October 3, 2019

Dear Fellow Shareholders,

When is the last time you thought about plumbing? Probably after a pipe burst in your home. Like many things that do not break often, plumbing becomes relevant when it stops working. The same can be said of the esoteric plumbing that props up the modern financial system – most people do not start thinking about it until it starts to break down like it did in September.

The rickety pipe that started to leak in the financial system’s plumbing in September is the market for repurchase agreements, commonly known as the “repo market.” Over $3 trillion worth of debt is financed each day in the repo market, making it one of the largest and most important components of a healthy, liquid financial system. The repo market enables banks and financial institutions to raise cash by lending collateral, oftentimes overnight, in exchange for what is usually a small amount of interest.

However, in September repo rates spiked as high as 10%, forcing the Federal Reserve to begin an open market operation to soothe this important short-term funding market and stabilize rates. This operation represents the first direct injection into the banking sector by the Fed since the Great Financial Crisis. The cause of the repo rate spike is complicated but stems mainly from a supply/demand imbalance. To be more specific, there were not enough parties willing to lend money overnight to satiate the demand for cash. Therefore, to entice more overnight lenders, repo market participants that needed cash were forced to pay higher and higher interest rates. When banks cannot get access to cash through repo markets, bad things start to happen. One of the reasons banks like Lehman Brothers failed over a decade ago was because they were unable to tap repo markets.

However, in September repo rates spiked as high as 10%, forcing the Federal Reserve to begin an open market operation to soothe this important short-term funding market and stabilize rates. This operation represents the first direct injection into the banking sector by the Fed since the Great Financial Crisis. The cause of the repo rate spike is complicated but stems mainly from a supply/demand imbalance. To be more specific, there were not enough parties willing to lend money overnight to satiate the demand for cash. Therefore, to entice more overnight lenders, repo market participants that needed cash were forced to pay higher and higher interest rates. When banks cannot get access to cash through repo markets, bad things start to happen. One of the reasons banks like Lehman Brothers failed over a decade ago was because they were unable to tap repo markets.

Other rates are also affected by the repo market. Volatility in the repo markets briefly pushed the effective federal funds rate to 2.30%, above the upper limit of the Fed’s target range. The secured overnight funding rate (SOFR) also spiked to 5.25% in mid-September, over 300 basis points above where it was earlier in the month. SOFR, which will likely replace LIBOR as the de facto benchmark rate for floating rate securities, affects about $285 billion of outstanding debt. Prolonged spikes in SOFR could have catastrophic consequences for overleveraged borrowers that would have trouble servicing debt that is suddenly twice as expensive.

The Fed will likely continue having to bolster money markets to prevent more leaky pipes. As this letter goes to print, Federal Reserve Chairman Powell just announced a plan for boosting the level of bank reserves on the Fed’s balance sheet through the purchase of Treasury securities. Early estimates call for around $200-$400 billion of stimulus from these measures. Even though the Fed is adamant that this is not another bout of quantitative easing, we cannot help but scratch our heads and wonder what the difference is. At some point, injecting all this capital into the financial system will have consequences.

Over the past several quarters we have written about the perils we see presiding over the credit market. Add the volatility in repo markets to the litany of other concerns we have, including record levels of debt, weak covenants, and inflated ratings. In this perilous environment, we continue to cautiously evaluate every potential investment opportunity and we remain biased towards short-dated credits issued by companies with stable cash flow generation and healthy balance sheets.

