October 5, 2018

October 5, 2018

Dear Fellow Shareholders,

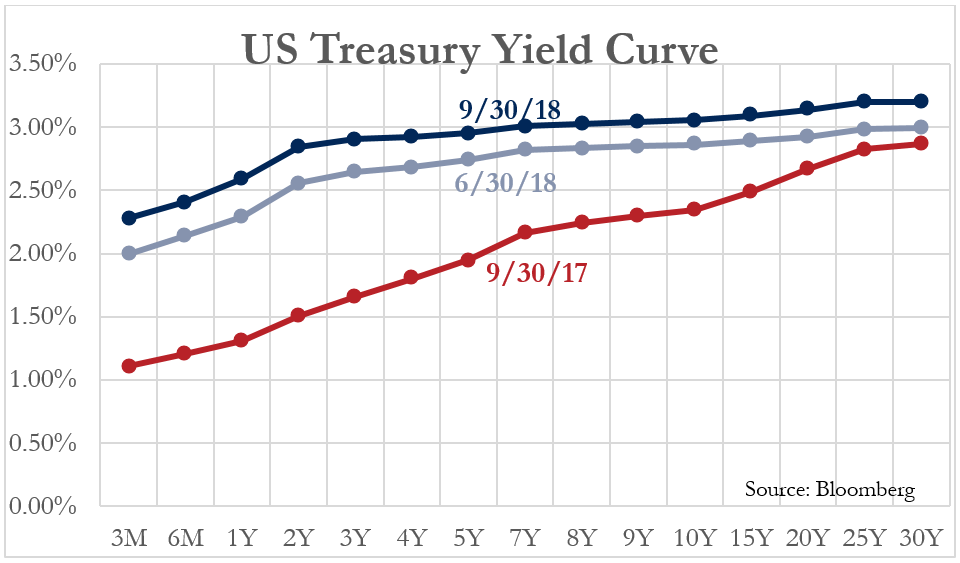

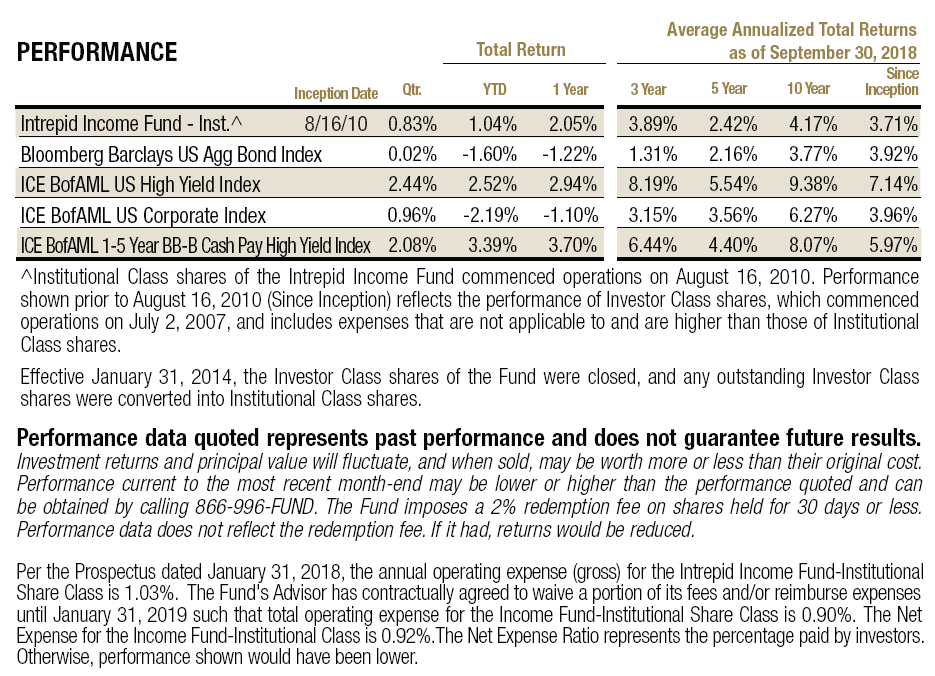

The domestic fixed income markets produced mixed results in the quarter ended September 30, 2018. The U.S. Treasury curve continued to shift higher across all maturities, resulting in lower bond prices. However, exposure to credit risk was highly rewarded. The Bloomberg Barclays US Aggregate, which is a broad measure of the investment grade fixed income market in the United States, eked out a 0.02% gain. The Aggregate’s relatively high exposure to US Treasury and agency securities meaningfully detracted from the index’s return but was more than offset by the positive impact of credit exposure.

Investment grade corporate bonds returned a respectable 0.96% after a tough first half of the year, as measured by the ICE BAML US Corporate Index. The lower quality ICE BAML US High Yield Index rallied an impressive 2.44%. Given the Intrepid Income Fund’s (the “Fund”) shorter duration and higher quality biases, we also cite the performance of the ICE BAML 1-5 Year BB-B Cash Pay High Yield Index, which returned 2.08% in the quarter. Weaker credit quality generally produced the best returns in the quarter, led by CCC-rated issues.

The Income Fund returned 0.83% in the third quarter. Nearly half of the Fund’s assets were invested in short-term investment grade bonds that we believe will produce attractive risk-adjusted returns relative to Treasury bills, but will certainly underperform lower-rated issues in risk-on environments like the third quarter. Furthermore, our high yield holdings are generally on the higher end of the quality spectrum and therefore do not experience as much appreciation during strong periods as the high yield indexes. The Fund did not have any material contributors or detractors in period. For the most part, the Fund clipped coupons for three months. We have no qualms with the lack of fireworks and are perfectly happy taking our coupon and principal payments on schedule, particularly in what may be the later innings of the cycle.

