October 2, 2017

Dear Fellow Shareholders,

I occasionally bring my kids to the office with me on the weekend for a few hours when I need to tie up loose ends and give my wife a break. About a month ago, our four-year-old son, Asher, tagged along while I finished up a report. I noticed him looking at a framed picture of Warren Buffett and me standing in a parking lot across the street from Piccolo Pete’s in Omaha. This conversation followed:

Asher (pointing to the Buffett photo): “Who is that?”

Me: “He’s an investor like your daddy, except he’s famous and successful.”

Asher: “Does he protect lizards?”

Me: “No. Why?”

Asher: “Because he looks like one.”

My first thought: Kids say the darnedest things. Then: Wait, does my four-year-old actually know that this guy owns the GEICO Gecko? Looking at the photo made me reminisce about the time as a teenager when I checked out Buffett: The Making of an American Capitalist, the biography by Roger Lowenstein, from my local library. Back then, I had an unspoiled image of the Oracle of Omaha that endured for many years. The photo in my office was taken during a business school trip in 2009, which was 14 years after I read the Lowenstein book. Mr. Buffett was incredibly generous with his time in Omaha. He answered questions from over one hundred business students at Berkshire’s headquarters, bought everyone lunch, and then patiently took individual pictures with each person, with poses ranging from headlocks to mock marriage proposals. I never expected to see this 79-year-old billionaire, the second richest person in the world, get on one knee while dressed in a suit just so a female business school student could have an unforgettable Facebook profile photo. After everyone had their moment with Buffett, he walked by himself down the street to his metallic beige Cadillac DTS, got in, and promptly peeled out as we all watched in awe.

Buffett has made an indelible impact on legions of investors, but even the great ones are prone to hyperbole and bias. On August 30, 2017, Buffett was asked by a Bloomberg interviewer whether Quantitative Easing has worked, since asset prices have increased but wages for the average worker have not. Buffett replied, “It did wonders for us coming out of 2008. Without it, we’d have gone back to the economics of 100 years ago, you know…I think the Fed has overwhelmingly done the right thing.” I’m in the camp that the inventions of the past century, including the television, the Internet, and cell phones, matter more for our economic well-being than the decisions to bail out Wall Street in 2008. Nevertheless, Buffett was once again giving his endorsement to the unprecedented government intervention we’ve experienced, nearly seven years after he penned a “thank you letter” to Uncle Sam for bailouts in a New York Times op-ed.[1]

In the 2016 Berkshire Hathaway shareholder letter, Buffett ridiculed as “nonsense” the advice of “naysayers” with gloomy forecasts for American stocks.[2] He said a few months ago that “stocks are dirt cheap” if interest rates increase only modestly over the next decade.[3] His latest prediction made a couple of weeks ago was for the Dow to hit 1,000,000…over the next 100 years.[4] Buffett is a bull on America and sanctimoniously dismisses those with a negative view of U.S. stock prices. He also has $100 billion of cash and equivalents parked at Berkshire Hathaway that is seemingly missing out on the “dirt cheap” stock opportunities he’s referenced.

In our opinion, we have one thing going for us that Buffett doesn’t have, and it’s not brains or money. We can give it to you straight. For some, when you get to be rich and famous, your overriding concern is crafting your legacy. Buffett seems to badly want to be remembered as the folksy billionaire who cared about the little guy, the do-gooder in an industry of villains, and the patriotic buy-and-holder of blue chip American businesses. In this industry, it’s easier to be an optimist. The pessimists only thrive when most everyone else is suffering, and that’s a lonely celebration. Nevertheless, it’s our pledge to you, our shareholders, to keep ourselves grounded in reality, not fantasy, as we execute our investment process.

