January 2, 2018

Dear Fellow Shareholders,

The capital markets are a lot like the German Autobahn, which has no mandated speed limit. You can act stupidly and have fun for a while, but eventually it could ruin your life. Bitcoin and other cryptocurrencies surged in spectacular fashion in the fourth quarter, even after paring gains near the end of the year. Many in the investment community say Bitcoin is an accident waiting to happen. Few express the same negativity toward the stock market, which enjoyed its own impressive run in Q4, for the year, and since 2009. We’ll spare you more opinions about Bitcoin, which is outside of our wheelhouse. On the stock market, we have a lot to say, but we’ll start with this: caveat emptor.

On December 20, 2017, Republicans muscled tax reform through Congress. One of the highlights of the package is a reduction in the federal corporate income tax rate from 35% to 21%. It seems like U.S. stocks have been repeatedly celebrating the passage of tax reform for the last thirteen months. Some sell-side analysts are gleefully modeling the 21.5% increase in net income that this fourteen-percentage point reduction in the federal tax rate implies.[1] That only takes fourth grade math skills, and in our opinion, is lazy.

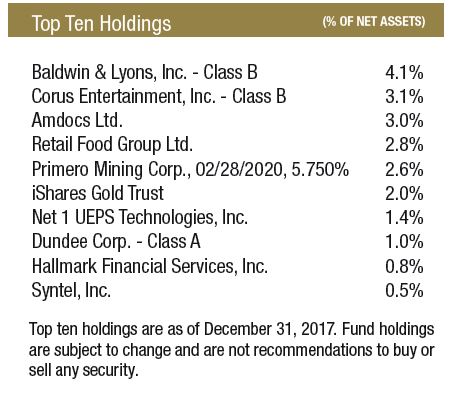

We could begin our discussion by dredging up some points from the Endurance Fund’s (the “Fund”) fourth quarter 2016 letter to shareholders, such as noting that one-third of U.S. small cap firms are losing money and won’t benefit from tax cuts or that changes to the tax-deductibility of interest would negatively affect leveraged companies. We could point out how hundreds of U.S. small caps utilize tax loopholes or derive a significant percentage of revenue from overseas, so they already don’t pay the full U.S. tax rate. We could discuss how an even larger percentage of income than revenue has been attributed to foreign sources. Syntel (ticker: SYNT), a recent Endurance Fund holding, is a case in point. We could focus on the astonishing 152x P/E ratio of the Russell 2000 Index when using unadulterated trailing twelve-month GAAP earnings, as opposed to forward estimates or adjusted figures. At a triple-digit earnings multiple, we would argue that any benefits from lower taxes are priced into stocks. We’ve said it all before. So, we will say something new.

Syntel 2016 10-k

First, we’ll start with the non-controversial: the value of a business depends on the spread between its return on invested capital and cost of capital, in addition to its growth rate. Companies with high returns on capital generate significant free cash flows and can expand without burdensome capital commitments. At Intrepid, we seek out these types of enterprises. Return on invested capital (ROIC) can be decomposed into three elements: operating margin, tax rate, and invested capital turnover.

![]()

Reducing the corporate tax rate directly impacts ROIC because companies get to keep more of their pre-tax profits. Since a higher ROIC corresponds to a more valuable business, all else being equal, the natural interpretation of tax reform is that the equities of American corporations are now worth more than before. However, we would argue that second order thinking is important here.

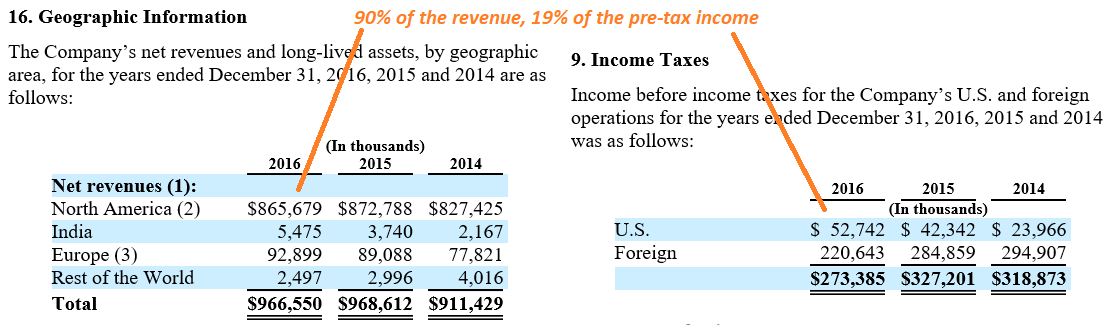

There is no correlation between lower corporate tax rates and higher returns on capital. We plotted returns on tangible invested capital against tax rates for over 7,000 companies around the world.[2] If lower tax rates (y-axis) corresponded to higher returns on capital (x-axis), then we would expect to see a downward sloping trend line. Instead, the results showed a regression line that was very slightly increasing. The r-squared, or coefficient of determination, was zero. This suggests that tax rates have no predictive power for forecasting returns on capital.

