April 2, 2020

Dear Fellow Shareholders,

As I sit down to write this letter, the governor of Florida just issued a stay-at-home order for residents. Just a few weeks ago, it would have been unthinkable to see sights of empty beaches and theme parks on a sunny Saturday afternoon in the spring. Indeed, similar scenes are playing out nationwide as the country adjusts to a strange period of isolation. We hope that you and your families remain healthy throughout this challenging time.

Financial markets pivoted perhaps just as hard as everyday life during the quarter. Investors entered the year cheering on the longest ever bull market expansion with bold predictions of ever-higher stock prices, valuations be damned. Since there was no clearly identifiable catalyst for a recession, why wouldn’t stocks continue to grind higher? However, after the full potential impacts of the coronavirus came more clearly into focus, stocks suffered the fastest drawdown in history. We find it interesting that most market participants seem to believe they will spot the signs of a bear market before others, and safely head for the exits before them. In our view, it is precisely this collective confidence that helps fuel bull markets on the way up and produce violent selloffs on the way down. The coronavirus, like the catalysts of other bear markets before, did not exactly repair the herd’s reputation of predicting recessions and smoothly heading for the exits.

As we have discussed in countless letters before this, it has been our opinion that stocks have been broadly overvalued, over leveraged, and did not compensate investors well for bearing the risk of ownership. The Endurance Fund (the “Fund”) had a 39% position in cash & treasuries coming into the year and a 34% position immediately prior to the significant sell-off which began on February 20th. In that respect, the Fund was positioned relatively well for the 41% plunge in the Russell 2000 over the next eighteen days. We should emphasize here that this defensive positioning was due to the valuations of the stocks in our opportunity set rather than predicting how the events of the virus might unfold. Like many other investors, we closely followed news related to the virus, but could not reasonably anticipate the economic shutdown and related damage it could create until prices had already begun to reflect this risk.

As we have discussed in countless letters before this, it has been our opinion that stocks have been broadly overvalued, over leveraged, and did not compensate investors well for bearing the risk of ownership. The Endurance Fund (the “Fund”) had a 39% position in cash & treasuries coming into the year and a 34% position immediately prior to the significant sell-off which began on February 20th. In that respect, the Fund was positioned relatively well for the 41% plunge in the Russell 2000 over the next eighteen days. We should emphasize here that this defensive positioning was due to the valuations of the stocks in our opportunity set rather than predicting how the events of the virus might unfold. Like many other investors, we closely followed news related to the virus, but could not reasonably anticipate the economic shutdown and related damage it could create until prices had already begun to reflect this risk.

The historic selloff and related volatility created some great opportunities to deploy much of the Fund’s war chest of cash & treasuries. True to its name, the Fund is designed to “endure” by remaining flexible and holding cash when valuations are not attractive and then allocating this cash into businesses that can “endure” in any environment. Over the duration of the quarter, approximately 19% of the 39% position in cash was invested, or about half. Our approach to investing in this crisis was not to dive directly into the “middle of the storm,” but rather to scrape along the edges for higher quality businesses caught up in the selloff. By this we mean, we did not concentrate our efforts at investing in hotels, cruise lines and restaurants that bore the brunt of the carnage. Many of these businesses were highly leveraged and may depend on government bailouts for survival. Instead, we focused on identifying stocks of good businesses selling off due to temporary setbacks, but whose long-term value we believed was intact.

