July 1, 2020

Dear Fellow Shareholders,

Today marks three months since we sat down to write our last quarterly commentary after a shockingly volatile first quarter. As if déjà vu, we find ourselves in a similar place to where we wrote the last letter. Coronavirus cases are spiking again in certain regions. State governments have started closing down businesses (currently bars in Texas and Florida). Markets have declined. We are even sitting in the same chairs.

While we ended with similar trends, that was not indicative of how the quarter actually went. After experiencing what was the sharpest market crash ever in the first calendar quarter, this past quarter experienced the biggest 50-day rally in market history.

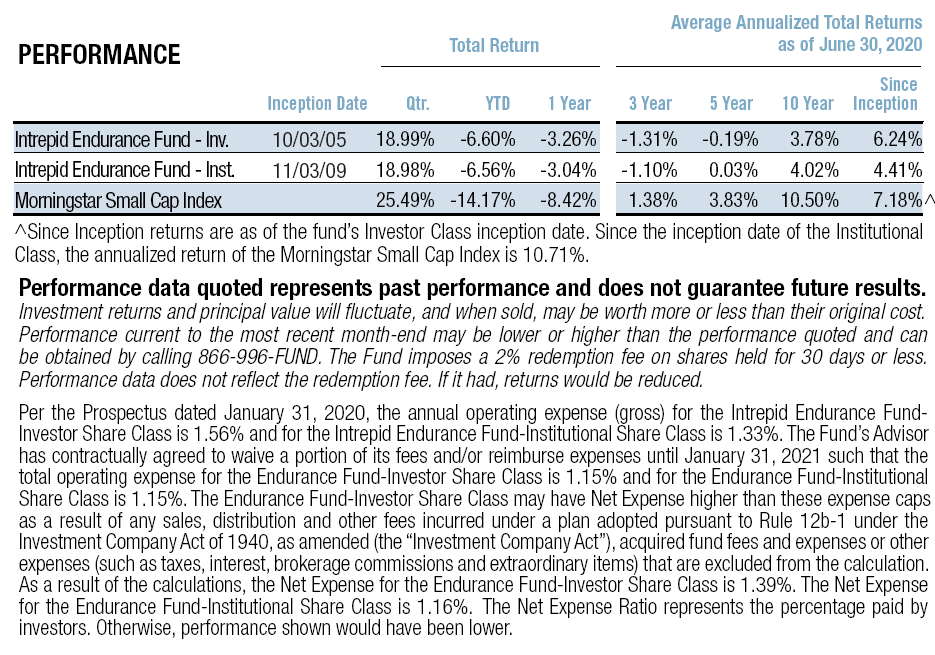

The Intrepid Endurance Fund (the “Fund”) participated in this rally, returning 18.99% in the quarter versus 25.49% for the Morningstar Small Cap Index benchmark. For the first six months of calendar 2020, the Fund returned -6.60% vs. -14.17% for the benchmark. And for the first nine months of the Fund’s fiscal year, the Fund returned -2.19% vs. -6.74% for the benchmark.

Contributors & Detractors

The Fund’s top three contributors to performance for the quarter were Ollie’s Bargain Outlets (OLLI), Skechers (SKX) and IAA (IAA). Each of these companies experienced a negative impact to their business from the economic shutdown, but the stocks rallied hard as investor optimism returned and states began re-opening their economies. There were only two stocks that were material detractors during the quarter – Crawford & Company (CRD) and Hanesbrands (HBI).

Volatility

This Fund is managed to take advantage of market volatility. Last quarter, we wrote about the elevated level of activity in the Fund as a result of the coronavirus-related panic. The free-fall in the markets provided unique opportunities, and the Fund was the most active it has been in over ten years.

This past quarter, we were much less active as markets rallied strongly through early June. Put simply, there were fewer opportunities this quarter, so we took less action.

Positioning

Sentiment in the capital markets feels like it is swinging from side-to-side on top of a knife’s edge. We believe the “foreseeable future” for corporate America, and its shareholders such as ourselves and our clients, has never been shorter. We are fastidious practitioners of due diligence and conservative valuation appraisals, but even now the range of outcomes for most companies is wider than we can ever remember.

So much is uncertain at the moment. Will consumer behavior actually change after a second wave? Will the country go through another partial shutdown? We do not have a crystal ball. Even our magic 8-ball says to “Ask again later” when we shake it up and inquire what will happen next.

