July 1, 2021

Dear Fellow Shareholders,

After a brief pause in May, high yield spreads tightened in June, shrinking to the lowest levels since the Great Financial Crisis. When we hear that junk bonds are yielding a number that starts in three, we joke that given the credit fundamentals, 30% would make more sense than 3%. Nonetheless, we struggle to pinpoint the catalyst that might spur the reversal in spreads. The re-opening trade continues to drive animal spirits and it seems like every momentary sell-off is greeted with endless liquidity. We continue to zig-zag through these frothy times by sourcing small issue, off-the-run securities that we believe are creditworthy and offer compelling yield.

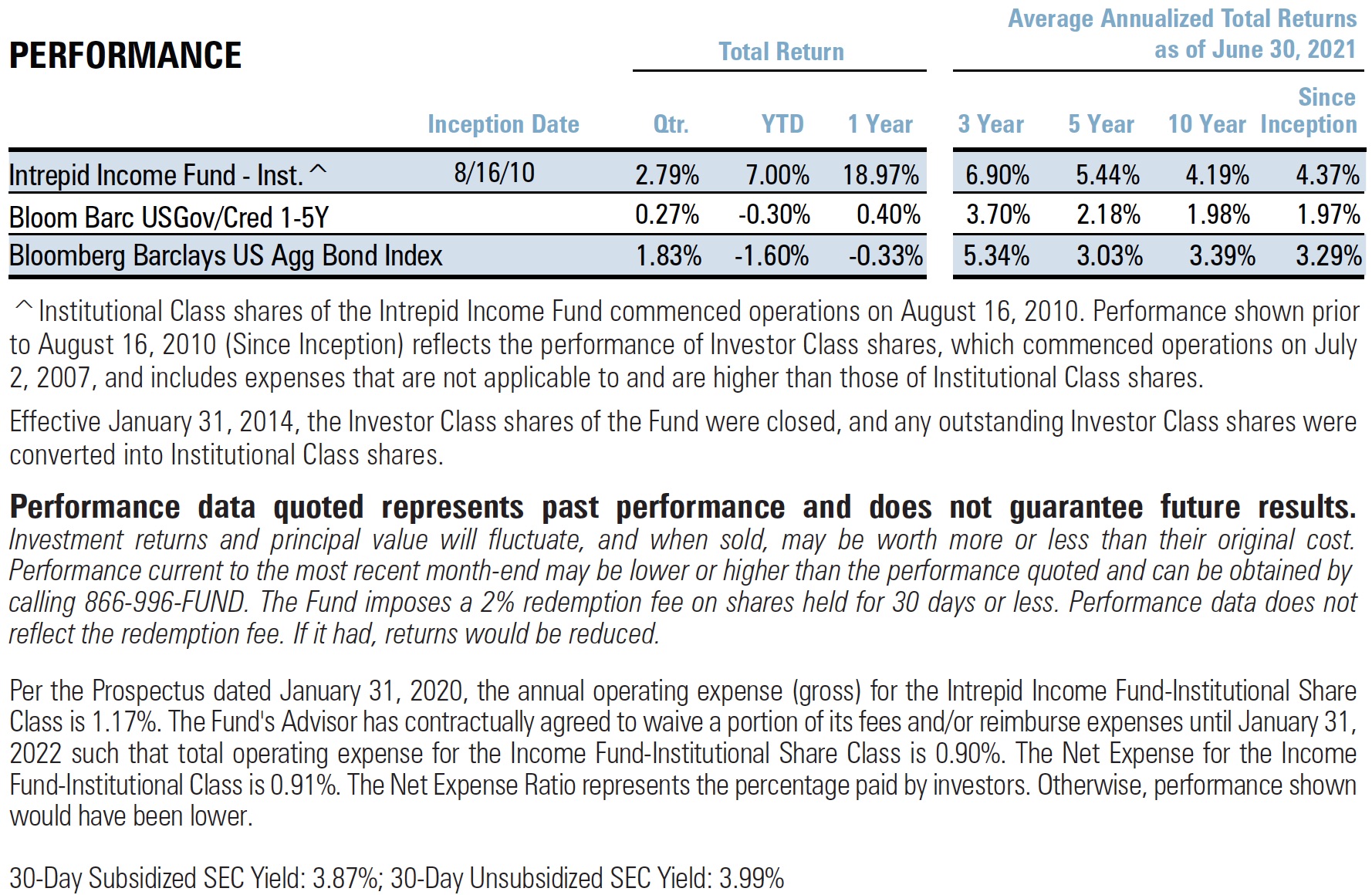

We are pleased to report that The Intrepid Income Fund (the “Fund”) gained 2.79% for the quarter ended June 30, 2021. General fixed income performance for the second quarter of the new decade was much improved relative to last year’s second quarter. Rates drifted lower, with the 10-Year Treasury ending the quarter yielding 1.45%, 29 basis points below the end of last quarter. This translated into good performance for the duration-heavy Bloomberg Barclays US Aggregate Index (the “Barclays Aggregate Index”), which rose 1.83% for the quarter ended June 30, 2021. Similarly, the ICE BofAML US Corporate Index (the “Corporate Index”) returned 3.60% over the same period. Riskier debt continued its recovery