From a trading perspective, the Fund was the most active it has been in many years. We increased our position sizes of several existing names and purchased new positions in several others. As discussed before, our additions tended to be businesses with strong cash flows, good balance sheets and ample liquidity to “endure” through this period. Rather than provide a detailed description of each, we think it would be helpful to highlight a few areas where we concentrated a meaningful portion of our activity:

- Professional Sports Franchises (BATRK, MSG, MANU) – We have written about sports franchises before. These franchises are brands that have been around for decades and have accrued massive brand value in the process (generations of fans and followers). In addition, due to the proliferation of Netflix and other on-demand entertainment, sports are one of the few forms of video content that are primarily consumed live, which has caused them to be very attractive advertising properties and thus generate increasing value in media distribution rights deals. These franchises also have tremendous scarcity value and usually change hands in private transactions at large premiums to estimated valuations – which historically have not been impacted much by recessionary environments. Unsurprisingly, these stocks sold off after sports leagues suspended their seasons, making short-term ticket and TV revenue more uncertain. We are confident that consumers will eagerly begin consuming sports entertainment again once the virus is safely behind us, and that these franchise values, based on decades of brand-building, remain strong.

- Outsourcers (WNS, SYKE, G, DOX, ICLR) – We added exposure to a few outsourcing companies during the quarter. It’s likely that these companies will have reductions in profitability this year as their clients either seek price concessions, have lower volumes of activity, or the outsourced companies are simply unable to mobilize their workforce to provide service due to government lockdown orders. However, the businesses in which we have invested are leaders in their respective niches (for example: accounting, pharmaceutical research, call centers, telecom billing, etc.) and their customers have permanently shifted these functions to outsourced providers. In general, their customers simply are no longer equipped to do this work themselves, and the longstanding relationships often make it expensive to switch to a competing outsourcer. We think the value of high-quality outsourced providers of business services remains intact despite the near-term economic volatility. In fact, some of these businesses could emerge stronger if the global economy goes through a more extended downturn. Many businesses turn to outsourcers as a way to cut costs in tough times, and some of these companies have a demonstrated history of growing volumes through recessionary periods.

- Discount Retailers (BURL, OLLI, FIVE) – Retailing is a notoriously tough business that has been made only tougher by the proliferation and adoption of e-commerce and omni-channel competition over the last ten years. However, there are certain physical retailing businesses that have thrived despite the intensifying competition – specifically models that can consistently provide consumers excellent value and a positive shopping experience. Within this space, we purchased the stocks of a few off-price and “value” retailers. This is one of the few categories of brick & mortar retail that have performed well operationally over the last decade, proving to be structural market share gainers that earn attractive returns on capital. Forced store shutdowns due to the coronavirus and the fact that these businesses have little to no online presence likely drove investors to dump them in favor of e-commerce businesses. However, it is the lack of an online presence that draws bargain hunters into these stores in the first place, thereby insulating them well from companies like Amazon. Similar to what we have mentioned above, we think life and consumer behavior will mostly go back to normal after this virus inevitably runs its course, and we viewed the selloff as an opportunity to scoop up shares of these great businesses at a discount.

- Salvage Auto (IAA, CPRT) – There are a number of players within the salvage auto industry, but the most lucrative position is the owner of the auctions in which totaled cars are sold. There are two companies that dominate this space and they compete rationally in a duopoly structure. These businesses have ridden a tailwind of (a) more vehicles and distracted drivers on the road leading to more accidents, and (b) a growing proportion of these damaged cars that end up totaled due to expensive replacement costs for increasingly complex parts (cameras, sensors, etc.). Earnings for these companies are expected to be hurt in the short-term as fewer people are driving during the nationwide lockdowns, leading to fewer car accidents. Some have suggested that earnings could be more structurally impacted as people may permanently cut down on driving and work remotely more often. We don’t fall in this camp. While it is quite possible that there could be more work done remotely after the virus, we doubt this will be material enough to impair the long-term values of these excellent businesses.

To summarize, we found a good deal of opportunity as stock prices went into free-fall in some high quality, market-leading businesses within already attractive industries. Like all businesses, we expect their operations to take a hit with the sharp slowdown to come near-term in the economy. But in many cases, we expect the companies we purchased within these categories to come out in an even stronger competitive position than they went into this crisis.

