April 8, 2019

Dear Fellow Shareholders,

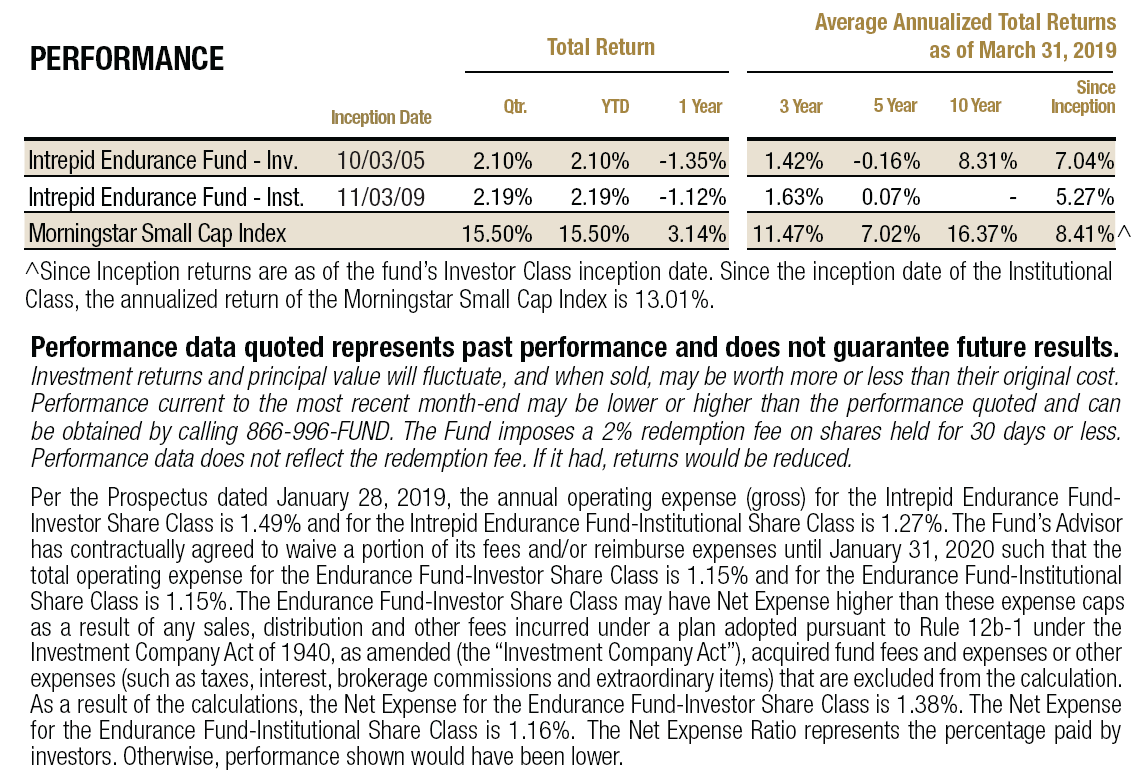

Stock and bond markets bounced back sharply in early 2019 after demonstrating broad and severe volatility late in 2018. The Morningstar Small Cap Index returned an impressive 15.50% in the first three months of 2019.

The Endurance Fund’s (the “Fund”) results were not as impressive, returning 2.10% during this period. The Fund’s large Treasuries position and focus on stocks with stable fundamentals and operating profiles drove a high degree of underperformance in a “risk-on” market with little downside volatility.

However, these same characteristics and positioning drove significant outperformance for the Fund during the last three months of 2018. As a reminder, the Fund returned -3.52% in calendar Q4 2018 versus the Morningstar Small Cap Index’s -19.54%. When linking these two quarters, which encapsulate the Fund’s first half of fiscal 2019, the Fund outperformed by returning -1.49% versus -7.06% for the Morningstar Small Cap Index.

The Fund’s strategy is designed around three objectives: i) to generate positive absolute returns; ii) avoid large drawdowns of capital; and iii) take advantage during periods of volatility. These three objectives combine to create guardrails that encourage us to take risks with your capital when it is attractively priced, avoid risk with your capital when expected returns are inadequate, and – in doing so – compound your capital in a manner that over-compensates you for the amount of risk you took by participating in the stock market.

We think the last six months provide a unique opportunity over which to judge the Fund on these objectives, as it included both the wild panic and euphoria reminiscent of a full market cycle – in only a fraction of the time frame.

