July 1, 2021

Dear Fellow Shareholders,

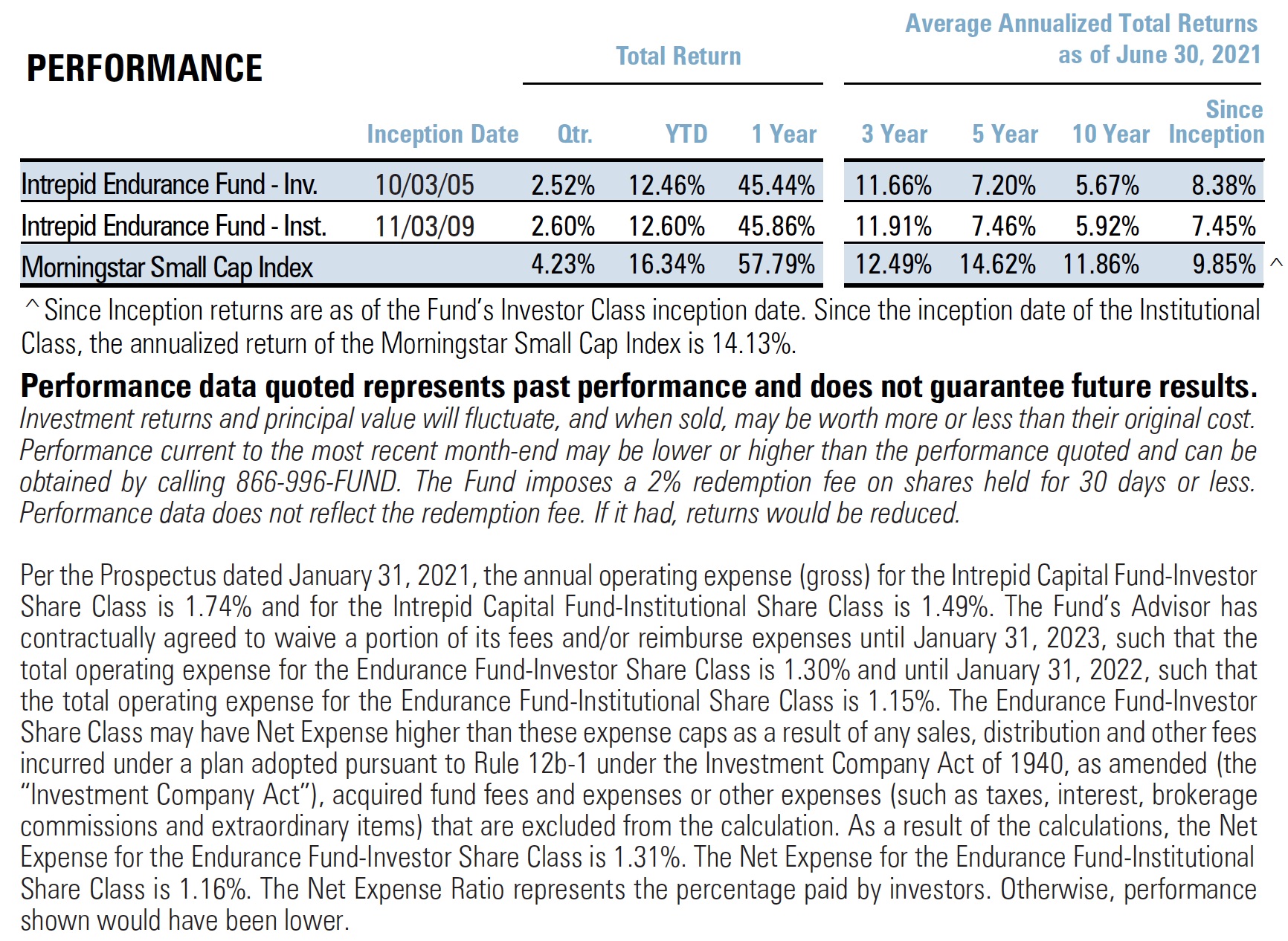

Small cap stocks continued to do well in the second calendar quarter of 2021, with the Russell 2000 Index returning 4.29%. The Intrepid Endurance Fund (“the Fund”) slightly underperformed the small cap market in this quarter, returning 2.52% versus 4.23% for its Morningstar Small Cap Index benchmark.

Broader small cap indices such as the Russell 2000 benefitted from an outlier return contribution from AMC Entertainment (AMC). AMC, the troubled movie theater chain, was the blockbuster sequel to the GameStop (GME) saga in Q1. The plot was virtually identical, as bands of internet traders set off a frenzy that drove AMC’s stock up 6x in less than a month. The speculative mania propelled AMC to the largest position (by far) in the benchmark. If there is a trilogy, we hope it involves a stock held by the Fund!