on the back of improved earnings, with the ICE BofAML High Yield Index (the “HY Index”) gaining 2.77% in the quarter. The shorter-duration Bloomberg Barclays US Govt/Credit 1-5 Year Total Return USD Index (the “1-5 Year TR Index”) returned 0.27% over the same period.

The Fund’s success during the second calendar quarter was primarily attributable to idiosyncratic security performance, but also benefited from a positive overall environment for risk assets. Our top contributors for the three months ended 6/30/2021 included:

security performance, but also benefited from a positive overall environment for risk assets. Our top contributors for the three months ended 6/30/2021 included:

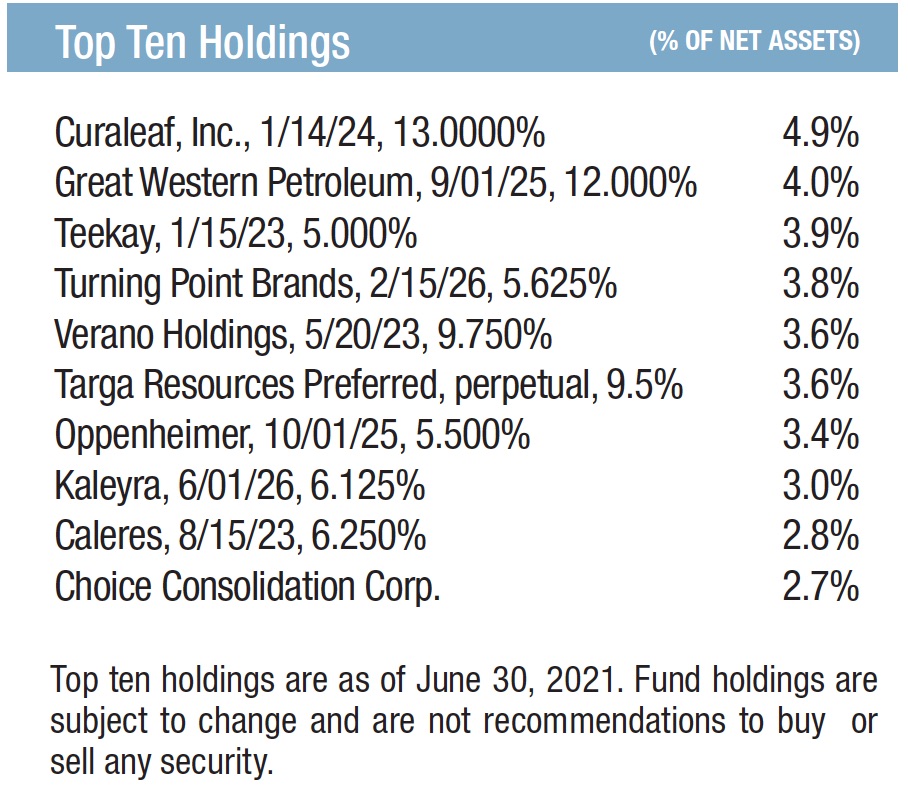

- GRTWST 12.0% due 9/01/2025 – It is only fitting that our largest detractor last quarter is our largest contributor this quarter. As readers may recall, Great Western refinanced its 2021 notes in February and issued these new 2025 notes. After initially struggling in the secondary market, these notes are now trading at par (they were issued at 97 cents on the dollar). Improving oil prices have bolstered the prospects for this DJ Basin producer and we believe that the company is a compelling acquisition target. The notes have a special call price of 110 through early next year. We believe the company’s relatively low leverage and robust hedge book make it a solid credit regardless of whether it is acquired or not.