Over this period, our disciplined absolute return focus clearly added value above the index, primarily by avoiding large drawdowns on your capital. However, due to the lackluster upside we demonstrated during calendar Q1, we did fall short of our objective of generating positive absolute returns during the full six-month period. While small cap indices fell much more than the Fund, we are not satisfied with outperformance when it includes a slightly negative absolute return, even over a short “mini” market cycle.

Finally, it’s important to assess what actions we took to exploit the recent volatility in order to achieve the Fund’s objectives moving forward.

You may remember that the Fund was extremely active (relative to its recent history) in the fourth quarter of 2018 as markets buckled and went into freefall. In that short time frame, we added four new positions in high-quality small cap companies with pristine balance sheets. Despite the rally in small cap prices to date in 2019, we were able to continue to find attractively priced opportunities – primarily by pivoting our focus throughout our opportunity set to companies with a bit more financial leverage. In fact, four of the six new positions established in Q1 2019 possess meaningful debt on their balance sheet.

This flexible approach allowed us to benefit by avoiding companies with a higher degree of financial risk when they were not priced as such, but then swoop in and selectively take on this risk as interest rates rose, credit spreads widened, and high yield issuance closed late in 2018 – punishing stocks with any sort of leverage concern. Of note, we remained disciplined when sourcing these opportunities with higher debt levels, requiring higher absolute returns on equity and a stable operating profile combined with ample asset coverage or extended debt maturities.

Essentially, we quickly shifted our focus in early Q1 2019 from avoiding financial risk to looking for opportunities to take it on in an acceptable manner. Later in the quarter, we again utilized our flexible, opportunistic mandate to purchase a well-run, conservatively-financed bank – the Fund’s first bank investment in nine years – as investors began to aggressively price the risk of an inverted yield curve into bank stocks. We also purchased an energy stock with a strong balance sheet and added meaningfully to two positions initially purchased in the fourth quarter of 2018, Cabot Oil & Gas and Protector Forsikring.

In summary, this activity drove the Fund’s cash levels down to 59.7% at the end of the first quarter, a decline of 13.5% from the 73.2% cash position at the end of Q4 2018. This follows the 9.3% decline that occurred in Q4 2018 from the 82.5% cash balance at the end of Q3 2018.

As a result, the Fund’s equity exposure has more than doubled over the last six months. Despite the meaningful change in positioning, this does not represent a change in the Fund’s strategy. Over this six-month period, we have been deliberate about utilizing any adverse market conditions or circumstances to take advantage of opportunities presented by volatility – consistent with the core objectives listed above. Executing on this objective drove the change in the Fund’s exposure, rather than any top-down change in strategy.

However, the increased equity exposure does represent a meaningful step-change in the potential return profile of the Fund. In that sense, we are excited to be able to address the objective we fell just short on (generating positive absolute returns) through the ten new stocks introduced over the last six months, all purchased at prices we believe will provide attractive absolute returns over reasonable holding periods. While we reiterate our disappointment in our modest upside performance during the first quarter, we are encouraged by the fact that our best performing stocks were all new holdings purchased over the last six months.

New purchases

- SP Plus Corporation (ticker: SP) is a leading parking facility operator in the US for office buildings, airports, hotels, hospitals, etc. Like many small caps with debt, SP sold off sharply late in 2018. However, SP’s debt load is comfortably supported by its stable operations and attractive business model primarily consisting of fixed rate contracts.

- PotlatchDeltic Corporation (ticker: PCH) is a leading timber REIT and top-10 lumber producer in the US. Investor concerns about the state of the housing market provided the opportunity to purchase the company’s stock at an attractive discount to the value of its high-quality timberland and lumber mill assets. While the company sports a leverage ratio of 2.2x, it is very well supported by the value of its assets and is much less levered than its timber peers or companies in other REIT categories.

- Hanesbrands, Inc. (ticker: HBI) owns and distributes many leading brands in innerwear, intimates, and activewear apparel. Despite a meaningful debt load, the company is utilizing its substantial free cash flow generation to aggressively deleverage while maintaining an attractive dividend. HBI’s recent results also indicate a return to growth due to stabilization in several core innerwear categories, along with booming distribution expansion in its 100-year-old Champion activewear brand, which has made a comeback as a fashion statement brand with teens, millennials and celebrities.

- Ingles Markets, Inc. (ticker: IMKTA) is a regional grocery chain with stores throughout six states in the Southeast US. Ingles’ rural store base has shielded it from many of the negative external pressures in the broad grocery category over the past several years, including new entrants, price competition, omni-channel adoption, and channel convergence. In addition, Ingles has aggressively invested in modernizing its stores to ensure it can compete as customer tastes and preferences change. While the company carries debt on its balance sheet, it also has substantial real estate holdings that support the debt (80% of it store locations are owned) and steady operating income that easily covers interest expense several times over.