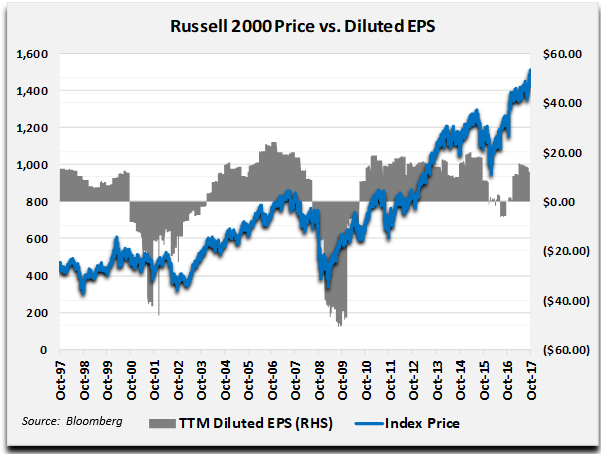

The P/E of the Russell 2000 Index is currently 126x. This is derived by taking today’s (10/2/17) closing price (1,509.47) and dividing by the actual GAAP diluted earnings per share of the index ($11.97). The index is 76% above the pre-credit crisis high, which occurred on Friday, July 13, 2007. The Russell has increased 340% from the credit crisis low on March 9, 2009. What an amazing run. The aggregate earnings for the Index’s components have not experienced the same appreciation. Diluted EPS for the Russell’s membership is down 38% from July 13, 2007.

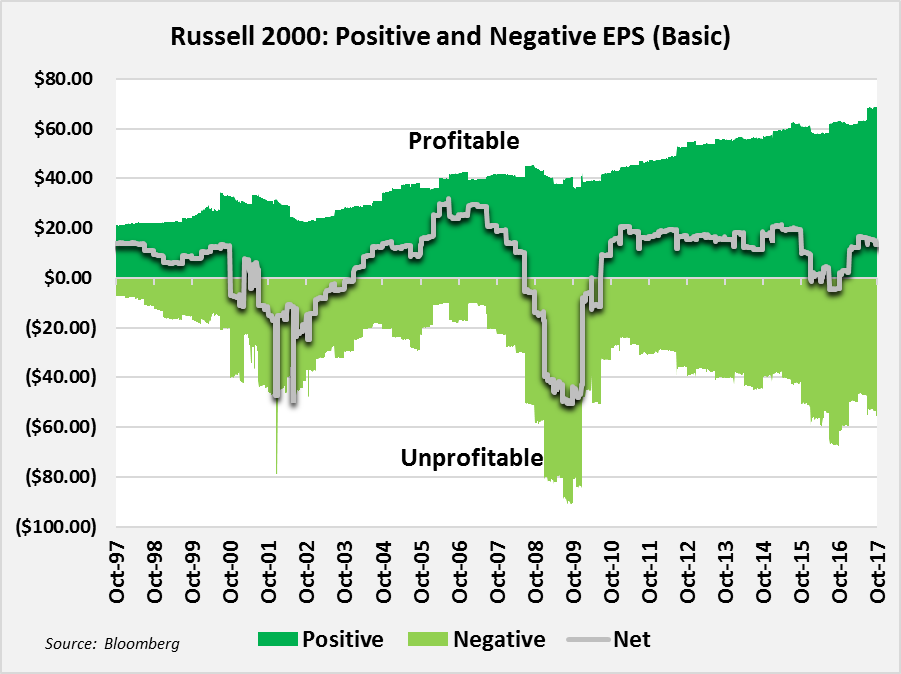

It’s very much a Jekyll and Hyde story, with those companies delivering positive earnings (68% of total) continuing to grow their bottom lines, while the unprofitable firms (32%) produce greater losses. We suppose this is one of the main bull arguments today: small cap averages are unfairly distorted by money-losing companies, and profitable businesses are reasonably valued. After all, the profitable businesses themselves sell for 22x earnings, a fraction of the overall Index multiple. This is not dramatically above the 20-year average P/E of around 18x for positive earnings companies. Why not just focus on this group? There must be value in there, right?

