January 9, 2020

Dear Fellow Shareholders,

All is well! It is amazing how much can change in the public markets in such a short period of time. The fourth quarter of 2018 feels like an eternity ago when you consider how sentiment, monetary policy, and the returns of indices have reversed since then. The fourth quarter of 2019 could not have been more unlike that of 2018. Indices experienced very little volatility in the quarter as they rocketed higher capping off the best year since 2013.

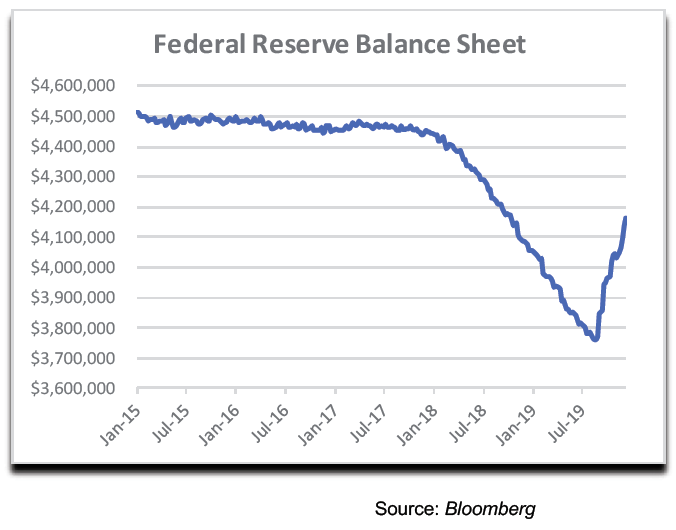

The Federal Reserve had already telegraphed that it would be patient and accommodative with interest rates going forward, but it upped the ante on October 4, 2019 when it announced it would extend and expand the “temporary” repurchase operations (“repo”) it had begun in September through at least January of 2020. A similar situation took place in 1999 when the Fed’s balance sheet expanded as it  supplied record amounts of repo ahead of the feared Y2K glitch. In 1999, it helped send the Nasdaq 100 Index up about 50% in the fourth quarter while the S&P 500 Index was up a more modest ~15%. Fast forward to 2019, and we saw a similar effect, albeit not to the same degree.

supplied record amounts of repo ahead of the feared Y2K glitch. In 1999, it helped send the Nasdaq 100 Index up about 50% in the fourth quarter while the S&P 500 Index was up a more modest ~15%. Fast forward to 2019, and we saw a similar effect, albeit not to the same degree.

The Federal Reserve announced on October 11th that it would begin purchasing Treasury bills at a rate of $60 billion per month in the open market in order to maintain ample reserve balances. This program is scheduled to run at least into the second quarter of 2020.[1] While many people consider this to be a form of QE (quantitative easing), Jerome Powell was quick to say otherwise. Call it what you want to call it—the Fed’s balance sheet is now rapidly expanding. And that tends to be good for equity markets.

Markets again cheered on October 11th when President Trump announced the U.S. and China had reached a tentative agreement for the first phase of a trade deal. As if “not QE” and a trade deal weren’t enough, the Fed cut the Federal Funds rate for the third time in late October, breathing life into many of the growth stocks that were battered last quarter.

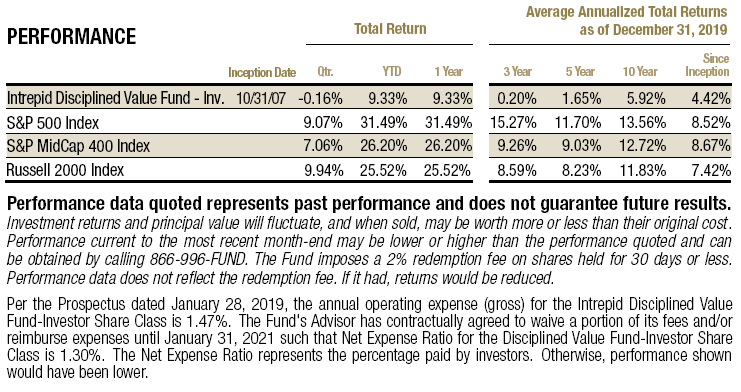

The Intrepid Disciplined Value Fund (the “Fund”) was down 16 basis points in the fourth quarter compared to 7.06% for the S&P 400 Mid-cap index, 9.07% for the S&P 500 index, and 9.94% for the Russell 2000 index. Much of the underperformance can be attributed to a rough earnings season. In fact, it was worse than rough. We cannot recall a time where we had as many securities with large (10%+) drops on earnings announcements that were clustered all within a few weeks. Making matters worse, most of these securities were top positions in the Fund.

