January 3, 2018

Dear Fellow Shareholders

My wife and I recently celebrated our ten-year anniversary. We traded the standard island locale for cold weather and hiking in Zion National Park in Utah. Zion is in an oasis in the middle of the desert. The location is quite remote. Visitors arriving from the nearest metropolis (Las Vegas) drive 2.5 hours through Nevada, into Arizona, then into Utah to arrive at the town of Springdale. As of the 2010 Census, Springdale had 529 residents. The nearest McDonald’s is 35 minutes away. Mobile phone service is spotty at best. Yet, a sticker on the window of a local Mexican restaurant made it difficult to completely forget the cryptocurrency madness occurring back in the connected world.

We at Intrepid have no opinion on the value of Bitcoin, or Litecoin, or Ethereum, or any of the other hundreds of cryptocurrencies. We aren’t sure we could ever have confidence in estimating the intrinsic value of these “securities,” but honestly, we have not dedicated the time to even form an opinion. Nearly all of our time is spent searching for appropriate securities for our clients, which no cryptocurrency would qualify for. We hope passing along our very limited knowledge gives you some entertainment or even something to discuss at your next cocktail party.

Many of you have probably heard of Bitcoin after its meteoric 1,300% gain in 2017. If not, Bitcoin and other cryptocurrencies are digital assets that are “mined” by computers solving mathematical problems. The total number of units that can be mined is often fixed (but not always), thereby giving a currency perceived value based on its scarcity. Bitcoin was the first cryptocurrency created and was initially used anonymously in online black market transactions. Some cryptocurrencies are now accepted for everyday transactions, like Bitcoin at the Mexican restaurant in Zion, but most are not and must be exchanged back into an accepted currency before use. In 2010, a bitcoin owner paid 10,000 bitcoins for two Papa John’s pizzas. At the time of this writing (the price of Bitcoin can fluctuate wildly), those bitcoins are worth nearly $150 million.

The crypto craze has spread by monumental proportions over the last few months. There are now over 1,000 different cryptocurrencies. Two of the most comical, in my opinion, are Dogecoin, which was initially created as a joke with an internet dog as its logo (pictured), and WeedCoin. Dogecoin now has a $2 billion market cap and has doubled since the beginning of 2018. Weedcoin was apparently created to take advantage of the hysterias of cryptocurrencies and legalization of marijuana at the same time. Due to the complete lack of regulation, initial coin offerings (ICOs) have taken the place of traditional capital raises for the most suspect of companies, many of which will turn out to be complete scams. Publicly traded companies have even begun to change their names to include cryptocurrency-related terms, such as blockchain, which is the technology many digital currencies are built on. Upon the name changes, the market capitalizations have soared, often by hundreds of percent. Recently the Long Island Iced Tea company changed its named to Long Blockchain Corp. LTEA generated about $5 million in revenues in 2016 through the sale of non-alcoholic beverages. In December, the firm announced that it would be changing its corporate strategy to seek investments in cryptocurrency and blockchain related technologies. The share price rose as much as 500% the following day. Can anyone say 1999?

