April 12, 2021

Dear Fellow Shareholders,

Vaccines for COVID-19 have been distributed across the US at a blistering pace. At the same time, a different type of vaccine is being injected into the American financial system. It has also been administered at a rapid pace and has temporarily halted the spread of financial collapse.

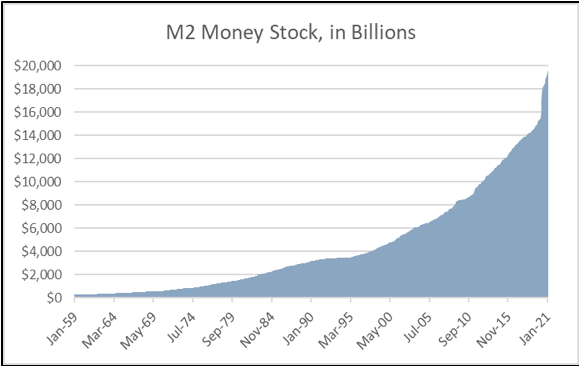

We are speaking, of course, about money printing. As the chart to the left shows, the M2 money stock has grown asymptotically since the onset of COVID-19. In addition to M1, this measure also includes savings deposits and money market accounts. Alongside direct injections of liquidity into American’s bank accounts, the Federal Reserve has administered this liquidity by purchasing corporate bonds and continuing to expand its balance sheet through Treasury purchases.

We are speaking, of course, about money printing. As the chart to the left shows, the M2 money stock has grown asymptotically since the onset of COVID-19. In addition to M1, this measure also includes savings deposits and money market accounts. Alongside direct injections of liquidity into American’s bank accounts, the Federal Reserve has administered this liquidity by purchasing corporate bonds and continuing to expand its balance sheet through Treasury purchases.

Many have applauded the Federal Reserve’s decision to rapidly inject money into the system. After all, the dollars printed for stimulus programs, direct deposits, and corporate credit facilities kept many small businesses afloat and food on people’s tables. Just like virologists had not seen something like COVID-19 before, economists had not seen anything like the rapid shutdowns that accompanied the virus.

Many have applauded the Federal Reserve’s decision to rapidly inject money into the system. After all, the dollars printed for stimulus programs, direct deposits, and corporate credit facilities kept many small businesses afloat and food on people’s tables. Just like virologists had not seen something like COVID-19 before, economists had not seen anything like the rapid shutdowns that accompanied the virus.

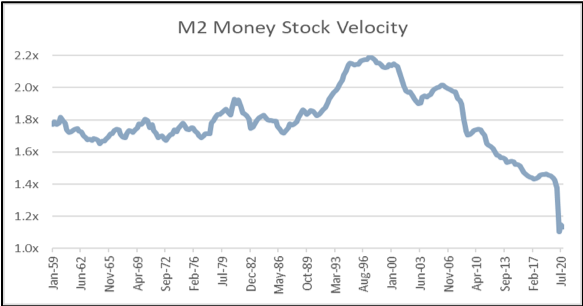

But eventually, we must deal with the fallout from the borrowed money. As the chart above shows, the velocity of money has fallen to a 60-year low. This measures the frequency a unit of currency is used.

It is logical for the velocity of money to slow down as people hunker down at home. But as consumption habits normalize, what will happen? Many believe a resumption of normal activity will lead to elevated inflation that will be difficult for the Federal Reserve to control. Others have argued that the velocity of money will not pick back up anytime soon, which could even lead to deflation. We believe our short duration credit strategy will continue to perform well in either scenario.