How could you not see it coming? It is a fair question. Stocks can drop significantly for a plethora of reasons, more than most readers would care to hear. Sometimes you can use data to shed light on intra-quarter trends and formulate a view on how the quarter is shaping up. Other times, there may be a major announcement or strategy change in conjunction with earnings that no investor could have discerned. We do not attempt to predict how a stock will react to each quarterly earnings report. Rather, we take longer term views on businesses and focus on those that we believe will grow and increase in value over a multiyear period all while generating strong free cash flow. In a world of immediate gratification, it is hard to preach patience, but that is what is required as an investor—businesses hit bumps in the road.

We added three new positions in the quarter: IAC/InterActiveCorp (ticker: IAC), Alpine Income Property Trust (ticker: PINE), and Etsy Inc (ticker: ETSY).

IAC/InterActiveCorp is a conglomerate with a long history of value creation. It has owned and spun off businesses like Expedia, TripAdvisor, LendingTree, Home Shopping Network, Ticketmaster, and more. The company currently has an 81% ownership in Match Group and an 84% ownership in ANGI Homeservices. It also has a portfolio of other businesses like Vimeo and Dotdash, among others, that generate around $1.5 billion in annual revenue. We purchased IAC after the shares of both ANGI Homeservices and Match Group had fallen materially. At the time of our purchase, the market value of IAC’s stakes in those two businesses were worth over $1 billion more than IAC’s market value. In other words, the market was assigning a large negative value to the portfolio of smaller businesses that IAC owns. This past summer, management mentioned that it was exploring options on what it may do with its stakes in Match and ANGI. This indicated that a spin of one or both businesses was likely in the near future which theoretically would help unlock the discount in value for IAC shares.

In December, IAC officially announced that it would be spinning off Match Group. IAC will be left with no debt and $2.9 billion in cash on its balance sheet. The following day IAC announced it would spend $500 million to acquire Care.com. The shares have had a positive reaction to both announcements and we continue to own the stock. In this case, we were happy to buy a great business that was trading at a discount to its public market value, and at the same time bet that the fantastic management will continue to create value for shareholders over time.

Alpine Income Property Trust is a recent IPO that is structured as a Real Estate Investment Trust (REIT). Another company that we own in the Fund, Consolidated Tomoka, sold/placed twenty of its commercial properties with Alpine in conjunction with the IPO. Alpine focuses on single-tenant net lease properties. It has a high-quality portfolio with an average lease term of over 8 years, 100% occupancy, and Wells Fargo as the largest tenant. The company has zero debt and plenty of liquidity to help fuel growth right out of the gate. If the company exhausts its current liquidity, we estimate that NOI will grow by about 70%. Alpine trades at a ~7.5% cap rate, far higher than its peers. We attribute this to the stigma of having an external management team and small market cap. However, Alpine is different than other externally managed REITs in that the management team is from Consolidated Tomoka, which owns a sizable amount of Alpine common shares as well as units in the operating partnership. In other words, management’s incentives are aligned with shareholders since there is an 8% hurdle before it can collect an incentive fee. We view Alpine as a core holding that will grow its intrinsic value at an attractive rate over a long period of time.

Etsy is the leading online marketplace for handmade crafts and goods like jewelry, art, wedding gifts, etc. This is not a typical investment for us due to the higher multiple we paid, but it is a high-quality business that is a market leader with a long runway for future growth. Etsy operates a marketplace where third-party buyers and sellers come together to transact. Online marketplaces are difficult to build in that you need sellers in place to attract buyers, and you need buyers in place to attract sellers. Etsy’s marketplace has grown to a point where we believe it is large enough to be mostly insulated from the competition. It does not manufacture anything so its business model can scale without investment in physical infrastructure. The company makes money by taking a cut of each transaction and it is growing revenue at over 20%. Since it is not a capital-intensive business model, we expect cash flow and margins to grow at an even faster rate as the company scales. For now, it is a small position and we would look to add to it if shares retreat from current prices.

