July 5, 2019

Dear Fellow Shareholders,

The small cap market’s return of 2.21% (represented by the Morningstar Small Cap benchmark) during calendar Q2 2019 probably seems like an unexciting or “as expected” result. However, it was not a pedestrian journey, as investors were subjected to some noteworthy volatility in the middle of the quarter – small cap stocks were down 8% in May before rebounding in June. The news flow was even more wild, with concerns and rumors about trade policy, slowing growth fundamentals, geopolitics (Iran), and Federal Reserve expectations trending in many directions.

We are aware of and follow all these issues but are not in the business of predicting how they might turn out. We find it much more productive to focus on what is most important: finding opportunities to put capital to work in quality small cap stocks at attractive valuations. By focusing on both quality and valuation, we believe we can generate returns for our clients over reasonable holding periods that over-compensate them for the risks inherent in small cap stocks – whether they be the macroeconomic risks listed above or the industry and company-specific risks related to each individual holding.

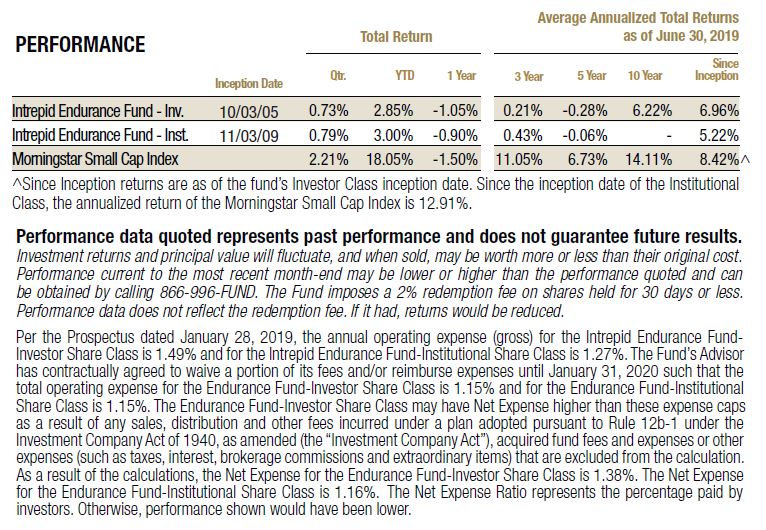

The Intrepid Endurance Fund (“the Fund”) returned 0.73% during calendar Q2 2018 compared to 2.21% for the Morningstar Small Cap Index benchmark. The underperformance is partly due to the firm’s large cash position relative to the index, but also because we continue to allocate to undervalued – but out of favor – small cap value stocks. We think this latter point is worth further discussion to provide context to the Fund’s positioning and recent results.

Stocks with value-oriented characteristics have underperformed growth-oriented stocks for some time. Much has been written about this divergence in the financial press – we have little unique insight to add to the debate. What we do find interesting and rarely discussed, however, is the underperformance of small cap value in particular.

According to market research firm Dalbar, the average investor holds an equity mutual fund for about four years. Unfortunately, the past four years has not been a good relative stretch for small cap value stocks, as investors have favored larger and more growth-oriented stocks. The Morningstar Large Cap Value Index has outperformed its small cap value peer index by over 24% during the four-year period ended June 30, 2019 – the second largest ever discrepancy in the 21-year history of monthly return data for these indices.

Similarly, mid cap value has outperformed small cap value by over 20% using the same Morningstar indices and performance periods, which is one of only a handful of periods in which this has occurred. Since value stocks have underperformed growth stocks over this four-year stretch, small cap value has suffered the double-whammy of being the loneliest subgroup within an unloved category.

History suggests this underperformance will not persist. In fact, small cap value has been one of the best performing asset classes over multi-decade periods, and numerous academic studies have provided reasons for this. Unsurprisingly, periods in which small value has underperformed significantly relative to other equity categories have often set the stage for significant future outperformance, as this data has tended to show strong mean reversion over time.

Some in the investment community have suggested (not for the first time) that value is dead, and that established businesses cannot compete with new-age disruptors in a winner-take-all digital economy. Consider us skeptics. We are confident that buying stable, cash-generative businesses at reasonable multiples will inevitably come back into favor.