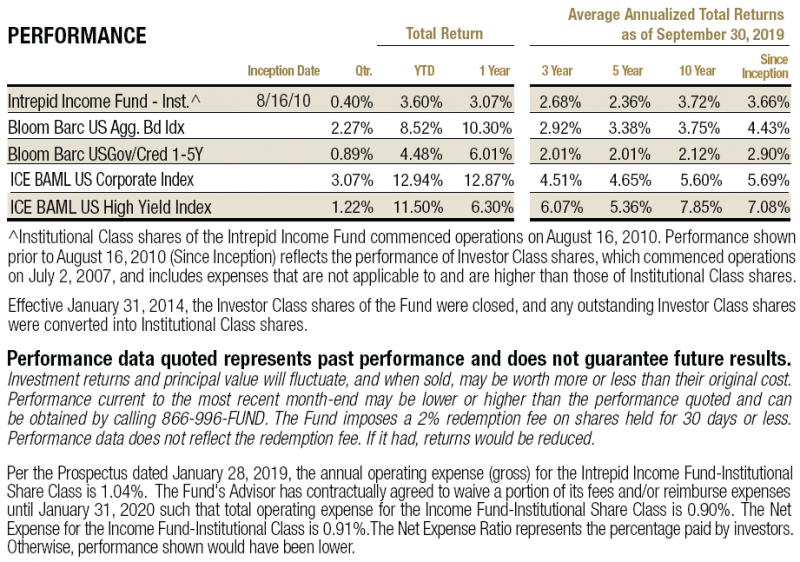

The domestic fixed income markets produced strong results during the quarter ended September 30, 2019, led once again by a decline in rates. The Bloomberg Barclays US Aggregate Bond Index (the “Aggregate”), which is a broad measure of the investment grade fixed income market in the United States, produced a 2.27% gain. The Aggregate’s relatively high exposure to longer duration US Treasury and agency securities meaningfully assisted the index’s return and was only slightly offset by modestly widening corporate debt spreads.

Investment grade corporate bonds returned 3.07%, as measured by the ICE BAML US Corporate Index. The lower quality ICE BAML US High Yield Index was up 1.22%. Given the Intrepid Income Fund’s (the “Fund”) shorter duration and higher quality biases, we also cite the shorter-duration Bloomberg Barclays US Govt/Credit 1-5 Year Total Return USD Index (the “1-5 Year TR Index”), which gained 0.89% over the same period.

The Income Fund returned 0.40% in the third quarter. Given the Fund’s shorter duration, we did not benefit as much from declining rates as the indices we cited, which accounted for most of the performance disparity. We also saw spreads on some of our high yield positions widen during the quarter. We have cut down our exposure to some of these positions as we anticipate more volatility and further widening of spreads as this cycle draws closer to an end.

The Fund’s three top contributors for the quarter were Central Garden 5.125% due 02/01/2028, Vitamin Shoppe convertible notes due 12/01/2020 and Great Western 9% due 09/30/2021.

Central Garden notes continued to be the beneficiary of a sanguine interest rate environment. The return for the quarter has less to do with the business fundamentals than with the price increase caused by these lowering rates. As one of our few longer-dated positions, we were fine with the duration and happy to participate in some of the upside. However, towards the end of the quarter we decided to lock in our gains as the bonds had run up quite a bit from our purchase price.

In August, Vitamin Shoppe (ticker: VSI) announced it was being purchased by Liberty Tax (ticker: TAXA), which sent our convertible notes from the high 80’s to just under par. We believe the convertible notes will be called at par once the deal closes sometime in the 4th quarter. VSI is emblematic of the type of fixed income securities we like to own – creditworthy, unrated, neglected (broken converts are often passed over), and small (these converts only had $60 million outstanding). We continue to diligently search for more credits like this one.

Great Western (ticker: GWB) announced 2Q19 results in July and completed the redetermination of their credit facility, which was a nice positive for the notes we owned. Despite E&P securities being extremely volatile during the third quarter, these 9% notes continued to trend up into the upper 80s, well above our purchase price. Although we continue to like the credit, we have reservations about E&P sentiment and the credit window for near-dated maturities like this one. Therefore, we decided to take our gains and exit this position.

The Fund’s three top detractors for the quarter were Ensign 9.25% due 4/15/2024, LSC Communications 8.75% due 10/15/2023, and Unit Corporation 6.625% due 05/15/2021.

Ensign (ticker: ENSG) and Unit Corporation (ticker: UNT) were two of our other energy holdings that were volatile throughout the third quarter. In the case of Ensign, the company continued to prove out the synergies from their Trinidad acquisition and pay down debt. Despite this progress, the sentiment around E&P service companies worsened considerably during the quarter and the notes traded down into the mid-90s. We still believe the bonds to be creditworthy but anticipate more volatility until the company is able to deleverage more. We reduced our position accordingly but would consider buying back bonds if the dollar price dropped more from here.

Unit Corporation is a name that Intrepid has owned on the debt and equity side in the past. Although this company has been around for decades and survived multiple commodity cycles, their 2nd quarter results this year were abysmal. Before that print, we felt good about the company’s strong balance sheet, with less than 2.0x leverage, long-tenured management team, and diversified portfolio of upstream, midstream, and drilling assets. However, during the second quarter the company’s differentials on the upstream side of the business widened, rig utilization declined, and the company started to draw on their previously untapped revolving credit facility, bringing the leverage multiple up.