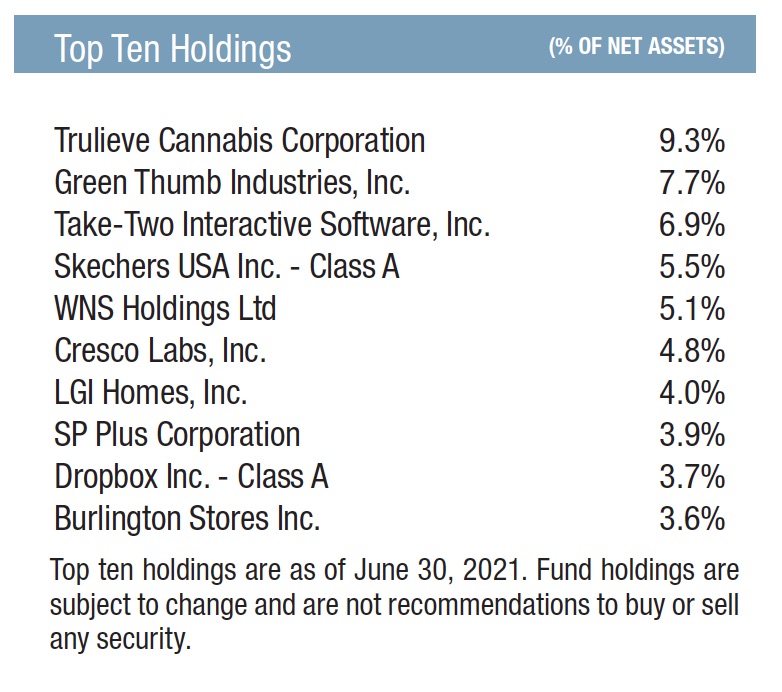

However, the primary driver of underperformance this quarter was a negative contribution from our cannabis positions. Last quarter, we detailed our thoughts on the US cannabis industry and its attractive qualities. We remain very bullish on this industry; however, the stocks had a challenging quarter. We believe the decline in US cannabis stocks was due to investor frustration about the timing of federal regulatory changes that would open up the stocks to broader investor participation. Essentially, investors lost patience waiting for a favorable regulatory change from the new Congress and sold the stocks for most of the quarter.

We are less upset about this development, as we believe the current status quo quagmire of federal and state regulations creates the enormous barriers to entry that these companies benefit from. We, too, would like federal regulations to change, but we believe that in the meantime our current holdings benefit through very limited and poorly funded competition as well as extending their first-mover advantages such as brand building, customer acquisition, etc. As a result, we maintained our weight in the industry, although we did sell out of the AdvisorShares Cannabis ETF (MSOS) that we initiated last quarter to purchase Green Thumb Industries (GTBIF) – another one of the industry’s leaders.

Other than that, it was a very quiet quarter for the fund with no other divestitures or new positions.

The largest detractors in the quarter were the three cannabis positions: Trulieve Cannabis (TRUL CN), Cresco Labs (CRLBF), and the now divested AdvisorShares Cannabis ETF (MSOS). As stated above, we believe most of the negative performance for the cannabis companies was due to investors losing patience on the timing of federal regulatory changes, although it is worth noting that during the quarter Trulieve announced the largest acquisition this nascent industry has seen. The associated integration risk could also have caused some investors to sell that stock.

The largest contributors were Skechers (SKX), Green Thumb Industries (GTBIF), and Becle Sab de CV (CUERVO MM). We have owned SKX for over 2.5 years now and have been continuously impressed by the degree of execution of their management team. We believe it continues to have a bright future – both short-term (as the world rebounds) and long-term. The favorable performance of Green Thumb was mostly attributable to the timing of when we purchased the position, while Becle reported excellent results for its calendar Q1 reporting period.

Whether a stock performed well or not this quarter was not necessarily driven by its results. As a whole, the results from the Portfolio companies continue to be very strong, in line with a recovering economy. In fact, this was the second quarter in a row in which we can say that reported results for the Fund’s holdings came in much better than we expected. However, as has been the case for what seems like several quarters, individual stock returns continue to be driven by sector and factor rotations (such as the “recovery play” we have written about in the past). We are hopeful the importance of individual stock selection, the hallmark of the Fund’s strategy, will increase in importance as investors get more clarity on the strength of the macro-economic recovery post-pandemic.

Rest assured, no matter what is happening in the market, we are working hard to ensure your capital is invested in companies that have significant competitive advantages, are well-managed, have conservative balance sheets, and trade at reasonable valuations. We believe that our portfolio companies’ current operating results, which show many are growing their market share within their respective industries, indicate that they are creating value for you as shareholders.

With a Fund full of high-quality companies reporting great results, we have seen little need to ramp up activity in the Fund. While we were very busy in the Fund during 2020 given all the opportunity that the volatility presented, we currently feel that the best path forward is to patiently allow our current holdings to work for us. We remain on the hunt for new opportunities, but are finding them more difficult to source than a year ago as valuations have increased substantially.

The Fund’s cash level ended the quarter at 6%, so we have the flexibility to add new holdings when we find more high-quality small caps that also match our valuation criteria. But for as long as stock market volatility remains subdued and the Fund’s companies continue to report great results, you should expect less activity in the Fund than last year.

Thank you for your investment.

Matt Parker, CFA, CPA

Intrepid Endurance Fund Co-Portfolio Manager

Joe Van Cavage, CFA

Intrepid Endurance Fund Co-Portfolio Manager

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.