January 6, 2018

Dear Fellow Shareholders,

I would love to be able to announce to you that we had a quarter where we outperformed the market. If I did in this raging bull market, I would hope you would question to what type of investment process you had committed your hard-earned capital! I do think the opportunity to make such an announcement is drawing nearer by the day. Our firm’s objective is to participate in an up market, but preserve capital in a down market. Unfortunately, in my opinion, most market participants think they can outrace the bull, much like the runners in Pamplona, Spain, and exit down a side alley to sit out the losses of the ensuing downturn.

For me, as a lifetime participant in the capital markets, I much prefer steadily higher fund balances, with small but tolerable drawdowns in my capital base when adverse conditions arise. The difficulty is that the adverse conditions almost always surprise market participants. From a valuation perspective, the fuel for adverse conditions is already here, with cyclically high share prices acting as kerosene just waiting for a trigger event (the match). That trigger could be something as widely discussed and feared as a trade war with China, a physical war with North Korea, or a rapid rise in inflation. My guess though, is that whatever it is and whenever it occurs, it will come out of left field and surprise most investors. As Carl Richards once said, “Risk is what’s left over when you think you’ve thought of everything.”

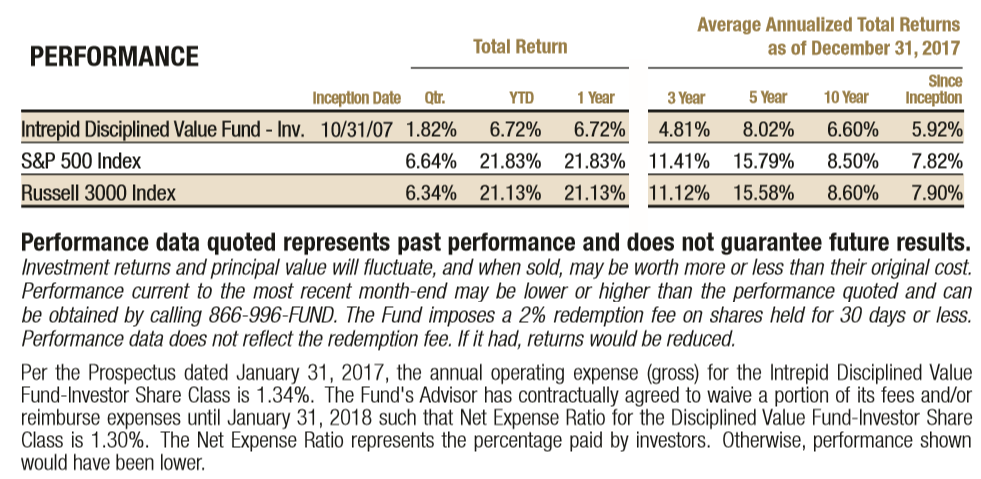

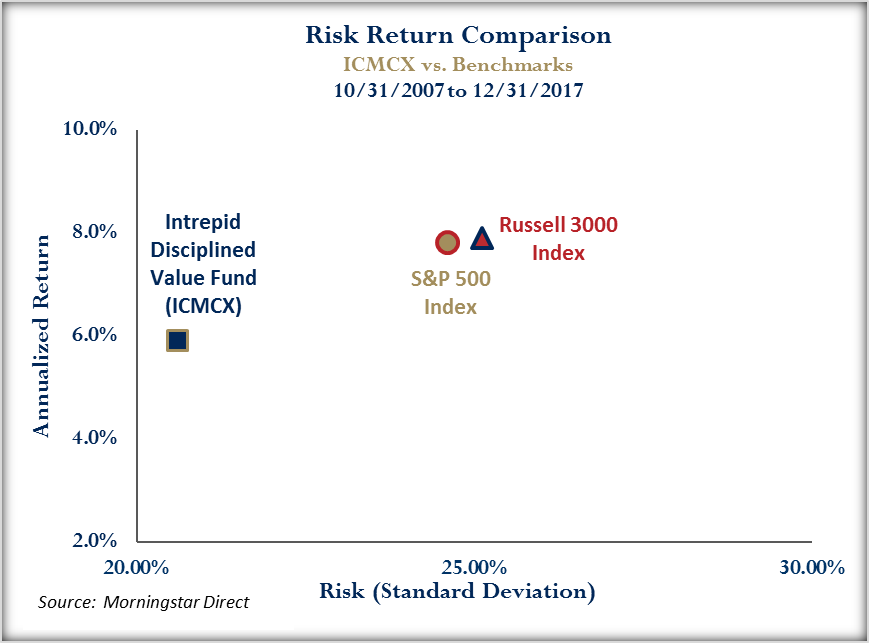

The Disciplined Value Fund (the “Fund”) marked its tenth anniversary on October 31, 2017. The beauty of the Fund is the disciplined team behind it. As I review the last decade of the Fund’s performance, I marvel at the consistency of the outcome. For the one-, five- and ten-year periods ending December 31, 2017, the Fund increased 6.72%, 8.02%, and 6.60%. In comparison, the S&P 500 Index returned 21.83%, 15.79%, and 8.50%, and the Russell 3000 Index returned 21.13%, 15.58%, and 8.60% for the same one-, five- and ten-year periods. The Fund’s performance numbers are substantially behind its 100% equity benchmarks, but the tradeoff has been substantially less risk incurred (see chart below).

Cash at the end of the quarter was 29.2%, lower than it has been in quite a while thanks in part to several purchases made during the period. These include a new position in Cheesecake Factory (ticker: CAKE) and additions to our Coach (ticker: COH) and Leucadia National (ticker: LUK) holdings. The Fund increased 1.82% for the fourth quarter, compared with increases in the S&P 500 Index and the Russell 3000 Index of 6.64% and 6.34%, respectively. Again, the Fund’s performance for the quarter was substantially less than the equity indexes but so was the risk incurred during the period. As mentioned before, we would expect this drastic performance gap to close when volatility eventually returns to the market.

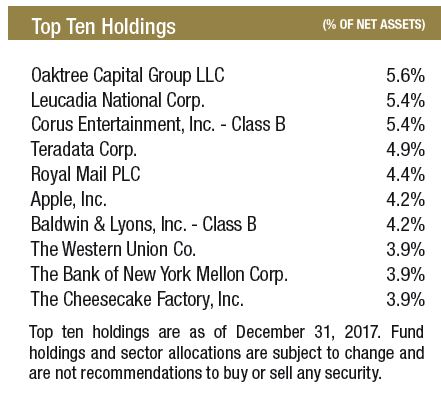

The top five performers for the fourth quarter were Teradata (ticker: TDC), Royal Mail (ticker: RMG), Apple (ticker: AAPL), Cheesecake Factory (ticker: CAKE), and Northern Trust (ticker: NTRS). The five major detractors for the quarter were Oaktree Capital (ticker: OAK), Corus Entertainment (ticker: CJR/B CN), Western Digital (ticker: WDC), Contango Oil & Gas (ticker: MCF), and Dundee (ticker: DC/A CN).

Thank you for investing with us. If there is anything we can do to serve you better, please let us know.

Best regards,

Mark Travis

President

Intrepid Disciplined Value Fund Portfolio Manager