April 4, 2017

Dear Fellow Shareholders,

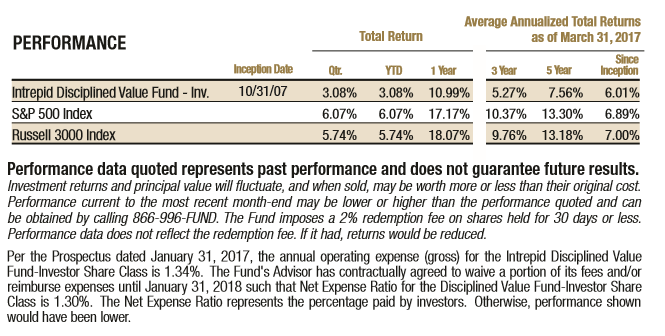

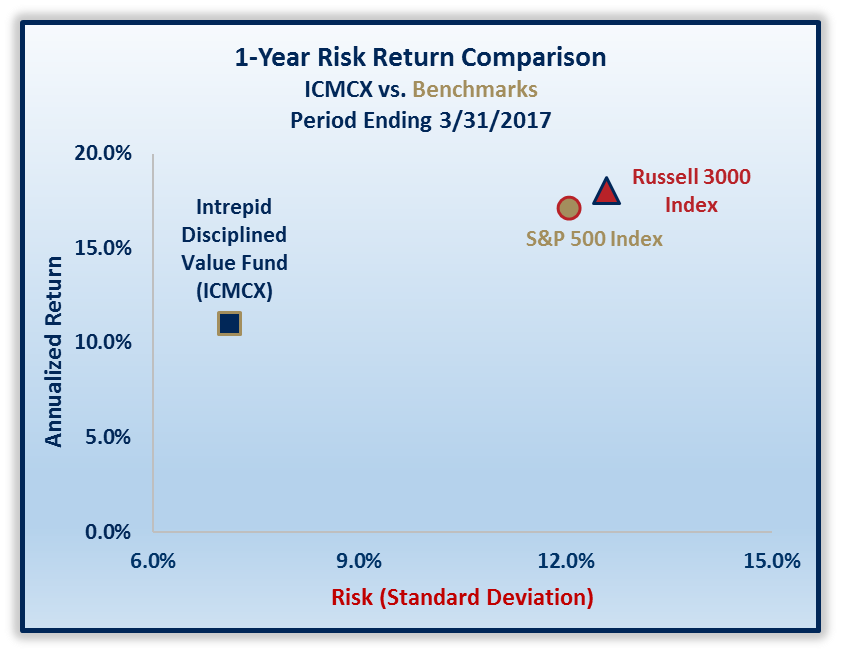

We are pleased to announce the performance of the Intrepid Disciplined Value Fund (the “Fund”) for the quarter and six-month periods ending March 31, 2017. For the quarter, the Fund increased 3.08%, which brings the return to 5.03% for the first six months of the fiscal year, which commenced September 30, 2016. For comparison, the returns of the S&P 500 Index and the Russell 3000 Index for the quarter were 6.07% and 5.74%, respectively. For the six-month period, the S&P 500 Index and the Russell 3000 Index returned 10.12% and 10.19%, respectively. Considering that the Fund held 52.2% in cash at the end of the period and cash has been at a consistently high level over the last several periods due to the challenge of finding high-quality businesses at what we consider a discount to intrinsic value, we believe the Fund has performed well with less risk than the benchmarks in this continued bull market.

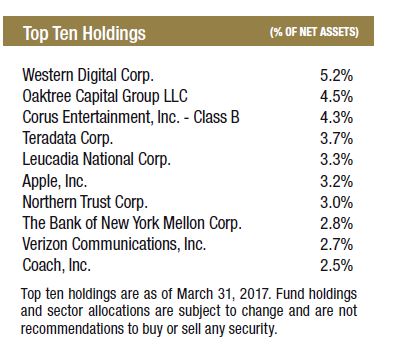

The Fund’s five largest contributors during the quarter were Western Digital (ticker: WDC), Oaktree Capital (ticker: OAK), Apple (ticker: AAPL), Teradata (ticker: TDC), and Coach (ticker: COH). The Fund’s five largest detractors for the quarter were Dundee Corp. (ticker: DC/A CN), Verizon (ticker: VZ), Contango Oil & Gas (ticker: MCF), Telephone & Data Systems (ticker: TDS), and Western Union (ticker: WU). Contributors to the Fund for the six-month period were Western Digital, Northern Trust (ticker: NTRS), Leucadia National (ticker: LUK), Apple, and Oaktree Capital. Detractors to the Fund for the same period were Dundee, Contango Oil & Gas, Verizon Communications, Alamos Gold (ticker: AGI), and Baldwin & Lyons (ticker: BWINB).

As you know from any recent communication from Intrepid Capital, we believe prices continue to be high, with the current trailing price-to-earnings ratio (P/E) of the S&P 500 north of 21x. The Fund has ample cash reserves if something were to go “bump in the night.” To be fully invested today assumes there will be no better opportunity tomorrow. Since we are stewards of your hard-earned capital, our goal is to first protect and then strive to grow what has been entrusted to us. Between the cash in the Fund and a now more global reach in our equity search than when the firm began, we hope to find more suitable investments in the days ahead, enabling us to put some of the cash to work.

There are changes afoot with the Fund going forward. Effective March 31, 2017, Gregory Estes, CFA, resigned from Intrepid Capital Management. After 16 years of working closely with Greg, I will miss his keen intellect and sense of humor. His departure is almost a calling from the Catholic Church. Greg was raised in Jacksonville, FL, receiving his early and high school education in local Catholic schools before heading off to Notre Dame for his undergraduate degree, then returning to attend the University of Florida for his graduate degree. He has continued his involvement with the Church over the years. Greg is moving to a local asset management firm which works with the local Diocese and will help them pursue other opportunities of this kind. We wish him well with his new adventure and appreciate his work here at Intrepid Capital. The two of us have a lunch bet on the outcome of the UGA v. Notre Dame football game, September 9th in South Bend. The outcome will be known by our fiscal year end September 30th, so stay tuned.

Assisting me in the role of lead portfolio manager of the Disciplined Value Fund are two analysts who both started here as summer interns between their undergraduate and graduate coursework. Clay Kirkland, CFA, was an All-American swimmer at Auburn University and completed his MBA at Columbia University. Prior to joining Intrepid Capital in 2012, he worked at UBS in New York City. Matt Parker, CPA, interned with us for two summers while earning his undergraduate and graduate degrees at the University of North Carolina at Chapel Hill. After he earned his Master of Accounting degree, Matt worked in the audit practice of EY in Atlanta. In 2014, Matt returned to Jacksonville to join Intrepid Capital and is currently a Level II candidate in the Chartered Financial Analyst® program. With my 32 years of “wisdom” in the investment management business, coupled with their collective skills and intellect, I am confident this will be a productive combination, and we will continue with our goal of providing attractive risk-adjusted returns to our shareholders. We thank you for your investment and your continued confidence in our process.

Best regards,

Mark Travis

President

Intrepid Disciplined Value Fund Portfolio Manager