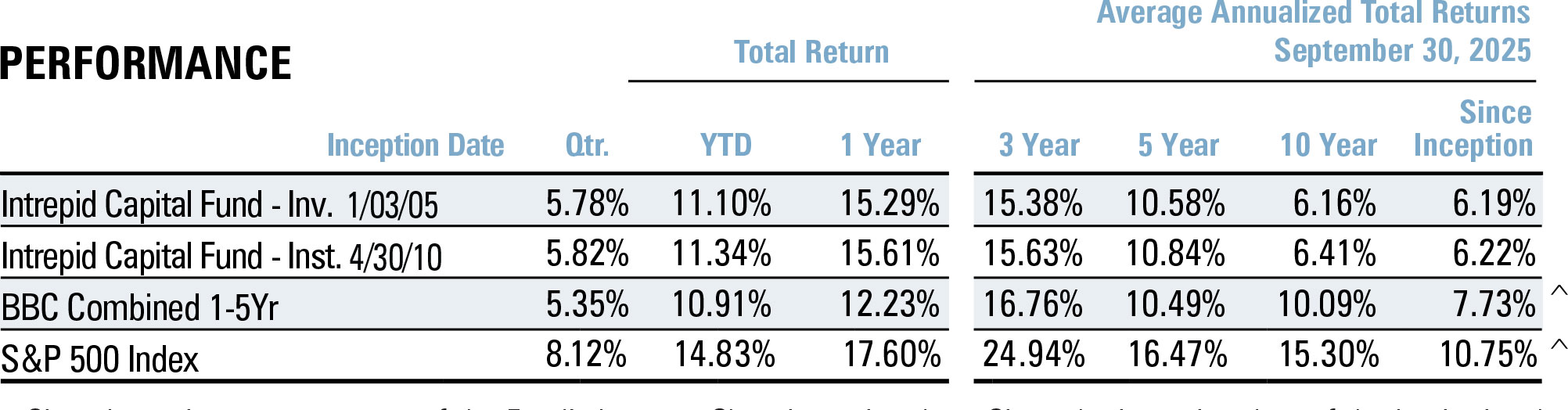

^Since Inception returns are as of the Fund’s Investor Class inception date. Since the inception date of the Institutional Class, the annualized return of the BBC Combined 1-5Yr Index is 9.31% and S&P 500 Index is 14.00%.

Performance data quoted represents past performance and does not guarantee future results.

Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-996-FUND. The Fund imposes a 2% redemption fee on shares held for 30 days or less. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

Per the Prospectus dated January 31, 2025, the annual operating expense (gross) for the Intrepid Capital Fund-Investor Share Class is 1.41% and for the Intrepid Capital Fund-Institutional Share Class is 1.16%. The Fund’s Advisor has contractually agreed to reduce its fees and/or reimburse expenses until January 31, 2026, such that the total operating expense (net) for the Capital Fund-Investor Share Class is 1.41% and for the Capital Fund-Institutional Share Class is 1.16%. The Capital Fund may have Net Expense higher than these expense caps as a result of any sales, distribution and other fees incurred under a plan adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), acquired fund fees and expenses or other expenses (such as taxes, interest, brokerage commissions and extraordinary items) that are excluded from the calculation. As a result of the calculations, the Net Expense for the Capital Fund-Investor Share Class is 1.41%. The Net Expense for the Capital Fund-Institutional Share Class is 1.16%. The Net Expense Ratio represents the percentage paid by investors. Otherwise, performance shown would have been lower.

October 4, 2025

Dear Fellow Shareholders,

I couldn’t be more pleased with our investment results for both the third calendar quarter of 2025 as well as the Fund’s full fiscal year (which ended on September 30th).

The Fund’s total return was 5.78% for the quarter and 15.29% for the trailing year. In the category of “you couldn’t do this again if you tried” the trailing 3-year annualized result was 15.38% – nearly identical! While we stress a consistent investment process, we would emphasize that shareholders should not anticipate annualized results between 15-16% like they have earned over the last three years. One can see this by observing the Fund’s trailing 5-year performance of 10.58%.

As of September 30th, 2025, the trailing 12 month return in the Fund ranked in the top 4% for total return in the Morningstar “Moderate Allocation” category out of 480 funds. For the trailing 5 years, the Fund was in the top 17% for total return in the Morningstar “Moderate Allocation” category out of 439 funds. These results were achieved in a less than conventional manner in that 1) the Fund’s stocks are not necessarily “index centric” as I often see in many competitors’ holdings, and 2) my preference for “family heirlooms” as I have described in prior shareholder letters. These “family heirloom” equity holdings tend to have valuation characteristics and balance sheets that allow me to rest a little easier knowing if something were to go bump in the night…we should potentially suffer less than many. At least that is my hope!

In addition, our fixed income holdings are carefully underwritten by our outstanding team that offer high and attractive income in an instrument that is a superior claim to the equity in the same business. In addition, we are a short-term lender, so we are less exposed to climbing interest rates. The combination of the equity dividends and bond holdings I described above allow us the luxury of a quarterly dividend, which was $0.54805 per share for the quarter ending September 30th, 2025. This dividend is included in the performance quoted earlier in this letter.

Over the course of the last six months, we have had two of our “heirlooms” acquired at attractive prices compared to our cost: WNS Holdings (WNS) and Skechers (SKX). These sales and others have caused the cash levels in the Fund to rise to slightly over 10% as we search for other similarly attractive equity securities and await some volatility to put this money to work.

In looking through the list of contributors for both the 3rd quarter and the trailing 12 months there is one thing that stands out (maybe I should say “shines”) and that is gold and gold-related securities! We have held an over 3% weight in the iShares Gold Trust (ticker: IAU) for an extended period along with shares of Sprott (ticker: SII), which is a Canadian-based asset manager of a number of gold-centric closed-end funds. These two positions combined for over 250 basis points of positive contribution for the trailing 12 months ended September 30th, 2025. This inert metal has been a store of value for thousands of years and a particularly good diversifier for a portfolio of stocks and bonds when held somewhere in the range of a 5-10% weight as a hedge against financial disruption. This year the dollar has dropped substantially, so it is not unexpected from my perspective that gold is a refuge from dollar depreciation.

Top Contributors for Q3 2025

- Alphabet Inc. – Class A (GOOGL)

- Fabrinet (FN)

- iShares Gold Trust (GLD)

Top Detractors for Q3 2025

- FRP Holdings (FRPH)

- Atlantic Braves Holdings – Series C (BATRK)

- BJ’s Wholesale Club (BJ)

Top Contributors for the Fiscal Year

- Liberty Media – Live Nation (LLYVA)

- Take-Two Interactive Software (TTWO)

- Fabrinet (FN)

Top Detractors for the Fiscal Year

- FRP Holdings (FRPH)

- Becle SAB de CV (CUERVO)

- Civitas Resources (CIVI)

Thank you for your continued support. If there is anything we can do to assist you, please don’t hesitate to call.

All the best,

Mark F. Travis, President

Intrepid Income Fund Co-Portfolio Manager