Our takeaway isn’t that no U.S. corporations will experience a lift in profitability in 2018. The initial impact of the cuts will boost the bottom lines of many businesses. Nevertheless, we believe the benefit from lower tax rates will be competed away in most industries. This is especially true for small caps, which are less likely to possess sustainable competitive advantages than larger companies and consequently enjoy lower returns on capital, on average. Take regional banks, one of the sectors most exposed to U.S. tax rates due to a domestic focus. Banking is a competitive space with limited barriers to entry. A reduced tax rate will enable management teams to sacrifice pre-tax margins to win business, while still maintaining the same return on equity. Rinse and repeat for other industries. Admittedly, the extra dollars not being sent to the government might help boost economic growth rates, but the impact there is difficult to quantify. We believe it’s unlikely to be dramatic.

Don’t get us wrong, we support measures to let people keep more of their own money. People own companies, so reducing business tax rates helps accomplish this objective. We are just not sold on the idea that the significant reduction in the U.S. federal rate will create a sizeable lasting impact on the profitability of U.S. corporations, especially given where we are in the business cycle.

Tax reform will exacerbate the federal deficit, according to the Congressional Budget Office. One side of the aisle says that’s a government spending problem, while the other side says it’s a revenue problem. We can all agree it’s a problem. The gargantuan federal debt and unfunded liabilities will become a crushing burden for younger generations. These issues seem distant and uncertain enough that professional investors generally avoid factoring them into their investment decisions. However, at a minimum, most would acknowledge that excessive debt will be a drag on long-term economic growth.

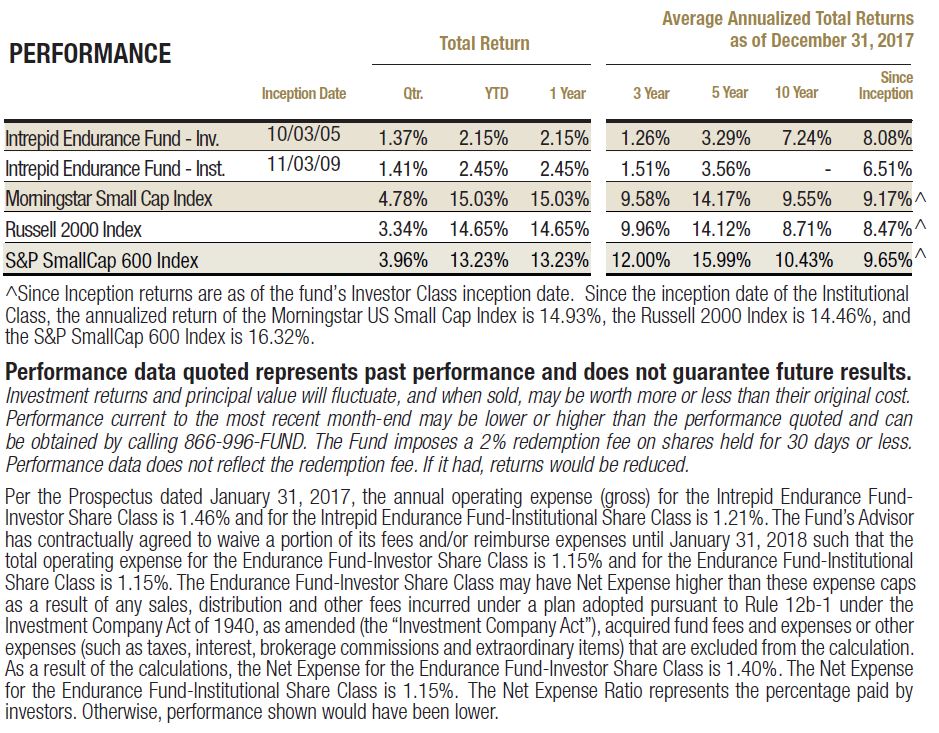

The Fund’s fourth quarter and full year performance significantly trailed benchmarks.