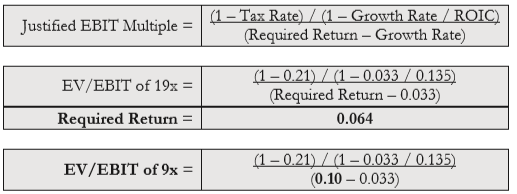

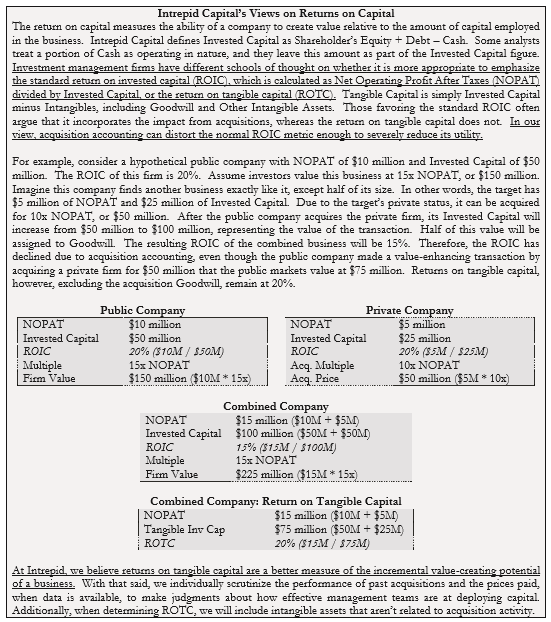

Not much. Excluding financial firms, the group of profitable companies collectively trades for an Enterprise Value to Operating Profit (EV/EBIT) multiple of 19x. The Enterprise Value metric adjusts for the impact of borrowing, which depresses P/E ratios in a low-interest rate environment. A 19x EV/EBIT multiple is very rich and probably only warranted for fast-growing, high-return businesses. Profitable small cap firms grew their revenue by 5.7% over the past year, and that’s including the benefit from acquisitions. We estimate that organic revenue growth was 3.3%.[5] That’s not exactly setting the world on fire and is even less than nominal GDP growth over the same span (+3.8%). The profitable firms had an aggregate effective tax rate of 21%, although the median company’s rate was close to 31%. The aggregate return on capital for this subset of companies was 8.5%. The aggregate return on tangible capital was 13.5%, excluding Goodwill and Other Intangible Assets. This probably overstates the return, since some intangibles, like software investments, are required for organic growth and do not result from acquisitions. Nevertheless, a 13.5% return on tangible capital suggests that the profitable Russell 2000 businesses are creating some value as they grow, with returns on capital that exceed their cost of capital.

I apologize in advance for the formulas. Valuation is very important to us at Intrepid, so the math is germane to our day-to-day investment process. Using the data cited above, we can solve for the discount rate (required return) implied by a 19x EBIT multiple. It’s 6.4%. That’s basically equal to the yield on 10 year Treasuries at the turn of this century. If we used the median tax rate of 31%, which would remove the effect of outliers that dragged down the effective rate, the implied required return falls to 6%. How many investment managers would admit to using a 6% discount rate to value their holdings? If we applied what we consider to be a more reasonable discount rate of 10%, the fair EV/EBIT of the profitable non-financial companies would be ~9x, or less than half of the market’s (19x) multiple. Investors today are paying 37x free cash flow for the profitable, slow-growing members of the Russell 2000 that do not belong to the financial sector. In our opinion, this is far from a bargain and radically diminishes arguments that small cap benchmarks only look expensive due to unprofitable businesses. They are expensive.