The Fund’s fiscal year, which ended September 30, 2018, was a bit more eventful. Treasury yields have exploded higher across the yield curve, and particularly at the front end, as the Federal Reserve has marched the overnight lending rate above 2%. The long end of the curve has shifted upwards to a lesser degree, but the higher interest rate sensitivity has led to a significant sell-off in longer-dated investment grade bonds.

Investment grade corporate credit was essentially flat over the last twelve months, but higher coupon rates helped to offset some of the market value decline. The US Corporate Index lost 1.096% in the period. On the other hand, high yield bonds performed quite well due to economic strength and desire for investors to own risky assets. The High Yield Index gained 2.94% over the last twelve months, and the 1-5 Year BB-B Index returned 3.70%. The Intrepid Income Fund gained 2.05%. The Fund’s allocation to high yield credits averaged less than 50% over the last year.

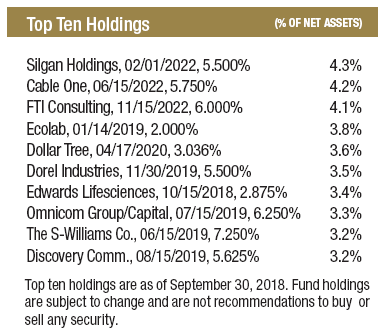

Primero Mining convertible notes, FTI Consulting 6% due 11/15/2022, and Silgan Holdings 5.5% due 2/01/2022 were the three largest contributors to the Fund’s performance in the twelve-month period, although most of the Fund’s large high yield positions were material contributors. Primero has been discussed in several past letters. The distressed junior miner was purchased earlier this year by First Majestic Silver, which repurchased our bonds at par value. FTI and Silgan are two of the Fund’s largest positions, and both outperformed the high yield benchmarks over the last year.

There were two material detractors that we have written about in past quarters. Retail Food Group common stock (ticker: RFG AU) and Corus Entertainment common stock (ticker: CJR/B CN) significantly impacted our performance in the last twelve months. Rather than reprint our previously recorded thoughts, we refer readers to our first and second quarter commentaries for indepth discussions on these holdings. At the time of this writing, our decisions to liquidate both of these securities appear to be well-founded. Neither business’ prospects have improved, which has translated into further price declines in the shares. Both securities have fallen roughly 50% since we exited the positions.

Several of the Fund’s short-term investment grade bonds matured in the third quarter, including two of our longer-term holdings in Dillard’s and Expedia. These issues outperformed similar maturity Treasury securities by three to four times. The maturing issues were replaced with investment grade bonds maturing in the next two to ten months. We believe opportunities are still present in the front end of the investment grade yield curve, but overall BBB credit quality appears relatively weak. We are carefully assessing credit quality and liquidity now that the three-month Treasury bill offers a yield of 2.15%.

We initiated positions in two bonds issued by Wyndham Destinations (WYND), the world’s largest timeshare business with over 220 resorts and nearly 900,000 members. Formerly known as Wyndham Worldwide, the company recently spun off Wyndham Hotels and sold its European vacation rentals business to become a pure-play timeshare operator. While the sale of timeshares is quite obviously cyclical, a significant portion of Wyndham’s earnings stream is derived from services that appear to be recession-resistant. Greater than half of the firm’s timeshare sales are generated from existing customers upgrading their vacation packages, for example, adding an additional week’s stay. Upgrade revenue proved to be much more resilient in the 2009 recession. Wyndham also provides financing to timeshare buyers that also performed relatively well during the financial crisis. After the timeshare sale is completed, Wyndham provides property management services that are required regardless of the economic cycle.

Wyndham’s earnings power is further bolstered by its ownership of RCI, the world’s largest timeshare exchange network. Timeshare owners pay around one hundred dollars a year to be a member of the network, which allows them to exchange their timeshares for stays at over 4,000 properties across the globe. RCI has 3.9 million members. While growth has been hard to come by, the exchange business is extremely stable and produces generous free cash flow. Wyndham has reported just one quarter as a standalone company since the spin-off was completed, but we believe pro forma EBITDA will exceed $950 million, placing leverage at under 3x. Management has pledged to reduce debt by $400-$500 million over the next three years. We purchased two Wyndham Destinations bond issues in the quarter – one maturing in 2021 and the other in 2023. In our opinion, the issues will prove to be attractive shorter-duration holdings.

Since the end of the quarter, U.S. Treasury yields have continued to spike. The benchmark 10-year yield broke through 3.2% in the first week of October, the highest level since early 2011. The consensus projection is that the Federal Reserve will continue to consistently raise rates through next year.

We are pleased with the Income Fund’s performance in such an environment and believe our opportunity set is becoming more attractive. The portfolio is well constructed and will enable us to redeploy cash from maturities into higher-yielding securities. With that said, we continue to see signs of excess in the credit markets, including the ballooning size of the BBB-rated bond market, historically high leverage ratios across ratings, and the loosest covenants in history.

A recent Bloomberg article noted that the absence of covenants is so common that the presence of them may actually be a red flag for investors. While we find these top-down perspectives to be interesting, they do not direct our investment strategy. We do not deploy capital based on the valuations of entire markets, and we will not pretend to be able to forecast the direction of interest rates. We will continue to follow a bottom-up process to identify attractive fixed income investments and apply rigorous fundamental analyses when underwriting credits.

Thank you for your investment.

Sincerely,

Jason Lazarus, CFA

Intrepid Income Fund Portfolio Manager