January 1, 2022

“A feeble government produces more factions than an oppressive one.”

— Fisher Ames

Dear Fellow Shareholders,

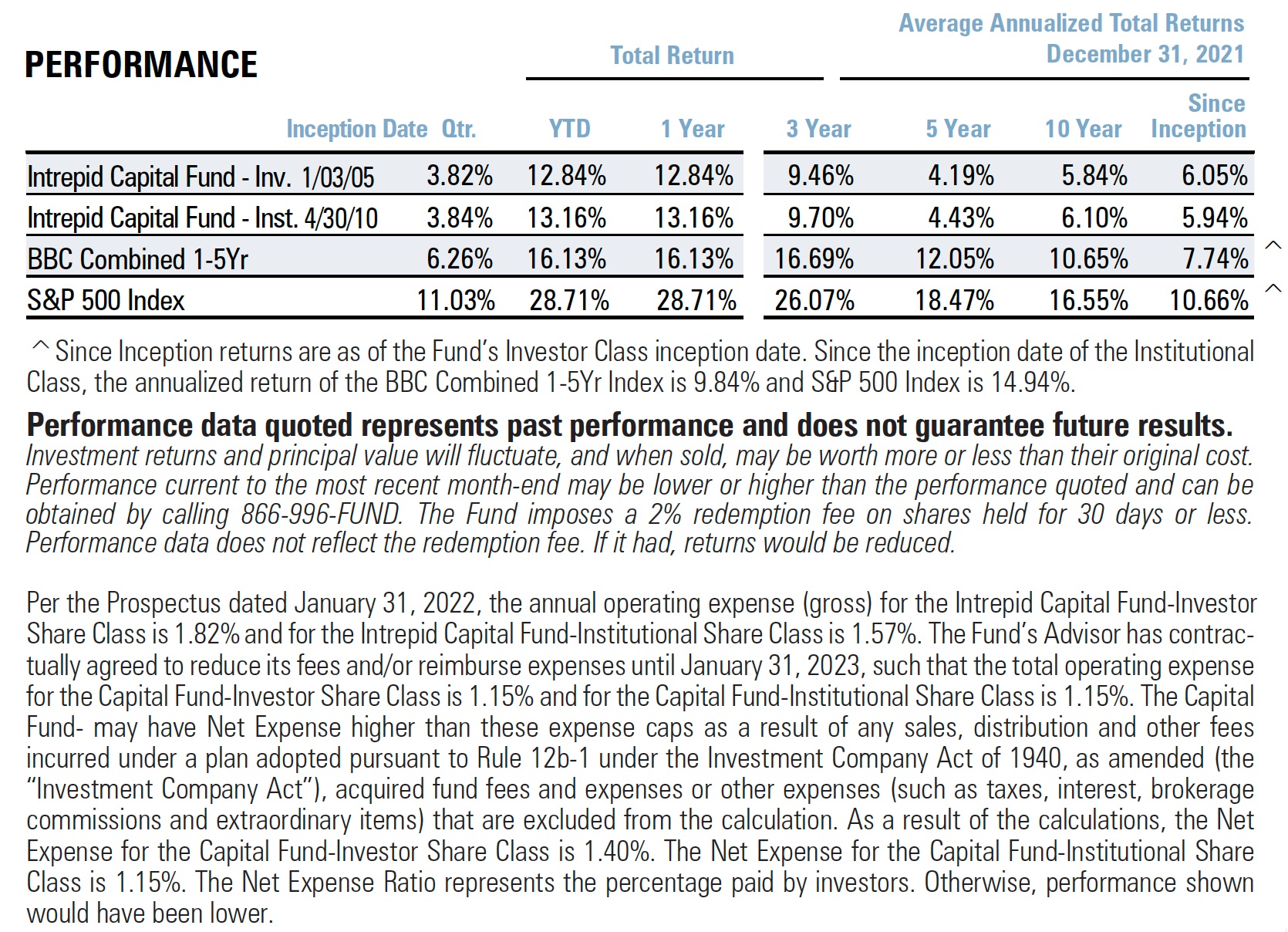

The Intrepid Capital Fund Investor Share Class finished the year with a fourth calendar quarter return of +3.82%, bringing calendar year 2021 returns to +12.84%.