Following the earnings announcement, the bonds tumbled on the market’s anticipation that Unit would have trouble refinancing their 2021 notes, which became callable at par in July. Although we believe Unit will find a way to refinance the notes, we decided to reduce our position given the volatility we expect between now and whenever that happens. The company announced it planned to cut capital expenditures in the back half of the year and generate free cash flow to pay down the revolver. We will scrutinize the company’s results carefully to see if they are able to deliver on this promise of deleveraging over the next couple of quarters.

We have now entirely exited our position in LSC Communications (ticker: LKSD). Back in mid-June, the U.S. Department of Justice (the “DOJ”) unexpectedly sued to block Quad’s (ticker: QUAD) acquisition of LSC, which sent the bonds lower. At the time, we were told by LSC’s management team that they were going to fight the DOJ decision in court. Normally these DOJ lawsuit processes take months and sometimes even years to play out, and we believed that there was a good chance the deal might eventually get approved. In the meantime, we figured LSC would hum along and we would continue to clip an attractive 8.75% coupon. A month later, however, another unexpected announcement surfaced stating that LSC and Quad had called off the merger and would no longer challenge the DOJ. This indicated to us that Quad no longer felt LSC was worth pursuing and that the company’s operating results, which had not been stellar during the period when it looked like the deal might close, were probably not faring well. We decided to sell right after the deal was called off and it proved to be good timing – since then, the bonds have sold off another 10 points.

Credit markets performed well during the Fund’s fiscal year, which ended September 30, 2019. The Bloomberg Barclays US Aggregate was up 10.30% over the period, benefiting tremendously from rates moving lower. The ICE BAML US Corporate Index gained 12.87% in the period. On the other hand, high yield bonds were more volatile due to the December sell-off and the subsequent move to riskier assets in January. The ICE BAML US High Yield Index gained 6.30% over the last twelve months, and the 1-5 Year Index gained 6.01% over the same period. The Intrepid Income Fund gained 3.07%.

Central Garden 5.125% due 2/01/2028, Firstcash 5.375% due 6/01/2024, and Actuant Corp 5.625% due 6/15/2022 were the three largest contributors to the Fund’s performance in the twelve-month period, although most of the Fund’s large positions were material contributors. All three of these positions have been discussed previously. The three material detractors for the Fund over its fiscal year were the same three detractors for the third quarter, which we discuss above.

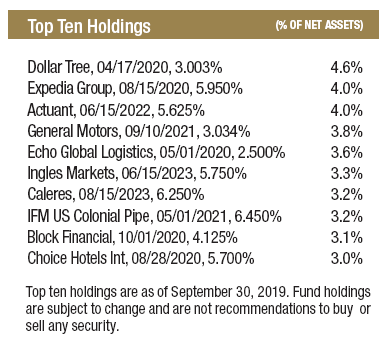

Several of the Fund’s short-term bonds matured in the third quarter, including two of our larger holdings in Twitter (ticker: TWTR) and Sherwin-Williams (ticker: SHW). We also had six positions called during the quarter. The maturing and called issues were replaced primarily with investment grade bonds maturing in the next two to ten months. We believe opportunities are also present in the front end of the high yield curve, and we are working hard to find new positions with adequate yield for their risk as credit spreads continue to widen.

Since the end of the quarter, U.S. Treasury yields have continued to trend down. The benchmark 10-year yield continues to flirt with 1.5% compared with 3.2% in the first week of October last year, which was the highest level since early 2011. The consensus projection is that the Federal Reserve will continue to consistently lower rates over the next year, whereas a year ago the consensus was they would continue to raise rates. A lot can change in a year.

Although we are pleased with the risk-adjusted return of the Income Fund over the last year, we are even more excited about how we are positioned going forward. We believe the portfolio is well constructed and will enable us to redeploy cash from maturities into higher-yielding securities as they become available. As we have said over the past several quarters, we continue to see signs of excess in the credit markets, including the cracks in the financial system’s plumbing, i.e. the repo market, historically high leverage ratios across ratings, and loose covenants.

We do not deploy capital based on an expectation that lenders will continue to underwrite debt to grossly overleveraged companies forever, and we will not pretend to be able to forecast the direction of interest rates. We will continue to follow a bottom-up process to identify attractive fixed income investments and apply rigorous fundamental analysis when analyzing credits.

Sincerely,

Mark F. Travis, President

Intrepid Income Fund Co-Portfolio Manager

Hunter Hayes

Intrepid Income Fund Co-Portfolio Manager