With that in mind, we believe the positioning that serves your best interest is to continue to focus on companies that have both the operating and financial capacity to “endure” through any economic environment.

There are other ways to potentially position the Fund in response to the uncertainty. We could take on little risk and hold an extreme level of cash, forfeiting potential upside should business and society adjust to the coronavirus impact better than expected. Or we could embrace elevated uncertainty and plunge into the most-impacted industries (hotels, restaurants, etc.) in hopes of favorable government intervention.

As we have written before, we will only invest your capital when we believe we are well compensated for the risk. The former stance strikes us as too conservative given the opportunities we see, while the latter seems imprudent for a fund with “Endurance” in the name.

New Buys

As noted earlier, the Fund was relatively inactive during the quarter. Two notable stocks that the Fund purchased were Floor & Décor Holdings (FND) and Charles River Laboratories (CRL). Floor & Décor is a fast-growing retail concept that sells hardwood flooring and other related home décor items. Owing to its large store sizes, broad inventory of SKUs, and direct distribution model, we think the company has a significant advantage in this flooring niche. Because customers like to see and feel this type of product before purchase, we think the threat from online competition is relatively low and believe the company has a long runway to continue to open new stores at attractive rates of return.

Charles River is an outsourced clinical research (CRO) business. Pharmaceutical and biotech companies are increasingly turning to CRO businesses to handle their non-core functions during the development of a new drug. Charles River has a leading position in the early stage, or preclinical phase of drug development. Notably, they are the leading provider of the rats and mice that are used in experimental trials of drug compounds before they are tested on humans. Like Floor & Décor, we think Charles River can continue to grow at an attractive rate for a long period of time.

Looking Forward

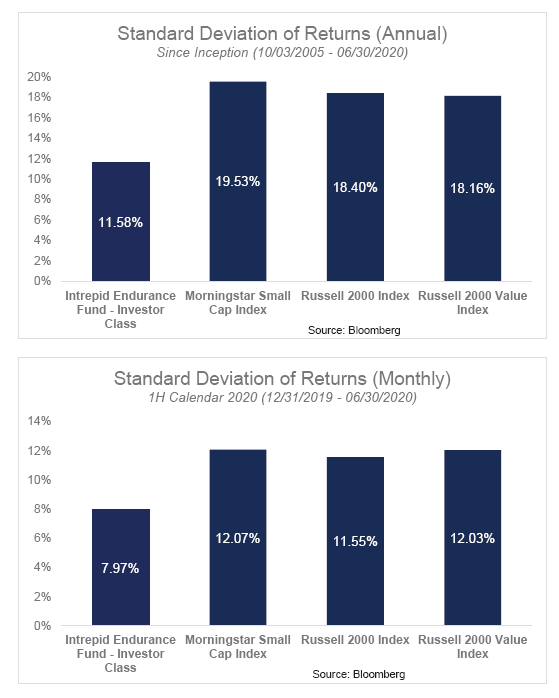

The Fund’s philosophy has historically caused returns to be less volatile than its benchmark and the overall small cap market, leading to strong

outperformance in bear markets. That is something we are proud and hopeful will continue.

But there will likely be times in the future, especially when sentiment is swinging wildly like this, in which we may need to accept higher volatility in the Fund in order to create the opportunity for higher returns in the future.

Said differently, we are proud of the Fund’s less volatile past, and plan to manage it with the same philosophy that drove those results. But that philosophy requires us to take more risk and expose the Fund to more volatility when markets and sentiment are declining, such as late in calendar Q1. Should markets crash like that again, you should expect buying activity in the Fund to pick back up. This could result in higher volatility – a trade-off we will make for attractive prices on the high-quality small cap stocks we follow.

Finally, given how we are positioned, the Fund performed about as we expected in this past quarter. Should business conditions improve and small caps rise, we expect it to participate, although perhaps not to the degree as if we had bought highly leveraged or cyclical stocks which are numerous in the Fund’s benchmark. And if markets roll over, we expect our positioning to protect our clients from the worst of the decline, while using the volatility to continue to add great “enduring” assets to the Fund’s holdings at attractive prices. The Fund ended the quarter with a cash position of 20.0%, so we continue to retain ample flexibility to take advantage of any future volatility for your benefit.

Thank you for your investment.

Matt Parker, CFA, CPA

Intrepid Endurance Fund Co-Portfolio Manager

Joe Van Cavage, CFA

Intrepid Endurance Fund Co-Portfolio Manager