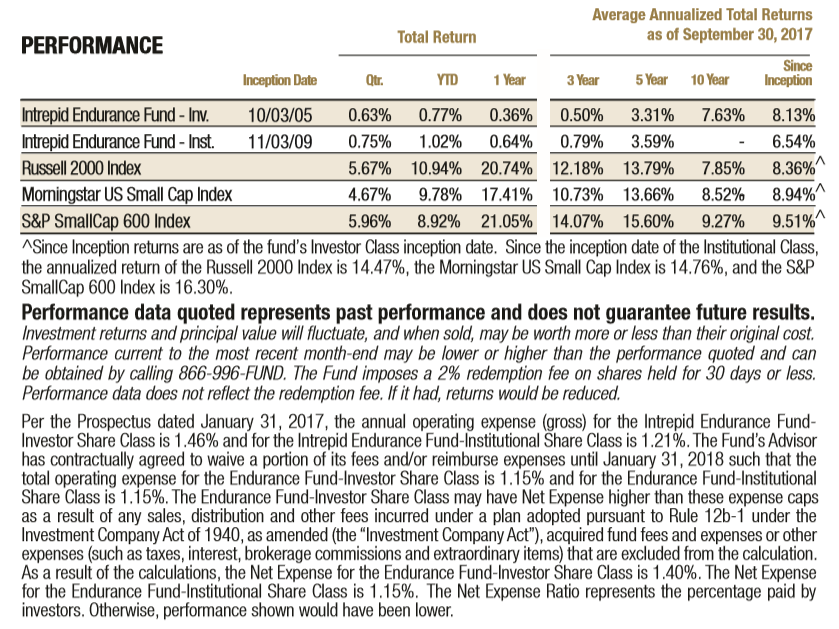

For the three months ending September 30, 2017, the Fund rose 0.63%, while the Russell 2000 Index increased 5.67%. Cash and Treasury bills accounted for 79.4% of the Fund’s assets at quarter end. The Morningstar Small Cap Total Return Index jumped by 4.67% during the quarter and the S&P Small Cap 600 was up 5.96%. We are now disclosing additional benchmarks because Russell representatives want to charge us to use their benchmark. We may transition to a different small cap benchmark over the coming year. The Fund inched up 0.36% for its fiscal year ending September 30th compared to a 20.74% pop in the Russell 2000, a 17.41% increase in the Morningstar Small Cap Index, and a 21.05% gain for the S&P Small Cap 600. We believe most of our shareholders pay closer attention to calendar year performance, but we are obligated to disclose fiscal year results. During calendar 2016, the Fund’s return (+7.9%) was front-end loaded before the election, whereas most small cap benchmarks earned the majority of their returns after the election. The Fund has a high active share and has not traded closely in line with benchmarks for some time.

The Fund acquired one new holding during the third quarter. Greenhill & Co. (ticker: GHL) is an independent investment bank that provides advice on mergers and acquisitions, raising capital, and restructurings. The stock recently fell to all-time lows due to the company’s failure to participate in the latest Mergers & Acquisitions (M&A) boom. Greenhill’s 2017 operating results are forecasted to be the worst ever recorded for the firm. Absent a sharp pullback in overall M&A activity, we believe 2017 will mark a trough in the company’s performance and Greenhill’s stock will rebound when 2018 results return to more normalized levels. We believed the shares were trading for approximately 10x adjusted free cash flow, assuming a cash impact from stock compensation, when we began establishing our stake. On September 25th, Greenhill announced a leveraged recapitalization (taking on debt to buy back its own shares) that sent the shares up by 16% before we could finish building our position. The stock is still trading below our estimated fair value, but we are not thrilled with the company’s new leveraged balance sheet. With that said, investment banking is a cash-generative business, and we think Greenhill could pay off its debt in less than five years. Since our position size is small, we plan to hold the name and wait for an expected recovery in Greenhill’s revenue.

We sold our Dominion Diamond (ticker: DDC) position in July. On July 17th, Dominion announced it would be acquired by The Washington Companies for U.S. $14.25 per share. The board had been conducting a strategic review since Washington first expressed interest earlier in the year. The takeover price represented a substantial premium to our $8.52 average cost basis in the shares, although we had partially reduced the position in March and April when the price was lower and a takeover was less certain. Our average selling price for Dominion was $13.39 per share.

For the third quarter, the largest contributors to the Fund’s performance were Syntel (ticker: SYNT), Dominion Diamond, and Greenhill. The only position negatively impacting the Fund’s return by more than 10 basis points was Baldwin & Lyons (ticker: BWINB). Since the Fund only has a handful of significant holdings, we thought it made sense to provide a general update on our investment rationale for each as opposed to trying to account for modest price movements that are more related to market direction than security-specific factors. The Fund’s top six holdings are Corus Entertainment (ticker: CJR/B), Baldwin & Lyons, Syntel, Amdocs (ticker: DOX), iShares Gold Trust (ticker: IAU), and Primero Mining’s 5.75% Convertible Notes (CUSIP: 74164WAB2).

Before this year, Corus Entertainment’s earnings had been adversely impacted by declines in advertising revenue on the company’s television networks. As a result of the company’s increased bargaining power due to being the largest operator of cable networks in Canada, management has now stabilized advertising. Going forward, Corus’s performance is likely to reflect overall television advertising trends, which are currently soft. Canada’s advertising market has migrated toward digital even faster than in the U.S, as Google and Facebook consume a growing portion of the global advertising pie. Although we expect digital players to account for the vast majority of advertising growth in the medium-term, trees don’t grow to the sky, and there have been many questions about the effectiveness of digital advertising compared to other mediums.

In order for Corus to better compete with streaming services like Netflix and protect and grow its advertising revenue, we believe the company must further enhance the on-demand television viewing experience. Traditional television networks must become more like Netflix by offering full seasons on-demand and reducing ad loads. Advertising is a material revenue contributor and subsidizes the price of TV for users. The best way to reduce ads while preserving the revenue stream is through more targeted advertising that is enabled by the latest cable technology. Advertisers will pay a higher price per viewer if they know their ads are reaching their target audience. We expect low-single digit revenue growth, at best, for Corus in the near-term. The stock is trading for about 9x free cash flow, which is a multiple that fully reflects the business’s tepid growth outlook. As the company deleverages, we believe value will accrete to the stockholders.

