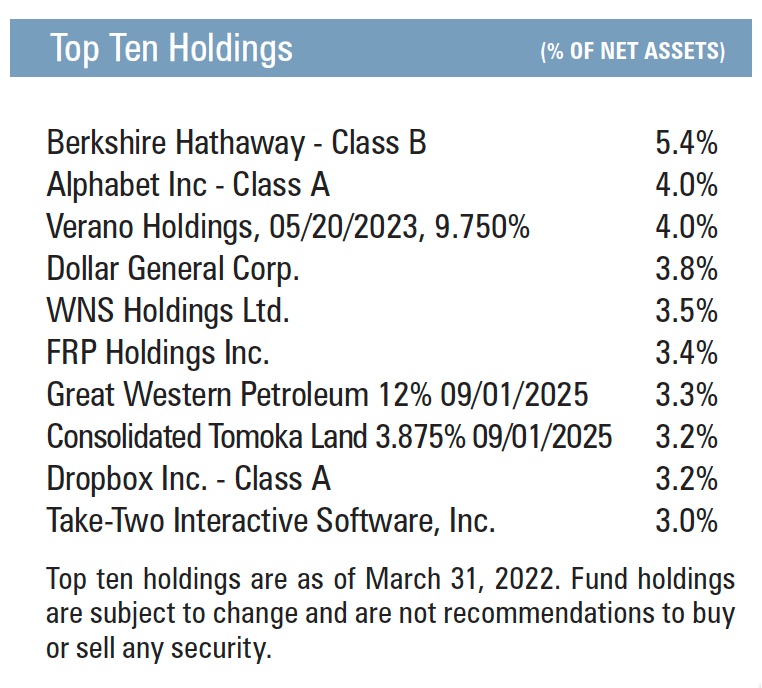

Top Contributors (Calendar Q1 2022)

Berkshire Hathaway (BRK/B)

Great Western Petroleum 12% 09/01/2025

Consolidated Tomoka Land 3.875% 05/14/25

Civitas Resources (CIVI)

Ayr Wellness 12.5% 12/10/24

Top Detractors (Calendar Q1 2022)

Copart Inc (CPRT)

Interactive Corp (IAC)

Accenture PLC (CAN)

Trulieve Cannabis (TRUL CN)

The TJX Companies (TJX)

Best Regards,

Mark F. Travis, President

Intrepid Capital Fund Portfolio Manager

Mutual fund investing involves risk.