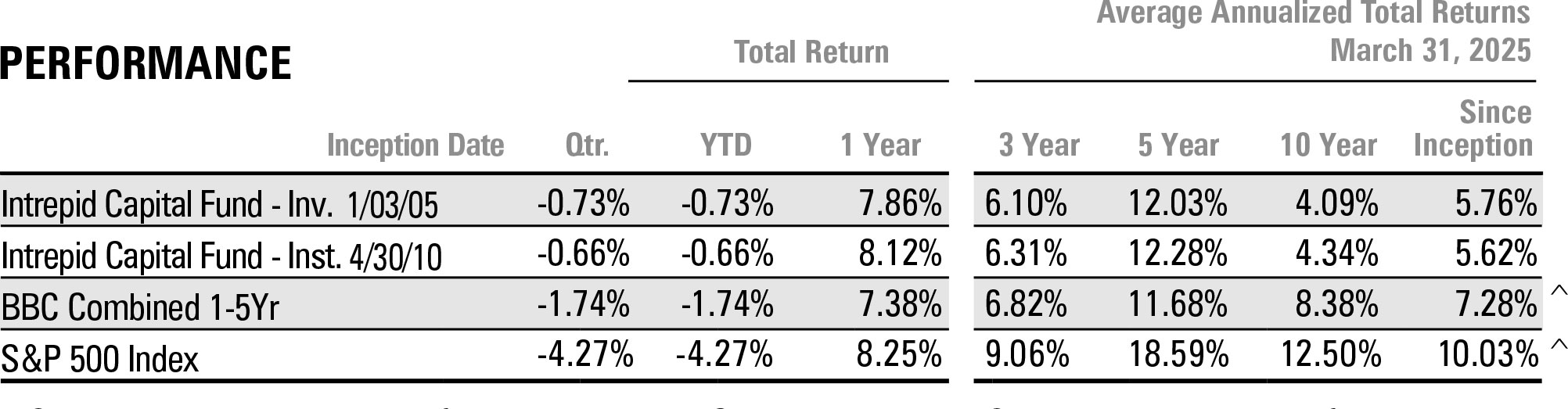

^Since Inception returns are as of the Fund’s Investor Class inception date. Since the inception date of the Institutional Class, the annualized return of the BBC Combined 1-5Yr Index is 9.04% and S&P 500 Index is 13.68%.

Performance data quoted represents past performance and does not guarantee future results.

Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-996-FUND. The Fund imposes a 2% redemption fee on shares held for 30 days or less. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

Per the Prospectus dated January 31, 2024, the annual operating expense (gross) for the Intrepid Capital Fund-Investor Share Class is 1.99% and for the Intrepid Capital Fund-Institutional Share Class is 1.84%. The Fund’s Advisor has contractually agreed to reduce its fees and/or reimburse expenses until January 31, 2025, such that the total operating expense (net) for the Capital Fund-Investor Share Class is 1.41% and for the Capital Fund-Institutional Share Class is 1.15%. The Capital Fund may have Net Expense higher than these expense caps as a result of any sales, distribution and other fees incurred under a plan adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), acquired fund fees and expenses or other expenses (such as taxes, interest, brokerage commissions and extraordinary items) that are excluded from the calculation. As a result of the calculations, the Net Expense for the Capital Fund-Investor Share Class is 1.41%. The Net Expense for the Capital Fund-Institutional Share Class is 1.15%. The Net Expense Ratio represents the percentage paid by investors. Otherwise, performance shown would have been lower.

April 10, 2025

“April is the month when the green returns to the lawn, the trees and the Internal Revenue Service.”

-Evan Esar

Dear Fellow Shareholders,

I am pleased to report that for the first half of the Fund’s fiscal year (the six months ending March 31, 2025), the Intrepid Capital Fund (“the Fund”) returned 3.01%. This compares favorably to the all-stock S&P 500 Index (-1.97%) and a combination of stocks and bonds represented by the BBC Combined Index (-0.58%), which we believe is a better index for comparison to the Fund. The Fund’s result for the trailing 12 months was 8.12%. Considering the Fund’s allocation to fixed income, this too compares favorably to the 8.25% return of the all-stock S&P 500 Index during the period. This brings the Fund’s 3-year performance to 6.10% and 5-year performance to 12.03%.