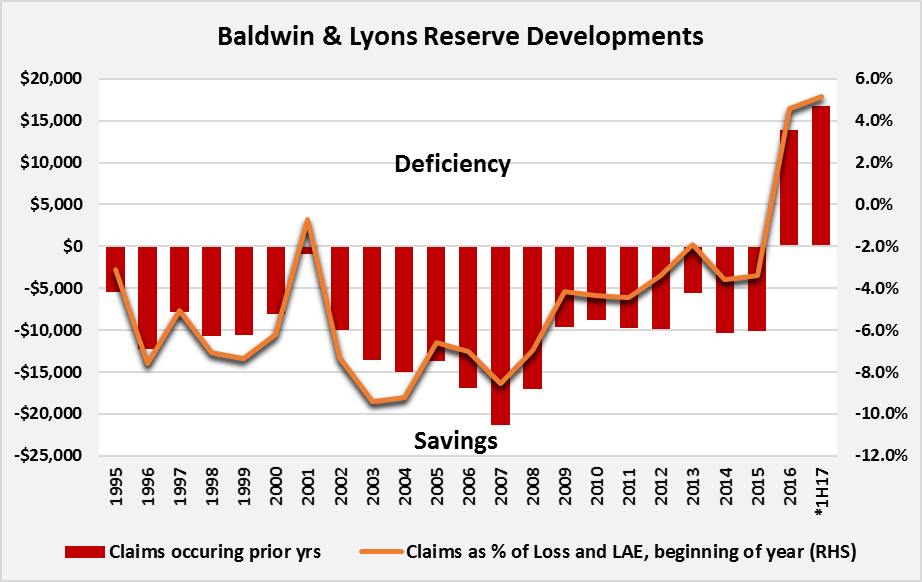

Baldwin & Lyons, the property and casualty insurer, is trading at a multiyear low Price to Book multiple near 0.8x. This is less than half the median multiple of other small cap P&C insurance firms. Baldwin specializes in commercial trucking policies, like FedEx contractors. According to Fitch, the commercial auto industry is experiencing its worst underwriting performance since 2001 as a result of accidents caused by texting and unexpectedly high jury awards. These factors have recently led to unfavorable reserve developments at Baldwin, which previously had an unblemished history of conservative reserving. In response, the company and other insurers are increasing premiums and promoting technology to monitor and control smartphone usage in an attempt to reduce accident rates. Competitors like AIG and Zurich have pulled back from certain markets. We believe Baldwin will restore its profitability, which will lead to a recovery in the stock price. Insiders have been buying shares.

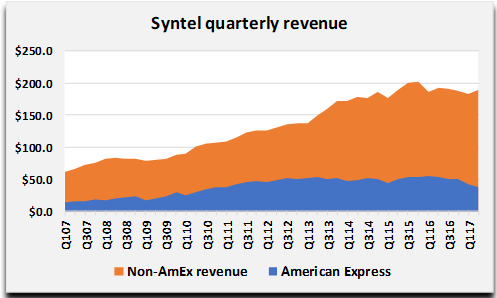

We believe the prescription to fix Syntel is simple: the company needs to grow revenue. Syntel has been disproportionately affected by a reduction in IT spending by American Express, its largest customer. However, the business has also been starved of new relationships due to an overly lean business development budget. Syntel is addressing these issues through increased marketing spending and a greater involvement from executives in closing deals. The company showed modest progress on this front in the second quarter, as revenue excluding American Express increased 3% sequentially. It’s too early to call a recovery. Nonetheless, immigration-related rhetoric has noticeably decreased, possibly indicating less of a headwind to Indian IT outsourcers from regulatory changes. Furthermore, the Indian rupee has weakened against the dollar over the past month, which relieves some pressure on the cost side for outsourcers. The stock is selling for approximately 11.5x expected free cash flow.

Amdocs is probably the best business the Fund owns. It’s also fully valued. Amdocs’ customer relationships are sticky and its revenue is largely recurring. It is the premier company for handling customer care and billing software and system transformations for leading telecommunication and cable firms. The company’s market capitalization excluding nearly $1 billion in cash is equal to 15x Amdocs’ average free cash flow over the past three years.

