January 4, 2019

January 4, 2019

Dear Fellow Shareholders,

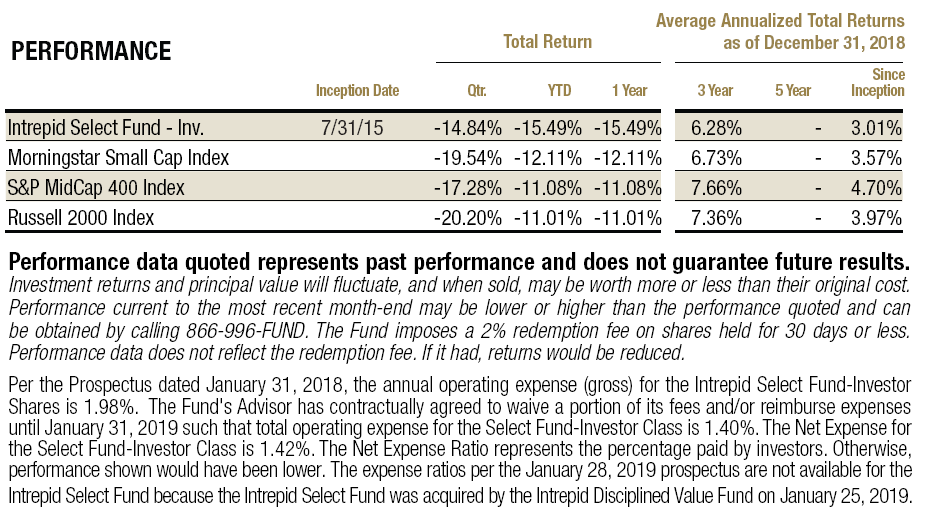

The fourth quarter of 2018 was painful for many small cap investors. Most major domestic indices entered bear markets and the Russell 2000 was no exception as it plummeted 20.20% in the quarter. The Intrepid Select Fund (the “Fund”) was not immune to the violent drop but fared better with a 14.84% decline.

This will serve as the final quarterly commentary for the Intrepid Select Fund. The Fund will be merging into the Intrepid Disciplined Value Fund on January 28, 2019. The final Net Asset Value will occur on January 25, 2019. Going forward, the Intrepid Disciplined Value Fund will have a similar mandate to that of the Select Fund, whereby it will primarily invest in domestic small and mid-cap equities with a cash target of no more than 10% of Fund assets. No action is required by shareholders of the Select Fund if you would like to maintain your cost basis and become a shareholder of the Disciplined Value Fund. If you have any questions, please do not hesitate to contact us.

October set the tone for the quarter with wild swings in prices amid increased volatility. November offered a glimmer of hope that there would be a so-called Santa Claus rally to follow, but December turned out to be one of the worst on record. Investors feared that a looming slowdown in growth may be met with rising interest rates due to monetary policy. At its December meeting, the Federal Reserve announced it was indeed increasing interest rates by 0.25% and signaled further increases may occur in 2019, which spooked markets and resulted in a deeper sell off into year end. In the days since, the Fed Chairman has tried to back track a bit with a more dovish tone. While this has helped buoy markets to start the new year, we are eager to hear commentary and outlooks from management teams when companies begin to report fourth quarter earnings in the coming weeks. A large deceleration in growth could again spook the markets as could the failure of a U.S./China trade deal to materialize.

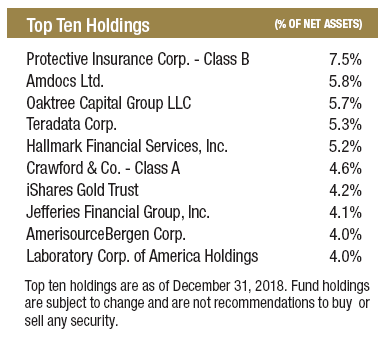

The top contributors to performance in the fourth quarter were Omnicom Group (ticker: OMC), Dollar Tree (ticker: DLTR), Party City (ticker: PRTY), and gold and silver ETFs. Omnicom operates in the advertising, marketing, and corporate communications business. Its clients include many Fortune 500 companies, as well as large international businesses. The industry has been under fire recently as advertising budgets have been cut and brands have shifted a larger portion of their spend to digital mediums. Omnicom has done a better job than many of its competitors in adapting to the new landscape. We like the resiliency the industry has displayed over many decades and the fact that Omnicom generates a large amount of free cash flow.

