October 8, 2018

Dear Fellow Shareholders,

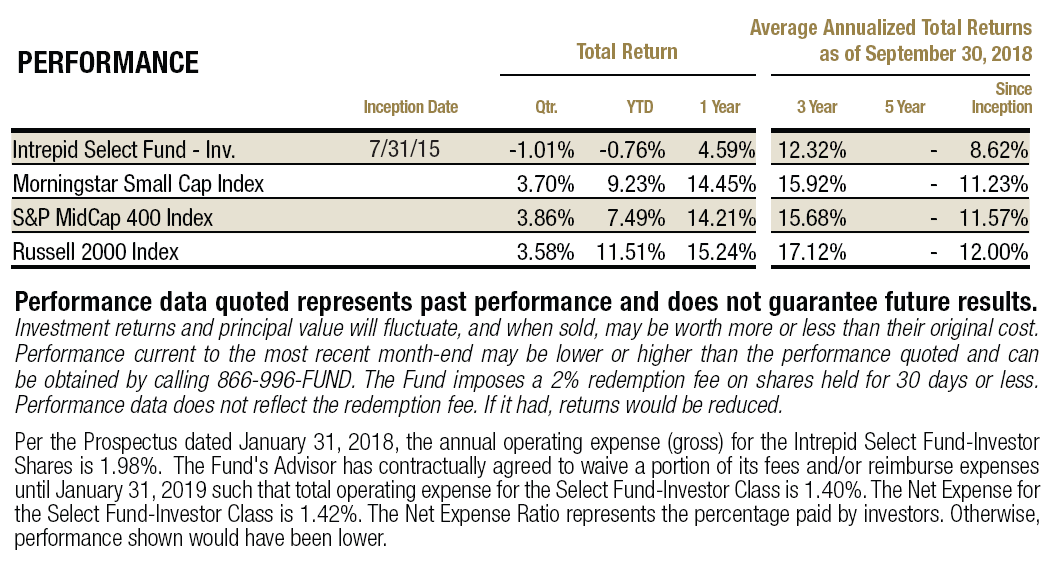

The third quarter of 2018 was another good one for small cap stocks. The Russell 2000 returned 3.58%, while the Morningstar Small Cap and S&P MidCap 400 indexes returned 3.63% and 3.86%, respectively. Small cap U.S. stocks have been a favored trade in 2018, as concerns over global trade relations have pushed investors toward smaller companies with less international exposure.

Yields have moved sharply higher and are now beginning to offer investors a more enticing alternative to equities. In addition, the performance of the Russell 2000 fell 2.41% in September, compared to an increase in the S&P 500 of 0.57% – the largest monthly divergence in four years.[1] With higher multiples and more leverage than large cap stocks, we have long held that small caps are not the safest place for investors to hide right now.

Another consequence of higher yields is that small cap companies will have a tougher time servicing the large debt piles they have accumulated during years of artificially suppressed interest rates and easy access to leverage. As of the writing of this letter, total net debt divided by total EBITDA of the Russell 2000 stood at 4.98x, or over one turn higher than at the tail end of the last bull market (2006-2007).

Augmenting the challenge that this mountain of debt creates for companies is the pervasiveness of variable interest rates. Earlier this year, Goldman Sachs analyst Jessica Binder Graham found that 42% of the debt owned by companies in the Russell 2000 carries floating interest rates, compared with just 9% for companies in the S&P 500.[2] These variable rates mean that small cap companies will feel an immediate squeeze on their income statements as rates lift. Many of these companies produce miniscule or negative operating profit and would have already been forced to restructure or exit the market in a more “normal” rate environment. We welcome market weakness and volatility that might come from a cyclical credit squeeze, as it should allow us to deploy capital at more attractive prices and higher expected returns.

With the above points in mind, we increased our position size in a handful of midcap holdings that have solid balance sheets and strong free cash flow generation. We also added a new midcap company to the portfolio, which will be discussed in more detail below.

