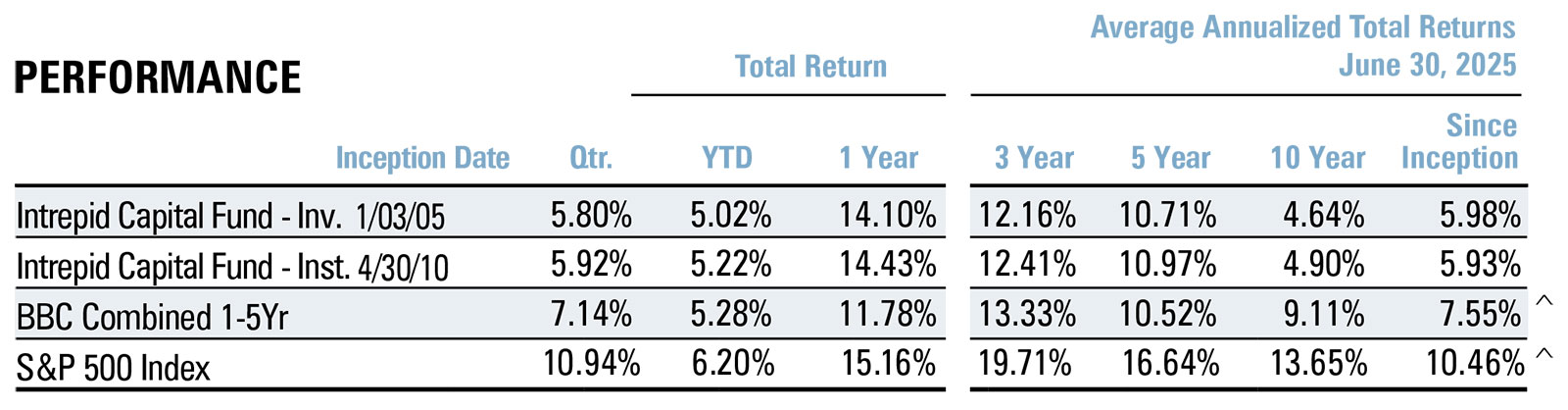

^Since Inception returns are as of the Fund’s Investor Class inception date. Since the inception date of the Institutional Class, the annualized return of the BBC Combined 1-5Yr Index is 9.04% and S&P 500 Index is 13.68%.

Performance data quoted represents past performance and does not guarantee future results.

Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-996-FUND. The Fund imposes a 2% redemption fee on shares held for 30 days or less. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

Per the Prospectus dated January 31, 2024, the annual operating expense (gross) for the Intrepid Capital Fund-Investor Share Class is 1.99% and for the Intrepid Capital Fund-Institutional Share Class is 1.84%. The Fund’s Advisor has contractually agreed to reduce its fees and/or reimburse expenses until January 31, 2025, such that the total operating expense (net) for the Capital Fund-Investor Share Class is 1.41% and for the Capital Fund-Institutional Share Class is 1.15%. The Capital Fund may have Net Expense higher than these expense caps as a result of any sales, distribution and other fees incurred under a plan adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), acquired fund fees and expenses or other expenses (such as taxes, interest, brokerage commissions and extraordinary items) that are excluded from the calculation. As a result of the calculations, the Net Expense for the Capital Fund-Investor Share Class is 1.41%. The Net Expense for the Capital Fund-Institutional Share Class is 1.15%. The Net Expense Ratio represents the percentage paid by investors. Otherwise, performance shown would have been lower.

July 4, 2025

“There is no freedom for the weak”

-George Meredith

Dear Fellow Shareholders,

As we are now approaching both the 250th anniversary year of the signing of the Declaration of Independence and the 4th of July holiday, I thought the above quote was timely when I came across it in the Forbes book of business quotations. The other quote that applies is “freedom isn’t free.” As we celebrate with our families, I encourage you to remember those that paid the ultimate sacrifice so that we could enjoy the freedoms we do as Americans.

There are certainly places across the globe where our freedoms of speech, religion, etc., would not be greeted kindly, to say the least, and would more likely result in prison or even death. The people of Iran, Russia, North Korea, and China come to mind. In those nations, the decisions are in the hands of the intelligentsia, and the proletariat are expected to fall in line – or else. This stands in contrast to these staterun economies where food, consumer goods, and automobiles are often inshort supply and, when available, are of low quality.

There are certainly places across the globe where our freedoms of speech, religion, etc., would not be greeted kindly, to say the least, and would more likely result in prison or even death. The people of Iran, Russia, North Korea, and China come to mind. In those nations, the decisions are in the hands of the intelligentsia, and the proletariat are expected to fall in line – or else. This stands in contrast to these staterun economies where food, consumer goods, and automobiles are often inshort supply and, when available, are of low quality.

Contrast that with our market economy, where free people get to decide how to allocate their time and resources, acting in their enlightened selfinterest. Imagine the look of a North Korean upon entering a Walmart or an Iranian entering a “mega” Christian church. How lucky we are!

We need to continue to resist “central planners” whenever they appear, particularly among our democratically-elected officials. The most recent candidate for Mayor of New York City comes to mind as he proposes ‘solutions’ that are nothing but the heavy hand of the state and, like all central planning, will actually make our issues worse. Just say “No!”

The quarter started off with the bang of “Liberation Day” with some outrageous tariffs proposed on almost all countries that trade with the US. The market took a header south on this, and for a moment it looked like a revival of the SmootHawley tariff bill of the early 1930’s – to which, I would add, helped make the Depression truly Great in my opinion!