We have been owners of one or more of the publicly traded dollar stores at Intrepid for a long period of time. Dollar Tree operates under its namesake banner, as well as the Family Dollar brand, which it acquired a few years ago. The equity materially outperformed the market in the quarter, returning almost 11%. Its business tends to do well in recessions, which may be one of the reasons investors viewed it as a “safe haven” while the broader market sold off. In early January a well-known activist hedge fund disclosed a stake in the company and made public a letter it sent to the Board of Directors urging change. The two major changes it believes will unlock value are an outright sale of Family Dollar and for Dollar Tree to introduce price points above $1.00. We are advocates of the proposed changes and agree that the shares would likely re-rate if either or both are undertaken.

Party City is a new position for the Fund. The company is the largest party goods retailer in North America with about 900 locations. It isn’t just your average retailer, as its business is vertically integrated with wholesale and manufacturing operations as well. We purchased shares when it was trading for about 6x earnings after reporting disappointing quarterly results. The company is facing supply chain disruptions in China as importers race to make purchases ahead of a potential 25% tariffs. Labor shortages and higher freight costs negatively impacted the company, but we believe that these issues will be resolved in the near future.

The other unusual situation is a helium shortage that has resulted in prices 15% – 25% above normal. This may not seem like a big deal, but Party City has about 60% market share in metallic balloons. Helium shortages happen from time to time, with the last being in 2012-2013. Our view is that this too will be resolved soon.

Management has signaled their confidence by putting their corporate and personal money where their mouth is; not only did the company announce a $100 million share repurchase program, but the CEO recently purchased ~$1 million in shares in the open market. While the company carries a debt load that exceeds what we are typically comfortable with, it also generates a substantial amount of free cash flow, which will help to pay down debt in the coming years.

The top detractors in the quarter were Net 1 UEPS Technologies (ticker: UEPS), Protective Insurance Corp (ticker: PTVCB), and Laboratory Corp of America (ticker: LH). We substantially cut our position in Net 1 UEPS after it reported disappointing quarterly results. The situation is complex, so we would encourage you to read a more detailed explanation of the situation in the Intrepid International Fund’s commentary. The bottom line is that we think the shares are worth significantly more than where they are today, but it is not without risks that need to be weighed.

Protective Insurance continues to experience challenges in its commercial auto business. This is not a company-specific issue, as others in the business are experiencing similar issues. In response, Protective has been aggressively increasing rates, but that did not prevent it from recording a large adjustment to its reserves. It gets worse, as the CEO abruptly resigned in October, which added to a growing list of departures of executives and board members. The shares remain very cheap at only 64% of tangible book value, matching their trough valuation during the financial crisis. We contend that the shares are worth significantly more than where they trade today and were pleased when the company announced in October that it had formed a sub-committee to explore opportunities to maximize value, often a precursor to an eventual sale.

Labcorp had a rough fourth quarter as industry headwinds became too much to overcome. The company’s largest segment experienced a deceleration to almost flat organic growth driven by a slowdown in the consumer genetics business, 23andMe. The company lowered expectations for this year and next which sent shares lower. Labcorp’s main competitor was not immune to the industry headwinds and is experiencing similar growing pains. We are more cautious on shares now that organic growth in its diagnostics business is minimal as we are concerned that it may be structural in nature. That said, the Covance business is growing quickly and accounts for about 30% of operating income, which should help to offset some of the weakness in the core business.

The pullback in the market was broad and left few companies unaffected. We believe the steep selloff just before Christmas may have been exacerbated by normal year-end dynamics – traders and decision makers out of the office, and low trading volume, tax loss selling in some underperforming names, and fund redemptions causing forced sellers (particularly in some ETFs). As a result, we think some securities were unjustly punished. Right now, we are seeing more attractive opportunities than we have seen in a few years. We are busy combing through the rubble to find high-quality businesses at good prices. We look forward to checking back in next quarter.

Thank you for your investment.

Best Regards,

Mark Travis, President

Intrepid Select Fund Co- Lead Portfolio Manager

Clay Kirkland, CFA

Intrepid Select Fund Co-Lead Portfolio Manager

Matt Parker, CFA, CPA

Vice President

Hunter Hayes

Vice President