The Fund was up 1.37% for the quarter and 2.15% for the year. In comparison, the Russell 2000, Morningstar US Small Cap Index, and S&P Small Cap 600 benchmarks increased 3.34%, 4.78%, and 3.96%, respectively, for the three months ending December 31, 2017. For all of 2017, the Russell 2000, Morningstar Small Cap, and S&P Small Cap 600 indexes rose 14.65%, 15.03%, and 13.23%, respectively. The Fund’s holdings increased more than small cap benchmarks during the year, but this was offset by the Fund’s operating expenses and large position in cash and short-term Treasury bills. At the end of the year, 78.5% of the Fund was held in cash equivalents. Cash declined slightly in Q4 because of outflows and the purchase of new positions.

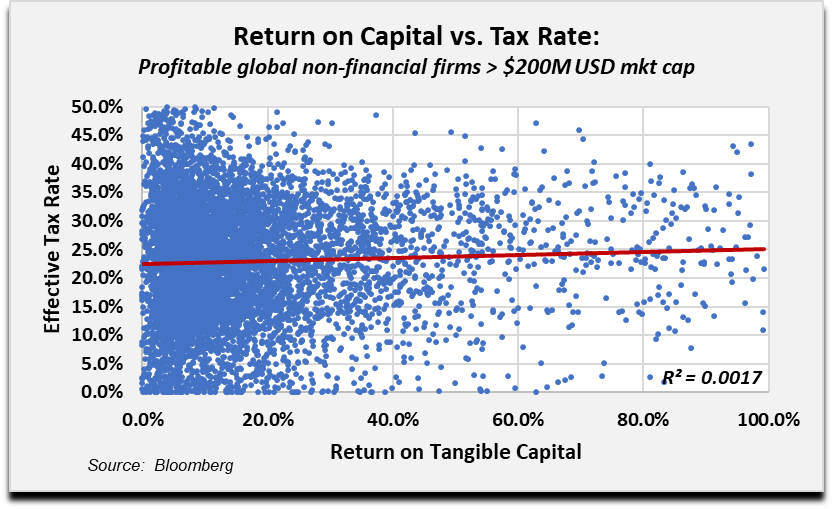

The Fund bought three new securities in the fourth quarter: Net 1 UEPS Technologies (ticker: UEPS), Retail Food Group (ticker: RFG AU), and Hallmark Financial (HALL). We’ve gandered at UEPS once or twice before, since it has historically traded at a low EBIT multiple. However, our looks were always superficial, and we were scared off by the firm’s outsized exposure to the South African government. Like Transformers, with UEPS there’s more than meets the eye. While UEPS derives significant cash flow from distributing welfare payments in South Africa and has been informed it is losing this contract, management is adamant that the company’s payment technology and infrastructure will have enduring value for other applications in the country and elsewhere. More importantly, UEPS has an interesting portfolio of other assets, including KSNET, one of the largest card payment processors in South Korea. The value of KSNET and UEPS’s investment portfolio could exceed the company’s market capitalization, even assuming the firm’s South African assets are worthless.

Retail Food Group (RFG) is an Australian franchisor of quick service restaurants. The heavily-shorted shares plunged 63% from December 8th to December 20th after a series of newspaper articles trashed the company and its treatment of franchisees. Several members of Intrepid’s investment team have previously researched RFG, but the price never met our margin of safety. This is an example of our demanding valuation standards benefiting us. On balance, not “paying up” for stocks has hurt the Fund’s relative performance over the past five years.

Franchise businesses are usually good businesses. They often generate copious free cash flow and are frequently awarded high multiples by investors for the stability inherent in the franchise model. In the U.S., Dunkin’ Brands trades for 18x EBIT. RFG was selling below 6x estimated forward EBIT when we bought it. RFG’s franchises sell donuts, other baked goods, coffee, and pizza. The firm also owns wholesale operations for coffee, cheese, and bakery products. Some of the franchise concepts are struggling, and the hostile press coverage claimed that a disproportionate number of RFG franchisees are trying to sell their stores compared to other franchise concepts. Our analysis indicates that the reporters exaggerated their claims. RFG may need to take steps to improve its relationship with franchisees, but we don’t see this business disintegrating at the rate implied by the stock action. Donut King and Gloria Jeans are strong brands in Australia, and a meaningful proportion of the company’s value is tied to these franchises and RFG’s wholesale operations. We entered our position near the lows, and the stock has recovered some lost ground already.

