April 2, 2021

“No matter what the form of government, there are in fact only two kinds of government possible. Under one system, the state is everything and the individual is an incident. Under that system, the individual has no rights, though they may be termed such; he has only privileges. Under that system, the state is the reservoir of all rights, all privileges, all powers. But this system our forefathers rejected. They declared that all just government drives its powers from the consent of the governed. They affirmed the dignity and the sanctity of the individual…they elected a man-made state, not a state-made man.”

-Frank Dixon

Dear Fellow Shareholders,

Welcome to the RobinHood market! I ran across the above quote as I was thinking about the US Capitol being over-run by Trump supporters contesting the election of Joe Biden. It did not appear from the mayhem that followed that “the governed were giving their consent”…at least not peacefully!

Unfortunately, an Air Force veteran of the Iraq War, along with a Capitol Hill policeman, lost their lives that day.

This was quickly followed up with the second impeachment of Donald Trump by the House of Representatives. And not too long thereafter, the exoneration by the U.S. Senate – many of whom decided against impeachment of someone no longer in office.

If that wasn’t enough news, traders using online forums and accounts at RobinHood circled like sharks around companies with large amounts of short interest in an attempt to “squeeze” the short sellers through focused buying in companies like Gamestop (GME), AMC Theaters (AMCX), and others. All this crazy activity almost brought down the broker-dealer (RobinHood), and maybe it should have.

As I’m sure you remember from your youth, the story of Robin Hood and his band of Merry Men took from the rich to give to the poor. In this case, I think the opposite happened! RobinHood trading, with catchy slogans and hip advertisements, convinced many that – with the RobinHood trading app, a little money, and a lot of chutzpah – one could go far!

I recall from earlier in the year a front-page story in the Wall Street Journal that chronicled the woe of a 31 year-old security guard living in his parent’s home. He took out a personally guaranteed $30,000 bank loan to fund his RobinHood account to trade Gamestop (GME) shares with his RobinHood app. I will jump to the punchline – it didn’t end well for the young security guard. Stories like this one make my blood boil!

I bring all of this up because it was a wild quarter, particularly when you consider all of the above took place only in January!

Once the transition of power to the Biden administration was complete, it didn’t take long at all for his $1.9 trillion (with a T!) stimulus bill to gain approval from both the US House and Senate using the reconciliation process. This stimulus bill, along with the interest rate suppression courtesy of the Federal Reserve, has ignited prices of almost everything…lumber, copper, oil, bitcoin, stocks, and some bonds.

Please keep in mind as interest rates rise, bond prices fall, which they did across the US Treasury and US investment grade bond yield curves. For example, the yield on the 10 Year US Treasury started the year at 0.90% and finished March at 1.77%, almost a double in yield in one quarter. This movement in rates hurt what we internally call “long duration assets” – this caused negative returns for some bonds in the quarter, and slowed the ascent of the Nasdaq Composite Index in the same time period.

At the Intrepid Capital Fund, with the continuing support from the Federal Reserve and the new stimulus package, we have stayed invested. But as you may have come to expect from us, we have stayed invested in securities that may have been overlooked by others. I have three examples:

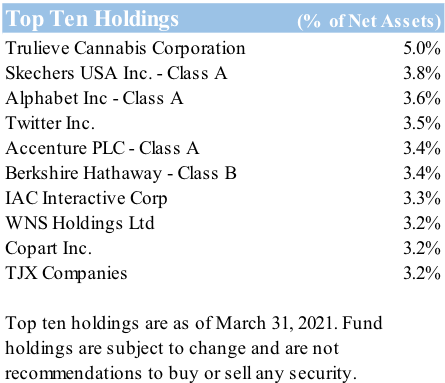

- Trulieve Cannabis. A home grown (no pun intended), Florida-centric producer and retailer of cannabis and related products, Trulieve markets to the rapidly growing population of residents with a medical marijuana license in Florida. The growth rate, EBITDA margin, and sales per square foot are nothing short of phenomenal.

- Great Western Petroleum 9% 09-30-21 Notes. It is not too often you see a corporate bond in the top ten performers. Along with a new administration comes a renewed push for renewable energy along with restrictions on oil and gas exploration, including but not limited to the prohibition of drilling on federal lands. Well, guess what? Restricted supply meets heightened demand, and voila – higher oil prices! Hunter Hayes followed this issue closely and deserves the credit here as I likely would not have made it to a refinancing and a higher bond price.

- Twitter. I know many of you are rubbing your eyes right now with a loud “what?!”. The last President certainly created a ton of brand awareness up until the day he was kicked off! Interesting note here: the average daily users are around 192 million, which is lower than Snapchat and well behind the 2.2 billion Facebook users, indicating there is plenty of room for growth. Elliott Management, the behemoth hedge fund run by Paul Singer, has taken a large stake and Board representation. Yes, CEO Jack Dorsey is odd.

We hope he continues to work with Elliott to create value and/or sell the company. His larger economic interests lie in his equity position in Square Holdings (SQ), the payment processing business.

We hope he continues to work with Elliott to create value and/or sell the company. His larger economic interests lie in his equity position in Square Holdings (SQ), the payment processing business.

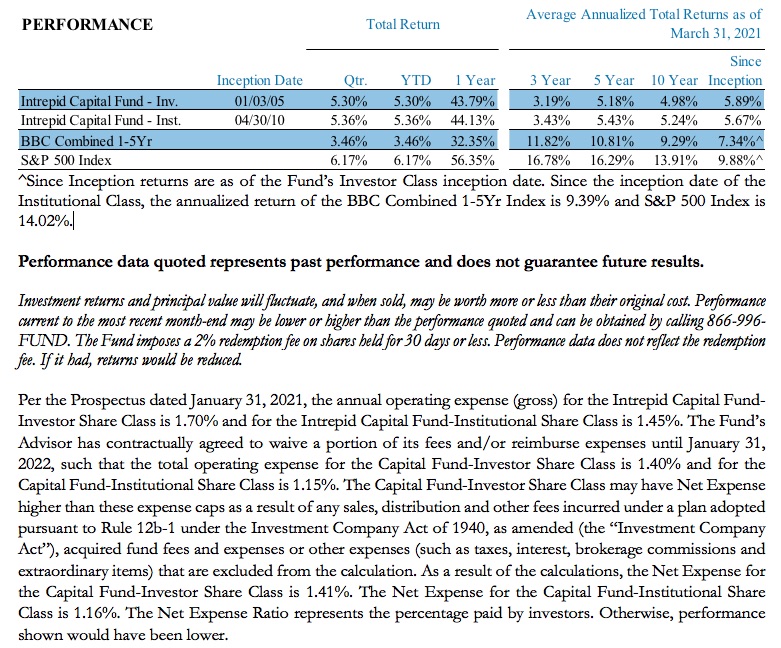

For the quarter ended March 31st, the Fund returned +5.30%. For the Fund’s fiscal first half (also ended March 31st), the Fund returned 20.41%. And for the trailing twelve months, the Fund returned +43.79%. Let’s see where we go from here!

Thank you for your continued support. If there is anything we can do to serve you better, please don’t hesitate to call.

All the best,

Mark F. Travis, President

Intrepid Capital Fund Portfolio Manager

Mutual fund investing involves risk.

All investments involve risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.