We are roughly at the five-year anniversary of the Covid-induced selloff of March 2020. A swim coach I knew was once quoted as saying: “sometimes success is hanging on, when all others let go.” In March of 2020, many were “letting go” – so I thank you for hanging on for a good outcome! Per Morningstar, the Fund’s Investor Class (ICMBX) is in the top quartile (top 25%) of 628 funds in the Moderate Allocation category for the 5-year period ending March 31, 2025 based on average annual total returns. The Investor Class shares paid a dividend on December 31st, 2024, of $0.00028 per share and one of $0.166937 per share on March 31, 2025. This income is included in the total returns quoted above.

The quote at the top of the page made me smile, as it is so true! As your Lead Portfolio Manager, I do my best to make April 15th less taxing where possible. As a refresher, a 1940 Act registered mutual fund is required to distribute all interest income (bonds, money markets) and short and long term gains (generally stocks, occasionally bonds) to Fund shareholders. I try to mitigate the tax man’s take by offsetting gains with losses where available and when appropriate. In addition, the Fund has significant tax loss carry forwards which are also helpful.

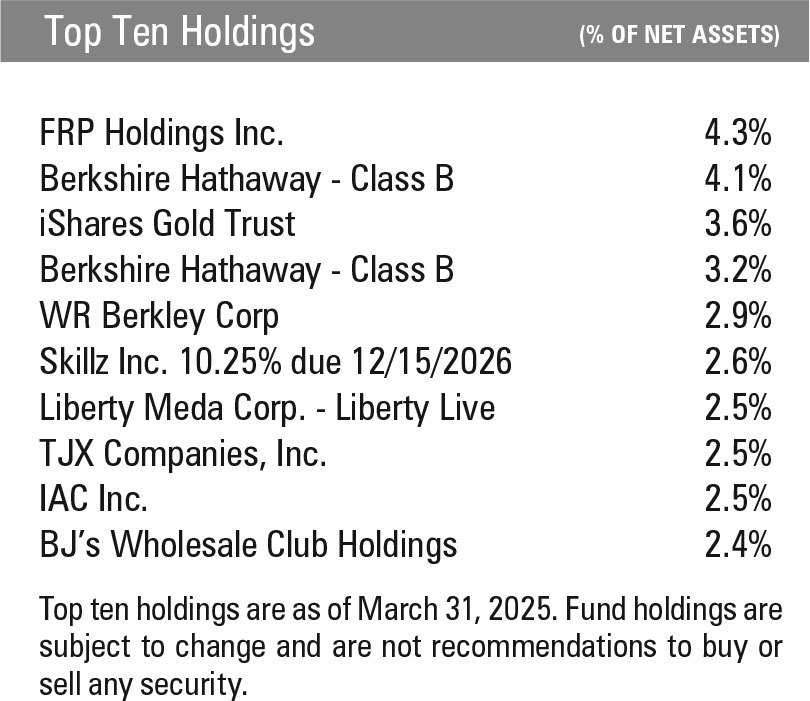

The Fund has held to a fairly consistent allocation of 70% equity, 25% debt, and 5% in cash. This is spread over 38 equity positions and 19 debt positions, which I regard as adequately diversified. The most consistent theme in the shares we own is a founder-led business that in some cases may apply to multiple generations of the same family. The appeal is a common interest in business success due to a large equity holding with the founding family that aligns our interests with theirs. In addition, many have balance sheets that have little debt and often a large cash balance. This is useful when things “go bump in the night” and the conservative balance sheet allows the business to carry on unstressed by debt and take advantage of opportunities a weakened competitor may present. Companies that fall in this category are Markel (MKL), WR Berkley (WRB), Watsco (WSO), Garmin (GRMN), Skechers (SKX), and numerous others in the Fund.

The top contributors for the three months ending March 31st, 2025 were:

- Berkshire Hathaway – Class B

- iShares Gold Trust

- BJ’s Wholesale Club

The top detractors for the three months ending March 31st, 2025 were:

- Jefferies Financial Group

- Alphabet Inc – Class A

- Polaris Inc.

Thank you for your continued support. If there is anything we can do to serve you better, please don’t hesitate to call.

All the best,

Mark F. Travis, President

Intrepid Income Fund Co-Portfolio Manager