30-Day Subsidized SEC Yield: 7.06%; 30-Day Unsubsidized SEC Yield: 6.78%

January 5, 2021

“Three things ruin people: drugs, liquor, and leverage.” -Charlie Munger

Dear Fellow Shareholders,

Taking on debt is like gaining weight – easy to put on but hard to take off. The past year has been an all-you-can-eat buffet for corporate debt issuers, happily catered by grinning investment bankers. All in all, high yield borrowers issued $436.5 billion of new debt in 2020, 61% more than in 2019 and over 100% more than in 2018, according to RBC Capital Markets.

Meanwhile, profitability for those issuers has cratered. On an adjusted basis, the median leverage multiple for a high yield issuer after 3Q20 earnings stood at 4.8x, according to CreditSights. Bear in mind that adjusting profitability is like buying pants that are a couple waist sizes too small. Pro forma for that diet, maybe they will fit… but you should probably not depend on it.

At year end, the ICE BAML US High Yield Index (the “High Yield Index”) had a yield-to-worst of just 4.24%. We lamented a year ago about how little yield existed to pay investors for myriad risks. Now there is less yield and even more risks, in our opinion.

While we are reminiscing, this time last year we wrote that “we cannot predict when or how this market bonanza fueled by cheap debt and monetary stimulus will end.” Indeed, a global pandemic was not what we were expecting to throw capital markets into momentary chaos. But then again, it almost never is what one expects.

Once again, we have no idea what will shake things loose in the high yield market now that spreads are back at all-time lows and leverage is higher than ever. The stumbling block could be inflation, vaccine distribution issues, or even civil unrest.

However, we do believe that the Intrepid Income Fund (the “Fund”) has a leg up in this picked-over market because of our bias towards smaller debt issues, willingness to lend to capital-constrained industries, and limited duration skew.

The Fund is comprised of mainly smaller, sometimes unrated debt securities. We believe these securities are often overlooked by larger fixed income investors, resulting in meaningful spread pickup. We have even found situations where two nearly identical bonds from the same issuer have significantly different yield profiles, with the smaller bond yielding significantly more. We have also found attractive opportunities in the busted convertible bond market. To source these credits, we have developed deep relationships with several broker-dealers that specialize in smaller-issue debt.

We also look for creditworthy companies in industries that are capital constrained, as we believe this can give us the ability to demand higher interest and/or attractive terms. In some cases, we are instrumental in constructing the credit documents. We usually look for situations where these companies have a meaningful path to a lower cost of capital.