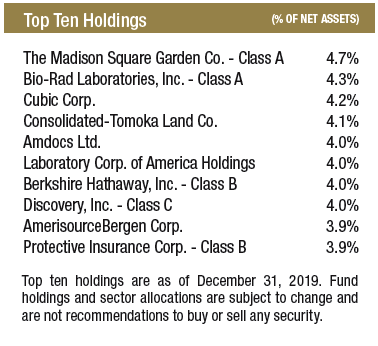

The top three contributors in the quarter were Discovery (ticker: DISCK), Wyndham Destinations Inc (ticker: WYND), and Madison Square Garden (ticker: MSG).

Discovery was discussed in the third quarter letter as a detractor to performance, but after adding to our position on the weakness shares rebounded and it was a top performer this quarter. Discovery is one of the world’s largest pay television programmers. Its brands include Discovery Channel, TLC, Animal Planet, HGTV, Food Network, and many other popular networks. The company is estimated to generate about $3 billion in free cash flow in 2020 and with net leverage below their target 3.0x – 3.5x, we could see more aggressive share repurchases in the coming year. The valuation remains undemanding. Cable tycoon and board member, John Malone, agrees—he purchased ~$75 million of Discovery shares in late November and declared in an interview that the stock is “dramatically undervalued.”

Wyndham Destinations is the world’s largest vacation ownership and exchange company. Management continues to execute on its plan that was laid out when it separated from the hotel business. There were concerns in the quarter that weather (Hurricane Dorian) might have impacted the business more than anticipated, but the company reported third quarter earnings that beat expectations. The business is generating strong free cash flow which is being used to fund a 3.5% dividend and a robust share repurchase program. The valuation remains compelling at current levels and therefore it is still one of our larger positions.

Madison Square Garden announced it approved the spinoff of all of its entertainment businesses. This is a change from the initial proposal which recommended spinning off the sports businesses. The switch is due to tax efficiency. Additionally, the company disclosed that the entertainment company will not retain any ownership in the sports business, making the transaction much cleaner. This has been on the table for about a year and a half, so it helped provide some clarity as to what the plan looks like. The transaction is scheduled to take place sometime in the first quarter of 2020. Shares still trade at a material discount to the underlying asset value.

The top three detractors in the quarter were Teradata (ticker: TDC), Dollar Tree (ticker: DLTR), and Select Interior Concepts (ticker: SIC).

Data analytics and data solutions company Teradata disappointed investors once again. The company reported solid third quarter results but provided very weak fourth quarter guidance and disclosed that the CEO would be departing. This was enough to send shares 18% lower on the day. We significantly reduced the size of our position. We are concerned with business trends and our conviction in a successful transition has taken a hit. The company remains one of the cheapest software stocks out there but for good reason.

Dollar Tree had strung together a few quarters of solid performance before surprising investors when it reported in November. The company cut its guidance for a variety of reasons. Its gross margin is under pressure due to high freight costs and a higher mix of consumables. Wage pressure continues to push payroll costs higher. And the new list of tariff items acted as another headwind. At the current price, the market is assigning very little if any value to the Family Dollar banner. We believe the situation is ripe for activism as a sale of Family Dollar would likely be well received by investors.

Select Interior Concepts, a residential design/installation and stone distribution company, was discussed last quarter as a new idea. Things went well initially as shares appreciated about 20% from our cost basis. We had valued the business much higher, so we thought it was too early to begin selling. Unfortunately, shares retreated, and we gave up all of our gains and then some. Select Interior has outsized exposure to the California market, which was sluggish throughout 2019. To combat this, it has been diversifying geographically in order to become less tied to the ebbs and flows of the west coast market. The company reported disappointing results for the third quarter, which implied it would fall short of full year expectations as well. While its stone distribution business continues to plug along, the installation business is facing headwinds. Not only is the market in California weaker than the rest of the country, but many of the new developments being built contain lower-end homes which are lower margin to Select. The company is still undergoing a strategic review, however, and the activist who owned ~10% of the business recently disclosed it had sold out of its stake. Also announced in the fourth quarter was that Bryant Riley would join the board of directors. Bryant is the Chairman & Founder of B. Riley Financial which is the second largest holder of Select Interior Concepts at 11%. We continue to own shares but have reduced the size of the position as a result of the recent developments.

Valuations have become less compelling as the market continues to hit record highs seemingly every day. The Fund’s cash levels remain elevated at 11.2% as we await opportunities to put it to work at more attractive levels. We are optimistic going into 2020 and thank you for your investment!

Sincerely,

Clay Kirkland, CFA

Intrepid Disciplined Value Fund Portfolio Manager

[1] Board of Governors of The Federal Reserve System. Statement Regarding Monetary Policy Implementation. Web. 11 Oct 2019.