July 1, 2020

“At the present time there is more danger that criminals will escape justice

than they will be subjected to tyranny.”

~Oliver Wendell Holmes, Jr.

Dear Friends and Clients,

I often listen to Spotify music as I write. Somewhat ironically, Edwin Starr’s song “War,” the Vietnam Era song with the refrain “war, what is it good for,

absolutely nothing,” is currently playing. Well, from a historical perspective it sure seems like 1968 all over again. That year we had the assassinations of both Martin Luther King, Jr., and Robert F. Kennedy. Lest we forget, there was rioting at the Democratic National Convention in Chicago, along with protests over racial inequality by Olympic medalists at the games in Mexico City. Let us just say it was a time of great unrest. Sounds familiar!

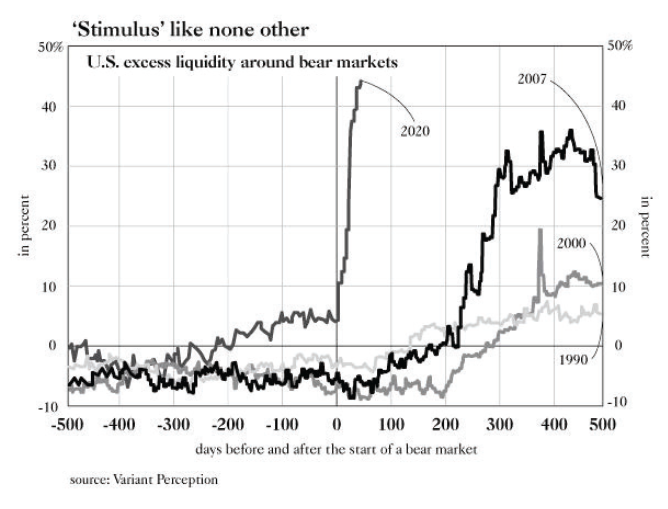

In the financial markets, we swung from “the worst of times” in the first quarter of 2020 to “the best of times” in the second quarter of 2020 as U.S. equity markets posted one of the best quarterly returns in the last 20 years. This, in my opinion, in the face of the COVID-19 pandemic and subsequent slow down along with the aforementioned social unrest, is largely the result of massive support from the Federal Reserve (see chart below).

The capitalization-weighted S&P 500 belies the underlying carnage that many U.S. share prices have suffered this calendar year.

In my last communication, I indicated we were using the 30% downdraft in prices to do two things: upgrade the quality of businesses we own and search for those with impeccable balance sheets.

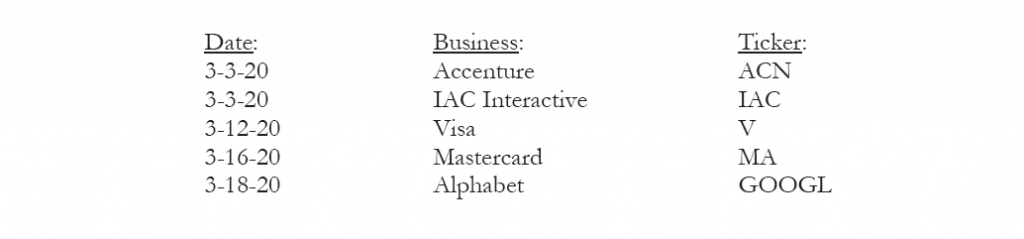

Below are a few of the securities that fit those parameters along with their respective acquisition dates, which shows our willingness to commit capital during heightened volatility. There is some academic support showing the long-term value creation from purchases during high volatility (VIX > 30), which we have certainly had since the pandemic erupted.

Several of these acquisitions made during the height of the COVID-19 pandemic sell-off helped lead performance in the second quarter.

At this point, with an election later in the year and the Federal Reserve continuing to provide massive amounts of liquidity to the financial markets, the bias for stock and bond prices will be up. Keep in mind, the last time the Federal Reserve started removing liquidity and raising rates (December 2018) the markets went berserk (i.e. down).

We will continue to focus on three things at Intrepid Capital that have helped lead to long-term value creation: (1) free cash flow generation, (2) strong balance sheets, and (3) rational business valuations. We believe this will lead to attractive risk-adjusted results in the future.

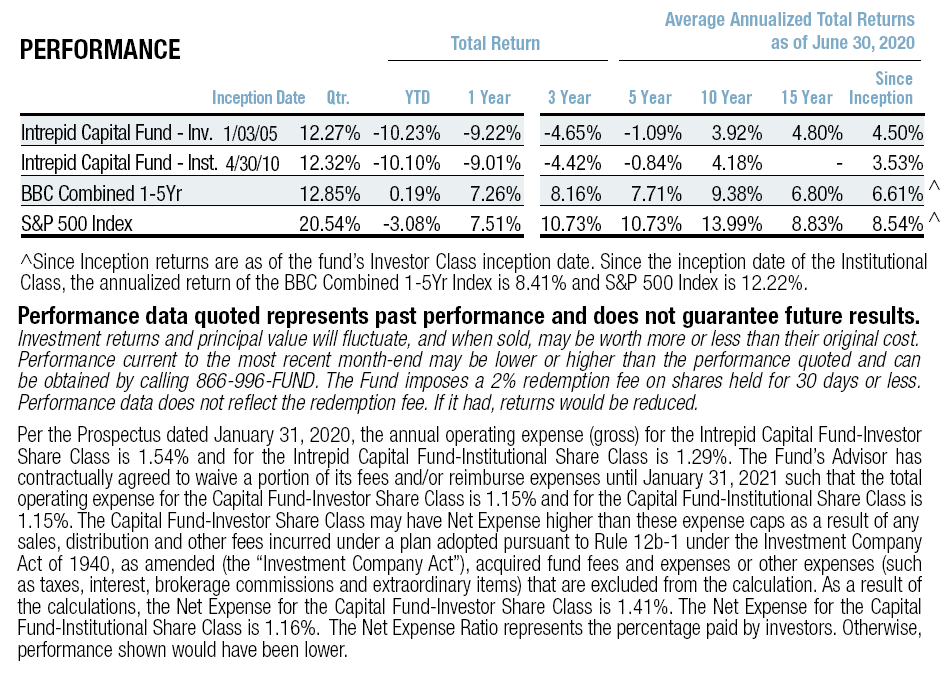

For the quarter ended June 30, 2020, the Intrepid Capital Fund (the “Fund”) increased 12.27% compared to the combined Benchmark’s (60% S&P 500 Index/40% Bloomberg Barclays US Gov/Credit 1-5 Yr Index) return of 12.85% during the period. The Fund’s top contributors for the quarter were IAC Interactive (ticker: IAC), Skechers (ticker: SKX), Electronic Arts (ticker: EA), Accenture (ticker: ACN), and Dollar General (ticker: DG). The Fund’s top detractors for the quarter were CTO Realty Growth (ticker: CTO), FRP Holdings (ticker: FRPH), Realogy 5.25% due 12/2021, Great Western 9.00% due 9/2021, and Berkshire Hathaway (ticker: BRK/B).

To conclude, let us hope we continue to make progress toward a COVID-19 vaccine and contain the virus the best way we can until then. Stay safe.

Happy 4th of July! God Bless America!

Best Regards,

Mark F. Travis, President

Intrepid Capital Fund Portfolio Manager