This was in line with our expectations for a Portfolio consisting of both equity and fixed income.

The equity portion of the portfolio is generally +/- 5% of 60% of the total, with the remainder in fixed income as well as cash. The equity portion did as well as one would think given major equity indices were up 14-28% for the calendar year.

The challenge has been in fixed income with broad bond indices down 4-5% in 2021. The fixed income team at Intrepid Capital has been up to this challenge, however. By sourcing shorter duration high yield issues, we were able to successfully add value in this portion of the portfolio as well.

What has the bond market all a-flutter?

The bane of all investors accepting a “fixed” return: inflation.

The December report on the Consumer Price Index (CPI) showed an increase of 7% from a year earlier – the highest reading in four decades– a by-product of the “easy money” policy at the Federal Reserve. The calculation is subdued by the way housing prices are calculated into the index. Prior to 1982, actual housing prices were used. Last year, actual prices rose 19%. In its place, the calculation includes imputed rent, a measure someone would be willing to pay to rent their home, was up only 3.8%. If actual prices were used, the CPI would have been up an additional 3.5%.

In the category of “if you don’t learn from history, you are doomed to repeat it,” the S&P 500’s top 10 companies now account for 31% of the Index (versus 17% in 1996) and boasts an average forward price- to-earnings multiple of 33.3 (versus an average of 19.8x since 1996). The other stocks are selling at 19.3x, well above their average of 15.7 since 1996 but far less than the top 10 companies.

I bring this up because December 1996 was when Alan Greenspan uttered the words “irrational exuberance.” The technology bubble popped a little over three years later in March of 2000.

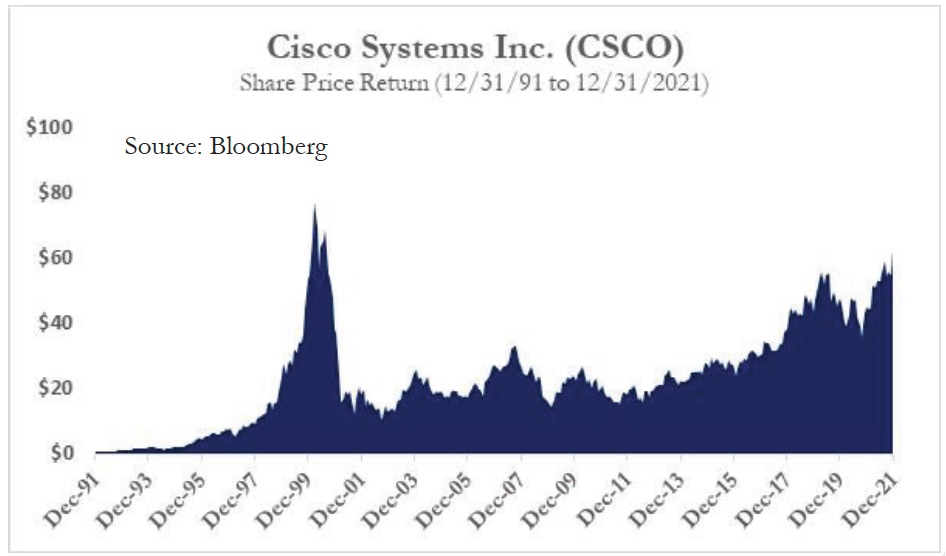

In thinking back to that period (yes, I’m that old!), one of the handful of investor favorites was Cisco Systems.

Out of curiosity, I printed a long-term chart of the share price (shown here). This chart reflects that the price you pay is important to long-term investment success. Those that purchased close to the peak in early 2000, still aren’t back to the level of their purchase price over 20 years later.

I say all this not to strike fear in your hearts, but to recognize we remain diligent in trying to assess a conservative estimate of value as we make decisions for your portfolio (and ours!).

I suspect now that the inflation “genie” is out of the bottle, the Federal Reserve will take actions that will test our fortitude as 2022 progresses.

January 23rd marks the 27th anniversary of Intrepid Capital! From all of us here, thank you for your continued support!

Best Regards,

Mark F. Travis, President

Intrepid Capital Fund Portfolio Manager

Mutual fund investing involves risk.