- Bonanza Creek Energy Inc. (ticker: BCEI) is an energy producer with 67,000 net acres of primarily oil-producing property in the Wattenberg Field in Weld County, Colorado. The company sports an attractive investment profile that includes an extremely strong balance sheet and the ability to grow production at a 20% rate while maintaining low leverage and a high degree of liquidity. In addition, the company trades at a substantial discount to the replacement cost of its producing assets and owns a hidden midstream asset that has attracted interest from external parties in the past. We believe BCEI’s stock is depressed primarily due to political risk in Colorado as legislators plot industry-unfriendly reforms, but we expect the company’s valuation to re-rate as the regulatory changes become finalized and investor uncertainty diminishes.

- Hilltop Holdings, Inc. (ticker: HTH) is a holding company whose primary operations are a regional bank and a handful of ancillary finance-related businesses. Hilltop’s stock has underperformed due to a flattening yield curve and slower-than-expected loan growth. However, we believe the firm has been well-managed and the deliberate effort to restrain loan growth in the interest of good underwriting has masked meaningfully higher earnings power.

Sales

- We sold the Fund’s entire position in Donnelley Financial Solutions, Inc. (DFIN) during the first quarter, reallocating the proceeds in the opportunities discussed above. A combination of challenging fundamentals, our concern regarding management’s decision to invest in growth in its mature legacy business line, and management’s reluctance to return value to shareholders drove our decision.

Top three contributors:

- Skechers USA, Inc. (SKX) reported robust growth and better-than-expected margins for the fourth quarter of 2018, which drove a reversal in investor pessimism and a higher stock price following several quarters of slowing domestic results and margin compression. We believe the stock still trades at a meaningful discount to its valuation based on reasonable assumptions and continue to maintain the position.

- During the quarter, it was reported that Protective Insurance Corporation (PTVCB) was in talks with several potential acquirers. This followed the company’s announcement in October of the formation of a Board subcommittee to explore opportunities to maximize long-term value, a common precursor to a company sale. The share price increased as a result of this development. We continue to maintain a meaningful position in the stock.

- Cabot Oil and Gas Corporation (COG) reported in-line results and, more importantly, began to show proof points regarding its two primary catalysts: a return to 20% production growth and an improvement in differentials as new takeaway pipelines begin operations. COG also jettisoned its only small exploration project during the quarter, clearing the way for consistent 20% production growth, reduced capex, substantial free cash flow production, and accelerated shareholder returns. We increased the Fund’s position meaningfully during the quarter and it is now our top holding.

Top three detractors:

- Net 1 UEPS Technologies, Inc. (UEPS) was the largest negative contributor during the quarter. In late January, UEPS preannounced two pieces of negative news: the reversal of a key South African Court decision and large operating losses in the December quarter. While we still believe there is value in the company’s collections of operating and investment assets, our confidence in management’s ability to realize that value has diminished materially. As a result, we have substantially reduced Net1’s position size in the Fund.

- Amdocs Limited (DOX) reported satisfactory results but fell victim to a highly-publicized short seller report in early January that was skeptical of the company’s growth profile, accounting policies, and numerous other characteristics. While hyperbolic on many points, the report did raise some important questions, which we believe management addressed more than adequately on their Q4 earnings call several weeks later. Nevertheless, the accusations did create an overhang on the stock during the quarter. We have maintained the Fund’s position.

- Hallmark Financial’s (HALL) stock fell during the first quarter despite Q4 results showcasing improved underwriting. While the company’s investment holdings predictably lost some value in Q4, we believe the stock’s decline was more due to the under-followed nature of this small, closely-held company than any fundamental developments. We maintained our position in the Fund.

Looking forward, we are committed to executing on our core objectives by remaining focused on capital preservation, while finding opportunities to put capital to work at attractive risk-adjusted returns. We will remain both highly disciplined and highly opportunistic. While we cannot commit to doubling the size of the Fund’s equity exposure again over the next six months – cash levels remain dependent on the potential returns available in high-quality small cap companies – we stand prepared to do so should the opportunity arise. The flexibility to move quickly and opportunistically has been a hallmark of this strategy’s ability to add value throughout past market cycles. We believe this will prove to be true regarding our recent spike in activity, along with future opportunities to do so as they emerge.

Thank you for your investment.

Matt Parker, CFA, CPA

Intrepid Endurance Fund Co-Portfolio Manager

Joe Van Cavage, CFA

Intrepid Endurance Fund Co-Portfolio Manager