- MTDR 5.875% due 9/15/2026 – Matador recently reported another strong quarter, generating strong free cash flow which allowed it to pay down most of its revolver and bring leverage down to 1.8x. We decided to trim some of our position above par, as our cost basis for these notes is ~83 and we feel that there is better relative value in other parts of the energy sector.

- EZPW 2.875% due 7/01/2024 – EZCORP has been a perennial Intrepid holding across its entire capital structure. These convertible notes were purchased in the low 80s last year when they were “busted.” We feel that the appreciation in the notes this quarter was the market finally recognizing EZPW’s resilient cash flow profile and rock-solid balance sheet, which now carries net cash. We continue to hold these notes, which have nearly run up to par, as well as the 2025 convertible notes, which carry a higher yield.

Our top (and only) material detractors for the three-month period ended 6/30/2021 were as follows:

- WETF 3.25% due 6/15/2026 – Towards the end of the quarter, WisdomTree issued a convertible note to fund share repurchases and to opportunistically buy back some of its existing convertible notes, which we also own. We continue to love WisdomTree’s AUM mix, which is heavily weighted towards commodities, and cash generative, asset-light business model. Although these notes traded off on the back of some market weakness following issuance, we believe they offer attractive risk/return. Hence, we recently purchased more of these notes in the mid-90s at over a 4% yield-to-worst.

- TPB 2.5% due 7/15/2024 – After a red-hot run, Turning Point Brand’s convertible notes gave back some of the gains we have enjoyed since purchasing these in the low 80s over a year ago. Although the converts are now “in the money” we continue to hold a small position because of our high conviction in the underlying business and management.

- UPH 6.25% due 6/15/2026 – UpHealth is a global digital healthcare company that recently went public via SPAC and issued these convertible notes as part of its qualifying transaction. We view these notes as being well covered by the underlying assets and look forward to the company getting a few earnings prints under its belt after a rocky start to trading that drove the price of the convertible notes down. We discuss this new position in more detail below.

The Income Fund had six corporate bond positions that were called or matured in the first calendar quarter. We also reduced several positions after they hit our internal yield bogey, selling out of our New Gold 6.375% Notes due 5/15/2025 and United Airlines 6.636% Notes due 1/02/2024, entirely. In a world of shrinking yields, these bonds will be missed.

The proceeds from the bonds that were called, sold, or matured were redeployed into a mixture of existing positions and new positions from borrowers we have lent to before, including:

- PBFX 6.875% due 5/15/2023 – PBF Logistics was spun off from PBF Energy in 2014 and owns most of PBF’s refined petroleum products terminals, pipelines, storage facilities, and related logistics assets. The PBF Energy credit complex has faced pressure on the back of stricter pollutions controls in Northern California. However, we believe PBFX’s operations are not impacted from this new requirement and that the baby is being thrown out with the bathwater. The company has manageable leverage and adequate liquidity to get through this near dated maturity, in our estimation, so we purchased a starter weight at ~7% yield.

- AYRWF 12.5% due 12/10/2024 – Ayr Wellness is a multi-state, vertically integrated cannabis operator that owns cultivation, manufacturing, and retail assets across the country. We have written extensively before about our broader cannabis thesis, which Ayr fits into nicely. We believe the company possesses investment grade credit characteristics, with less than a turn of net leverage and top-line revenue that should double in the next few years. We were able to pick these notes up at nearly a double-digit yield.

- Verano 9.75% Term Loan due 5/20/2023 – Similar to Ayr, Verano is a multi-state, vertically integrated cannabis operator with arguably even better credit characteristics. These notes carry less than a turn of gross leverage and are collateralized by licenses worth multiples of the debt. We purchased this loan at a discount to par, which translated to a double-digit yield.

- Cansortium 13% Term Loan due 4/29/2025 – Rounding out our additions to the cannabis sleeve of our portfolio is a small position in a term loan issued by Cansortium. Unlike Verano or Ayr, Cansortium’s operations are primarily in Florida, where the company operates 26 dispensaries as well as a couple cultivation and manufacturing facilities. We believe the loan is well covered by the underlying licenses and that the company is on track to bring gross leverage down to under 2x by the end of the year. This loan was issued at 97 cents on the dollar and came with warrants. It trades hands in the secondary market today at 105.