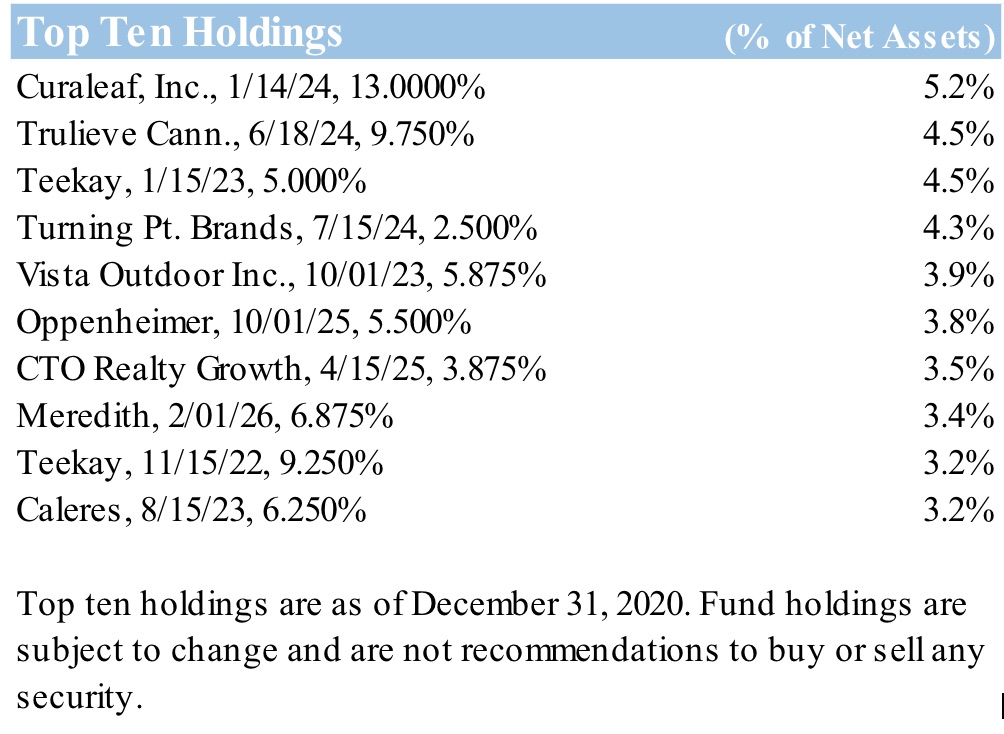

A great example of a capital constrained industry with a path to a lower cost of capital is cannabis. Over a year ago, we lent money to the largest cannabis company in the United States by market capitalization, Curaleaf Holdings. The loan paid a 13% coupon, which we believed more than compensated us for the risks. Over the past year, the company has exceeded expectations and now carries only two turns of net leverage.

That loan, which was issued at 97 cents on the dollar, now trades hands at 109 cents on the dollar, and we have enjoyed a year’s worth of 13% interest on our initial capital. What is more, Curaleaf just raised additional capital at a 10.25% interest rate, significantly lowering their cost of debt. We believe the original loan will be refinanced next year at the first call date as more investors flock to the sector.

Opportunities like Curaleaf require a prodigious amount of work. We spent hundreds of hours learning about the cannabis industry, met with the management team several times, flew to Massachusetts to tour one of the company’s many cultivation facilities, and spoke to countless industry experts. However, once we were comfortable, we were able to take a significant weight in the loan which helped bolster the Fund’s performance. We believe the ability to do this type of specialized work in underfollowed or out-of-favor industries is a huge differentiator for our Fund and makes us unique.

In addition to cannabis, we continue to find additional opportunities in sectors like energy, specialized financing, and gaming. In our view, these situations can offer a much better risk-adjusted return than the vanilla high yield market, which is yielding significantly less on average.

We like to lend money for short amounts of time, as we believe our ability to forecast greatly diminishes beyond 2-3 years into the future. Limiting duration is also a way of hedging for potentially rising rates and/or inflation. The lower the duration, the quicker we get our cash back and the sooner we can redeploy it. Furthermore, our lower duration allows us to be nimble when there is a dislocation in the market, like last spring when we redeployed nearly a third of the entire Fund into better market opportunities. The Fund’s effective duration at the end of the fourth quarter was 1.79 years compared to 3.67 years for the High Yield Index.

By cautiously deploying capital where others will not, and by limiting the amount of time our capital is lent, we believe we have built a robust portfolio that is well positioned regardless of whether we have more market complacency or volatility.