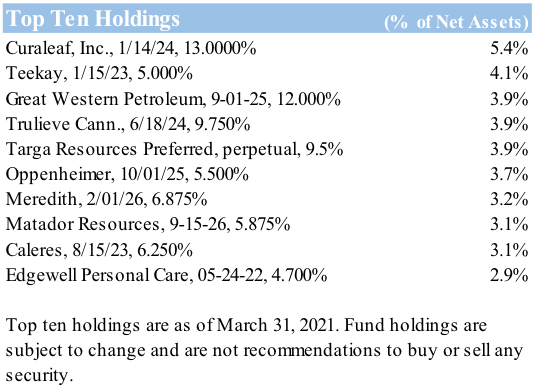

For now, the Federal Reserve’s “vaccine” has bolstered credit markets to new all-time highs. Last week, yields for CCC-rated bonds, the riskiest slice of the market, dropped to an all-time low of 6.10%. This time last year, there was over $1 trillion of distressed bonds and loans in just the US alone, which today has shriveled to less than $100 billion, according to Bloomberg. Any and every high yield issuer is rushing to lock in record-low rates as primary supply continues to vaporize previous records. There remain plenty of attractive securities amidst the frothiness, but we believe it has never been more important to know and understand the businesses to which one lends capital.

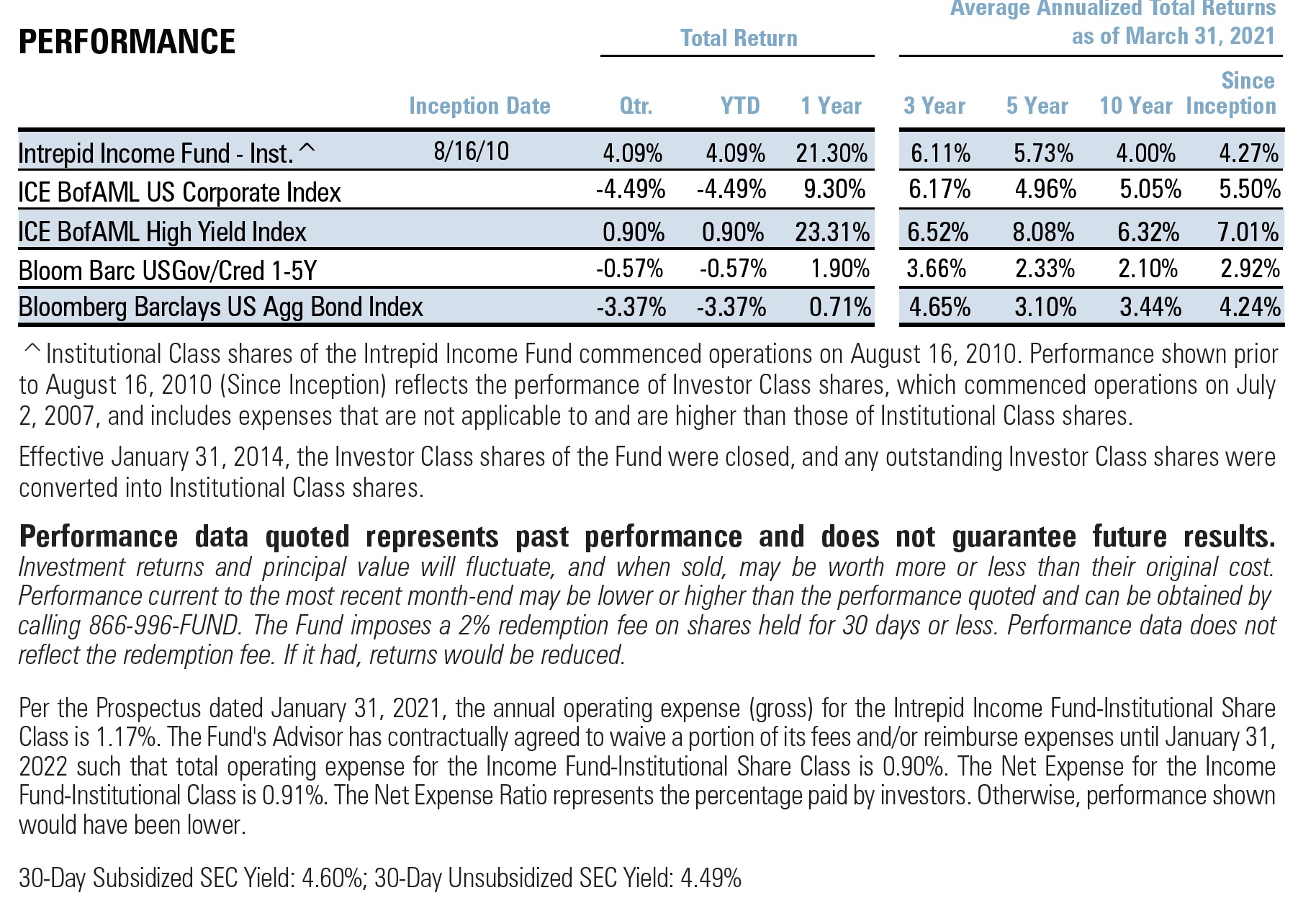

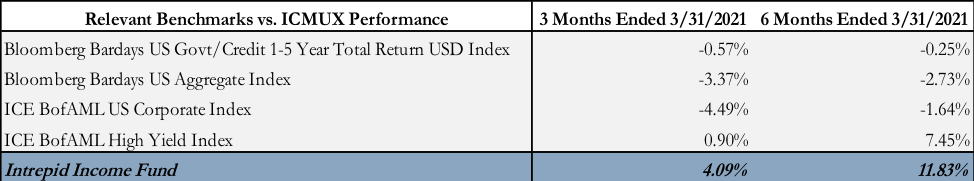

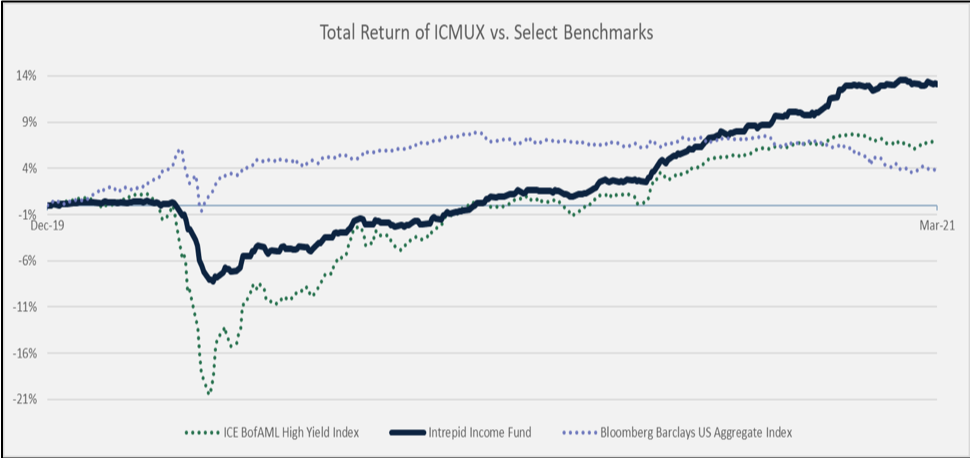

Fixed income performance in the first quarter was mixed. Rates rose to welcome the new decade, with the 10-Year Treasury ending the quarter at 1.74%, nearly double its yield to start the year. Accordingly, the duration-heavy Bloomberg Barclays US Aggregate Index (the “Barclays Aggregate Index”) dropped -3.37% for the quarter ended March 31, 2021 and the ICE BofAML US Corporate Index (the “Corporate Index”) returned -4.49% over the same period. On the other hand, riskier debt continued its recovery, with the ICE BofAML High Yield Index (the “HY Index”) gaining 0.90% in the quarter. The shorter-duration Bloomberg Barclays US Govt/Credit 1-5 Year Total Return USD Index (the “1-5 Year TR Index”) returned -0.57% over the same period. We are pleased to report that The Intrepid Income Fund (the “Fund”) gained 4.09% for the quarter ended March 31, 2021.

We also report semiannual results given the Fund’s 9/30 fiscal year end. For the first six months of the Fund’s fiscal year, the Fund gained 11.83%. This compares to a loss of -2.73% for the Barclays Aggregate Index and a loss of -1.64% for the Corporate Index. The 1-5 Year TR Index lost -0.25% and the HY Index gained 7.45% over the same period.

Our performance vs. benchmarks is summarized in the table below.

The Fund’s success during the first calendar quarter was primarily attributable to security selection, but we also benefited from a positive overall environment for risk assets. Additionally, we are very pleased with how our short duration focus has protected your capital in the face of rising rates.