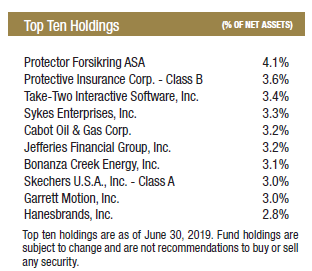

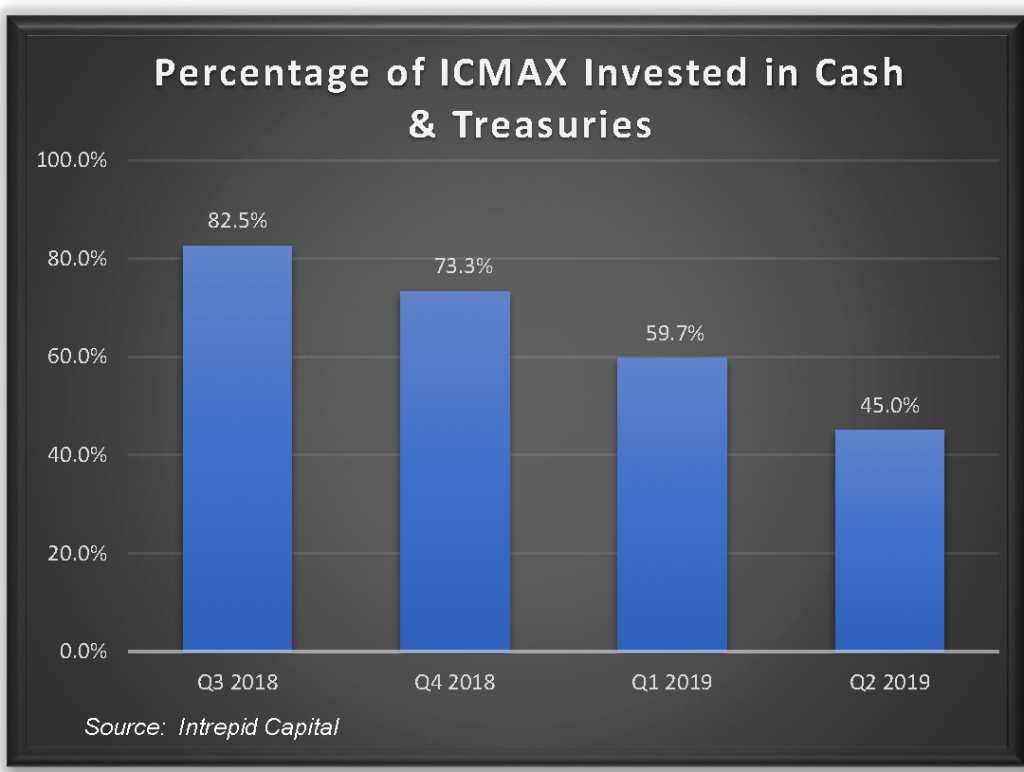

In that sense, we view the unpopularity of small cap value stocks as a good thing, as it has provided an opportunity to prudently deploy more of the Fund’s cash in high-quality businesses that we believe are priced to generate attractive returns looking forward. The Fund’s cash level ended calendar Q2 at 45.0% – down from 59.7% at the end of Q1, 73.3% at the end of Q4 2018, and 82.5% at the end of Q3 2018.

Specifically, we purchased six new holdings during Q2. They are listed and briefly described below.

- Silicom (SILC) – A technology company that is a leading manufacturer of equipment to enhance networking speeds for businesses. We think this small company is overlooked (it has almost no sell side coverage) and that investors are not giving Silicom enough credit for its growing exposure to cloud and SD-WAN applications.

- Garrett Motion (GTX) – A spin-off from Honeywell in 2018, Garrett Motion is the market-leading turbocharger manufacturer worldwide. Auto manufacturers are increasingly installing turbochargers in newer car models, as they improve engine efficiency and are a cost-effective solution for compliance with increasingly stringent environmental regulations. The company has a unique supply chain model that allows it to earn returns on capital over 100%. However, due to its small size relative to its former parent, we believe it is generally undiscovered – and meaningfully mispriced – by investors.

- Greensky (GSKY) – A fast-growing financial technology business that brokers home improvement loans to customers through a network of contractor partners. We think the company has carved out an interesting niche within the consumer finance space, and that its key bank partnerships and strong results validate the business model.

- Take-Two Interactive Software (TTWO) – One of the largest video game developers that owns the rights to successful game franchises such as Grand Theft Auto, NBA 2K, and Red Dead Redemption. We think the company’s intellectual property is extremely valuable and that future game releases and overall industry growth should continue to compound the company’s intrinsic value.

- Jefferies (JEF) – A financial holding company that owns the Jefferies investment bank and a collection of other assets. We have followed the company for a long time and believe the stock trades at an unfairly large discount to the sum of its parts. JEF’s value-oriented management team also recognizes the discount and has been taking steps to realize value, including buying back significant amounts of stock.

- IAA Inc. (IAA) – Another spin-off, IAA is one of two players in the duopoly salvage auction industry that provides a marketplace to connect buyers and sellers of damaged or “total loss” vehicles. IAA’s auction-based business model generates high returns on capital and has growth tailwinds as vehicles become more complex and expensive to repair.