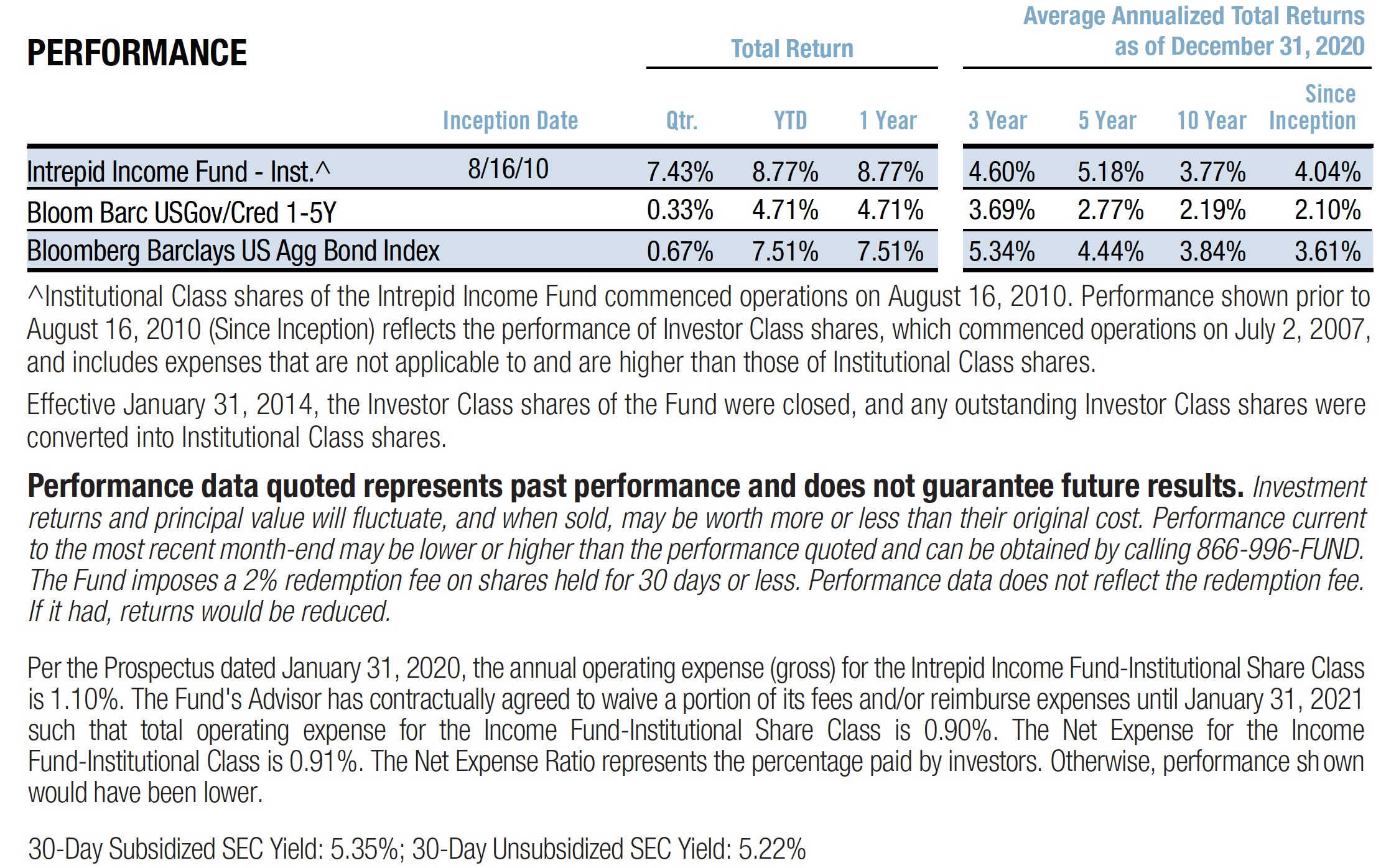

We are pleased with our recent performance. The Fund returned 7.43% in the fourth quarter, one of its best quarters ever. The High Yield Index increased 6.48% over the same period. The Bloomberg Barclays U.S. Gov/Credit 1-5Y TR Index returned 0.33% and the Bloomberg Barclays US Aggregate Bond Index returned 0.67% during the quarter.

The Fund’s top contributors for the quarter were Turning Point Brands 2.5% due 7/15/2024, WisdomTree Investments, Inc. 4.25% due 6/15/2023, and Meredith Corporation 6.875% due 2/01/2026. The Fund had no material detractors in the quarter.

We had five bonds that were either called or matured during the quarter. Most of our purchases and sales were limited to positions we already owned.

Despite the risks that lie ahead for our country and the world, we remain optimistic that driven people will continue to find creative solutions to difficult problems. We will try our best to do the same while protecting your hard-earned capital.

Thank you for your investment.

Sincerely,

Mark F. Travis, President

Intrepid Income Fund Co-Portfolio Manager

Hunter Hayes

Intrepid Income Fund Co-Portfolio Manager