Our top contributors for the three months ended 3/31/2021 included:

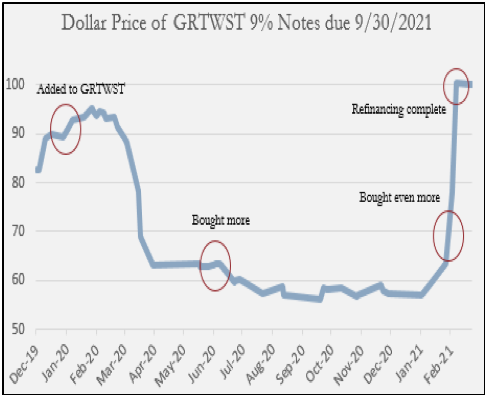

- GRTWST 9.0% due 9/30/2021 – We have written about our Great Western thesis in previous commentaries, so we will not rehash the entire thing. The company’s 9% bonds plunged this time last year on the back of negative oil prices, but we believed this Colorado-based producer had low enough leverage, robust enough hedges, and adequate liquidity to refinance its notes, so we purchased more at around 60 cents on the dollar.We face a difficult choice in fixed income markets when a position we own gaps down. Given the binary nature of bonds, conviction becomes paramount in the heat of this sort of volatility. We went into April with a conservative enough weight in GRTWST that we were comfortable doubling down on our position. We have a rule that when a position trades down significantly, we must either add or sell, forcing us to have a view.

Great Western had been talking about refinancing its notes well before the bonds sold off. In fact, as the chart to the left shows, we added to our position at what we thought was an attractive yield last January. Then the pandemic hit! As COVID-19 infected markets with fear, we spoke with other GRTWST lenders, as well as the company, and became confident the notes would be refinanced. In June, we purchased more bonds at close to a 50% yield. The bonds traded sideways for the next few months, despite the overall recovery in energy.In February, we finally received a call from Barclays’ credit syndicate about Great Western’s refinancing. At the time, GRTWST’s year-end leverage was only 1.6x and the company was roughly 90% hedged in 2021 at prices that would lock in free cash flow generation. Still, exiting bondholders, including us, played hardball, and demanded that the existing GRTWST equity holders make some credit-positive concessions to make a new issue more attractive.The biggest concession came from one of the company’s largest equity investors. This shareholder agreed to roll its preferred equity, with a large dollar coupon, into common stock, saving the company considerable amounts of cash interest. Concurrently, this experienced, institutional energy investor became the majority equity holder, which we believe puts the company in a great position. Lastly, other existing equity investors poured a modest amount of additional capital into the business and the company carved out 2nd lien capacity on the existing credit agreement, giving GRTWST’s new notes a better spot in the capital structure. In short, other investors recognized the value of the company’s assets which lifted the price of our notes.As we continued to gain conviction that the old GRTWST notes were going to roll into a new issue, we purchased even more GRTWST 9% notes in the low 70s. Shortly after that purchase, our entire position was called at par, earning us a substantial return.Great Western is not the typical sort of position in our Portfolio, but it showcases how our credit process paid off during one of the sharpest selloffs in short-duration energy bonds ever. Given our knowledge of GRTWSTs credit situation, and our relatively small weight going into the selloff, we were able to deploy capital opportunistically when we saw a mispricing. We did this knowing the risks, but believing we had a sufficient margin of safety such that, even in a worst-case scenario (bankruptcy), we would likely have had a good recovery.