- IIPR 5.5% due 5/25/2026 – Innovative Industrial Properties, Inc. is an industrial REIT that services the cannabis industry. Because of the lack of access to capital across the industry, IIPR can lease to companies at double-digit rates with nearly 20-year average terms. Pro forma for this debt deal, the company’s debt / total capitalization is still less than 30% and its debt service coverage ratio is nearly 10x. IIPR’s notes are rated BBB by Egan-Jones Ratings and, because the company is not plant touching, can be owned by most institutions. After the notes traded up several points, we trimmed most of our position as we believe there are better opportunities elsewhere in other parts of the cannabis sector.

- COLGTE 7.75% due 2/15/2026 & COLGTE 5.875% due 7/01/2029 – Colgate Energy is a private exploration & production (E&P) company with an attractive, scalable asset base in the Delaware Basin. We started to acquire the company’s 7.75% 2026 notes until it announced a $400 million new deal that we decided to round out our position with instead. The company is very prudently managed with a history of free cash flow generation through entire cycles and no material exposure to federal lands. The company has a stated leverage target of 1.0x by the end of 2022, which we believe is conservative. We also believe the company is a strong M&A target.

- KLR 125% due 6/01/2026 – Kaleyra is an Italian-based software company with sticky revenues and a large growth ramp on the horizon. We purchased a small weight in these convertible notes as part of the company’s financing for its acquisition of mGage, an American-based company that also operates in the Communications Platforms as a Service (CPaaS) space. We view these high coupon converts as particularly attractive for a company with very little other debt, plenty of cash, and a combination of high revenue growth and margin accretion expected over the next few years. We expect gross leverage to fall to under a turn by the end of 2022 and for the company to generate ~15% of its current enterprise value in free cash flow by then. We plan to add to this position as we gain more conviction in our long-term thesis and as management proves they can successfully integrate its recent acquisitions.

- UPH 6.25% due 6/15/2026 – UpHealth is a digital healthcare company that recently went public via SPAC. We acquired a small weight in these convertible notes as part of the qualifying transaction. Just like with Kaleyra, these high coupon notes are well covered by the underlying pieces, which include a telehealth business (CloudBreak) and an integrated care management business (Thrasys). We would consider adding to this position as the company executes on its revenue backlog and continues to build out its service offering. We expect UPH to carry ~2.5x of gross leverage by the end of 2022 making this one of our more speculative positions which we mitigate by keeping this at a small weight until we gain more conviction.

- WETF 3.25% due 6/15/2026 – We have written about our WETF thesis previously. When the company did a drive-by offering of new convertible notes, we decided to add back to our overall WETF position, which we had trimmed earlier in the quarter at a compelling price point. When these notes sold off a few points after issuance, we added to our position.

- CNSL 5% due 10/01/2028 – Consolidated Communications is a wireline company with stable fundamentals and some compelling growth initiatives in underpenetrated markets. The company is in the middle of a lean fiber build with a fully-funded plan that should support future EBITDA growth and deleveraging. We expect leverage to stay in the ~3x area over the next several years and feel the ~5% yield on the 2028 notes we own compensates us well for the commensurate risk for such a stable cash flow generator.

We maintain a cautiously optimistic view regarding the prospects for economic recovery, and, in turn, for credit markets. We recognize that yields across the entire debt spectrum continue to breach all-time lows, but also believe that most high yield issuers will continue to improve earnings, albeit from a dismal trough. Bank of America Corp. recently reported that second quarter EBITDA for high yield issuers that have reported so far has improved 32% year over year.

Strong liquidity will likely continue to drive demand for anything with a coupon. We anticipate that high yield money managers will point to improving fundamentals, balance sheet deleveraging, and decent relative value as reasons to justify 3% junk bond yields. Nonetheless, the Intrepid team will continue to hunt for short-dated, high-yielding securities issued by credit-worthy companies.

Although we are very proud of how we have protected and grown our investor’s capital given the volatility of the past 18 months, we are even more excited about the way we are positioned for the future. At the end of the quarter, the portfolio had a yield-to-worst of 6.06% and an effective duration of 1.99 years. The investment team continues to turn over every rock in the pursuit of unique, exceptional credits.

Thank you for your investment.

Sincerely,

Mark F. Travis, President

Intrepid Income Fund Co-Portfolio Manager

Hunter Hayes

Intrepid Income Fund Co-Portfolio Manager