July 1, 2023

Dear Fellow Shareholders

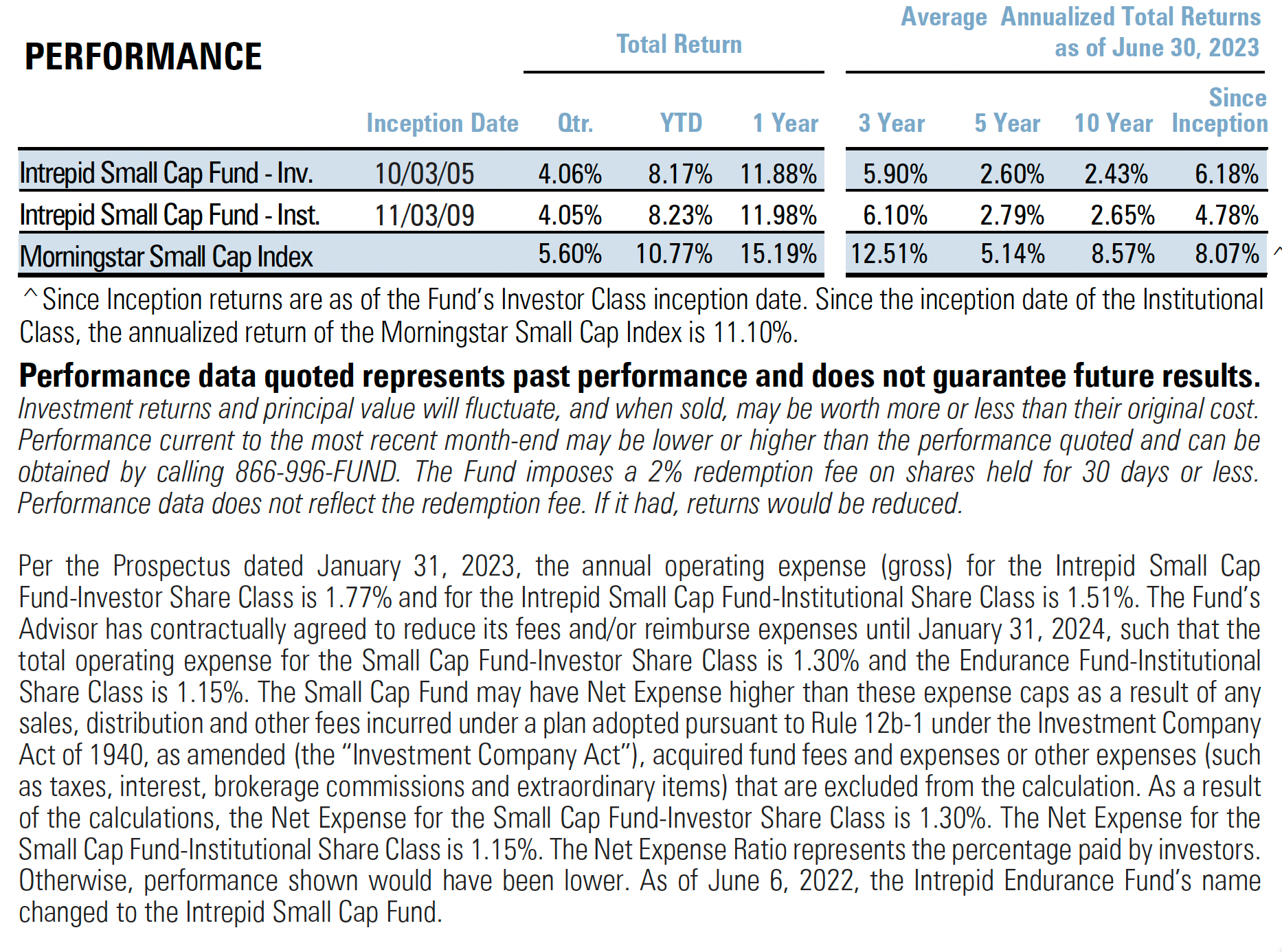

This past quarter was one of the milder periods for the small cap market in recent memory. While small cap stocks (as measured by the Russell 2000 Index) were negative for most of April and May, they rallied sharply in June to return just over 5% during the second calendar quarter of 2023. The Intrepid Small Cap Fund (“the Fund”) returned 4.06% during the same period.

In the first half of the calendar year, the Intrepid Small Cap Fund returned 8.17% versus 8.06% for the broad small cap market and 10.77% versus the benchmark Morningstar Small Cap Index.

Despite the more subdued price action, the news flow related to the markets and economy continues to be frantic. Continuing concerns about inflation, a banking crisis, commercial property distress, rising and falling interest rates, and a potential geopolitical coup in Russia all have supplied the financial media with plenty of things to worry about.

Speaking of which…as the quarter ended, interest rates started to flare higher again. Since the Federal Reserve (“Fed”) began hiking rates in early 2022, rate increases have typically resulted in stocks selling off (e.g. Q3 2022). This time, however, stocks appear to be reacting positively to this news (based on the strong index returns in June).