While most of the additions to the Fund fit into the categories above, there were a few exceptions that the Fund purchased which we will briefly highlight:

- Brown & Brown Inc. (BRO) – Brown and Brown is one of the largest insurance brokerages specializing in the middle-market (small businesses). We are attracted to Brown & Brown’s industry leading profitability, high insider ownership, and robust and consistent free cash flow generation, which we balance with the company’s outsized exposure to its small business customers – many of which will struggle in the near term.

- EZCorp Convertible Bonds due 7/1/2024 – EZCorp is a pawn shop operator with over 1,000 store locations mainly in the US and Latin America. We have owned similar convertible bond issues from this company in the past and understand the business well. Although the stock price is depressed and the bonds are far from having conversion value (i.e. “busted”), we believe the company will be able to pay them back out of internally generated cash flows, which tend to be resilient in recessionary periods. The company’s stores, inventory, and collateral securing its pawn loans outstanding also provide strong asset coverage. We purchased the bonds at a deep discount to par value and expect to earn an equity-like return.

- Fabrinet (FN) – Fabrinet is a manufacturer of electronic components used in telecom equipment and several other industries. It is a high-quality industrial business that we have owned in the past and took advantage of the recent selloff to once again purchase the stock. We expect future investment in 5G infrastructure and related technologies to support robust future growth for their business.

- Ryanair Holdings (RYA ID) – Ryanair is a discount airline that primarily operates in Europe. We are not fans of the airline business in good times, and with almost all flights grounded until further notice, things could not be worse for the industry. But Ryanair is the rare exception in terms of i) airline business quality, and ii) instances where we found opportunities in the “middle of the storm.” The company has perhaps the best management in the industry, with a low-cost model that has helped it gain tremendous share from other legacy European carriers while producing ample and consistent profits and free cash flow. In addition, the company has maintained a strong and liquid balance sheet and has recently revealed that it can survive an entire year without any revenue. We don’t think their competitors can accomplish this, and believe Ryanair is positioned to come out of this period in an even stronger competitive position absent widespread European airline bailouts. While our position in Ryanair is relatively small, we believe it is a good example of the Fund’s ability to be opportunistic and search overseas for value when it becomes attractive.

Despite all this buying activity, it’s worth mentioning that the Fund still has a bullet in the chamber, so to speak, in the remaining 20.2% position in cash. Despite a historic crash in prices, we still do not believe small cap stocks are screaming bargains – a testament to how stretched we think valuations had gotten before the selloff. Proclaiming that we are in a recession right now is not controversial. More debatable, however, is how long this period will last. Will it be a V-shaped recovery that snaps back when the economy is re-opened? Or will this be a more drawn out period of weakness? While we obviously don’t know for certain, we would argue the odds of the latter scenario have increased meaningfully – there is simply a tremendous amount of debt for the economy to deal with as it processes this exogenous blow. In our opinion, there are still many stocks that are not adequately pricing in this risk. There are a number of high-quality stocks in our “on-deck” circle, but we are still waiting for more attractive entry prices. To play off an old Warren Buffett-ism, we are still picking up falling stocks with a thimble and have not yet reached for the bucket.