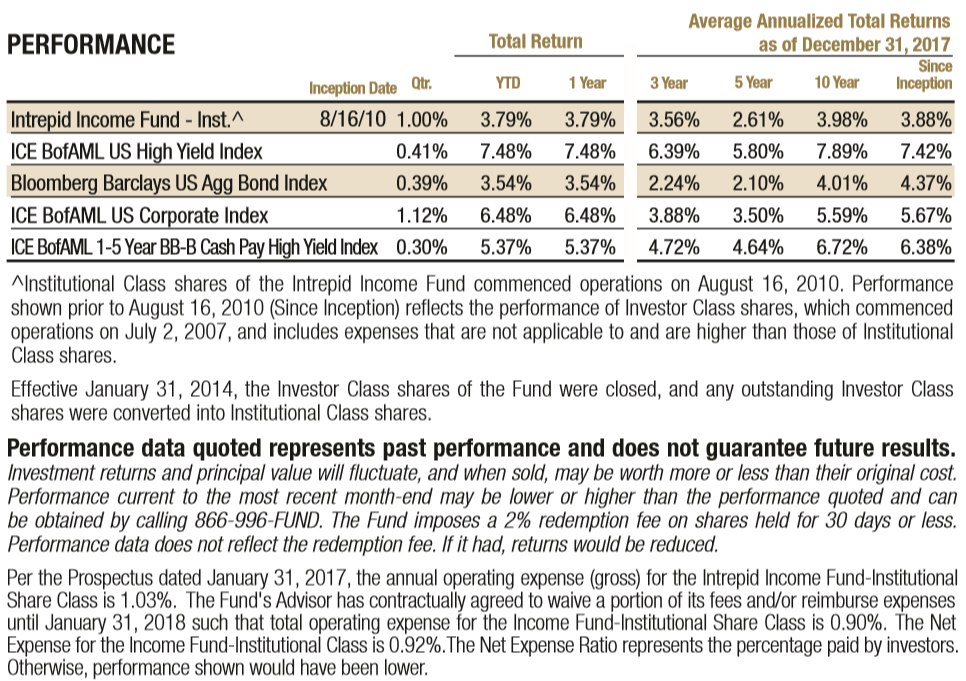

The Intrepid Income Fund (the Fund”) performed well in the fourth quarter ended December 31, 2017. The Fund gained 1.00% in the period, besting the ICE BofAML US High Yield Index’s (the “High Yield Index”) 0.41% return and the Bloomberg Barclays US Aggregate’s (the “Aggregate”) 0.39% return. We have recently started to include the ICE BofAML 1-5 Year BB-B Cash Pay High Yield Index (the “1-5 Year BB-B Index”) in our commentary, as we believe this index is more closely representative of the duration and credit quality of the Fund. This index gained 0.30% in the quarter. Lastly, the longer-duration, investment-grade ICE BofAML US Corporate Index (the “US Corporate Index”) posted an enviable 1.12% return in the quarter as investment-grade spreads tightened inside of 100 basis points to the lowest level since 2007. The Income Fund benefited significantly from its equity and convertible bond positions. Most of our B and BB rated holdings (we do not currently own CCC or lower issues) outperformed the high-yield indexes cited here.

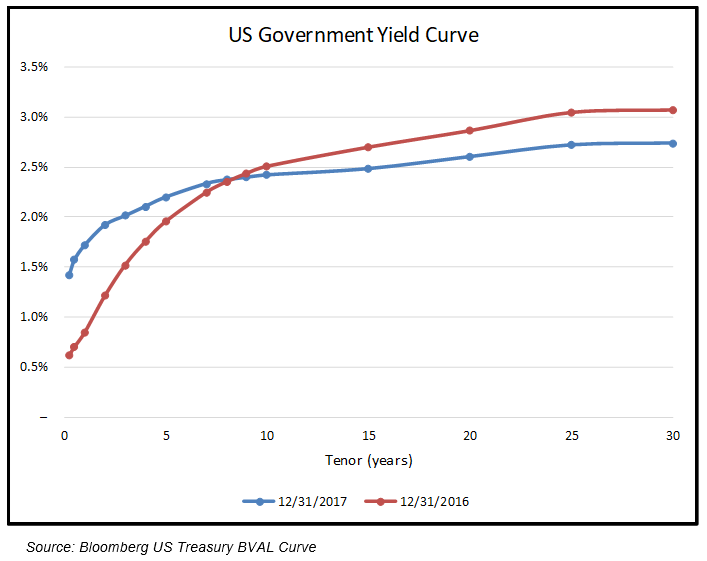

Our relative performance for all of 2017 is significantly less favorable. Exposure to credit risk was rewarded in 2017 as a result of the stable economic environment, low unemployment, and the prospect of tax reform. Default rates remained well below average in 2017, which resulted in strong high-yield returns. The High Yield Index rose 7.48% in the calendar year, while the 1-5 year BB-B Index gained 5.37%. Higher government bond yields would normally coincide with the positive economic backdrop. However, the yield curve has instead flattened as the Fed’s rate hikes put upward pressure on short-term yields while low wage growth has kept a lid on inflation. The flattening could also be construed as bond market participants worrying about a recession. Whatever the reason, long-duration corporates benefited from the decline in long-term rates. The US Corporate Index returned a healthy 6.48% in 2017. The Aggregate has a lower duration and less credit risk than the Corporate Index, so its annual return was lower at 3.54%. The Intrepid Income Fund increased 3.79% in 2017. The Fund outperformed the Aggregate due to higher exposure to credit risk, but underperformed both high-yield indexes due to more defensive posturing. Approximately 16% of the Fund’s assets were allocated to T-Bills and cash during 2017, and short-term investment grade bonds accounted for another 28%. The benefit of the jump in front end rates is that we have been able to deploy what was once 0% yielding cash into assets producing at least some income, however little.

Two convertible bonds and an equity security were the top contributors to the Fund’s performance in 2017. Consolidated-Tomoka Land Company’s 4.5% convertible bonds (ticker: CTO) were one of the Fund’s best performers and constituted a larger position in the Fund. The notes rose significantly in price as the company’s common stock appreciated by nearly 20% in the year. The convertible feature of the bond therefore became more valuable. CTO’s management has done an admirable job disposing of its land holdings around the I-95 corridor in Daytona Beach, Florida and redeploying the capital into income-producing properties. The sales have come at a faster pace than we anticipated, which caused us to increase our estimate of the firm’s intrinsic value.

EZCORP’s 2.125% convertible bonds (ticker: EZPW) also benefited from the strong performance of the underlying equity in the second half of the year. We have discussed this investment on several occasions over the past few years, but to quickly refresh, EZCORP is one of the U.S.’s largest owners of pawn shops. It had been struggling through several non-pawn-related issues. These issues included accounting irregularities at a troubled Mexican subsidiary that was eating the cash generated by the pawn business. The bonds traded at distressed levels in late-2015 and early-2016. At the time, it was Intrepid’s largest firm-wide position. Our belief was that the core pawn business had significantly more value than the market was assigning. As it became clear that the Mexican business’s issues were manageable, and a sale of that business was announced, the bonds recovered close to par. With the stock trading above our estimated valuation, we believed that the likelihood of further upside in the bonds was limited. Additionally, we believed the sale of the Mexican business had an above-average risk of falling through, so we took the opportunity to reduce our exposure. We entered 2017 with less than 1% of the Income Fund’s assets invested in the convertible bonds.