We continue to leave the macro forecasting to others. Instead, we remain focused on finding high quality small cap companies at attractive valuations.

If anything, we try to use investors’ concerns about the market (or certain segments of it) and economy as opportunities to add positions that are being discarded or ignored due to these fluctuating fears.

In the recent past, that included establishing new positions that had “higher but manageable” debt loads as they sold off heavily in response to rising rates. Last quarter, we discussed our purchases of Armstrong World (AWI) and Vector Group (VGR) in that context.

In calendar Q2, the artificial intelligence (AI) trend captured the market’s attention, creating skyrocketing valuations for some players and a free fall in stock price for those companies that investors believe will be negatively impacted.

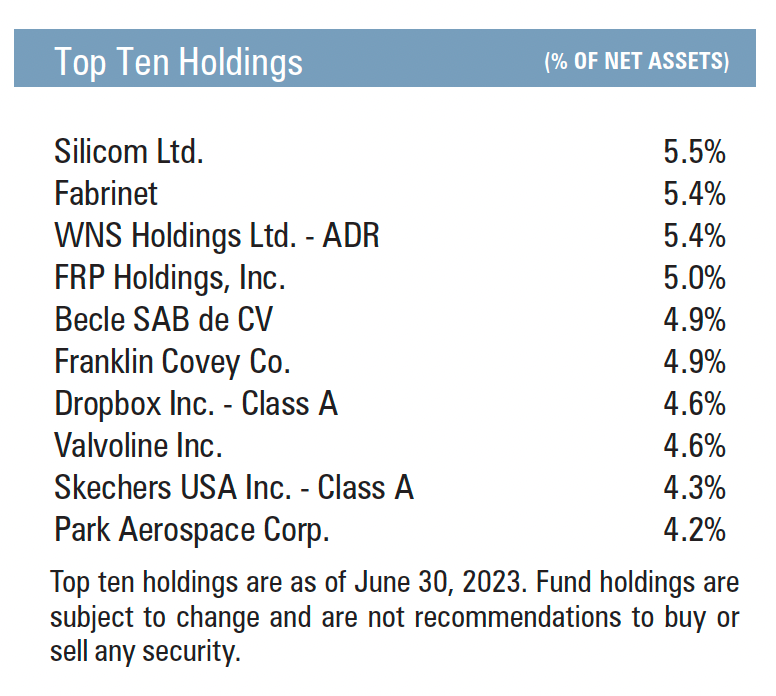

We used this to our advantage by adding to our existing position in WNS Holdings Ltd. (WNS) and initiating a new position in Keyword Studios (KWS LN), which the Fund held from 2019-2022 but sold when the price exceeded our valuation estimate. The market punished companies during Q2 that provide outsourced business services based on the premise that their customers will begin to use AI to automate many of the tasks these outsourcers perform. Our research, and the history of these industries, suggests that well-managed outsourcers are the early movers on major technological changes and end up being the ones that implement these new capabilities into their customers’ businesses. If this remains the case for AI, we expect these two companies to see expanding business opportunities as their customers begin to utilize AI instead of what the market clearly thinks will be a significant decline in their business (based on the recent price action).

WNS is an Indian-based business process outsourcing (BPO) business that provides a number of non-core services to its client base. Keywords Studios is the largest outsourcer for the video game industry, performing a number of functions for major game publishers. Both companies are market leaders in their respective niches and extremely well-managed. In addition, both have pristine balance sheets. We believe the market’s perception of the impact of AI on these two companies is likely wrong and has created very attractive opportunities. To be clear, this is not an anti-AI bet. We are believers that AI will be impactful in corporate America, we just disagree with the market’s assessment that it will hurt these two specific companies. In fact, we think they are more likely to benefit from it.

Top Contributors in Q2 2023 Top Detractors in Q2 2023

Dropbox Inc., Class A (DBX) WNS Holdings LTD (WNS)

Franklin Covey Co. (FC) Becle SAB De CV (CUERVO MM)

IAC Interactive Inc. (IAC) Acuity Brands Inc. (AYI)

As for overall positioning and performance, we are reasonably pleased with the results in the first half of the calendar year. Returns on individual holdings in the Fund were sporadic – some positions were up significantly and others were down significantly. In some ways, we would expect to have done a little better given how well-positioned we were for the banking crisis in March (very few financial positions). Conversely, some of our largest and highest-conviction holdings – that have reported very satisfying results of late – have been our worst performers in terms of stock price.

With that context, we are frustrated by these positions not reacting well to good results, but relieved that returns have been strong enough elsewhere in the Fund to still generate an attractive return as we wait for the market to recognize the value of our top holdings.

We will continue to stay flexible and try to take advantage of what the market offers. Thank you for your investment.

Thank you for your investment.

Matt Parker, CFA, CPA

Intrepid Endurance Fund Co-Portfolio Manager

Joe Van Cavage, CFA

Intrepid Endurance Fund Co-Portfolio Manager