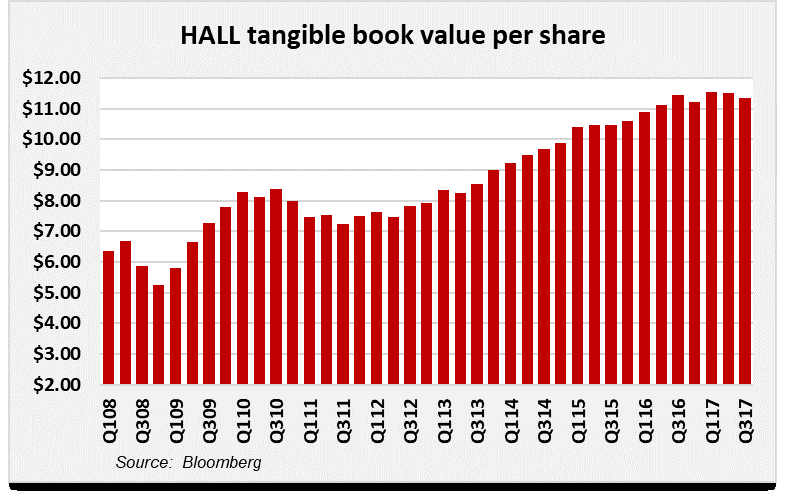

Hallmark Financial Services is a specialty property and casualty insurance company that focuses on transportation-related niche commercial markets with a concentration of business in Texas. We were encouraged that Hallmark’s shareholder’s equity was only negatively impacted by 1.5% from Hurricane Harvey. Hallmark will underwrite accounts ignored by larger carriers due to the insured’s loss history, years in business, minimum premium size, or type of business. The firm derives a significant portion of premiums from trucking companies, which Hallmark has in common with Baldwin & Lyons (ticker: BWINB), another Endurance Fund holding. Hallmark has a decent long-term track record of growing book value per share, but underwriting losses and unfavorable reserve adjustments have saddled returns over the past two years. Management has worked to address problem areas by raising rates and exiting markets like personal automobile insurance, where Hallmark has failed to make money. The company is well-capitalized, and Hallmark’s bond portfolio carries a weighted-average credit rating of BBB+ with a three-year duration. This should help protect the balance sheet under a scenario of rising interest rates. We bought a small position in the stock at a discount to tangible book value.

We exited our position in Greenhill (ticker: GHL) and sold all but a small piece of our stake in Syntel (ticker: SYNT) in Q4. Greenhill’s stock price moved higher after jumping late in the third quarter, when management announced a leveraged recapitalization. The company’s Q3 results, reported in October, were lower as expected, with improved results in the U.S. offset by significantly lower activity in Europe. Management reiterated their expectation of operating improvements in Q4, and we have seen evidence of this recently with Greenhill working on deals such as the $6 billion merger of McDermott International and Chicago Bridge & Iron. Greenhill’s higher stock price reduces our intrinsic value estimate because the firm will be repurchasing fewer shares than we had modeled. We took the quick win on the investment.

Syntel’s shares rallied after the company reported third quarter earnings. Revenue increased sequentially even with an ongoing drag from American Express, and margins were better than expected. Excluding American Express, Syntel’s sales increased 3.1% year-over-year and 3.7% on a sequential basis. Revenue defined as “digital” was up 18% from Q316. While the third quarter report was a positive surprise and management revised guidance higher, the forecast still suggests a weak Q4. We don’t know whether management is sandbagging or if fourth quarter performance will deteriorate. Since the stock exceeded our valuation, we sold the vast majority of our holding.

During the fourth quarter, the Fund’s main contributors to performance were Syntel, Baldwin & Lyons, and Retail Food Group. Baldwin is the Fund’s largest position and increased modestly this quarter. The stock’s reaction to Q3 results was muted, even though Baldwin’s small underwriting profit marked a major turnaround from the losses experienced in the first half of the year. Investment results added $1 per share to book value, bringing the stock’s P/B ratio to ~0.85x. Management is planning to grow market share as certain competitors exit the challenging commercial auto insurance space. Although we don’t expect Baldwin’s combined ratio to quickly return to levels from the glory days, we believe we’re owning a historically well-managed business at a substantial discount to the peer group.

The primary detractors from the Fund’s Q4 results were Corus Entertainment and Dundee Corp. Canadian equities were less ebullient than their U.S. counterparts in 2017, but Corus and Dundee’s share prices underperformed local benchmarks. Corus delivered improved results in fiscal 2017 compared to the prior two fiscal years, as the firm succeeded in stabilizing advertising revenue. Nevertheless, the company’s ad results were slightly below expectations, and management has cautioned that the outlook for television advertising in Canada remains soft. Corus is holding its own in a tough environment and trades at a 10% dividend yield, but even this low valuation cannot withstand a resumption of top line declines. Corus and other TV network owners must work quickly to implement technology to deliver targeted advertising and more flexible viewing options to defend against the onslaught from over-the-top services. We’re watching closely.