The Fund has a modest position in the iShares Gold Trust. We believe that the Fed will halt its current path of tightening at the first sign of any market trouble. Central banks around the world remain extremely accommodative, and geopolitical risk seems more palpable than it has been in years. Such conditions are historically favorable for gold. President Trump will soon nominate the next Chair of the Federal Reserve. He has spoken to both John Allison, the former CEO of BB&T and staunch Fed opponent, and Kevin Warsh, a previous governor of the Federal Reserve and later a critic of the Fed’s loose money policies. We would cheer the selection of Allison, and Warsh would probably be an acceptable pick as well. Nevertheless, given the President’s proclivity to celebrate new stock market highs on Twitter, we expect a more conventional choice like Janet Yellen, Jerome Powell, or Gary Cohn. But hey, who knows—Trump likes to surprise.

We see an impressive bubble forming in cryptocurrencies. No, we don’t know the value of Bitcoin. Yes, we like the idea of a currency that isn’t controlled by a government. Just don’t lose your private key, or you can kiss your funds goodbye forever. While one of the original premises for Bitcoin was that only a finite amount could be mined, the explosion of Initial Coin Offerings is saturating the market with speculative cryptocurrencies. We wonder how many people would praise Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin, Dash, Ethereum Classic, etc. for their “scarcity” and would happily commit funds to these interesting blockchain technologies at today’s skyrocketing prices, yet would scoff at the idea of owning gold. Gold is harder to transact than Bitcoin, but it has been a store of value for centuries, can’t be hacked (but it can be stolen)[6], and they aren’t creating any new versions of it.

Speaking of gold, let’s discuss the Fund’s stake in the convertible bonds of Primero Mining. Primero owns the San Dimas gold and silver mine in Mexico. San Dimas has a silver stream attached to it, for which the vast majority of silver is sold to Wheaton Precious Metals at $4.30 per ounce. Primero’s liquidity is evaporating and it has told investors that it needs the stream to be relaxed in order for the mine to continue operating. With a reduced stream, the cost structure of the mine can be vastly improved. The company has received multiple takeover bids that are contingent on a restructuring of the stream. The management of Wheaton Precious Metals has stated it is willing to modify the San Dimas stream if it is appropriately compensated. It is unclear exactly what form of compensation they would require. Our bonds are currently marked in the low 60s. We believe it is in Wheaton’s best interest to work with Primero to modify the stream now. We anticipate an announcement on this front sometime during the next couple of months.

“Price is what you pay. Value is what you get.”

“Be fearful when others are greedy and be greedy when others are fearful.”

“Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.”

These widely known quotes represent the classic wisdom of Warren Buffett. The Russell 2000 Index is up 11% in just the past six weeks—a jaw-dropping rally first inspired by a “no man left behind” mentality as small caps had relatively underperformed year-to-date, but which accelerated on renewed hopes of corporate tax reform. Over this stretch, the Russell only declined more than 24 bps on one day. This is during a period when three major destructive hurricanes hit the U.S. or its territories, North Korea successfully tested long-range missiles and threatened the U.S. with nuclear annihilation, the national debt officially topped $20 trillion, and Russell 2000 earnings expectations for 2017 descended to a year-to-date low. While some of these developments are more impactful to the economy than others, the near total absence of downside volatility in the stock market suggests a lack of fear and surfeit of greed. The Russell is up 340% from its March 2009 trough, while the profitable companies in the Index have grown earnings by 73% since then. Investors are paying record high prices for small cap equities, but are they getting commensurate value? Paging Mr. Buffett: Have we all forgotten Rule No. 2?

Thank you for your investment.

Sincerely,

Jayme Wiggins, CFA

Chief Investment Officer

Intrepid Endurance Fund Portfolio Manager

[1] Buffett, Warren E. “Pretty Good for Government Work.” Nytimes.com. 16 Nov 2010. Web. Accessed 2 Oct 2017.

[2] Buffett, Warren E. “Berkshire Hathaway, Inc.” Berkshirehathaway.com/letters/2016ltr.pdf. 25 Feb 2017. Web. Accessed 2 Oct 2017.

[3] Bary, Andrew. “Buffett: Bonds ‘Terrible’ In Comparison to Stocks.” Barrons.com. 8 May 2017. Web. Accessed 2 Oct 2017.

[4] Gara, Antoine. “Dow 1,000,000? That’s Warren Buffett’s Latest Call.” Forbes.com. 20 Sept 2017. Web. Accessed 2 Oct 2017.

[5] We estimated acquired revenues by taking cash paid for acquisitions from the cash flow statement and assuming acquirers paid the same EV/Sales multiple as their own current multiple.

[6] The hacking of cryptocurrencies has so far been largely tied to the exchanges where they trade as opposed to the underlying blockchain technology