Great Western had been talking about refinancing its notes well before the bonds sold off. In fact, as the chart to the left shows, we added to our position at what we thought was an attractive yield last January. Then the pandemic hit! As COVID-19 infected markets with fear, we spoke with other GRTWST lenders, as well as the company, and became confident the notes would be refinanced. In June, we purchased more bonds at close to a 50% yield. The bonds traded sideways for the next few months, despite the overall recovery in energy.In February, we finally received a call from Barclays’ credit syndicate about Great Western’s refinancing. At the time, GRTWST’s year-end leverage was only 1.6x and the company was roughly 90% hedged in 2021 at prices that would lock in free cash flow generation. Still, exiting bondholders, including us, played hardball, and demanded that the existing GRTWST equity holders make some credit-positive concessions to make a new issue more attractive.The biggest concession came from one of the company’s largest equity investors. This shareholder agreed to roll its preferred equity, with a large dollar coupon, into common stock, saving the company considerable amounts of cash interest. Concurrently, this experienced, institutional energy investor became the majority equity holder, which we believe puts the company in a great position. Lastly, other existing equity investors poured a modest amount of additional capital into the business and the company carved out 2nd lien capacity on the existing credit agreement, giving GRTWST’s new notes a better spot in the capital structure. In short, other investors recognized the value of the company’s assets which lifted the price of our notes.As we continued to gain conviction that the old GRTWST notes were going to roll into a new issue, we purchased even more GRTWST 9% notes in the low 70s. Shortly after that purchase, our entire position was called at par, earning us a substantial return.Great Western is not the typical sort of position in our Portfolio, but it showcases how our credit process paid off during one of the sharpest selloffs in short-duration energy bonds ever. Given our knowledge of GRTWSTs credit situation, and our relatively small weight going into the selloff, we were able to deploy capital opportunistically when we saw a mispricing. We did this knowing the risks, but believing we had a sufficient margin of safety such that, even in a worst-case scenario (bankruptcy), we would likely have had a good recovery.

- TK 5% due 1/15/2023 – Teekay Corporation’s busted convertible notes remain one of our favorite positions. This small, unrated, and misunderstood debt issue has continued to shine since we started nibbling on it in the low-80s. Both of TK’s daughter companies, TGP and TNK, continue to perform well as LNG demand returns and tanker day rates have steadied. We believe this parent company will attempt a global refinancing later this year, meaning these convertible notes still likely carry a double-digit yield, despite trading in the mid-90s at the time this letter was written.

- TPB 2.5% due 7/15/2024 – Turning Point Brand’s business continued to crush expectations, resulting in a tremendous run-up in the stock and, hence, the convertible debt we purchased. Since these converts are no longer “busted,” we have reduced our position substantially. We still believe the business is poised for continued outperformance on the back of its Stoker’s and Zig-Zag brands, but we have no interest in holding onto convertible notes without a positive yield. We happily participated in TPB’s debut high yield bond offering in February, which we discuss below. Our equity counterparts also continue to love TPB’s common stock.

Both TPB and GRTWST were also top contributors for the six months ended 3/31/2021, along with:

- WETF 4.25% due 6/16/2023 – Similar to TPB, Wisdom Tree Investments’ business has performed exceptionally since our purchase and the stock has nearly doubled on the back of sanguine market conditions. The convertible notes we purchased are no longer busted, so we have substantially reduced our position.

We had only one material detractor for the three- and six-month periods ended 3/31/2021:

- GRTWST 12% due 9/01/2025 – As we discussed above, Great Western refinanced its debt in February. The new notes, which we purchased upon issuance, have scarcely traded as bondholders await news on the company’s new capital plan. These new notes come with a special M&A call at 110 cents on the dollar if the company merges or is acquired in the first 12 months. We believe that GRTWST is a good M&A target, especially given the recent trend of consolidation in the DJ Basin. Regardless of whether the company is acquired or not, we believe the company’s low leverage and solid liquidity profile position it well to succeed as oil and gas prices continue to recover and cash flow generation improves.

The Income Fund had seven corporate bond positions that were called or matured in the first calendar quarter. We also reduced several positions as they hit our internal yield bogey, selling out of our Nordstrom 6.95% Notes due 3/15/2028 and ServiceMaster 7.45% Notes due 8/15/2027, entirely. The proceeds from the bonds that were called, sold, or matured were redeployed into a mixture of existing positions and new positions from borrowers we have lent to before, including:

- TRGP 9.5% Perpetual Preferred – Targa Resources is an operator of crude and natural gas gathering and processing assets. The company is squarely focused on deleveraging, as it believes it is close to ratings improvements. We have owned a different issue of TRGP preferred stock in the past, which was called by the company this past December.This preferred issue, which was also partially paid down in December, carries a high dividend and is currently callable at 110 cents on the dollar before dropping to 105 cents on the dollar in 2022. We purchased this security at 105.25 cents on the dollar, which works out to over a 9% yield-to-worst. We believe that TRGP will prioritize paying down this high-cost issue as it cleans up its balance sheet and that there exists asymmetric upside relative to the risk.