January 10, 2018 update: Corus just reported a 4% decline in television advertising revenues for its fiscal first quarter despite easy comparisons from the prior year. These results were significantly worse than management telegraphed shortly before the fiscal quarter ended, which further reduces their credibility. While the shares trade for a low multiple of cash flow, we have lost confidence in the revenue stabilization story. We believe management and the board overemphasize dividends at the expense of debt reduction. We sold our position at a loss.

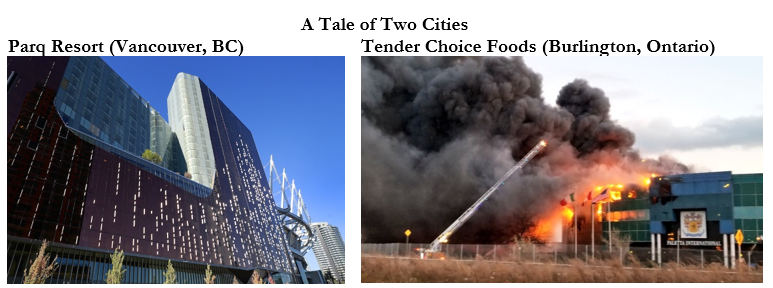

Dundee achieved two important milestones in the third quarter, including closing the sale of United Hydrocarbon (UHIC) to Delonex Energy and opening the Parq Vancouver casino and resort. The UHIC deal eliminates a $12 million annual cash drag to Dundee and offers the potential for a future royalty tied to Delonex’s Chadian oil production several years from now. Parq Vancouver is Dundee’s main opportunity for near-term cash flows, although this is dependent on refinancing the project’s prohibitively expensive construction debt. We believe Dundee should capitalize on the strong market for Vancouver hotel transactions and sell the two hotels attached to Parq Vancouver, with proceeds applied to reducing borrowings.

Just when Dundee’s situation seemed to be incrementally brightening, the company reported in November that it suspended activities at Blue Goose’s Tender Choice chicken processing facility to address repairs required by the Canadian Food Inspection Agency. Weeks later, the facility burned down. While destructive fires are unpredictable (usually, and hopefully in this case), Dundee’s original rationale for purchasing Tender Choice wasn’t strong. Management claimed Tender Choice would help Blue Goose expand its organic brand into conventional chicken, and they also suggested vertical integration synergies, but the main purpose was to acquire EBITDA to dilute losses at the Blue Goose subsidiary. This is another disappointing example of capital allocation by Dundee’s leadership. With that said, Dundee’s stock already reflects nothing favorable, as it’s trading at less than 25% of tangible book value. If management can begin extracting cash flow from Parq Vancouver in 2018, Dundee could partially stem its ongoing bleed in book value. Dundee is not a material position for the Fund.

We are pleased that we found a few new ideas this quarter, however, the Fund remains mostly uninvested as we wait for opportunities that meet our criteria. Our patience is being tested by the second longest bull market in history, which has pumped valuations for the average stock to all-time highs.

In light of the Fund’s relative underperformance over the past five years, we have encountered a growing number of skeptics about our investment process. This is the same process that guided Intrepid through the tech and housing bubbles. Our investment process is not designed to outperform consistently. It is not built to beat indexes over three or even five-year stretches. Our process is configured to exceed peers and benchmarks over a full market cycle, and that is our goal. We have not compromised our process in an attempt to “keep up” by purchasing securities that we believe are overpriced. In our opinion, the U.S. small cap market has been overvalued for several years, and today’s nosebleed valuations are incompatible with a value-oriented investment approach. We expect the final phase of this market cycle to be very damaging to investors who ignore or deemphasize traditional valuation backstops such as free cash flow.

Discipline makes the difference. Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Chief Investment Officer

Intrepid Endurance Fund Portfolio Manager

[1] (1 – 0.21) / (1 – 0.35) – 1

[2] Bloomberg search for all profitable non-financial companies with a USD market cap exceeding $200 million and data easily available to compute effective tax rates and returns on tangible capital. Excluded outliers with effective tax rates exceeding 50% or returns on capital exceeding 100%. The exclusion of these firms does not materially alter the findings.