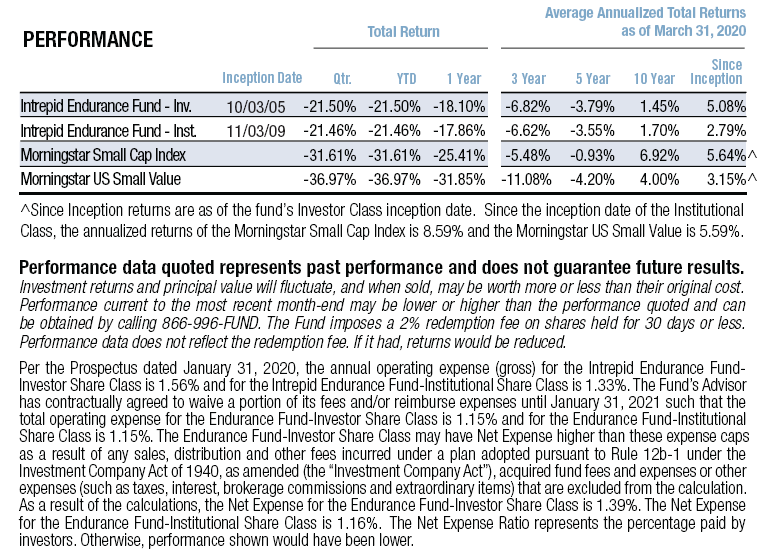

For the quarter ended March 31, 2020, the Endurance Fund returned -21.50%. As absolute return-oriented investors, we are frustrated to have lost money during the quarter. Unfortunately, there were few places to hide amidst the selloff and the stocks that the Fund owned were not immune from the selling pressure. While it pains us to have to report that your capital suffered a loss, we think it’s recoverable. Swings in prices are a reality of investing in the stock market, but we are confident in the long-term intrinsic values of the businesses that the Fund holds. We also view the selloff as an opportunity to deploy more of the Fund’s cash and position itself to capture more upside when prices recover.

The Fund’s return was more palatable compared to the -31.61% return of the Morningstar Small Cap Index benchmark. And better still when compared to value-oriented small cap indices, such as the Morningstar US Small Value Fund category which fell 36.97%. It was yet another period in which small value indexes lagged those of larger and more growth-oriented companies. If the last two recessions are a guide, then we might expect to see a sharper recovery from small caps coming out of this bear market than large caps. The Russell 2000 suffered a larger drawdown than the S&P 500, Dow Jones Industrial and Nasdaq averages during the financial crisis, but recovered to its prior peak faster than the S&P and Dow (the Nasdaq recovered equally quickly). In the recovery following the bust of the tech bubble in the early 2000s, the Russell 2000 also led the recovery.

The top three contributors to performance were:

- Burlington Stores (BURL) – Burlington is one of the off-price physical retailers mentioned earlier that was purchased during the quarter. The company has improved its business meaningfully over the last decade by increasingly adopting the off-price model, jettisoning excess stores, and improving inventory turns and efficiency. We purchased the company in the midst of the panic during mid-March at very opportunistic prices, and the stock rebounded into the close of the quarter.

- iShares Gold Trust (IAU) – The Fund has maintained a small position in an ETF that tracks the price of gold for several years. The purpose of the holding has been to maintain some exposure to the precious metal as a hedge against the unprecedented monetary policy we have witnessed over the last decade. We increased our holding during the quarter (4.9% of Fund as of 3/31/20) after observing the government’s economic response to the virus.

- Net 1 UEPS (UEPS) – The Fund sold its small remaining holding of UEPS during the quarter after the company completed the sale of its South Korean payment services business.

The top three detractors to performance were:

- SP Plus (SP) – SP is the nation’s largest operator of parking lots, managing the parking operations for airports, commercial properties, hotels and others. While it is normally a remarkably stable business, the shutdown of the economy, particularly in sectors like air travel and hotels, will have a significant impact on parking revenues. Fortunately, the business earns about 80% of its profits from fixed contracts in which they earn a fee regardless of the lot’s occupancy. The company is one of the few owned by the Fund which has a meaningful amount of debt on the balance sheet, but we think the company’s characteristics – stable cash flows and highly variable cost structure – can support this debt. We have increased our position size as the stock has fallen.

- Skechers (SKX) – Skechers is the Fund’s second largest position behind video game publisher Take Two (TTWO). About a quarter of the company’s earnings come from China, and the country is a meaningful growth engine for Skechers. We believe the impact in China will prove to be mostly temporary and that people will once again start buying Skechers brand shoes. If Nike is a good representation, the damage may not be so bad. In their most recent quarter, they reported only a 4% decline in footwear sales in China during a period (November – February) which coincided with China’s peak impact from the virus. Skechers has a fortress balance sheet with cash that significantly exceeds its debt.