- VTOL 6.875% due 3/01/2028 – Bristow Group provides offshore helicopter services to international energy companies, plus search and rescue operations for the UK government. We purchased a small weight in this new issue after our old notes, which were originally issued by ERA Group before it merged with Bristow, were called. The new issue has collateral coverage of 2.6x per 3rd party appraisal, and leverage is relatively light at 2.1x.

- CURA 10.25% Revolving Credit Facility – We have written extensively about our Curaleaf thesis. When the company did a small, $50 million drive-by in January, we decided to participate. The terms and protections of this revolving credit facility are the same as the existing term loan we own. We expect both issues to be called next January.

- GRTWST 12% due 9/01/2025 – As discussed above, we rolled into Great Western’s new issue, which has a favorable position in the capital structure, a fat coupon, and a special M&A call. We believe these notes will do well as oil and gas prices continue to recover.

- TPB 5.625% due 2/15/2026 – TPB tapped the high yield market for the first time in February, raising $250 million for a war chest to continue its buy-and-build strategy. We believe TPB’s management is best-in-class and has demonstrated the ability to make sound acquisitions that lead to value creation. The deal was well-oversubscribed, with the bonds trading up several points off the break. Net leverage remains manageable at ~3.1x and we expect the company to continue generating plenty of free cash flow to offset its acquisitiveness.

- VSTO 4.5% due 3/15/2029 – Vista Outdoor is another issuer whose bonds we rolled into after our 2023 notes were called. We continue to love VSTO’s core business, focused on outdoor sports and recreational activities, and believe that the extra dollars raised by this issue will allow the company to continue making accretive acquisitions. Although the coupon is relatively low, especially for the duration, we feel the strong cash flow profile justifies holding a small position, which we will add to opportunistically.

We remain cautiously optimistic about the prospects for economic recovery, and continue to hunt for short-dated, high-yielding securities issued by credit-worthy companies. We endeavor to find securities that do not operate with an unhealthy reliance upon the mercurial credit window, preferring those rare borrowers that view leverage as a bridge to a destination, not an endless highway with increasingly expensive fuel stops.

We anticipate some volatility over the next several quarters, which may present excellent buying opportunities in credit markets, and remain committed to our short duration bias as an organic way to maintain some “dry powder”.

We anticipate some volatility over the next several quarters, which may present excellent buying opportunities in credit markets, and remain committed to our short duration bias as an organic way to maintain some “dry powder”.

Looking back over the past year, we could not be more pleased with the way our strategy has worked. Going into last March, we were able to redeploy cash from maturing short duration positions into attractive, sometimes longer-dated positions at a time when liquidity was hard to come by. At certain times, it was almost a “name your price” exercise, where forced sellers had no choice but to unload creditworthy positions at deep discounts.

As the graph below shows, our short duration bias hedged us from the brunt of last year’s selloff and allowed us to quickly redeploy capital at great prices. We have slowly trimmed or sold many of the positions we piled into as those credits hit our yield bogeys, but we believe we will have ample opportunities to purchase bargain securities in the future as more bargains avail themselves.

As we discussed earlier, a debate is raging on whether inflation might accelerate on the back of unprecedented money printing. We have no superior forecasting ability when it comes to something as complex as inflation. We do, however, take solace in how our short-duration bias and careful credit work has protected and rewarded investor capital over the past year, and continue to believe our strategy will generate attractive absolute returns.

In the event inflation does begin dislodging stubbornly low yields on certain longer-dated, creditworthy fixed income securities, we will have the nimbleness, afforded by our short duration bias, to redeploy capital if/when we deem it to be an attractive opportunity for the commensurate risk.

Thank you for your investment.

Sincerely,

Mark F. Travis, President

Intrepid Income Fund Co-Portfolio Manager

Hunter Hayes

Intrepid Income Fund Co-Portfolio Manager