These stocks add to the list of new holdings we have purchased since the end of Q3 2018 – which now totals sixteen (we divested one stock during this period as well). This “buying spree” over the last nine months was first triggered by the enormous volatility that emerged in Q4 2018 (small caps were down 20% that quarter), but the underperformance of small cap value stocks since then has provided additional attractive opportunities despite a rising stock market.

Our top three contributors to performance during calendar Q2 were:

- Hallmark (HALL) – Hallmark reported a great first quarter which featured improved underwriting profitability, strong top line growth, and an attractive outlook on future results. Initially, investors didn’t seem to notice, but the stock rallied sharply in June. We reduced the position size as the stock neared our valuation estimate.

- Amdocs (DOX) – Amdocs also reported a strong quarter to start the year. DOX was a top detractor in the prior quarter, as it fell victim to a short seller report in January. Although Amdocs management addressed many of the short seller’s allegations in the company’s Q4 earnings call, we think the solid Q1 earnings report was the proof that some investors wanted to see, as the results included improvements in certain areas that were alleged to be red flags.

- Crawford (CRD/A) – Although we didn’t think the company’s Q1 earnings report was noteworthy, Crawford’s stock rallied sharply in June. Perhaps other investors are beginning to notice the improving fundamental picture for this small, underfollowed company.

Our three worst detractors on performance during calendar Q2 were:

- Garrett Motion (GTX) – Garrett’s stock suffered along with a host of other auto suppliers, as slowing global auto production data weighed on these companies shortly after we established our position. At less than five times forward earnings, we think the risk of continued slowing auto production is more than priced into this stock.

- Skechers (SKX) – A large winner last quarter, we think the pullback in SKX during calendar Q2 was mostly related to the trade war with China. Although we believe the trade war only has a minor impact on Skechers’ manufacturing capabilities, a significant portion of their sales come from China, and investors are concerned that tariff-related weakness in China’s economy could slow consumer spending on footwear.

- Cabot Oil & Gas (COG) – Cabot reported a very strong Q1 2019 result that proved out its commitment to low costs, accelerated growth, free cash flow generation, and returning capital to shareholders. However, the price of natural gas fell 13% during the quarter, dragging the stock down with it.

Finally, it is important to continue to assess the Fund’s performance and actions relative to the three strategic objectives we laid out last quarter. We are pleased with our performance against the first two objectives but have fallen short with the third:

i) Avoiding large drawdowns on your capital – The Fund performed very well in the two recent small cap market drawdowns, including Q4 2018 when the Morningstar Small Cap Index was down -19.51% (Fund -3.52%), and in May of this year, when the benchmark fell -7.89% (Fund -3.36%).

ii) Taking advantage during periods of volatility – The Fund has purchased 16 new positions in the nine months of this fiscal year, and cash has fallen from 82.5% to 45.0% in response to increased volatility and the general underperformance of small cap value stocks.

iii) Generate attractive positive absolute returns – The Fund has a -1.05% return over the trailing twelve-month period ended June 30, 2019, compared to the -1.50% return of the benchmark Morningstar Small Cap Index and the -7.86% compared to the Morningstar Small Value Index. Based on these results, it would be fair to say that the Fund managed the value-related headwinds over the last year well. However, we are not thrilled with this outcome as it falls short of our objective of generating positive absolute returns.

With that said, we believe the Fund is positioned well to bounce back from the slightly negative absolute returns over the last twelve months. Recent actions – highlighted by the sixteen new holdings established during the past three quarters – position the Fund for more potential upside than it has had in years. While still remaining defensive and flexible (cash is at 45.0%), the Fund now has over 3x the equity exposure it had nine months ago as we have exploited several dislocations in our value universe. While we don’t have pre-determined plans to continue allocating cash to new opportunities at this rate – that will depend on how our opportunity set is priced at any given time – we will not hesitate to act should volatility spike again or our core universe of small cap value continue to offer an increasing number of attractive opportunities.

In closing, we are very optimistic about the future performance of the Fund. We expect the multitude of new purchases and higher equity exposure to provide attractive future absolute returns within a category that may be poised for a mean-reverting outperformance on a relative basis. Meanwhile, our significant cash position provides an overall defensiveness while maintaining the ability to deploy additional cash as further opportunities appear. We believe this simple, flexible, and opportunistic approach should continue to add value over the benchmark, over reasonable holding periods, and provide attractive positive absolute returns that are worth the risk assumed.

Thank you for your investment.

Matt Parker, CFA, CPA

Intrepid Endurance Fund Co-Portfolio Manager

Joe Van Cavage, CFA

Intrepid Endurance Fund Co-Portfolio Manager

[1] Several studies have examined this issue over the years and our conclusions drew off the work included in the 30-year return data from the study Periodic Tables, Long Term Investing, and Illusions of Randomness by Stephen J. Huxley, Ph.D. and Brent Burns, President, Asset Dedication, LLC.