Before getting into the performance, we wanted to note an important update about the management of the Intrepid Select Fund (“the Fund”). On September 10th, Jayme Wiggins was terminated as lead portfolio manager of the Fund. We are grateful for the efforts and discipline he contributed while at Intrepid and wish him all the best in the next chapter of his career. Unfortunately, the Fund’s performance over the last several years has not met our expectations. Mark Travis and Clay Kirkland, CFA, will now serve as co-lead portfolio managers of the Fund. Research analysts Matt Parker, CPA and Hunter Hayes are also part of the team for the Select Fund.

Importantly, there will be no major changes to the investment process and our rigorous approach to evaluating securities. However, we plan to employ more stringent qualitative parameters resulting in a tilt toward higher quality businesses that compound value over time.

For the quarter ended September 30, 2018, the Fund returned -1.01%. We are disappointed in the performance. The frustrating part is that most of the underperformance can be attributed to just a few positions. For the fiscal year ended September 30, 2018, the Fund returned 4.59%.

The Fund’s top three contributors for the quarter were Tetra Tech (ticker: TTEK), Syntel (ticker: SYNT), and Hallmark Financial Services (ticker: HALL).

Intrepid has held an equity stake in engineering services provider Tetra Tech since mid-2013, well before the Fund’s inception. The company has a solid management team that has compounded value over time, and the business is firing on all cylinders. It continues to see double digit top line growth across both government and commercial clients, as well as a steady stream of new contract wins coming into the backlog. Tetra Tech also reported rising margins and raised guidance, driving the stock to new all-time highs.

Syntel, which we have written about on multiple occasions, has been a strong performer for the Fund. We had been trimming our position as shares appreciated materially this year until it was announced on July 22nd that Atos S.E. would be acquiring the company for $41 per share. The deal closed early in the third quarter, so it is no longer held in the portfolio.

Hallmark reported a second consecutive quarter of underwriting profit, following several quarters of rough underwriting results in 2017. Poor results have stemmed from Hallmark’s commercial auto insurance division. The challenges have been industrywide, but there are signs that conditions are improving. Insurers in this market niche have been aggressively hiking rates and some competitors have retreated from the market. The industry tends to be cyclical, so we expect results to gradually improve. The stock is trading at a discount to tangible book value, and we continue to believe it is an attractive place for our capital.

The Fund’s top three detractors for the quarter were Western Digital (ticker: WDC), Net 1 UEPS Technologies (ticker: UEPS), and Protective Insurance Corporation (ticker: PTVCB, FKA Baldwin & Lyons).

Western Digital shares have fallen by almost 50% from their peak in March, making it one of the cheapest securities in the S&P 500 despite its strong balance sheet and free cash flow generation. Its business is divided into two parts: HDD (hard disk drives) and NAND memory, which can be used in many applications including solid state drives. Revenue is about equally spilt between the two businesses, but NAND carries a much higher margin. The two technologies are substitutes in many instances with each having its own set of strengths and weaknesses. HDDs are much cheaper on a per gigabit basis but lack the performance capabilities of NAND. When NAND prices are high demand for HDDs increases, and vice versa.

Despite what we consider a hedge of sorts, investors only seem to care about the NAND business and more specifically, where NAND pricing is going moving forward. Unfortunately, pricing weakness started to show up much sooner than management had communicated to investors. It has continued to be the case up through the most recent quarter and has caused a dramatic sell-off in the price of the stock.

Fundamentally, the company is doing quite well. The HDD business is exceeding expectations and the NAND business is still wildly profitable. The company is generating massive amounts of free cash flow and continues to grow its operations. Investors worry that this memory cycle will be like past memory cycles which have seen material swings in pricing. We do not believe this will be the case. We are in the midst of a secular trend of increased demand for memory chips and view Western Digital as well positioned within the marketplace.

