April 5, 2020

“If you can’t stop, smile on your way under.”

~Bumper Sticker on Large 4-Wheel Drive Truck

Dear Friends and Clients,

In the height of the market panic this past March, I was asked to “Skype” into a CNBC Nightly Business Show. For those who may have missed it, when asked what I thought, my response was “the Federal Reserve and Central Banks of the world held rates too low for too long, giving us too much corporate debt equaling a giant margin call.” From a prior letter at the end of the 3rd Quarter of 2019, I said at the time, “I believe this is an ‘Emperor Has No Clothes’ moment, one years hence we will look back on incredulously.” Rate suppression activity by central banks around the world has encouraged all sorts of shenanigans to persist, in my opinion, from financing larger U.S. budget deficits to unicorns like WeWork, to an IPO market of largely unprofitable offerings.”

Well…now for my “mea culpa,” I wish I had better prepared our portfolios for this unforeseen global pandemic. While our portfolio results may, depending on the strategy, have “relative” outperformance, one can only eat from “absolute” returns (i.e. positive). My wife of 30 years, Rosalind, inquired recently about the fund performance. I replied “nowhere to hide,” with the notable exception being long maturity U.S. Treasury Bonds and gold. A ladder of these treasury bonds now has interest rates from 3 months to 30 years all less than 1.20% (30-year). I refer to them, with a touch of sarcasm, as “return free risk.” It will take very little upward movement in rates to vaporize those small coupons with lost principal.

Well…now for my “mea culpa,” I wish I had better prepared our portfolios for this unforeseen global pandemic. While our portfolio results may, depending on the strategy, have “relative” outperformance, one can only eat from “absolute” returns (i.e. positive). My wife of 30 years, Rosalind, inquired recently about the fund performance. I replied “nowhere to hide,” with the notable exception being long maturity U.S. Treasury Bonds and gold. A ladder of these treasury bonds now has interest rates from 3 months to 30 years all less than 1.20% (30-year). I refer to them, with a touch of sarcasm, as “return free risk.” It will take very little upward movement in rates to vaporize those small coupons with lost principal.

I mentioned earlier the source of “the problem,” at least from my perspective, was easy and lenient credit terms for borrowers, particularly Corporate America. We entered this crisis with as heavily leveraged Corporate Sector as ever with $1 trillion of debt rated marginally investment grade (BBB). Well, when you are levered up and a new government edict is issued to suspend business activity, you now have a “Houston, we have a problem” moment. Many of these bonds’ prices are now under intense pressure as leverage ratios shoot up with less cash flow to service the existing debt. As sales collapse, I have heard it said before: Stocks climb the stairs but take the elevator down. There have been 5 weeks in which the Dow Jones Industrial Average has fallen 12% or more since the fall of France in 1940. The good news is that I have been around in this business (and survived!) for almost all of them (except the one in 1940!).

So, what are we doing about this down 30% downdraft in prices? Buying! I don’t know, nor does anyone here or elsewhere know where the bottom is for prices. The analogy I use is this: remember as a kid going swimming in a lake, river or ocean, and wondering, “how deep is it?” Well, you held an arm over your head, pointed a toe and started gradually letting air out to assist in your descent, knowing that if it was really deep, you didn’t want to exhale all of your oxygen necessary to return safely to the surface. The portfolio management team has been taking advantage of the downdraft in prices and wild volatility to do two things: upgrade the quality of the businesses we own, looking for impeccable balance sheets (see discussion earlier) that now after this swoon in prices are much more attractively priced. Next, we are very gradually adding to companies where we already own shares and can average down our cost basis.

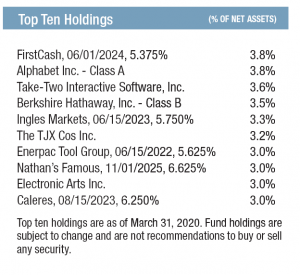

Lastly, in the bond market we are busily acquiring very short-term bonds with net cash (cash greater than debt) and often unused lines of credit. Our preference is the next scheduled bond in their respective maturity schedule, knowing they have the necessary liquidity to pay it off. Frankly, I think this part of the capital markets may be offering one of the better risk-adjusted returns currently, with many of these bonds fetching a low double-digit yield-to-worst.

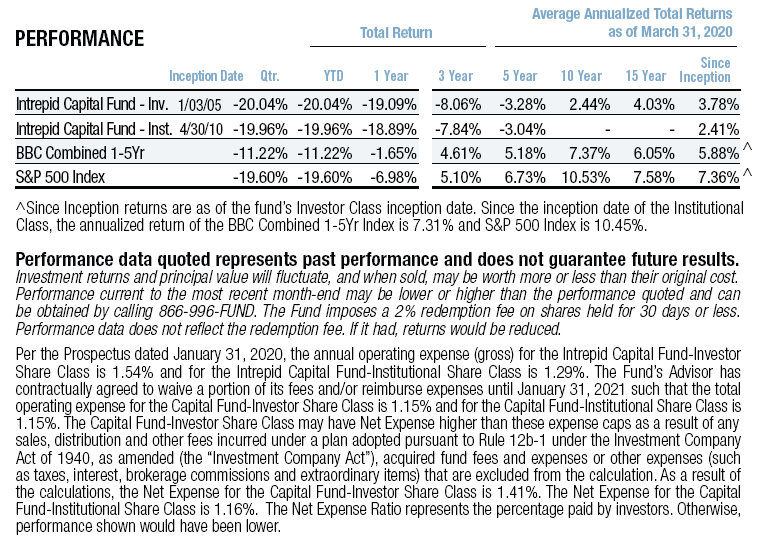

For the quarter ended March 31, 2020, the Intrepid Capital Fund (the “Fund”) declined 20.04% compared to the S&P 500 Index’s decline of 19.60% and the combined benchmark’s (60% S&P 500 Index/40% Bloomberg Barclays US Gov/Credit 1-5Yr Index) decline of 11.22% for the period. The Fund’s top contributors for the quarter were Visa (ticker: V), AmerisourceBergen (ticker: ABC), CVS Health Corp. (ticker: CVS), Mastercard (ticker: MA) and IFM US Colonial Pipeline 6.45% due 5/1/2021. The Fund’s top detractors for the quarter were SP Plus (ticker: SP), Skechers (ticker: SKX), WNS Holdings Ltd (ticker: WNS), Copart (ticker: CPRT), and Discovery (ticker: DISCK). The Fund ended the first quarter with 4.8% in cash.

I know this has been scary for many of you, and as your portfolio manager, I am entirely and completely empathetic to where we find ourselves today. I won’t dredge up the charts suggesting you stay invested (they are too numerous to include here), but I will leave you with this parting thought: there is opportunity in chaos and frankly we are now focused on the abundant opportunities that we haven’t seen since the failure of Lehman Brothers in the fall of 2008 which ignited the Great Financial Crisis. We came through that period in fine form and I expect no different this time. As your “Captain,” I will say: “Passengers, please return to your seats and buckle your seat belts, we are expecting some turbulence.”

Best Regards,

Mark F. Travis, President

Intrepid Capital Fund Portfolio Manager