- IAA Inc (IAA) – IAA is one of the two salvage auction businesses discussed earlier. Earnings will undoubtedly be impacted from the fewer car accidents expected to take place during the shutdowns, but we think the selloff in IAA’s shares may have been exacerbated by their leveraged balance sheet. While the company does have a significant amount of debt, the principal payments on this debt are not due until 2026. We expect their earnings to normalize and that the company can easily pay this back out of their operating cash flows. Like SP, we are willing to accept the financial risk of this business due to the strength of the operating business. We increased the position size as the shares fell.

The Fund sold out of six positions during the quarter:

- Cabot Oil & Gas (COG) – Cabot is one of the largest producers of natural gas, which has been in a long bear market that Cabot has navigated well due to its strong balance sheet and its position as a low-cost producer. However, due to what will likely be a significant decline in natural gas demand on top of an already over-supplied market, we have decided to reduce our overall energy exposure until we see how other producers react to the current environment. The energy industry has been dominated by irrational behavior for years, and until we have confidence that other players will begin to act more rationally about supply, we have reduced our exposure to the sector in general. As a result, we have sold our position in Cabot.

- Garrett Motion (GTX) – Garrett is the turbocharger manufacturing business that has unfortunately been a material detractor to performance since purchase. While we think the quality of the business is high, the balance sheet was simply too levered. We were willing to tolerate this upon initial purchase because of their highly variable cost structure, figuring that they would be able to scale back sufficiently to stay afloat if there was a global recession. We did not, however, expect that there could be a significant period in which auto production would completely grind to a halt. While the stock still appears extremely cheap on equity multiples, we believed there was simply too much financial risk and sold the stock.

- Hilltop Holdings (HTH) – This is a regional bank out of Texas which was sold after reaching our calculation of intrinsic value.

- Protective Insurance (PTVCB) – We consider ourselves to be patient investors but admit to losing patience over the five years we have owned this business. This commercial auto insurer has been trying to weather brutal industry conditions for years, but premium rate hikes have simply not kept up with skyrocketing costs to settle claims. We expect the industry will eventually become profitable again but have lost confidence in this timing. While we have confidence in the new CEO, we would need to see a clearer improvement in underwriting profitability before owning again.

- Net 1 UEPS (UEPS) – As noted above, we sold this holding after the business monetized its interest in a South Korean payment processing company.

- Protector Forsikring (PROTCT NO) – We purchased this Norwegian P&C insurer in late 2018 after some underwriting challenges led to a decline in the stock price. We judged that these issues were most likely temporary given the company’s history of good results and the extremely profitable industry structure in the Nordic market. Unfortunately, underwriting continued to disappoint and there emerged a pattern of actual results that differed substantially from what the company’s management had suggested. Our thesis no longer held, and we sold the shares shortly after the company’s Q4 results were released.

For the first six months of the Fund’s fiscal year, the Fund returned -17.80% vs. -25.68% for the benchmark Morningstar Small Cap Index. The Fund underperformed during the period of low volatility through mid-February, but then meaningfully outperformed when volatility spiked and panic ensued later in the period.

Despite the carnage in the markets, the current investing landscape is a more favorable environment for the Fund’s strategy than we have seen in years. Prices are cheaper, bargains are far more plentiful, and the extreme volatility has created attractive opportunities. The Fund is now positioned for much more upside should stocks rally higher and stands ready to deploy the remainder of its cash should volatility continue. This valuation driven approach has served well in periods such as this, and we are working diligently to assess the best opportunities in which to invest your capital for attractive long-term appreciation.

In closing, we want to express our sincere appreciation for the patience of the long-term shareholders of the Fund. Its positioning has been unconventional, leading to lackluster returns during the later stages of this record long bull market. We are hopeful that the current environment – with far lower prices and heightened volatility – will allow us to position the portfolio for much more desirable results looking forward. Thank you for your investment.

Matt Parker, CFA, CPA

Intrepid Endurance Fund Co-Portfolio Manager

Joe Van Cavage, CFA

Intrepid Endurance Fund Co-Portfolio Manager