Net 1 UEPS Technologies (UEPS) reported its fiscal year results a few weeks ago. It’s been a volatile year for UEPS shares as the company prepared to end its long-held contract with the South African Social Security Agency (SASSA). As of October 1, the contract is no more. After years of negative publicity, extensions, and uncertainty about the replacement vendor, we view the completion of the welfare distribution contract as a net positive that will allow management to focus on the company’s bright future. UEPS’ fast-growing EasyPay Everywhere (EPE) banking offering will offset much of the foregone revenue, and our hope is that UEPS will no longer be the South African media’s scapegoat for the myriad issues plaguing SASSA.

Just before writing this, the Supreme Court of Appeal of South Africa ruled in UEPS’ favor to continue letting grant recipients choose any bank account they like to receive their grant payments. Furthermore, recipients can transact freely with any service provider, utilize the full functionality of their bank accounts with the money from those grant payments. This bodes well for EasyPay Everywhere (EPE), as grant recipients can continue receiving grant money in their EPE accounts and, in turn, utilizing UEPS’ vast financial services infrastructure. That infrastructure includes the most extensive distribution network of mobile and fixed ATMs in South Africa (~2,000) and access to services like microloans, life insurance, prepaid utilities, telecommunications products, and other offerings typically not available to the unbanked. As of 6/30/2018, there were ~2.9 million EPE account holders.

In addition to its core South African business, our investment in UEPS is reinforced by the company’s balance sheet and ownership of KSNET Inc., one of the largest South Korean payment companies. The combined value of those balance sheet investments and KSNET, even without the core business, is well above UEPS’ current stock price. Once the company proves its South African business can thrive despite the SASSA contract expiring, we are confident that the market will recognize the value in UEPS.

Baldwin & Lyons changed its name to Protective Insurance Corporation in August in order to align the holding company name with the name of the underwriting subsidiary. There were no major developments for the company during the quarter, and we believe the company will benefit from a cyclical recovery in commercial auto insurance. In the meantime, the stock continues to offer an attractive dividend yield near 5%.

A new position we would like to highlight is Madison Square Garden (ticker: MSG). MSG is the owner of many iconic sports, real estate, and entertainment assets. The most valuable assets include the New York Knicks, New York Rangers, and, of course, the famed Madison Square Garden arena. Our base case uses the latest Forbes estimates for the value of the sports franchises. We view this as conservative since NBA transactions have historically taken place at significant premiums to Forbes’ estimates. In fact, the last eight NBA transactions have come at a 32% premium on average, and this excludes the Los Angeles Clippers sale which was at a ~250% premium. Additionally, recent steps to legalize sports gambling should only help to increase the value of professional sports teams.

Another quality we like is the fact that professional sports team valuations have not historically been very sensitive to business cycles. Valuation for professional sports teams have historically held up well during recessions as billionaire owners do not sell teams at fire-sale prices. For example, the Knicks’ value only fell by 4% in 2009.

Another layer of conservatism in our estimates involves the real estate value of Madison Square Garden. We assume the building and land are worth $1 billion, which is right in line with the latest tax assessment. Macy’s, which is located just around the corner on a parcel of land about half the size, has been valued by market professionals at $3.3 billion. We acknowledge the buildings are completely different and have different uses, but we suspect the gap between the two is much too large.

The company recently announced that it plans to spin off the sports assets from the entertainment and real estate assets in 2019. We believe this will help unlock value, as investors are often reluctant to assign appropriate values to unrelated assets owned by a single holding company. The shares are currently trading at a significant discount to our conservative estimate of the sum-of-the-parts value of the assets.

We appreciate your investment in the Fund.

Best Regards,

Mark Travis, President

Intrepid Select Fund Co-Portfolio Manager

Clay Kirkland, CFA

Intrepid Select Fund Co-Portfolio Manager

Matt Parker, CPA

Research Analyst

Hunter Hayes

Research Analyst

[1] Liu, Evie. “Small-Cap Stocks May Be Sending a Bear-Market Signal.” Barron’s. 3 Oct 2018.

[2] Arends, Brett. “Unseen Dangers in Small-Cap Stock Rally.” Barron’s. 20 Jan 2018.