I have not been a fan of Peter Navarro, the man that I think has President Trump’s ear in regard to tariffs. But hey, maybe there really is a method to the madness of the President. From my perspective, the perfect tariff would be 0% – in line with the economic principle known as the “Law of Comparative Advantage.” To simplify: if, for example, Vietnam can produce Nike sneakers more cost-effectively, and we can produce semiconductors more efficiently here, then each country should specialize in what it does best and trade – sneakers for semiconductors – so that all parties benefit.

The only way I can rationalize the current tariff policy promoted by the President is to think he might raise some tax revenue through tariffs so that he can claim he didn’t raise taxes on Americans. As our country faces a yawning gap between what we spend ($7 trillion) and what we bring in through tax revenue, this may help at the margin. As more Americans turn 65 this year than any year prior, we must drive our growth rates of GDP higher if we hope to address the burden of our entitlement programs (Social Security, Medicare, Medicaid). The clock is ticking.

To add additional excitement to the quarter, the President gave the go ahead for our B-2 Bombers to accelerate the destruction of the locations in Iran that, based on intelligence, were being used to develop a nuclear weapon. Our long-range bombers and “bunker buster” bombs were needed as the Israeli’s didn’t possess that type of ordinance.

The B-2’s took out the facilities at Natanz, Fordow, and Isfahan. With this action, coupled with the targeted assassinations of Hamas, Hezbollah, and Iranian Revolutionary Guard leadership, President Trump was able to demand – with some expletives – the cease fire between Israel and Iran. The success in these endeavors of the Israeli secret service (“Mossad”) must have the leadership in Tehran looking over their shoulder anytime they hear footsteps!

I am pleased to report, despite all the global conflict discussed above – and I didn’t mention or forget the Russian attack on neighboring Ukraine – the Fund performed quite well.

For the nine months into our fiscal year (ending in September) the Fund’s total return has exceeded the S&P 500 Index’s return (9.25% vs 8.76%) during the period.

It is worth repeating that the result is NOT by design. As the Intrepid Capital Fund is a combination of small to large cap value-oriented shares, coupled with short duration, high-yield debt and cash, it just worked out that way. The Fund is currently allocated roughly 70% to equity, which is close to a historic high. As a “Moderate Allocation” fund per Morningstar, we don’t have a mandate or cap on our equity holdings, and yours truly tries to avoid the tax man as long as possible.

In that Moderate Allocation category, Morningstar has the Fund’s Investor Class (ICMBX) performance in the 6th percentile of 453 funds for the 12 months ended June 30th, 2025, and the 15th percentile of 404 funds for the trailing 5-year period. To deliver growth and income to our shareholders, the Fund also paid a quarterly dividend of .0886 cents per share on June 30th, 2025. This annualizes to a 2.70% yield at that rate. Please keep in mind that although we do pay a quarterly dividend, it is not “ratable” like that of a money market account. We pay out what we receive in dividends and interest income every quarter, and it may not be the same every quarter.

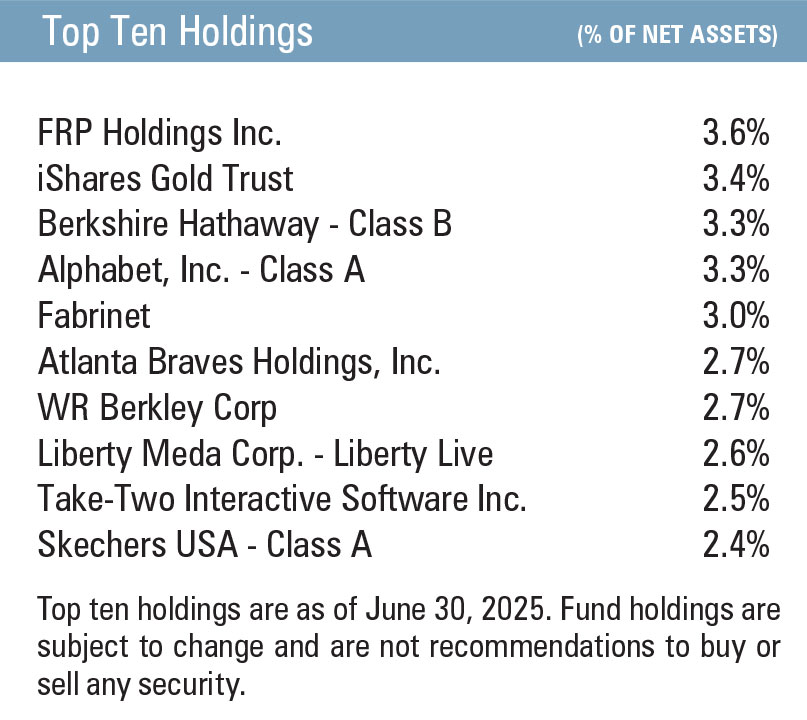

Contributors YTD

- IAC Inc. (IAC)

- Fabrinet (FN)

- iShares Gold Trust (GLD)

Contributors QTD

- Fabrinet (FN)

- IAC Inc. (IAC)

- Sprott Inc. (SII)

Detractors YTD

- Jefferies Financial Group (JEF)

- Civitas Resources (CIVI)

- FRP Holdings Inc. (FRPH)

Detractors QTD

- Berkshire Hathaway – Class B (BRK/B)

- Civitas Resources (CIVI)

- Copart Inc. (CPRT)

Thank you for your continued support. If there is anything we can do to serve you better, please don’t hesitate to call.

All the best,

Mark F. Travis, President

Intrepid Income Fund Co-Portfolio Manager