EZCORP was able to close the divestiture on what we believe to be very favorable terms. This substantially de-risked an investment in the firm, in our opinion. Yet, the equity slipped nearly 30% early in 2017. The convertible bonds were also under pressure. We used the opportunity to triple our position size. Our timing was lucky. EZCORP shares crossed $12 last month, up from less than $8 in July. The Fund sold its entire position in the convertible bonds at prices near $102.

The timing of our investment in Dominion Diamond common stock (ticker: DDC) was also fortuitous. As discussed in our previous commentary, Dominion received a buyout offer shortly after we purchased the stock. The acquisition closed in November.

Not all of our convertible bond investments have worked out as well as Consolidated-Tomoka and EZCORP. The Income Fund had just one material detractor in 2017. Primero Mining 5.75% convertible bonds due 2/28/2020 cost the fund about 10 basis points, which is just at the cusp of what we classify as material. Primero was discussed at length last quarter by Endurance Fund Portfolio Manager Jayme Wiggins.

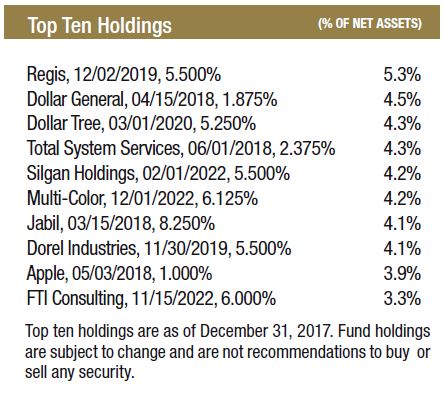

There was a moderate amount of portfolio activity in the fourth quarter. As mentioned, we exited our position in EZCORP’s convertible bonds entirely. This was one of the Fund’s larger weights. Our second largest position, Nathan’s Famous 10% due 3/15/2020, was called by the company. Nathan’s (ticker: NATH) replaced the bond with a new issue due in 2025, in which we initiated a small position. Match Group called its issue that was due to mature in 2022. Lastly, several of our investment grade bonds matured in the quarter. We rolled the incoming cash into new short-term investment grade bonds and added to existing high-yield positions.

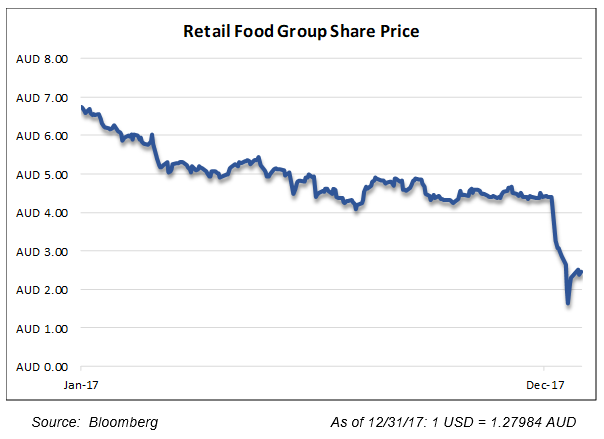

The Fund’s most notable new holding is the common stock of Retail Food Group (ticker: RFG AU). RFG is an Australian restaurant franchisor with several concepts operating in the bakery, coffee, and pizza categories. The portfolio consists of roughly 1,500 restaurants. Our interest in the company was piqued this summer by the languishing stock price (see below), which declined from a high of nearly AUD 7 to just above AUD 4 per share. We declined to get involved until December when the stock was slammed by a negative report from a media outlet on the company’s treatment of franchisees. About a week later, the firm put out a press release stating earnings would be lower than expected. The stock lost more than half of its value in ten days. To be sure, some of the negativity is probably deserved. Nevertheless, our belief was that the company was trading far too cheaply at 6x estimated forward EBIT. We bought very close to the low, and RFG’s shares gained about 50% in the final days of 2017. As a result, the position was the top contributor to the Fund in the fourth quarter.

The highlight of our Zion experience was our hike through The Narrows. The entire hike is done wading through the waters of the Virgin River, which cut a slot canyon through the rock over 18 million years. The most breathtaking section located three miles upriver is called Wall Street, named for the 1500-foot walls on both side of the canyon. I have probably spent more time at Zion’s Wall Street than I ever have at New York’s. Intrepid’s offices are far from New York City. We like to think that this helps us maintain a more independent view. Every fund Intrepid manages aims to be different. We are not in the business of simply gathering assets to charge a fee. There is no point in creating another index-hugging product. We truly believe we are offering you something unique. We believe our investment philosophy is aligned with your best interests, and we are invested right alongside you.

We wish you a prosperous 2018. Thank you for your investment.

Sincerely,

Jason Lazarus, CFA

Intrepid Income Fund Portfolio Manager